Disney shares (NYSE: DIS) rose over 10% yesterday after the entertainment giant reported better-than-expected earnings in its fiscal second quarter of 2025 and also announced a new theme park in the UAE. Here are the key takeaways from the company’s earnings and how analysts reacted to the report.

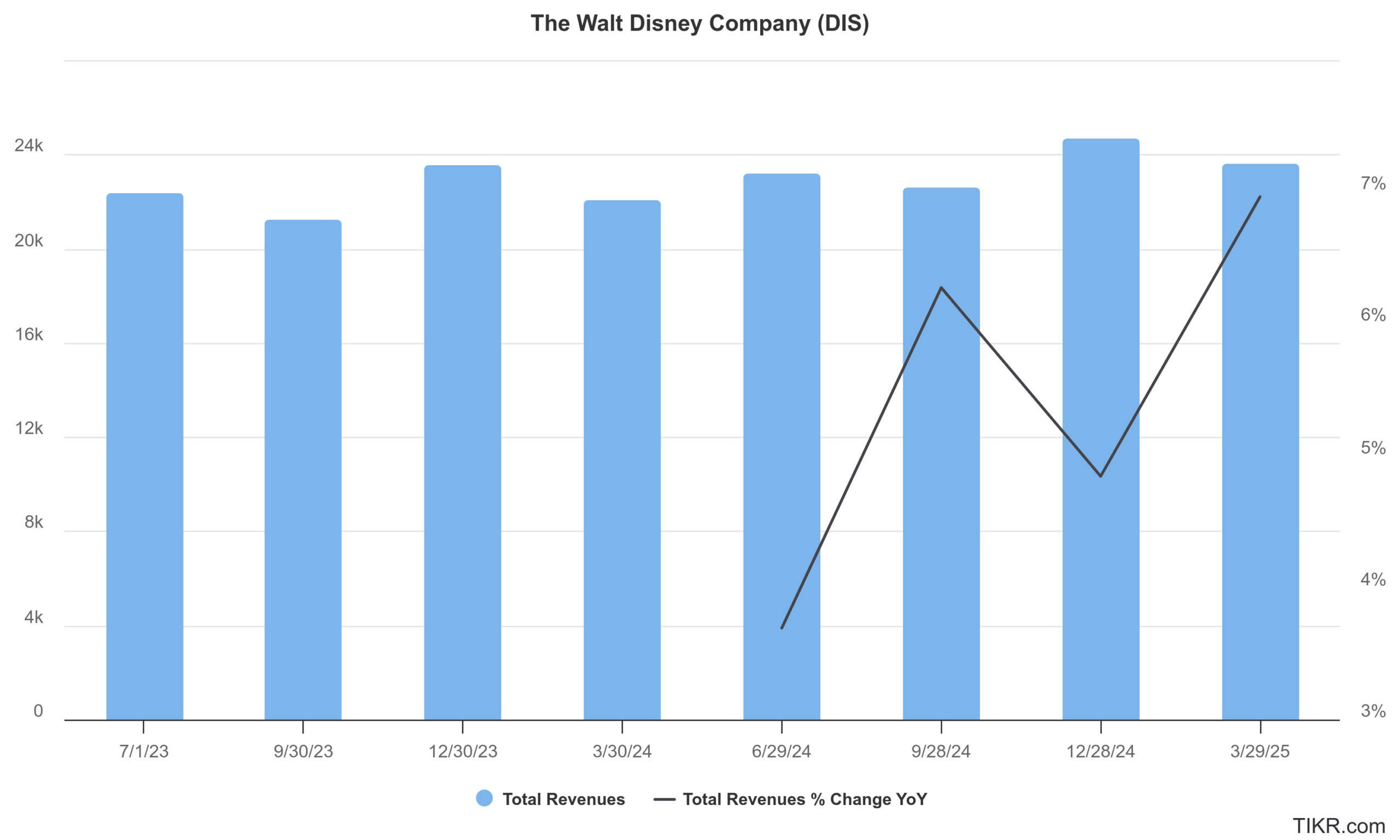

Disney’s fiscal Q2 revenues rose 7% YoY to $23.62 billion and were slightly ahead of the $23.14 billion that analysts were expecting. The company’s adjusted EPS rose 32% to $1.45 and easily surpassed the $1.20 that analysts were modeling.

“Our outstanding performance this quarter—with adjusted EPS up 20% from the prior year driven by our Entertainment and Experiences businesses—underscores our continued success building for growth and executing across our strategic priorities,” said Disney CEO Bob Iger in his prepared remarks.

He added, “Overall, we remain optimistic about the direction of the company and our outlook for the remainder of the fiscal year.”

Disney reports better-than-expected earnings

Looking at the different business segments, Disney’s Experiences segment, which houses its hugely profitable parks business, posted revenues of $8.9 billion, which was 6% higher YoY. The segment’s operating profit rose 9% to $2.49 billion during the quarter.

Notably, the segment accounts for around 60% of Disney’s operating income while its revenue contribution is below 40%. During the earnings call, Iger said, “Experiences is obviously a critical business for Disney and also an important growth platform.”

He added, “Despite questions around any macroeconomic uncertainty or the impact of competition, I’m encouraged by the strength and resilience of our business as evidenced in these earnings and in the second-half bookings at Walt Disney World.”

Disney announced a new theme park in the UAE

Disney also announced a new theme park in the UAE in partnership with Abu Dhabi-based Miral Group. It said that as part of the deal, “Disney will oversee design, license our IP and provide operational expertise, while Miral will provide the capital, construction resources and operational oversight.” Notably, the investment would be in addition to the $60 billion investment that Disney previously vowed for its Parks.

“This is a thrilling moment for our company as we announce plans to build an exciting Disney theme park resort in Abu Dhabi, whose culture is rich with an appreciation of the arts and creativity,” said Iger.

He added, “As our seventh theme park destination, it will rise from this land in spectacular fashion, blending contemporary architecture with cutting edge technology to offer guests deeply immersive entertainment experiences in unique and modern ways.”

Iger said that a third of the world population resides within a four hour flight from UAE and the region has a addressable market of 500 million tourists which bodes well for the upcoming theme park.

Speaking with CNBC. Josh D’Amaro, chairman of Disney experiences said, “This groundbreaking resort destination represents a new frontier in theme park development.”

He added, “Our resort in Abu Dhabi will be the most advanced and interactive destination in our portfolio. The location of our park is incredibly unique – anchored by a beautiful waterfront – which will allow us to tell our stories in completely new ways. This project will reach guests in a whole new part of the world, welcoming more families to experience Disney than ever before.”

Sports segment

Disney’s Sports segment which includes ESPN and Star India reported revenues of $4.53 billion in the fiscal second quarter which was 5% higher than the corresponding quarter last year. The segment however posted an operating profit of $687 million which was 12% lower YoY.

During the Q1 earnings call, Disney forecast its streaming subscribers to fall in Q2. However, the company added 1.4 million Disney+ subscribers in Q2 and ended the quarter with 126 million subscribers which was ahead of the123.35 million that analysts were expecting.

Disney’s streaming business was posting massive losses under Iger’s predecessor Bob Chapek, and quarterly operating losses peaked at around $1.5 billion before Iger took over in November 2022. He changed the company’s strategy, and Disney started targeting streaming profitability instead of chasing subscriber growth. The strategy has paid off, and Disney’s streaming business has now turned profitable.

The Direct-to-consumer segment posted an operating profit of $336 million as compared to $47 million in the corresponding quarter last year.

Notably, Iger has been focusing on content quality rather than quantity. During the earnings call, he admitted, “In our zeal to flood our streaming platforms with tons of content, we lost a little focus by making too much.”

Disney raised its guidance

After the strong Q2 performance, Disney raised its full-year EPS guidance to $5.75, which implies a 16% YoY growth and is significantly higher than the prior guidance for “high single-digit growth. The company however, sees a $300 million loss in its India joint venture owing to “purchase accounting amortization.”

Disney, meanwhile, cautioned on the volatile macro environment and said, “We continue to monitor macroeconomic developments for potential impacts to our businesses and recognize that uncertainty remains regarding the operating environment for the balance of the fiscal year.”

How analysts reacted to DIS’s earnings

Disney’s earnings were received well by the markets, and several brokerages raised their target prices. “At a time when so many businesses in the U.S. are worried about the potential impact of tariffs on consumer spending, on household budgets, Disney is feeling confident,” said Danni Hewson, head of financial analysis at AJ Bell.

Question & Answers (0)