Chinese EV (electric vehicle) companies have released their February delivery reports, with most reporting stellar numbers for the month. Here are the key takeaways from their reports.

NIO delivered 13,192 EVs in February, which was 62.2% higher YoY and ahead of estimates. Of these, 9,143 vehicles were for the premium eponymous brand NIO, while 4,049 vehicles were for the budget brand ONVO. In the first two months of the year, NIO delivered 27,055 EVs, which was 48.8% higher than the corresponding period last year.

Notably, it is prudent to look at the combined figures for January and February, as China’s economic data at the beginning of the year gets distorted due to the Lunar New Year Holidays. While the Lunar New Year fell in January last year, this year, it overlapped between January and February. Meanwhile, NIO’s cumulative deliveries reached 689,619 at the end of February.

Xpeng Motors reported a sharp rise in EV deliveries

Xpeng Motors delivered 30,453 EVs in February, which was 570% higher YoY. While the rise is admittedly coming from a lower base, as the company’s deliveries were quite subdued in the first half of 2024, the numbers are nonetheless quite reassuring and came in ahead of estimates.

Xpeng Motors’ Mona MO3 model has been a hit, and its sales have been above 15,000 units for three consecutive months. Thanks to the stellar sales of the budget EV model, Xpeng Motors’ total deliveries have been above 30,000 for four consecutive months. The sales of its XPENG P7+ model have also been strong, and cumulative sales have topped 30,000 within the first three months of launch.

Xpeng Motors also has autonomous driving capabilities, which are among the most advanced in China. In its release, Xpeng Motors said, “According to the Spring Festival smart driving usage report released by XPENG, XPENG’s total mileage of smart driving and total time by smart driving during the Spring Festival travel season increased 98.2% and 103.5%, respectively, over the same period last year.”

Xpeng Motors said that the monthly active user penetration rate of its XNGP in urban driving reached 86% in February and added that it intends to release its Turing AI Smart Driving features in international driving this year.

BYD partnered with DeepSeek for assisted driving

Last month, BYD released an assisted driving system named “DiPilot” in partnership with DeepSeek. The Chinese AI (artificial intelligence) startup created waves with its low-cost AI model, which performed better than models from OpenAI and Meta Platforms on some parameters. BYD would offer assisted driving for free and would become the only automaker offering these features in cars priced below $10,000.

While one may argue that players like Tesla and Xpeng Motors offer a more advanced version of autonomous driving, BYD offering assisted driving for free has raised fears about other companies’ ability to charge premium pricing for their self-driving features.

BYD’s EV deliveries rose in February

Notably, BYD sells both BEVs (battery electric vehicles) and PHEVs (plug-in hybrid vehicles) and is the biggest global seller in the combined category known as NEV (new energy vehicles).

In February, BYD sold 322,876 NEVs, which took its total deliveries in the first two months of the year to 623,384 – a YoY rise of 92.5%. Notably, while other Chinese EV companies reported a sequential fall in deliveries, the February deliveries of BYD, Zeekr, and Xpeng Motors were high compared to January.

BYD sold 67,025 vehicles in international markets in February, which was a new record. While several countries, especially the EU, have clamped down on EV imports from China to protect their domestic industries, Chinese EV companies haven’t pared back their ambitions and continue to target export markets aggressively.

BYD could become the biggest EV seller

In 2024, BYD became the world’s fourth largest automaker after Toyota, Volkswagen, and Hyundai Group. Unlike these companies that get most of their revenues from sales of ICE (internal combustion engine) vehicles, BYD sells only NEVs. The company’s EV deliveries surpassed Tesla’s in Q4, even as the US EV giant retained the crown for the full year. BYD is widely expected to become the world’s biggest seller of EVs and is already the market leader in the NEV category.

Li Auto’s February deliveries

Li Auto delivered 26,263 vehicles in February, which was 29.7% higher YoY. Its cumulative deliveries rose to 1,190,062 at the end of the month, which is well ahead of other emerging NEV companies in China.

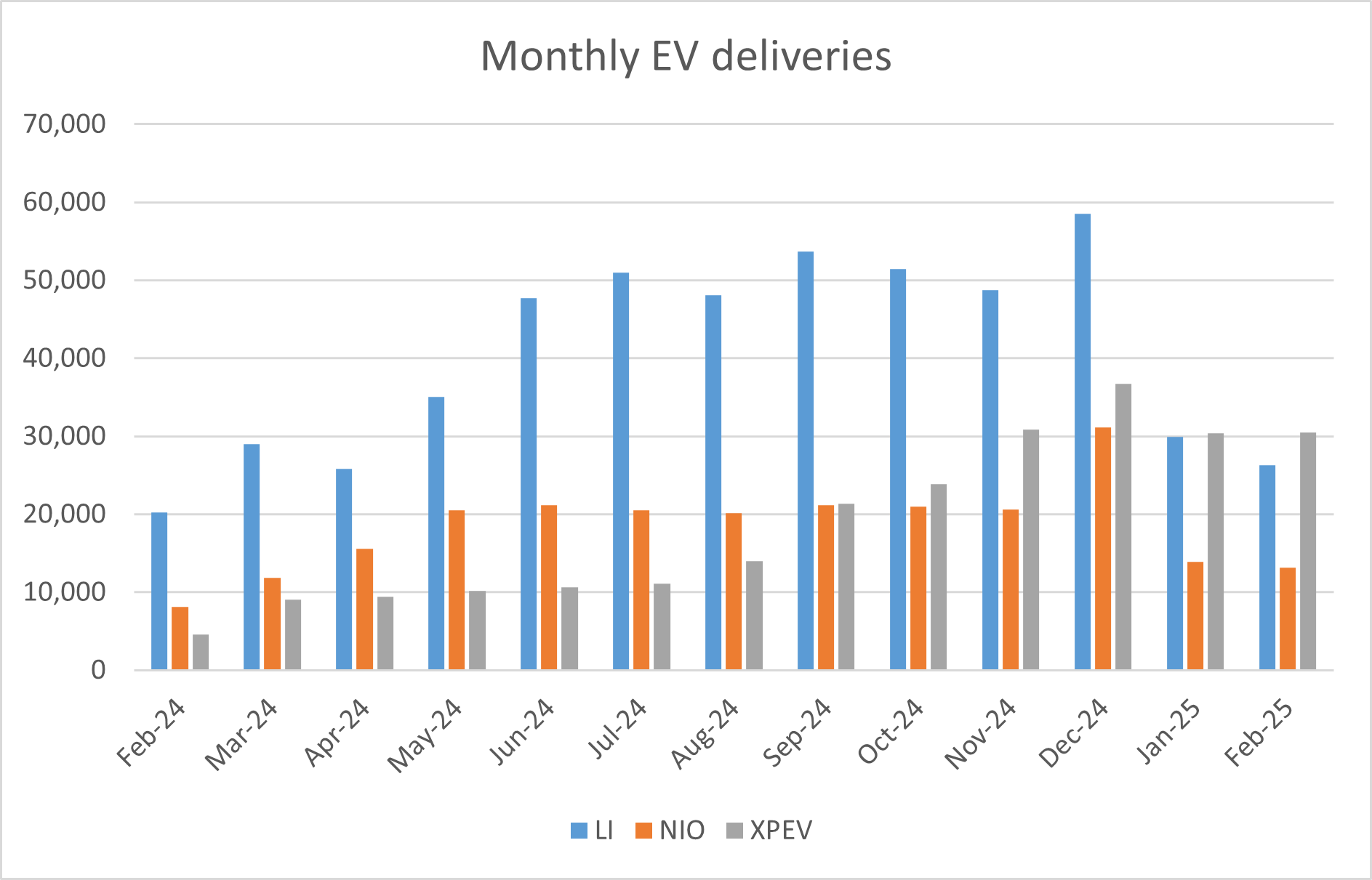

For the last many months, Li Auto’s deliveries were consistently higher than NIO and Xpeng Motors. There have been instances when Li Auto’s monthly deliveries came in higher than the cumulative deliveries of NIO and Xpeng Motors.

However, February was the second straight month where Li Auto’s deliveries trailed Xpeng Motors. Prior to that, it was way back in September 2022 when Li Auto delivered fewer vehicles than Xpeng Motors.

Li Auto primarily sells EREVs (extended-range electric vehicles) and has been pivoting to EVs. However, its Mega EV model, which was launched last year, was a disappointment. The company unveiled its second EV model, named i8, on February 25, and a soft launch is expected at the Shanghai Auto Show in April.

Li Auto shares have underperformed Xpeng Motors this year, but some analysts see a recovery on the horizon. Earlier this week, JPMorgan upgraded the stock to an “overweight” from “equal weight” while raising its target price from $22 to $40. The brokerage expects Li Auto to “comeback” in 2025 and beyond and sees its volumes doubling by 2027 on i8 demand.

In early February, Macquarie had also upgraded Li Auto stock to “overweight” despite the soft deliveries in Q4.

Zeekr reported strong deliveries in February

Zeekr delivered 31,277 vehicles in February, and the Chinese EV company’s deliveries rose almost 87% YoY. Of these, 14,039 were from the Zeekr brand, while 17,238 were for Lynk, which it acquired in February.

Notably, amid a structurally slowing economy, China has taken several measures to revive its growth and announced a flurry of stimulus measures last year. The country provided a trade-in subsidy to spur EV sales last year, which helped the sector report stellar numbers in the final quarter of the year. The country has renewed the subsidy this year, which came as a relief to the sector.

Earlier this month, Chinese President Xi Jinping delivered a speech at a symposium of entrepreneurs. Among those in attendance was Alibaba’s co-founder Jack Ma, who perhaps previously became the face of China’s tech crackdown in 2021.

Xi’s meeting with Chinese entrepreneurs was a positive sign, especially as the Chinese president is known for his hard communist credentials. Under his leadership, China cracked down on its burgeoning tech sector, especially edtech companies. The crackdown began in late 2020 when the country scraped Ant Financial’s IPO.

Question & Answers (0)