Disney (NYSE: DIS) released its fiscal Q4 2024 earnings last week and the shares have risen sharply since the report. Wall Street analysts also warmed up to the entertainment giant as CEO Bob Iger’s turnaround plan has gained traction.

Disney reported revenues of $22.57 billion in the quarter, up 6% YoY and ahead of the $22.45 billion that analysts were expecting. Its adjusted EPS came in at $1.14, which also surpassed the $1.10 that analysts were modeling.

“As I reflect on the two years since I returned to the company, I’m incredibly proud of how much progress we’ve made. We have emerged from a period of considerable challenges and disruption, and we’re well positioned for growth,” said Iger in his prepared comments.

He added, “We put in place specific strategies to generate growth across our businesses, and our solid results this quarter are a clear indication they’ve been successful.”

Disney reported better-than-expected fiscal Q4 earnings

Looking at the different business segments, Disney’s Experiences segment, which houses its hugely profitable parks business, posted an operating profit of $1.66 billion which was 6% lower YoY. However, on a full-year basis, the segment’s operating profits grew 4% to a record $9.27 billion.

While there have been concerns over the segment, it delivered strong performance last fiscal year. Disney said that it expects the segment’s profits to grow by between 6%-8% in the current fiscal year. Notably, ever since Iger returned as the CEO in 2022, he embarked on a turnaround plan, including increasing the outlay towards the parks.

He announced a massive $60 billion expansion plan spread over 10 years to expand the company’s parks and improve customer experience. The announcement came after many visitors complained of long queues and poor experiences at the parks, which are Disney’s lifeblood.

Streaming business churns out a profit

Disney’s streaming business had been posting losses and quarterly operating losses peaked at around $1.5 billion before Iger took over. He changed the company’s strategy and Disney started targeting streaming profitability instead of chasing subscriber growth.

The strategy has paid off and Disney’s streaming business has now turned profitable. It ended the fiscal year with total Disney+ subscribers of 122.7 million of which 56 million are in the US and Canada. Disney+ Hotstar subscribers totalled 35.9 million at the end of the year while total Hulu subscribers were 52 million.

Iger was upbeat after the company’s strong quarterly numbers and said, “This was a pivotal and successful year for The Walt Disney Company, and thanks to the significant progress we’ve made, we have emerged from a period of considerable challenges and disruption well positioned for growth and optimistic about our future.”

Disney provided rosy guidance

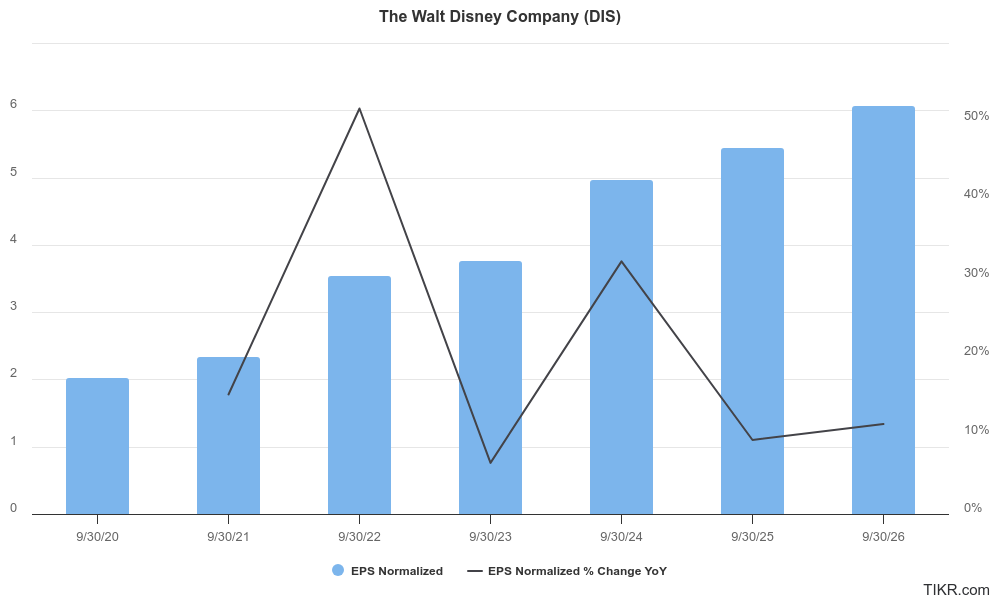

The company’s guidance for the coming years was perhaps the cherry on the cake. It expects its adjusted EPS to rise by high single digits in the fiscal year 2025. Disney expects its dividend growth to mimic its earnings growth during the year and expects to repurchase $3 billion of its shares during the fiscal year.

The company expects double-digit adjusted EPS growth in its fiscal years 2026 and 2027. Notably, while previously Disney provided long-term guidance for its streaming subscriber numbers Iger withdrew that guidance. It has now provided long-term guidance on profits and provided granularity by different segments.

How did analysts react to DIS’s Q4 earnings?

Analysts reacted positively to Disney’s Q4 earnings. UBS maintained its buy rating on the shares and was particularly impressed by the long-term earnings guidance. “Disney reported largely in-line fiscal fourth-quarter results and provided a three-year outlook ahead of consensus,” said analyst John Hodulik in his note.

MoffettNathanson also reiterated its buy rating on Disney and said, “This level and specificity of guidance may represent a whole new world for Disney, and of course is appreciated by us and the Street.”

The brokerage added, “But now it is left to all of us to dig into how confident management is in the forward projections. While this degree of guidance may be a departure for Disney, the broader industry in which the company operates remains as volatile as ever.”

While CFRA maintained its hold rating on Disney it raised the target price by $22 to $120. “Disney took a bold move in providing three years of earnings guidance through fiscal year 2027 which got the equity market’s attention via higher share price,” said analyst Kenneth Leon.

He added, “A major turnaround was seen in direct-to-consumer (DTC) to operating income … offset by a decline in linear networks.”

Disney movies performed well last fiscal year

Disney had a strong performance at the box office in 2024 and became the first studio to gross $4 billion in total collections. Its “Inside Out 2” became the highest-grossing movie of all time surpassing the previous record set by its “Frozen 2.” It has Moana 2” and “Mufasa: The Lion King lined up for the holiday season and the management sees strong momentum for these franchises.

Notably, Iger cut down on the number of movies that Disney produces and instead focused on quality instead of quantity. The strategy has paid off well looking at the recent box office performance of its movies.

According to Disney, “The renewed creative strength at Disney’s studios is a result of the extensive work the company began two years ago to restore creativity to the center of the company.”

“With the combination of our intellectual property, creative talent, and an increased number of consumer touchpoints extending the reach of our stories, a successful Disney movie today drives more value than ever before,” said Iger and CFO Hugh Johnston in their note.

Meanwhile, Disney shares rose 16% last week and have extended their YTD gain to 27% which is higher than the S&P 500 Index.

Question & Answers (0)