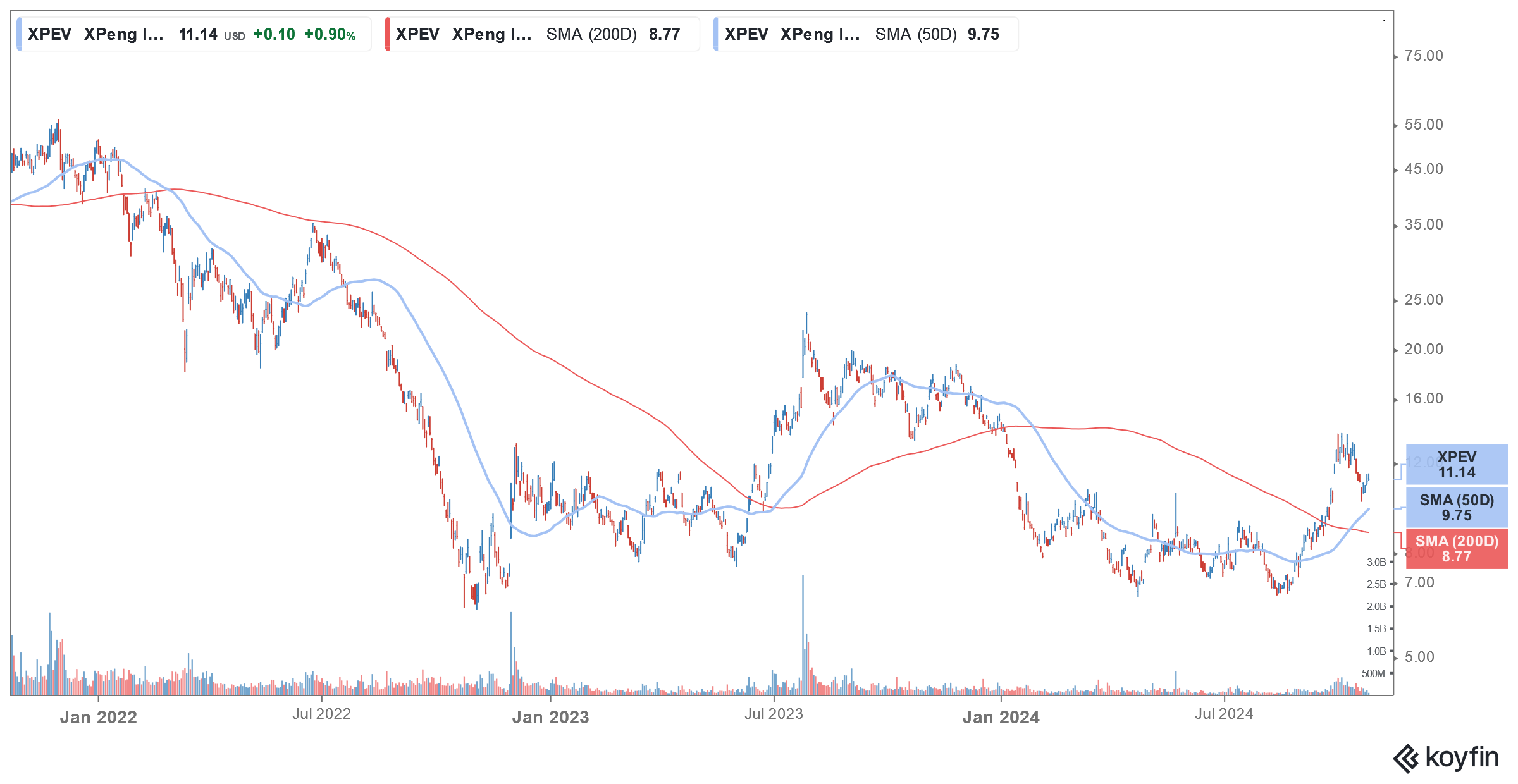

Chinese shares have risen sharply over the last month after the country announced a flurry of measures to revive its economy. Chinese electric vehicle (EV) shares including Xpeng Motors and NIO have especially rallied smartly and have rebounded from their 2024 lows. While the rally in Chinese shares has stalled, JPMorgan sees more gains from Xpeng Motors in the short term.

JPMorgan analyst Nick Lai who has an “overweight” rating and $14 target price on Xpeng Motors, added the share to its positive catalyst watch list and sees the shares rising in the short term.

“In addition to our positive sector stance into the year-end (i.e. 35% QoQ PV growth in 4Q24 vs. seasonality ~20%, click here), XPeng’s upcoming new product strategy, advancing in-house technology and solid 3Q earnings as well as strength in 4Q vehicle delivery should altogether support its share price,” said JPMorgan in its note.

Xpeng Motors delivered a record number of vehicles in September

Xpeng Motors’ EV deliveries rose 39% YoY to a record 21,352 units in September, and the company delivered over 10,000 units of its budget Mona MO3 model during the month. In its release, Xpeng Motors said, “With a broad array of superior configurations and competitive pricing, XPENG MONA M03 has experienced a significant increase in orders since its market launch. XPENG and supply chain partners are sparing no effort to prepare for XPENG MONA M03’s further production ramp-up.”

The Chinese EV company delivered 46,533 units in Q3 which was 16% higher YoY. The company’s cumulative deliveries stood at 498,892 units at the end of September and it has inched close to the milestone of 500,000 cumulative EV deliveries.

Analysts see a sharp rise in Xpeng Motors’ deliveries

JPMorgan expects Xpeng Motors to deliver 300,000 vehicles in 2025 while Citi expects the Chinese EV company to deliver 400,000 vehicles in 2026. Xpeng has started delivering the budget model Mona which is expected to spur its deliveries.

Last year Volkswagen invested in Xpeng Motors and as part of the agreement, XPEV will build two EVs on its platform. The deal was a milestone for the Chinese EV ecosystem as it reflected the confidence of Volkswagen in a startup EV company. It was also a testimony to Xpeng Motor’s self-driving capabilities which the company intends to further build upon. The two companies are also said to be exploring international partnerships.

JPMorgan expects Xpeng Motors to launch an EREV

JPMorgan expects Xpeng Motors to launch extended-range electric vehicles (EREVs) which are quite popular as they come with a generator that can extend the battery range. The brokerage also expects XPEV to launch a robot in the future. “We believe XPeng’s future models will all adopt [a] visual-based solution with [a] competitive price point for buyers (e.g. Max version of Mona 3 sedan at ~Rmb150k from 1Q25),” said Lai in his report.

Lai expects Xpeng Motors to report positive free cash flows in 2025 and a net profit in 2026.

The EU imposed definitive tariffs on Chinese electric cars

Earlier this month, the European Union (EU) imposed definitive tariffs on electric vehicle (EV) imports from China after a split vote. Overall, five members, namely Germany, Malta, Hungary, Slovakia, and Slovenia voted against the tariffs. 12 countries including Greece, Spain, Belgium, and Portugal abstained from the voting. However, the proposal went through as 10 members including Italy, France, Denmark, and Ireland voted in favor of the tariffs.

The tariffs were however much softer than the 100% levy that the US and Canada have imposed on EV imports from China.

In its statement announcing the tariffs, the White House said, “With extensive subsidies and non-market practices leading to substantial risks of overcapacity, China’s exports of EVs grew by 70% from 2022 to 2023—jeopardizing productive investments elsewhere. A 100% tariff rate on EVs will protect American manufacturers from China’s unfair trade practices.”

Notably, the Biden administration took several steps to boost EV adoption in the country. It has linked the EV tax credit to the localization of production – including that of critical battery metals. After the targeted policies, companies like Toyota announced new investments in the US in an apparent bid to make its EVs eligible for the $7,500 EV tax credit.

Meanwhile, the US tariffs were not much of a challenge for Chinese EV companies as they anyways don’t ship much to the country. However, Europe had emerged as a key export market for companies like Xpeng Motors and the tariffs would impact their sales in the region.

EV price war in China

Amid domestic overcapacity, Chinese EV companies like NIO and Xpeng Motors were looking at international markets, especially in Europe.

Notably, there has been a brutal price war in the Chinese EV industry since Q4 of 2022 when Tesla started to cut car prices to spur sales.

Tesla’s price cuts were followed by similar announcements from other carmakers including Xpeng Motors, Ford, Toyota, and Nissan. Last year, even NIO lowered car prices. Previously the company had categorically said that it wouldn’t join the price war.

As new EV models hit the road, the price war might only escalate in the coming months as companies try to push sales through aggressive pricing. These price cuts have meanwhile taken a toll on the margins of all companies – including Tesla, whose margins were once the envy of the automotive industry.

As for Xpeng Motors, markets next look forward to its October delivery report and Q3 earnings. While the company had a tough first half where its deliveries sagged, its shipments have gained pace over the last couple of months and the October deliveries would throw more light on how its Mona model has fared in the market.

Xpeng Motors shares are trading over 1% higher today. The share has gained over 55% over the last six months but is still in the red for the year.

Question & Answers (0)