The odds of a September Fed rate cut have risen after the June jobs report which showed the US unemployment rate ticking up to 4.1%. Here’s what the June jobs report means for interest rates and markets.

The US economy added 206,000 jobs in June which was slightly higher than expected. However, the Labor Department downwardly revised the nonfarm payroll data for April and May for a combined 111,000.

Also, the June unemployment rate was 4.1% which was higher than the 4% that economists had expected. Importantly, average hourly earnings rose 3.9% in June which was the slowest pace of increase since 2021.

June jobs data shows a softening of the labour market

Reacting to the report, Seema Shah, chief global strategist at Principal Asset Management said, “On one hand, the downward revisions to prior months and the rise in the unemployment rate raises the odds of a September Fed rate cut — bond markets are certainly celebrating this.”

She added, “But those same figures cannot help but prompt a twinge of concern about the direction of the U.S. economy. The broad host of economic data all point to a softening — today’s report adds to that picture.”

Fed rate cut probability rises after June jobs report

Meanwhile, the odds of a September rate cut have increased after June jobs data. According to the CME FedWatch Tool, the odds of a 25-basis point rate cut in September is now 72%. The odds were 68.4% before the jobs data was released and 57.9% a week back.

Notably, the Fed has a dual mandate and strives for a healthy labour market along with keeping inflation at 2%. In the past, Fed chair Jerome Powell has argued that a strong labour market was fueling inflation and making the task of bringing it back to 2% difficult.

Notably, the term “labor” featured 32 times in the minutes of the Fed’s June meeting. The minutes said that “demand and supply in the labor market had continued to come into better balance.”

The minutes added, “Participants observed that many labor market indicators pointed to a reduced degree of tightness in labor market conditions.”

Fed still needs confidence before cutting rates

At the June meeting, the Fed held interest rates steady – something it has done for the last year. The minutes said that “Members agreed that they did not expect that it would be appropriate to reduce the target range until they have gained greater confidence that inflation is moving sustainably toward 2 percent.”

Notably, even the May CPI data showed inflation rising 3.3% YoY which was 10 basis points lower than what analysts were expecting. Now, with June jobs data also showing softening of the labour market, investors have started fancying chances of a rate cut as soon as September.

Fed rate increase timeline

The Fed has been on a rate-hiking spree since March 2022. It raised rates by 25 basis points in March 2022 and by 50 basis points in May. In the next four meetings, it raised rates by 75 basis points each before lowering the pace of hikes to 50 basis points in December.

The US central bank raised rates four times in 2023 by 25 basis points each. Currently, the Fed fund rates are 5.25%-5.50% which is the highest since 2001. Amid the Fed’s rate hikes, the yields on the 10-year Treasury spiked to 5% last year for the first time since 2007. The yields since came and were around 3.8% at the end of 2023 but have since risen and currently stand at around 4.2%.

US annualized CPI peaked at 9.1% in June 2022 and has since moderated – even as it is still a long way for it to hit the 2% that the Fed targets.

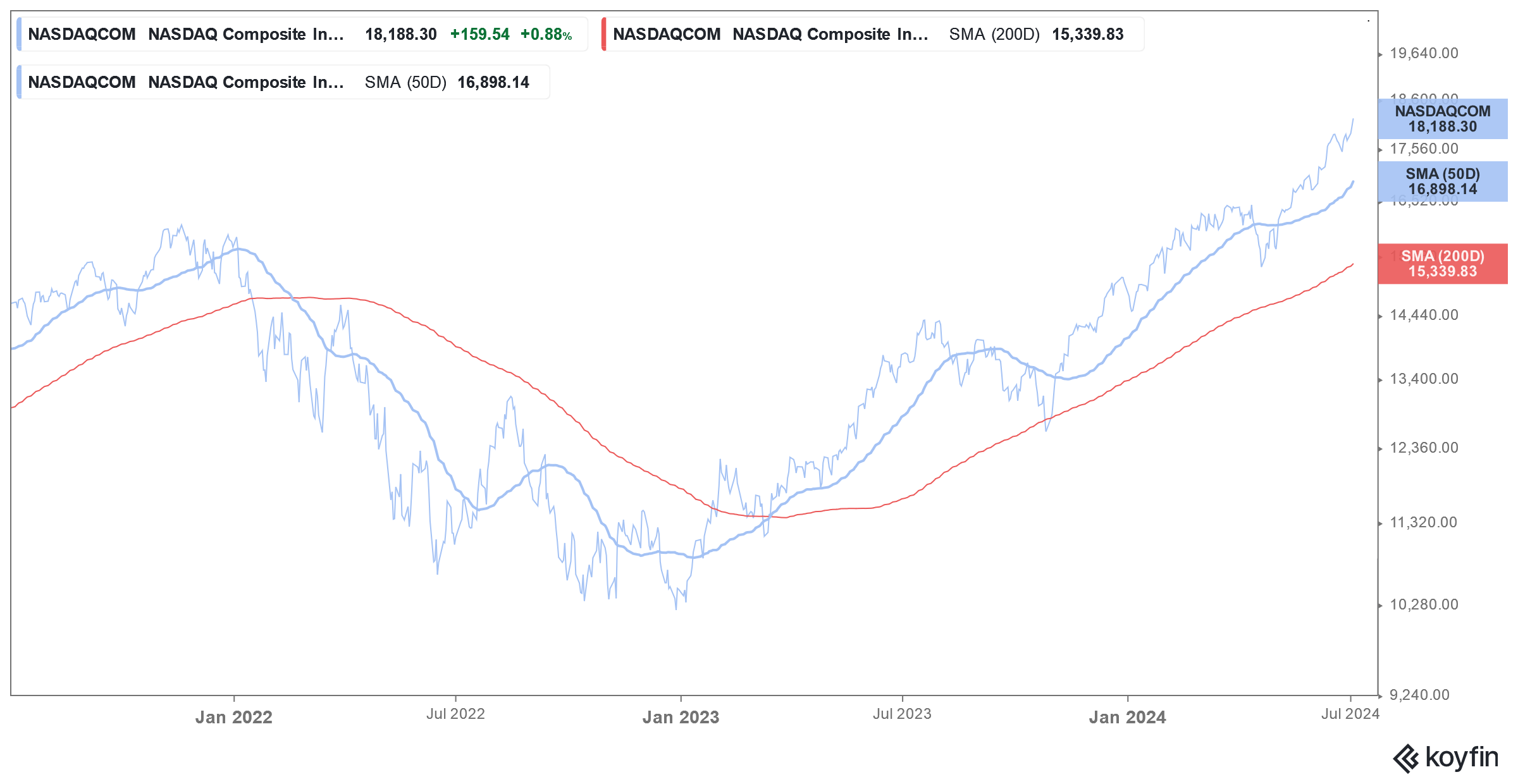

US share markets have risen to record highs

Meanwhile, defying all pessimism US share markets have hit record highs in 2024 and both the S&P 500 and Nasdaq Composite hit new closing highs on Friday after the jobs reports raised the odds of a September rate cut.

Notably, the June dot plot calls for only a 25 basis point rate cut in 2024. In December, the dot plot showed a cumulative 75 basis point rate cut for the year. However, a combination of strong labour markets and sticky inflation prompted the FOMC (Federal Open Market Committee) to tone down its projections of rate cuts.

Now, with both the labour markets and inflation showing signs of softening, investors are fancying their chances of a September rate cut.

Question & Answers (0)