Tesla (NYSE: TSLA) shares fell to their 52-week lows in early US price action today after long-time bull and Deutsche Bank analyst Emmanuel Rosner downgraded the share from a “buy” to “hold” and lowered his target price from $189 to $123.

“The delay of Model 2 efforts creates the risk of no new vehicle in Tesla’s consumer lineup for the foreseeable future, which would put continued downward pressure on its volume and pricing for many more years, requiring downward earnings estimate revisions for 2026+,” said Rosner in its note.

Notably, on April 5, Reuters reported that Tesla had canceled plans to build its low-cost called dubbed Model 2. While TSLA CEO Elon Musk denied the report and said that Reuters was “lying” he did not provide any further details.

Musk touted Model 2 last year

In a December 2023 interview with Sandy Munro – a car industry veteran and owner of Munro & Associates – Musk said, “We are working on a low-cost electric vehicle that will be made at very high volume.” He added, “We’re quite far advanced in that work. I review the production line plans for that every week.”

Musk claimed in his usual way, “The revolution in manufacturing that will be represented by that car will blow people’s minds. It’s not like any car production line that anyone’s ever seen.”

He added, that Tesla is in advanced stages in working on the low-cost model and termed it “a level of production technology that is far in advance of any automotive plant on earth.”

Musk said that it would first build the low-cost model at its plant in Austin, Texas. He added, “Mexico will be the second place [it will be manufactured]. It would take too long to complete the factory in Mexico.”

Tesla has delayed the construction of its Gigafactory in Mexico amid slowing demand for electric cars.

Tesla reported a YoY fall in Q1 deliveries

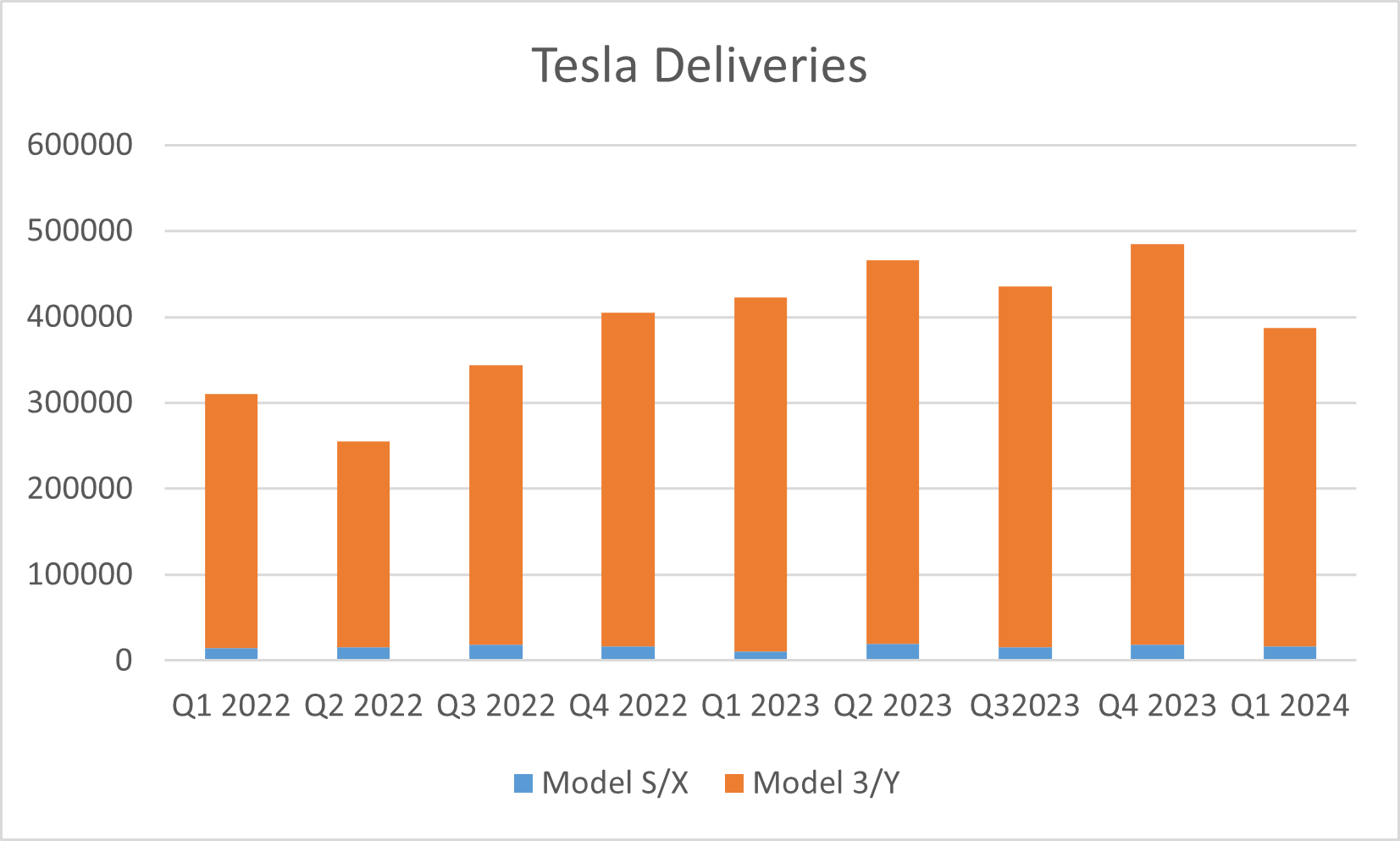

Earlier this month, Tesla reported its deliveries for the first quarter. The Elon Musk-run company reported deliveries of 386,810 in the quarter which was 8.5% lower than the corresponding quarter last year. It was the first time since 2020 that the company reported a YoY fall in deliveries and went on to show that even Tesla is not immune from the EV industry slowdown.

Meanwhile, Deutsche Bank believes that Tesla’s delivery volumes might remain subdued in the near term.

“The delay of Model 2 efforts creates the risk of no new vehicle in Tesla’s consumer lineup for the foreseeable future, which would put continued downward pressure on its volume and pricing for many more years, requiring downward earnings estimate revisions for 2026+,” said Rosner in his note.

He added, “Without any new vehicle, we feel that Tesla could face more headwinds to growth, as competition arise in China and from other OEMs, to which the company may not be able to respond due to limited [free cash flow,]”

Tesla has been lowering prices to spur sales

Tesla has been lowering prices to spur vehicle sales – a move that has sparked an industry-wide price war.

In an employee memo in February, Xpeng Motors’ CEO He Xiaopeng said that the price war in the EV industry could end in a “bloodbath.” Notably, there has been a brutal price war in the Chinese EV industry since Q4 of 2022 when Tesla started to cut car prices to spur sales.

Tesla’s price cuts were followed by similar announcements from other carmakers including Xpeng Motors, Ford, Toyota, and Nissan.

Last year, even NIO lowered car prices. Previously the company had categorically said that it wouldn’t join the price war.

The Elon Musk-run company has since lowered prices multiple times. Last year, The China Association of Auto Manufacturers (CAAM) tried to bring about a truce in the EV price war but soon rescinded the pledge admitting it was against the country’s antitrust laws.

EV demand has been quite weak

EV demand has been quite weak prompting companies to readjust their production plans. For instance, both Ford and General Motors which have committed billions of dollars towards building EV plants are delaying their investments. Startup EV companies have been under even severe stress and are grappling with continued cash burn. Several startup EV companies have either gone bankrupt or are on the verge of doing so.

Tesla is facing severe competition in China

Tesla is also facing severe competition in China from domestic Chinese automakers. Musk meanwhile has been all praise for Chinese EV companies and during the Q4 2022 earnings call he said, “Frankly, I think, if there are not trade barriers established, they will pretty much demolish most other companies in the world.”

He added, “The Chinese car companies are the most competitive car companies in the world. So, I think they will have significant success outside of China depending on what kind of tariffs or trade barriers are established.”

Meanwhile, there is a massive EV overcapacity in China and even US Treasury Secretary Janet Yellen called out the country for its EV overcapacity.

As for Tesla, investors would next watch out for the Q1 earnings which are scheduled for next week. For now, Tesla is the worst-performing S&P 500 share as markets grow increasingly wary of the company’s business outlook amid the slump in EV sales.

Question & Answers (0)