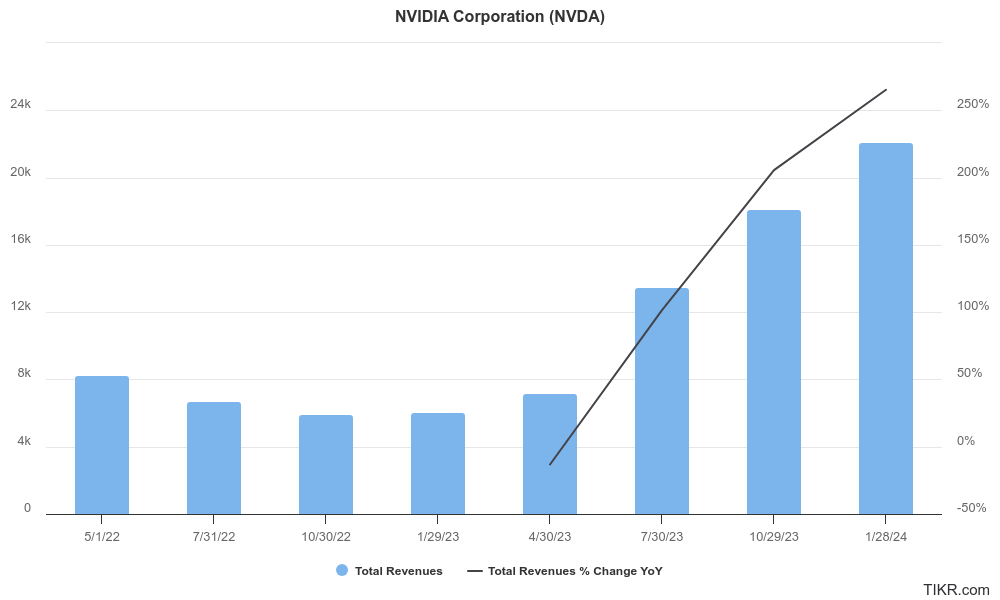

Nvidia released its fiscal Q4 earnings after the close of markets on Wednesday. Here’s how analysts reacted to Nvidia’s earnings.

Nvidia reported revenues of $22.1 billion in the fiscal fourth quarter of 2024 which was 265% higher YoY and ahead of analysts’ estimates. The company’s net income rose a whopping 769% over the period as it continues to benefit from soaring demand and strong pricing for its artificial intelligence (AI) chips.

Nvidia forecast revenues of $24 billion at the midpoint for the fiscal first quarter which was also well ahead of estimates.

Nvidia’s shares rose after the report

Nvidia’s shares soared in US price action yesterday and it added a record $273 billion to its market cap in a single day. It was a new single-day record and beat the previous record of nearly $200 billion that Meta Platforms set earlier this month only when it also impressed markets with its Q4 earnings and guidance.

NVDA is benefiting from AI pivot

NVDA is benefiting from the AI pivot. CFO Colette Kress said during the earnings call, “The consumer Internet companies have been early adopters of AI and represent one of our largest customer categories. Companies from search to e-commerce, social media, news and video services and entertainment are using AI for deep learning-based recommendation systems. These AI investments are generating a strong return by improving customer engagement, ad conversation and click-through rates.”

She also listed how different other industries are working on AI and said that the company estimates that the Automotive vertical’s Data Center revenue contribution through the cloud or on-prem was over $1 billion in the last fiscal year.

She added that in the healthcare industry, “digital biology and generative AI are helping to reinvent drug discovery, surgery, medical imaging, and wearable devices.”

Kress added that in “financial services, customers are using AI for a growing set of use cases from trading and risk management to customer service and fraud detection.” She gave an example as to how American Express improved its fraud detection accuracy by 6% through Nvidia AI.

Nvidia’s China revenue falls

While Nvidia’s Data Center sales were strong in all markets, China was an aberration, thanks to the US chip export restrictions.

Kress said, “Although we have not received licenses from the U.S. government to ship restricted products to China, we have started shipping alternatives that don’t require a license for the China market. China represented a mid-single-digit percentage of our Data Center revenue in Q4, and we expect it to stay in a similar range in the first quarter.”

In response to an analyst question on the company’s China business, Jensen Huang said that through its actions, the US government intends to stop the flow of Nvidia’s accelerated computing and AI to China but added that even with the restraint the government wants it to “as successful in China as possible.”

Jensen Huang on Nvidia’s earnings

Huang said, “we’re going to do our best to compete in that marketplace and succeed in that marketplace within the specifications of the restriction. And so that’s it. This last quarter, we — our business significantly declined as we paused in the marketplace. We stopped shipping in the marketplace. We expect this quarter to be about the same. But after that, hopefully, we can go compete for our business and do our best, and we’ll see how it turns out.”

Responding to an analyst question about the trajectory of Data Center revenues in 2024 and 2025, Huang said that AI is “enabling a whole new industry.”

He stressed, “A whole new industry in the sense that for the very first time, a Data Center is not just about computing data and storing data and serving the employees of the company. We now have a new type of Data Center that is about AI generation, an AI generation factory, and you’ve heard me describe it as AI factories.”

Huang also added that “fundamentally, the conditions are excellent for continued growth” even beyond 2025.

Analysts raise Nvidia’s target price

Wall Street analysts went overboard with raising Nvidia’s target price in what has been quite a ritual for the last year. Bernstein analyst Stacy Rasgon raised Nvidia’s target price to $1,000 and said “the company is printing money at this point,” while adding “and the prospect for continued growth from here still seems solid.”

JPMorgan also raised Nvidia’s target price to $850 and analyst Harlan Sur said, “More importantly, the [Nvidia management] team noted that demand will continue to outstrip supply through CY24, allaying fears of an inventory build/correction in the 2H of the year.”

Goldman Sachs also raised Nvidia’s target price from $800 to $875.

Deutsche Bank analyst Ross Seymore meanwhile retained his hold rating on NVDA and said, “Overall, we applaud NVDA for yet another quarter of massive upside on both the top and bottom line … and believe fundamental momentum remains in NVDA’s favor in the near and medium terms,” Seymore wrote. “However, on moderately higher estimates … and after embedding a modest cyclical correction in 2025, we believe NVDA’s earnings potential is sufficiently reflected in the [company’s] current valuation.”

UBS lowered Nvidia’s price target

UBS meanwhile lowered Nvidia’s target price by $50 to $800 even as it maintained its buy rating. “The bottom line is that we are still in such early stages of what is possible with AI (especially health care/drug discovery) and NVDA is the de-facto global AI platform, it seems too soon to take a more cautious view. We are trimming estimates a bit to reflect some potential slowing in revenue growth and price target goes from $850 to $800 but we maintain our Buy,” said the brokerage in its report.

Meanwhile, after rising over 16% yesterday, Nvidia shares are up in US premarket action today also amid the continued optimism over the company’s business.

Question & Answers (0)