AstraZeneca shares are unresolved this morning after the holidays while the stock seems headed for its sixth red day in a row as the British pharmaceutical giant was left behind in the race to secure the approval of its COVID-19 vaccine.

Based on today’s quotation, AstraZeneca (AZN) stock accumulates an 11.5% plunge since 14 December, when the company announced the acquisition of US-based drugmaker Alexion Pharmaceuticals in a deal valued at $39 billion.

On that day, AZN shares lost 5.7% during a high-volume session as the deal involved a stock allotment of 2.1243 AstraZeneca American Depositary Shares (ADRs), which is around 1.06215 regular shares.

This deal would represent roughly 27.5% of AstraZeneca’s market capitalisation on the day before the announcement and the resulting downtick was partially caused by the effect of the newly-issued shares that will now be granted to Alexion’s shareholders.

In summary, Alexion shares are being valued at $175 per share with a total of $60 granted in cash while the remaining $115 will be paid through the issuance of new AZN shares. As a result, Alexion’s stockholders will now hold a 15% stake in the British pharmaceutical.

A total of approximately 230 million new AstraZeneca shares would be issued as a result of the deal, which represents almost 9% of the current 1.31 billion shares in circulation.

The current 11.5% slid in AZN shares since the deal was announced seems to be almost fully explained by the upcoming dilution, while other factors including the potential approval of the firm’s COVID-19 vaccine could also be weighing on the valuation.

In this regard, UK regulators appear to be ready to approve the firm’s vaccine over the coming days as the virus situation in the country continues to worsen.

The approval of AstraZeneca’s COVID vaccine, which is being developed alongside the Oxford University, could be a game-changer for the British nation, as 100 million doses have already been ordered to fully inoculate the country’s 66.6 million residents.

However, the fact that the British pharmaceutical giant lost the race to get its vaccine approved before its American rivals Pfizer (PFE) and Moderna (MRNA) has also weighed on its share price as investors have probably cut back on their forecasts, possibly predicting lower-than-expected revenues from this specific treatment.

How have AstraZeneca shares performed this year?

This latest downtick seen by AstraZeneca shares has sent the stock to neutral territory in regards to its performance since the year started, producing zero gains for investors after delivering a solid 25% gain during the month of July – back when the company was considered a front-runner in the race to find a vaccine.

Meanwhile, the firm’s acquisition of Alexion poses some questions for investors, as the size of the transaction might affect the company’s financial performance over time. In response to the announcement, Fitch Ratings has revised its outlook for AstraZeneca to Stable from Positive while Moody’s cut its outlook to Negative amid the deal.

What’s next for AstraZeneca shares?

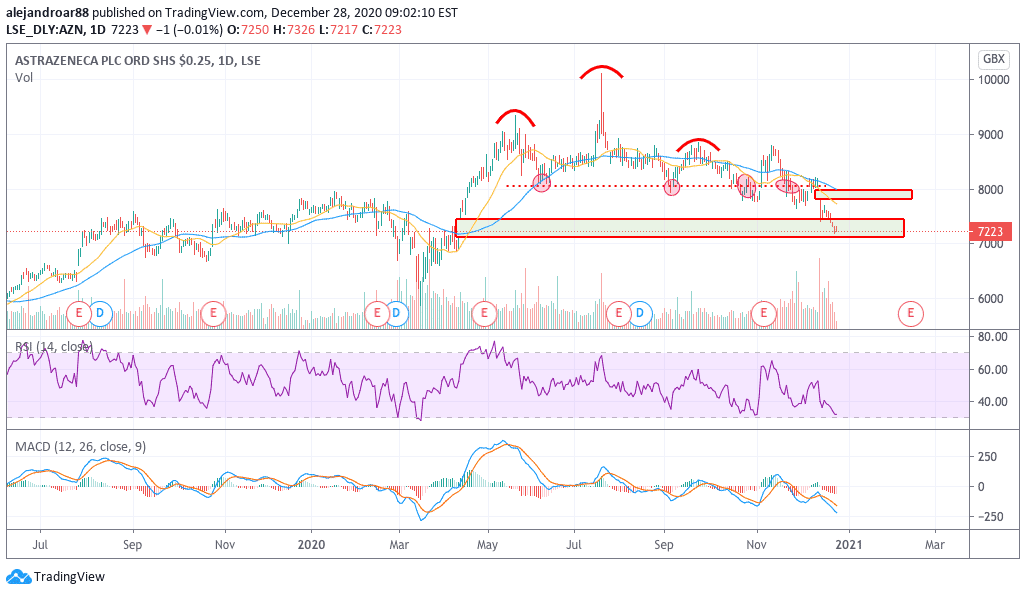

AstraZeneca’s latest price action shows that the bullish gap left behind in April has been almost filled, which reinforces a bearish short-term outlook for the shares – especially now that its yearly performance is close to turning negative.

Meanwhile, the bearish gap left behind during the 14 December plunge will now serve as resistance and chances are that a few months might go by before investors fill it as the company will have to prove that this acquisition was actually worth the dilution that shareholders will take.

For now, the base of the April bullish gap remains a support level to watch, while the stock has already plunged below virtually all of its short-term and long-term moving averages.

These bearish indicators could be signaling the beginning of a strong downtrend, although some believers may jump in shortly to buy shares at a potential dip if they come up with positive thoughts in regards to the acquisition.

Question & Answers (0)