Best Yield Farming Platforms UK

Passive income generation is perhaps a little-known tool in today’s market and can prove to be an attractive option for anyone who wants to increase their income with little involvement or work. Yield farming is one way that crypto can be used as a source of passive income. In this article, we are going to review the best yield farming platforms in the UK Additionally, we will talk about what yield farming is and the difference between yield farming and staking.

Best Yield Farming Platforms UK (List)

- DeFi Swap – Generate Returns From 30% To 75% APY On Defi Swap In The UK

- Crypto.com – Excellent Platform For Generating High APY Yields Through Stablecoins In The UK

- BlockFi – Earn High Interest From Stablecoins And Traditional Digital Assets

- Coinbase – The Best Yield Generating Platform Available For Beginners In The UK

Best Yield Farming Platforms UK – Reviewed

Next, we will review the best yield farming platforms in the UK so that you can choose the one that best suits your financial objectives. We recommend you analyze them well to make the best decision and succeed in cryptocurrency farming.

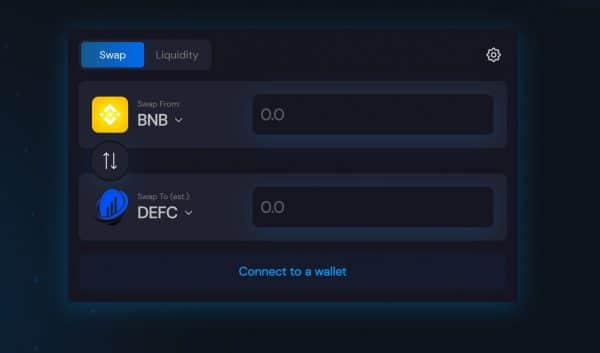

1. DeFi Swap – Generate Returns From 30% To 75% APY On Defi Swap In The UK

Crypto investors can earn up to 75% APY with DeFi Swap, a crypto exchange, and yield farming platform. The high rates offered by DeFi Swap can be attributed to its native token, DeFi Coin (DEFC), which is the platform’s only cryptocurrency that can be used. A 30-day lock-in period is required for coins, with a maximum of one year allowed. The APY rate for a 30-day lock-in period is 30%, while for a 1-year lock-in period, it is 75%.

Crypto investors can earn up to 75% APY with DeFi Swap, a crypto exchange, and yield farming platform. The high rates offered by DeFi Swap can be attributed to its native token, DeFi Coin (DEFC), which is the platform’s only cryptocurrency that can be used. A 30-day lock-in period is required for coins, with a maximum of one year allowed. The APY rate for a 30-day lock-in period is 30%, while for a 1-year lock-in period, it is 75%.

DeFi Swap is a relatively new platform but has quickly gained recognition as one of the best-performing platforms of 2022. As a DeFi exchange and service, it is fully decentralized. Most stablecoins are also supported on the DeFi Coin exchange. Early investors could see higher fees or more yield farming options in the future thanks to DeFi Swap, which has made no secret of its goal to become the most important place for decentralized finance.

It should be mentioned that DeFi Swap levies a tax on DeFi Coin transactions which can make it an excellent alternative if you are looking for a cryptocurrency that will give you great returns in the long run using yield farming. The tax is around 10% on purchases and orders. Half of that amount is passed on to DEFC holders as a reward, and the rest goes to DeFi Swap liquidity funds to simplify token exchanges. Currently, more than 6,000 people are part of the DeFi Swap community on their Telegram platform.

The DeFi swap app is available online or as a decentralized app for download. However, yield farming options and interest rates are only available when a wallet is connected.

Cryptoassets are highly volatile unregulated investment products. No EU or UK Protection.

2. Crypto.com – Excellent Platform For Generating High APY Yields Through Stablecoins In The UK

Using Tether, for instance, requires locking up your tokens for three months to earn the full 14% APR. A minimum of 40,000 CRO tokens must also be staked. The APY drops to 6% if you deposit Tether without staking any CRO tokens and withdraw on an as-needed basis. The APYs offered by Crypto.com are suited to different needs as a result.

Additionally, Crypto.com offers over 250 digital currencies that yield interest outside of stablecoins. Bitcoin, Ethereum, Litecoin, and Solana are included here, as well as Shiba Inu and Decentraland. Of course, it will depend on the lock-up period and whether you can earn APY if you wish to stake CRO tokens. No matter where you are, you can access your account through the Crypto.com mobile app.

Crypto assets are highly volatile unregulated investment products. No UK or EU investor protection.

3. BlockFi – Earn High Interest From Stablecoins And Traditional Digital Assets

A Bitcoin investment can yield up to 4.5% if you want to generate a return on your investment. Deposits up to 0.10 BTC are eligible for this rate. A 1% rate is then applied after that. However, this only applies to the first 1.5% ETH, so Ethereum is a bit more competitive at 5%.

A large percentage of BlockFi’s digital client funds are stored in cold storage in order to ensure their safety. BlockFi’s insurance policy also covers remote hacking.

BlockFi offers traditional trading accounts as well as crypto yield services. Digital currencies can be bought and sold at competitive fees thanks to this service. Furthermore, the BlockFi platform allows you to generate yields immediately after purchasing a crypto asset. In addition to its top-quality customer service, BlockFi also offers phone support.

Your capital is at risk.

4. Coinbase – The Best Yield Generating Platform Available For Beginners In The UK

A staking tool that does not require lock-up is available via the company’s automated staking tool. Currently, Coinbase only supports six crypto yield tokens since it entered this space only recently. There are four cryptocurrencies included in this list: Cosmos (5%), Tezos (4.63%), Ethereum (4.5%), and Algorand (4%). In addition, USDC (0.15%) and Dai (2%) are good examples of stablecoins. Compared with other platforms, Coinbase offers less competitive APYs, even though it is ideal for newbies.

Furthermore, Coinbase offers some of the most advanced security protocols in this space, including cold storage, two-factor authentication, and IP address/device allow listing. The company is also regulated in the United States and traded on the NASDAQ. With over 50 digital tokens supported on Coinbase, you can also build a diversified portfolio of cryptocurrencies.

68% of retail investor accounts lose money when trading CFDs with this provider.

What is Crypto Yield Farming?

Having reviewed the best Yield Farming platforms in the UK, it’s time to know what exactly cryptocurrency Yield Farming is. Simply put, crypto yield farming is the process of lending or betting your cryptocurrency holdings to generate returns passively. Decentralized platforms like DeFi have been gaining popularity recently and have very novel features for users to utilize, such as liquidity mining. In this way, users can increase their profits.

Crypto Yield Farming Explained- How Does It Work?

Using any yield farming platform, you aim to generate income by lending your digital assets passively.

This works in the same way as depositing money into a regular savings account, and offers you something called (APY) which is ultimately an annual percentage yield.

Although the concept of cryptocurrency yield farming is more difficult than a regular savings account, therefore there are higher risks. If you desire to learn more, we invite you to continue reading our guide about cryptocurrency lending platforms.

How To Make Money With Crypto Yield Farming

After learning how yield farming works, you may be wondering how money is made through the process.

After asking yourself that question, we must say that there is no exact formula for making profit through yield farming. Instead, you should consider the possible variables that may arise, such as the APY paid for lending your cryptocurrency holdings to liquidity funds.

By lending $2,000 in crypto at an APY of 10%, you will increase your digital asset portfolio by $200 in 12 months.

However, the rewards are paid in digital tokens rather than fiat money in cryptocurrency farming.

That said, you should consider the digital tokens’ price when you make the respective investments and how market conditions will determine the interest participation.

We will show this with an example below to help clear up any doubts.

- Imagine investing in a fund offering 6% annual interest on Ethereum.

- You invest a totality of 1 ETH, which, at the time of deposit, is worth $3,000.

- A year after making your 1 ETH investment, you have received 0.06 ETH in interest payments. As a result, your total balance is now 1.06 ETH.

- You would have $3,180 in your account if you were to invest $3,000 12 months earlier.

- Since Ethereum is trading at $4,000 per token, your 1.06 ETH balance is worth $4,240.

Based on the previously explained example, cryptocurrency yield farming is not only for the ultimate purpose of earning APY. It can also serve as analysis to see how much the value of the respective token has increased.

If you succeed in everything, you will be able to generate income in two ways: capital gains and interest.

If this happens, you will earn money on two fronts: interest and capital gains.

However, it is also important to remember that if the price of the token goes down, the consequences will be that your investment will be worth less. That is why it is vital to be aware of the market to know the precise moment and do performance farming.

Another recommendation is to always carry out previous research of the market, since this way you will have a broader vision of the market and it will help you to make fewer mistakes and obtain profits faster.

But we want to reiterate that although it is a tool that is used to generate income passively, profit is not guaranteed.

Crypto Yield Farming Taxes

The issue of taxes has a lot of relevance in this type of investment. Let’s illustrate with an example: you acquired $1,000 of Ethereum, and you could cash out $1,500, meaning that there is $500 that is conditioned to taxes by way of your withdrawal.

It is also very likely that if you get to earn interest using cryptocurrency yield farming, you have to pay some tax. People often don’t keep this in mind and are a bit discouraged when they have to do so. However, it all varies depending on your country of residence.

Having explained this, the taxes linked to cryptocurrencies, and yield farming, can be complex for most people. That is why the best recommendation we can give you is to consult an advisor with the necessary preparation and a specialist in digital currency taxes.

Which Coins Can You Yield Farm?

No set number of digital assets can be used to earn interest using cryptocurrency yield farming.

What you are looking for with yield farming is that you can use a cryptocurrency pair with similar levels of liquidity.

All cryptocurrency trading pairs need liquidity to produce the best market conditions, meaning that you will have many alternatives open to you when you choose the token.

That said, the liquidity pool you deposit your tokens into will greatly influence the amount of interest you earn.

An example would be:

- APYs will be modest if you offer liquidity for major pairs like ETH/BTC or BNB/ETH.

- Conversely, you can earn more competitive interest rates if you add funds to a less liquid pool, such as AAVE/ETH.

- On the other hand, you could earn triple-digit APY if the liquid pool refers to a newly launched digital token with a minuscule market cap.

Again, it is important to determine your risk tolerance before farming cryptocurrencies. Yield farming of cryptocurrencies can be mitigated by investing in various pairs to spread your risks.

Yield Farming vs Staking

Surely when you heard about farming, you thought it was the same as staking. This may turn out to be a misconception. It must be said that while it is possible to earn interest with cryptocurrency token staking, both processes have differences.

The most important difference is where your tokens are deposited.

The deposit of tokens when using yield farming will is into smart contracts. At the same time, the smart contract is in charge of distributing your funds to a liquidity pool.

Now in the case of crypto staking, the tokens are deposited directly into the blockchain network.

Each process has its benefits and difficulties, so we recommend you analyze which one is the most suitable for your financial goals. Do not forget to consider the risks involved with both processes.

Comparing these two processes concerning security, cryptocurrency staking is much more favorable because the tokens are locked in a blockchain network instead of a smart contract.

This means, however, that the yield provided when staking is much lower when compared to yield farming.

This implies that crypto staking will typically produce lower performance than performance farming. Furthermore, the only blockchain networks that support crypto staking use the proof-of-stake consensus mechanism.

Despite this, any cryptocurrency can be used for yield farming.

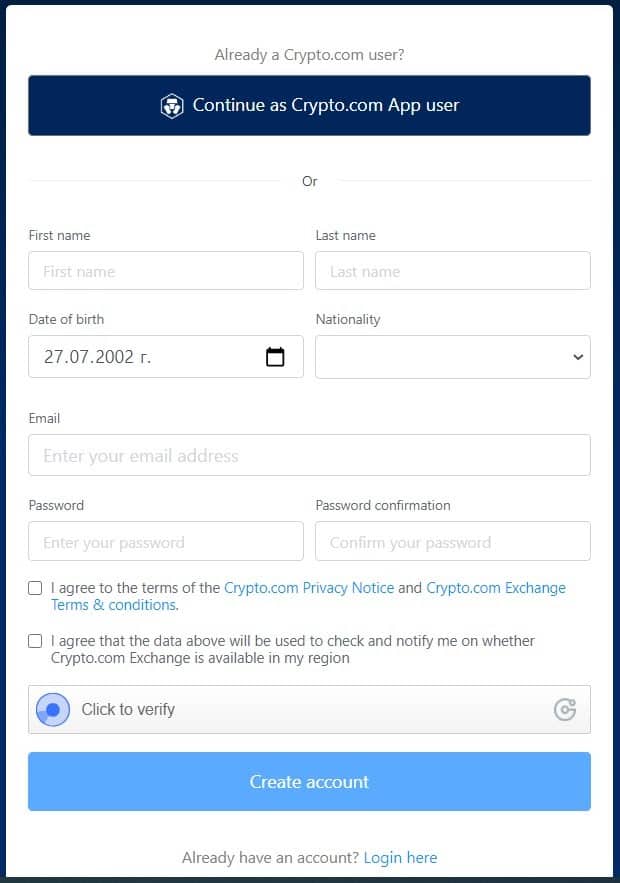

How to start Yield Farming in the UK

In the next part of our article, we will illustrate how to yield farming starts in the UK. The platform we will use as an example will be Crypto.com, one of the best platforms on the market. Therefore, you should not miss any step and see that you will succeed at the process’s end.

Step 1: Open a trading account

The first step is to open an account. For that, you should go to official website and enter your basic details, confirm your identity, and transfer funds to your account to be used. This whole process will probably take you a few minutes.

Step 2: Buy ETH

Now you need to buy ETH so that you can generate liquidity in the market. Using a cryptocurrency such as Ethereum, you can use peer-to-peer pairs. Remember that in order to be able to buy, you must have previously added funds to your account.

Step 3: Open a hardware wallet

You need to open and have an account to be able to use a hardware wallet. Connecting to a hardware wallet can be done using a mobile device with the internet.

Step 4: Research farming opportunities

The last step is to always look for opportunities. For that, it is of utmost importance that you do previous research to know the right moment for farming in the market. In some opportunities, patience is important to wait for the most favorable conditions.

Yield Farming Platforms in the UK- Conclusion

This article on farming has been mentioned as a way to achieve yields passively in the market. We have also discussed the difference between yield farming cryptocurrencies and staking cryptocurrencies.

It is important to emphasize that your digital assets will be held in smart contracts, providing a lot of confidence regarding security.

It is also imperative to emphasize never to invest more than you are allowed to lose because if you use cryptocurrency farming to generate income, the opposite effect can also occur. You must be very attentive to the issue of taxes and know the values you must pay when reporting your profits.

If you want to start today in one of the most recognized crypto platforms in the market and be able to do yield farming, just click on the link below.