Best DeFi Projects UK to Buy

Decentralized finance (DeFi) is among the most exciting cryptocurrency and blockchain technology applications. In essence, DeFi is a cheaper, more transparent, and more secure financial solution than the current central financial intermediaries. This article explains what DeFi coins are and discusses the best DeFi projects UK to invest in 2024.

In addition, we will discuss some of the newest DeFi projects in the UK and some of the best platforms to buy DeFi for your portfolio. As a result, here are the best DeFi projects to invest in 2024!

Best DeFi Projects UK – List

Several thousand coins are traded in the DeFi sector, with a market cap of $50 billion. To assist you in navigating this vast space, we have selected the top 5 best DeFi coins to buy in 2024.

The list below includes:

- LuckyBlock – Top UK DeFi Project To Buy In 2024

- DeFi Coin– Overall Best DeFi Coin to Buy in 2024

- Uniswap – Top DeFi Project and Liquidity Provider

- Decentraland – DeFi Project to Invest in the Metaverse

- PancakeSwap – Popular DEX Exchange in UK

- SushiSwap – One of the Top DeFi Coins for an All-in-One DeFi Platform

- Yearn. Finance – Defi Services via Decentralized Lending Agreements

- Cosmos – Top-Rated Defi Coin Protocol Offering Blockchain Interoperability

Best UK DeFi Projects to Buy in 2024

The best DeFi projects should be analyzed based on long-term growth, market capitalization, current coin price, and available exchanges.

Based on these factors, here are some of the best DeFi projects to buy in 2024.

1. LuckyBlock – Top UK DeFi Project To Buy In 2024

Lucky Block is an exciting new DeFi project that leverages decentralized technology to promote transparency and fairness in the gaming industry.

Lucky Block’s online crypto prize draw system runs on Binance Smart Chain (BSC), so it is accessible anywhere. The Lucky Block ecosystem revolves around the LBLOCK – the native digital token.

To purchase draw tickets and receive the jackpot rewards, users must have the LBLOCK coin.

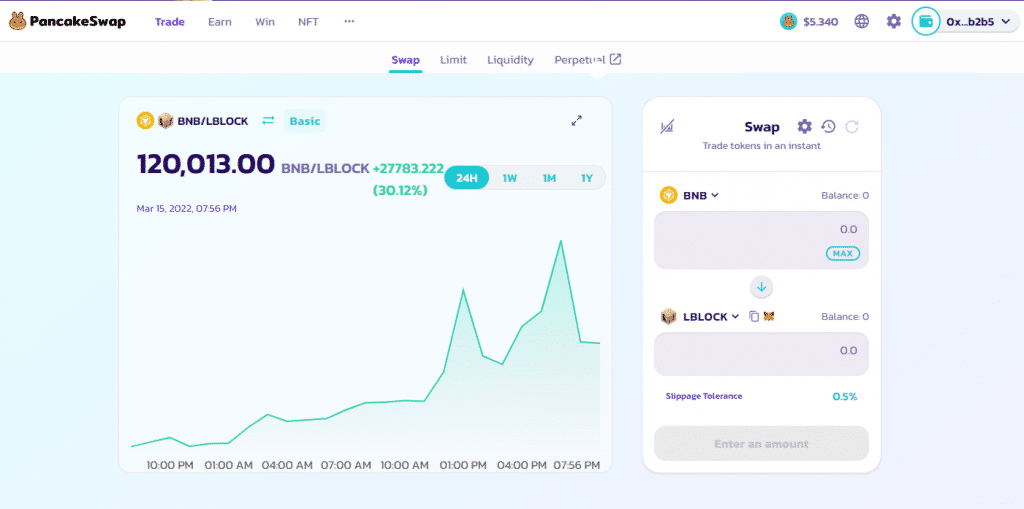

LBLOCK was released on Pancake Swap – one of the industry’s largest decentralized exchanges (DEX). With an ICO price of $0.00089, LBLOCK rose to an all-time high (ATH) of $0.009617.That represents a 10x price increase.

LBLOCK’s price has been corrected to $0.001358 since January. However, the correction may benefit investors looking to hold the token for a long time. In addition, owners of LBLOCK may benefit from long-term holding, including the possibility of regular dividends.

Lucky Block has a trading volume of just over $1 million, placing it among the top upcoming DeFi coins and an exciting new coin to watch in 2022.

If you are interested in buying Lucky Block, check our latest review!

Cryptocurrency markets are highly volatile and your investments are at risk.

2. DeFi Coin – Overall Best DeFi Coin to Buy in 2022

DeFi Coin is at the top of the best DeFi coins to buy. This cryptocurrency token is firmly rooted in the ever-growing sector of decentralized finance (DeFi). DeFi Swap is a native token on the new DeFi Swap decentralized exchange (DEX), which offers swapping, staking, and yield farming services. DeFi Swap also offers some of the best interest rates for holders of DEFC tokens.

After months of development, DeFi Swap was launched in early May by the team behind the exchange, resulting in over 300% in the price of DeFi Coin (DEFC). In addition to being the native token for the exchange, DEFC also has several other exciting use cases, including ‘static rewards’ for holders.

That is made possible by a 10% tax imposed on anyone who buys or sells DeFi Coins. DEFC holders receive 50% of the collected amount back as a reward, providing a regular passive income source. The other 50% is redirected back into DeFi Swap’s liquidity pools, which boosts liquidity automatically.

As a result, the team behind DeFi Coin burned all their tokens at launch, demonstrating that this is not a ‘get rich quick scheme, as has been the case with certain other projects. These characteristics have already attracted significant attention on social media, and the token is now available for purchase through BitMart, the leading cryptocurrency exchange.

DeFi Coin is currently working on several plans, including DeFi Swap V2, including technical analysis, webinars, news, and more. The DeFi Swap app will also be released later this year, including educational content. DEFC is one of the best DeFi coins to consider in your portfolio when you factor in these exciting plans and the growing membership in the DeFi Coins Telegram group.

DeFi Coin can be purchased today by either selecting the best DeFi app or by following the four steps outlined below:

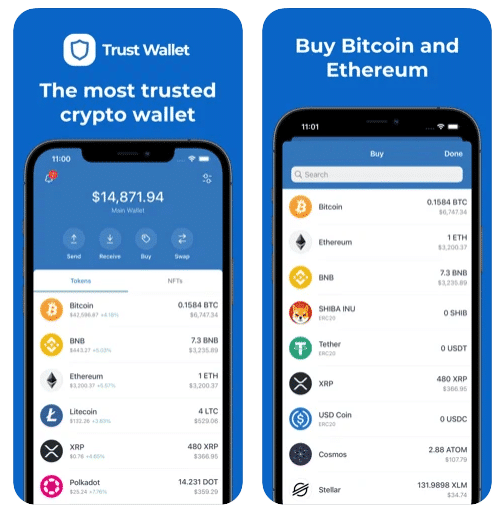

- Step 1 – Get MetaMask or Trust Wallet: To get started, you will need a wallet that can connect to the Binance Smart Chain – the network that supports DeFi Coin. For this purpose, MetaMask (browser extension) or Trust Wallet (mobile app) are the best options.

- Step 2 – Transfer BNB to Wallet: To purchase DeFi Coin, you will need BNB tokens. Transferring BNB tokens to your wallet is the first step. BNB can be purchased directly through MetaMask and Trust Wallet.

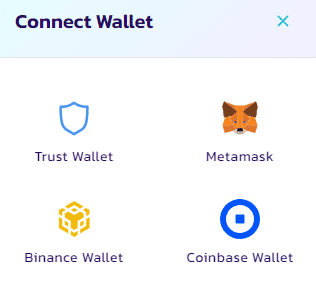

- Step 3 – Connect to DeFi Swap: Click the ‘Connect Wallet’ button to choose MetaMask or WalletConnect (for Trust Wallet). You will receive a pop-up notification on the device where your wallet is installed. Make sure that you are authorized to use DeFi Swap.

- Step 4 – Buy DeFi Coin: You will be asked to select the currency you wish to receive and the token you wish to use to pay for your swap. To exchange BNB tokens for DeFi Coins, enter the number of tokens you wish to exchange and confirm.

Cryptoassets are highly volatile unregulated investment products. No EU or UK Protection.

3. Uniswap – Top DeFi project and liquidity provider

As one of the top projects to buy in 2022, Uniswap comes to mind when considering DeFi coins.

Uniswap is a protocol that enables buyers and sellers to trade ERC 20 tokens without an exchange or intermediary. However, buyers and sellers must provide liquidity to conduct P2P transactions on most centralized exchanges, which can be difficult for even the largest markets.

With Uniswap, this process is automatic. In the protocol, the swap rate is automatically calculated based on the balances of both tokens and the demand for the swapping pair. That makes trading tokens easier for investors.

With a market cap of $4.7 billion, Uniswap’s native token, UNI, ranks 26th among all coins. UNI has corrected from a price-high of $43 to only $7, but it still benefits from a strong ecosystem that provides easy liquidity to allow peer-to-peer transactions.

Cryptoassets are highly volatile and unregulated in the UK. No consumer protection. Tax on profits may apply.

4. Decentraland – DeFi Project to Invest in the Metaverse

Grayscale, a crypto-investment company, claims that the metaverse will reach a market capitalization of $1 trillion annually. Therefore, you should explore the best DeFi crypto and projects in this growing market.

Consider investing in Decentraland, a virtual reality platform powered by the Ethereum blockchain, to diversify your DeFi portfolio. The Decentraland platform enables users to purchase, hold, and trade virtual real estate using MANA – the native token of Decentraland.

A MANA token serves as a liquidity provider for the ecosystem and can be used for various in-game purchases. In late 2021, MANA was one of the top-performing tokens on the metaverse.

Almost 600% of the price of the DeFi cryptocurrency token increased in November 2021. MANA is now trading at just $1.16 a token after reaching an ATH of $5.4. Still, Decentraland’s token has a market capitalization of $637 million, making it the 40th most valuable token in the cryptocurrency space.

5. PancakeSwap – Popular DEX Exchange in UK

PancakeSwap is a decentralized cryptocurrency exchange with gamification features and multiple channels for earning crypto. There are hundreds of tokens, yield farming, liquidity pools, lotteries, and more.

The CAKE token powers CakeSwap’s ecosystem, and CAKE holders can earn millions of dollars in free tokens each week, thanks to major projects within the ecosystem. Additionally, CAKE can be pledged to provide liquidity for cryptocurrency trading, while PancakeSwap allows users to trade directly from their wallet app.

Additionally, CAKE can be used to vote on proposals, acquire NFT, and buy tickets for the PancakeSwap lottery for up to 11,000 people per day. The PancakeSwap ecosystem continues to grow as new features and options are added.

You can exchange any token by connecting your wallet to Binance Smart Chain through PancakeSwap. PancakeSwap’s exchange allows you to trade without holding your funds by the exchange, and its transaction costs are lower than those incurred by other major decentralized exchanges.

6. SushiSwap – One of the Top DeFi Coins for an All-in-One DeFi Platform

Other popular DeFi 2.0 coins include SUSHI, the native network token of the SushiSwap DEX, which is built on Ethereum and is designed to operate platforms that allow users to buy and sell cryptocurrencies. Unlike other DEXs such as UniSwap and PancakeSwap, SushiSwap works on multiple blockchains.

SUSHI is not only one of Coinbase’s DeFi coins, but it also runs on a unique platform and has quite a dramatic history. SushiSwap has numerous use cases and applications. By contrast, SUSHI is a governance token, which means that holders can vote on how to update and improve the blockchain.

7. Yearn. finance – Defi Services via Decentralized Lending Agreements

We now recommend Yearn.finance as the next best Defi projects for 2022 on our list. This is because the project specializes in decentralized financial services – at the time of writing, mainly peer-to-peer loans are offered. In other words, Yearn. finance provides a direct connection between borrowers and lenders without an intermediary.

Yearn.finance uses smart contract technology to make it possible to borrow money from everyday consumers without requiring them to undergo a credit check. Instead, the loans are funded by investors who wish to earn a yield on their idle cryptocurrency holdings.

As a result, investors earn an attractive rate of return on their investments. In addition, Yearn.finance allows investors to provide liquidity for trading pairs, offering an APY that far exceeds traditional banks and financial institutions. You can invest in Yearn.finance by buying the project’s Defi coin – YFI.

At an initial price of $907, YFI originally launched on public exchanges in July 2020, according to CoinMarketCap. Since then, the YFI token has reached highs of over $93,000. That represents gains of over 10,000%. However, the total supply of this digital asset, the Defi coin, is extremely limited at just over 36,000 tokens.

8. Cosmos – Top-Rated Defi Coin Protocol Offering Blockchain Interoperability

Another top-rated Defi project that you might consider adding to your portfolio is Cosmos. This project is developing a newly developed solution to blockchain interoperability. That means that competing blockchains can communicate thanks to the underlying Cosmos protocol.

As a result, Bitcoin, for example, could extract data from the Ethereum blockchain – and vice versa. As a result of this concept, Cosmos has become one of the most sought-after Defi coins for 2022.

In the 12 months before writing, ATOM, the native digital token of Cosmos, traded at just over $21. By early 2022, the ATOM token is now trading at around $30, a gain of over 35%.

What are DeFi projects?

DeFi projects attempt to recreate traditional financial systems by using cryptocurrencies, such as banks and exchanges. Ethereum is the blockchain most commonly used.

According to John Wu, president of Ava Labs, developing DeFi Apps on the Avalanche blockchain, DeFi apps operate “without a central service exercising control over the entire system.”

In DeFi lending, users can loan out cryptocurrency to earn interest as lenders, just like traditional banks do with fiat currency. DeFi applications are commonly used to lend and borrow, but there are also many more complex options, such as becoming a liquidity provider or offering liquidity on a decentralized exchange.

Traditional banks typically offer lower interest rates, and the entry requirements to borrow are lower than they are with traditional lenders. The only thing a borrower needs to do to take out a DeFi loan is to be able to pledge other crypto assets as collateral. If the DeFi protocol is used, users may be able to offer their nonfungible tokens as collateral, for example.

DeFi is also much riskier than a traditional bank due to these factors.

Best DeFi Projects UK

Binance Smart Chain DeFi Projects

Binance Smart Chain (BSC) is a dual-chain platform that enables users to build and develop decentralized apps and digital assets. In addition, the platform enables users to take advantage of the growing trade between blockchains. Since its launch, BSC has experienced significant growth in activity and volume.

Last year, BNB Chain – formerly Binance Smart Chain – became the third most popular DeFi ecosystem, thanks to its nearly $12 billion in assets held in its most successful DeFi protocols.

Combining Binance Chain and Binance Smart Chain, BNB Chain stands for “Build and Build” instead of Binance Coin.

Because of its fast transaction times, low transaction fees, and high throughput, BNB Chain is widely considered a low-cost alternative to Ethereum. As a result, more than a thousand projects and tokens have already been deployed.

Some of the projects in the BSC are:

- Binance Coin (BNB)

- PancakeSwap

- Chainlink

- Baby DogeCoin

- Venus

- Swipe

- Tranches

- CryptoBlades

- Mobox

- BSCPad

- Honorable Mentions

- Alien Worlds

- 1inch

- MCDEX

Solana DeFi Projects

Since its launch, Solana has supported several DeFi projects. Currently, the Solana-based DeFi projects have a massive total value locked (TVL) of $8.6 billion. As a result, Solana is becoming a go-to blockchain platform for DeFi projects, next only to Ethereum.

The interest in DeFi projects based on Solana is at an all-time high due to its ability to process up to 65,000 transactions per second and lower transaction costs, as low as $0.00025 per transaction. Despite this, it is difficult to identify the most promising Solana-based DeFi projects without extensively researching the market.

Nezha: A Game-Changing Prediction Market Protocol

If you hear the term prediction market, what is your first thought? Is it the high rewards prediction markets provide? Is it the possible losses users might experience if their numbers don’t match the drawn number? Unfortunately, many people are deterred from participating in the promising prediction markets by the prospect of losing their hard-earned money. DeFi protocol Nezha, built on Solana, resolves this problem once and for all.

Hubble Protocol: Supercharging Liquidity on Solana

The Hubble Protocol is a DeFi-based project that seeks to ‘supercharge liquidity on Solana. This month, Hubble is scheduled to launch its mainnet following a $10 million funding round.

Zebec Protocol: Powering Real-Time Transactions

Solana-powered DeFi protocol, Zebec, provides real-time settlement of transactions. It simplifies the process of sending and receiving payments. Zebec has successfully raised funding twice so far. Zebec raised $6 million in pre-seed funding in November 2021, when the DeFi protocol raised its first funds. During that time, Zebec released Zebec Payroll, a complaint payroll app.

MarginFi Protocol: Bringing CeFi Margin Trading Capabilities to DeFi

In the decentralized finance space, margin trading has not yet acquired the same traction as it has in centralized finance. Margin trading involves a lot of complexities and intricacies when it comes to DeFi.

Ethereum DeFi Projects

The DeFi economic framework focuses on the internet age and is open-source worldwide. An excellent alternative to a firmly controlled financial system run and managed by centuries-old financial processing and infrastructure concepts. By contrast, Defi allows you to monitor and control your financial accounts. With it, you are open to international business sectors and have multiple options for your regional currency or other banking alternatives.

DeFi refers to financial services and articles available to anyone with a good internet connection and those using Ethereum. Clients maintain the financial records of Defi. Ethereum DeFi applications have allowed for the exchange of millions of dollars worth of cryptocurrencies, and the method is advancing with each passing day.

Advantages of Ethereum Defi ecosystem

Here we have some advantages of the Ethereum DeFi ecosystem which is considered the best place for DeFi projects.

Access to stable currencies

Several economic elements and general spending are affected by cryptocurrency instability. The Ethereum DeFi community has addressed this by issuing stable coins, whose value is tied to another valuable resource, typically a famous currency like dollars.

Borrowing with security

There are two ways to borrow funds from decentralized suppliers:

- Peer-to-peer: The borrower can obtain a loan directly from a moneylender.

- Pool-based: It involves moneylenders loaning funds (liquidity) to a specific pool of borrowers. Borrowers can take money out of such pools whenever they need it.

International fundings

A decentralized lender provides free access to global funds. That allows you to receive funding from your chosen institution or bank and from anywhere in the world. Thus, the interest rate on loans increases.

Tax-efficiencies

Borrowing under the Defi system allows you to access the funds you need without selling your ETH. If you want a stable coin loan, you can use ETH as a security credit. You can keep your ETH in addition to getting the allowance you need. Because Stablecoins tokens are immutable, they are beneficial when you need cash flow as their value does not fluctuate like ETH.

Flash loans

You don’t have to give any security or personal information to borrow money in flash loans. The loans are more like experiments in decentralized lending. Non-technical people do not have easy access to them at the moment.

On the Ethereum DeFi ecosystem alone, 197 activities have been created. Comparatively to several other networks, Ethereum has the highest daily volume of exchanges and application usage. Assets saved in Ethereum can be utilized as stocks of significant value, consumable assets, or capital assets. The Defi ethereum ecosystem has dealt with the following projects:

- Crypto wallets

- Asset management protocols

- Stablecoins

- Portfolio trackers

- Payment solutions

- Derivatives

- Decentralized exchanges

- Argent, Dharma

- Coinbase Wallet

- Huobi Wallet

- InstaDApp

- Uniswap

- MetaMask

- MyEtherWallet

- Trust Wallet

Polkadot DeFi Projects

There have been many mentions of the need for standardization across blockchains, smart contracts, and DeFi protocols, and for a good reason. For example, in the case of financial contracts, inoperability and the inability to access information from certain ledgers will put those ledgers at risk of being left out.

PolkaDot could solve this problem. It provides a secure network for transferring information and data from other platforms that need it. Further, it has the potential to support multi-chain networks in areas with a low level of trust. For example, in DeFi, a noncustodial protocol is just the tip of the iceberg. To ensure trust between trading pairs and their respective blockchain networks, PolkaDot becomes the neutral ground.

Over time, solutions like PolkaDot may become a foundation for many future DeFi projects and perhaps even make their way onto this list.

How to Buy LuckyBlock

After learning more about DeFi coins, let’s look at how to buy DeFi coins, specifically Lucky Block.

Step 1: Download Trust Wallet

Lucky Block is only available on PancakeSwap, a decentralized exchange, which means you need a crypto wallet to access and store it. To get started, download the Trust Wallet and create an account.

Step 2: Transfer BNB

If you want to purchase Lucky Block in PancakeSwap, you’ll need Binance Coin (BNB), the cryptocurrency used to purchase it. BNB tokens can be transferred to our Trust Wallet if you already own them. However, if you wish to purchase BNB immediately, you can use the Trust Wallet’s bank card payment option.

You must comply with KYC regulations and provide valid and government-issued IDs to verify your account.

Step 3: Connect to PancakeSwap Exchange

Connect to the PancakeSwap platform once you have BNB tokens in your crypto wallet. Simply select the PancakeSwap logo and then click the ‘dApps’ button. When the notification appears, you’ll be required to connect your Trust Wallet to PancakeSwap.

Step 4: Search for LuckyBlock

You can exchange your BNB tokens for LBLOCK tokens on the PancakeSwap exchange by searching for Lucky Block.

Step 5: Buy LuckyBlock

Please enter the number of BNB tokens you wish to exchange for Lucky Block. Next, click on the ‘Swap’ button to confirm the purchase.

Cryptocurrency markets are highly volatile and your investments are at risk.

Best DeFi Project – Conclusion

DeFi is still a very young and upcoming part of the cryptocurrency space, despite the concept being operational for a few years. However, if done correctly, DeFi coins can be an extremely lucrative investment opportunity. For example, LuckyBlock, a new DeFi coin that is already the fastest-growing DeFi cryptocurrency in history, is one of the best DeFi coins. Therefore, in the number two spot on our list, investors should consider adding DeFi Coin to their portfolio to take advantage of upcoming growth.

Cryptocurrency markets are highly volatile and your investments are at risk.