Halifax is a banking brand owned and operated by Lloyds Banking Group, the massive British banking and investment firm. The bank offers Halifax share dealing and ISA accounts that are distinct from those that Lloyds offers, although much of the platform and research tools are shared.

The biggest difference between Lloyds and Halifax is the pricing structure. Halifax is geared towards long-term investors who only place trades infrequently, with low account fees but relatively high trading commissions.

If you’re considering using Halifax as your share broker, our Halifax share dealing review will cover everything you need to know. We’ll take a closer look at what markets you can access with this broker, what fees and commissions you’ll pay, and how the research and trading tools stack up against competitors’.

What is Halifax?

Halifax was established as a bank in Halifax, West Yorkshire, in 1853 and became one of the largest banks in the UK. It merged with the Bank of Scotland in 2001, and formally became a subsidiary of Lloyds in 2009 when the UK banking behemoth purchase the Bank of Scotland. Currently, Halifax manages about £13 billion in investor assets.  Today, although Halifax is part of Lloyds, which also owns iWeb, it retains its own distinct brand and offers many of the same services it had before the acquisition. Halifax offers a wide range of products, including bank accounts and loans, credit cards, home insurance, and investing accounts. The firm also specifically has wealth management division, which can be useful for clients looking to manage more than just share investments.

Today, although Halifax is part of Lloyds, which also owns iWeb, it retains its own distinct brand and offers many of the same services it had before the acquisition. Halifax offers a wide range of products, including bank accounts and loans, credit cards, home insurance, and investing accounts. The firm also specifically has wealth management division, which can be useful for clients looking to manage more than just share investments.

What Shares Can You Buy on Halifax?

The Halifax online share dealing account offers a reasonable but not overly wide selection of assets to trade.

UK Shares

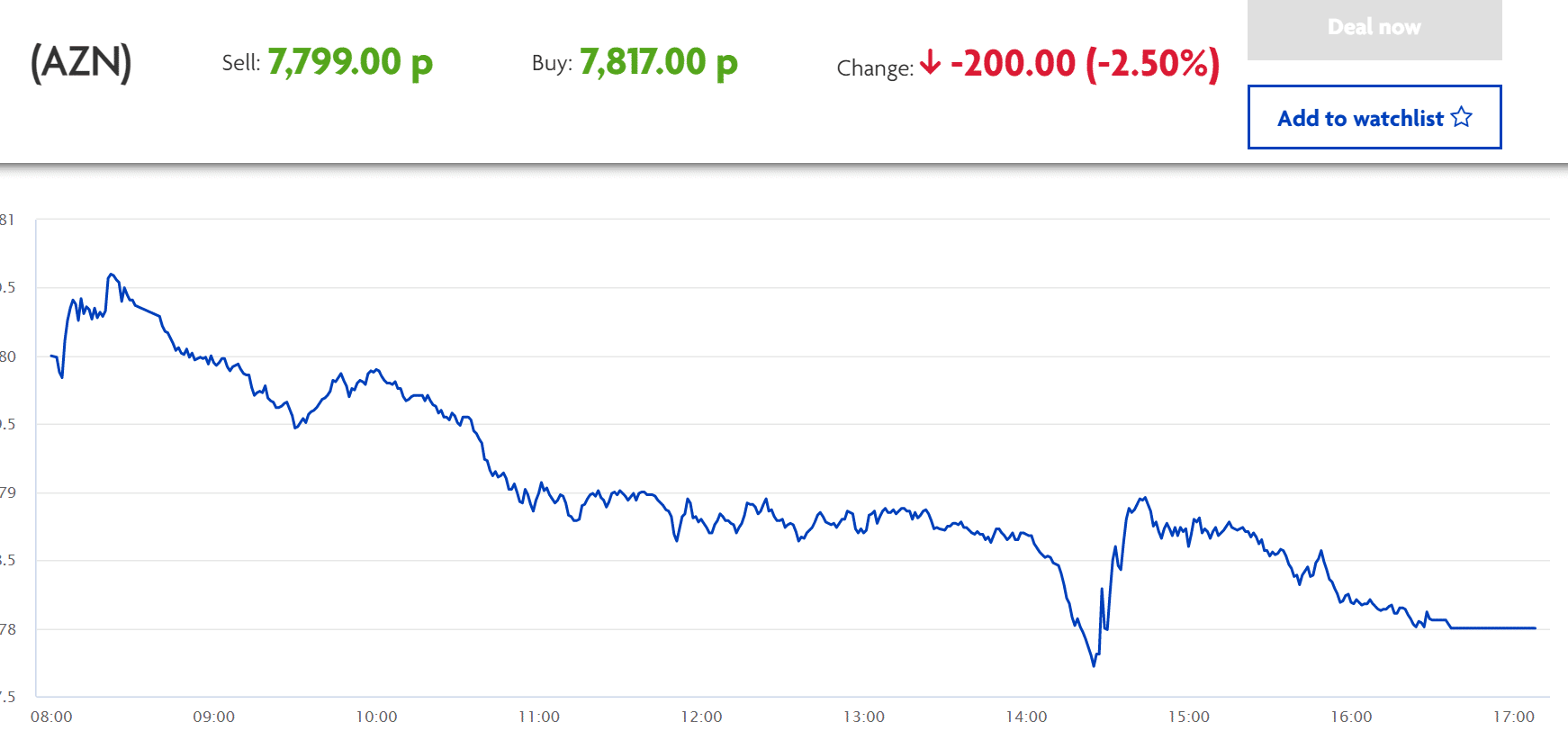

As a UK-based brokerage firm, it goes without saying that Halifax gives you direct access to the London Stock Exchange. This means that you will find the the most popular shares to buy on the FTSE 100. This includes everything from AstraZeneca, Royal Mail, BP, and BT.

With that said, our Halifax share dealing review found that the platform also offers hundreds of smaller UK stocks that fall outside of the main FTSE 100 index. For example, you can buy companies that make up the smaller FTSE 250 index.

This includes the likes of:

- Just Eat

- Pershing Square Holdings

- Weir Group

- Direct Line Insurance

- EasyJet

- ITV

- Wizz Air

- Unite Group

In addition to shares listed on the UK’s primary London Stock Exchange, Halifax also gives you access to the Alternative Investment Market (AIM). This exchange hosts smaller UK companies that aren’t large enough to be listed on the LSE.

Additionally, the AIM is often the go-to platform for up and coming firms that are still operating in an unproven sector. Either way, if you’re looking to add some AIM shares to your investment portfolio, Halifax covers hundreds of companies.

This includes the likes of:

- Boohoo

- Hutchinson China

- Abcam

- Fevertree Drinks

- Jet2

- Breedon Group

- Ceres Power Holdings

- Keywords Studios

As we discuss in more detail shortly, Halifax share dealing also offers funds that cover hundreds of UK stocks. This avoids the need for you to select individual shares.

International Shares

While Halifax offers a huge library of UK shares, the platform also gives you access to the international markets. This includes stocks listed in the US and mainland Europe.

Regarding the former, Halifax covers the vast majority of stocks listed on the S&P 500 index. This means that you can buy shares in companies such as Apple, Amazon, Facebook, IBM, and Walmart.

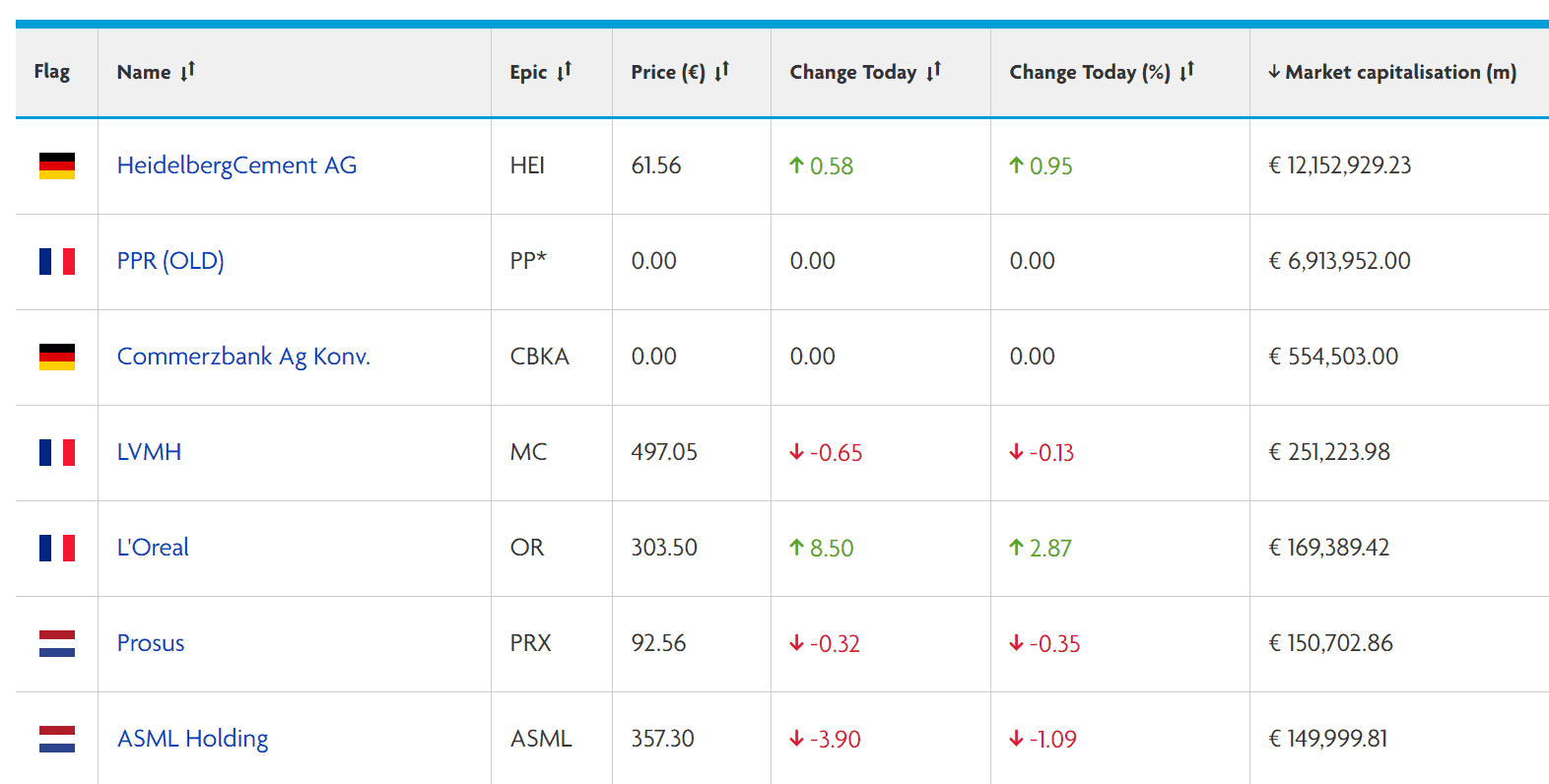

Over in Europe, Halifax covers exchanges in France, Belgium, Germany, and the Netherlands. This means that you can buy European shares in companies like:

- HeidelbergCement

- Commerzbank

- LVMH

- L’Oreal

- Prosus

- SAP

- Total

- Linde

Funds, ETFs, and Trusts

The Halifax share dealing account offers more than 2,000 mutual funds, approximately 575 exchange-traded funds (ETFs), and nearly 300 investment trusts. Compared to other UK brokers, these numbers aren’t all that exciting. But, the available funds cover a relatively wide range of assets, including commodities, real estate, and emerging markets.

The selection might not be the widest at Halifax, but most investors will be able to build a fully diversified portfolio using the available funds and ETFs. Helpfully, it’s very easy to find funds that suit you thanks to the broker’s screener tool. We’ll cover this in more detail below, but it enables you to search funds by market region, sector, and rating.

Fractional Investments

An additional short-fall when using the Halifax share dealing service is that you will not have access to fractional ownership. This is something that is very popular with UK investors, as it allows you to purchase a ‘fraction’ of a share, ETFs, or fund.

For example, instead of needing to fork-out $3,000 on a single Amazon stock, you might decide to only invest $150. In doing so, you’d be buying 5% of one Amazon share.

Ready-Made Investments

Halifax also offers ready-made portfolios that are managed on your behalf. These include shares, real estate, and bonds – primarily through mutual funds – and there are three options that vary in their risk tolerance.

While these ready-made portfolios seem interesting, their performance leaves a lot to be desired. Over the past five years, the funds have returned an average of 1.3% to 2.1%. By comparison, the FTSE 100 has gained an average of 7% per year over that same time period.

Halifax ShareBuilder

The Halifax ShareBuilder feature is an interesting offering. Put simply, this is designed as a long-term investment plan where you need to commit to at least £20 per month. In doing so, you can get your share dealing charges down to just £2 per trade.

However, this does need to be a scheduled investment on a specific asset. For example, you might decide to invest £50 each month in BP shares and £20 per month in Royal Mail shares.

With that said, a long-term scheduled investment plan is suited for index funds like the FTSE or Dow Jones. This will allow you to make diversified investments as opposed to sticking with single stocks.

CFD Trading at Halifax

Halifax offers a traditional share dealing platform – meaning that it does not touch CFDs. While this might not matter to those of you that simply want to buy shares or ETFs – this will disappoint the day traders in the room.

As such, you won’t have access to leverage facilities. Additionally, this lack of CFD markets at Halifax means that you won’t be able to short-sell.

This means that if you think one of your investments is due to go southwards, all you can do is sell or hold on and hope for the best. If, however, you were able to access a CFD market on the stock, this would allow you to short-sell it thus – profit if the shares decrease in value.

Halifax Share Dealing Charges, Fees and Commissions

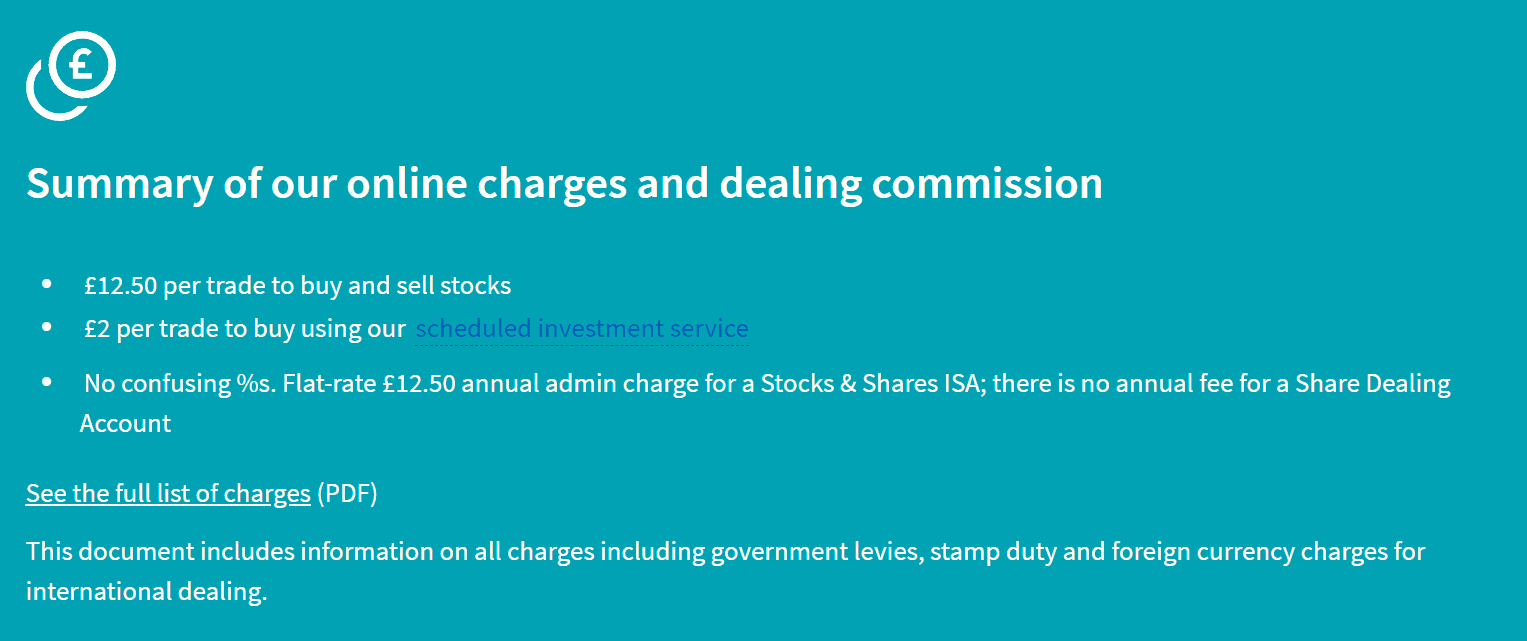

In this section of our Halifax share dealing review, we are going to explore how much the broker charges in fees and commissions.

Fees on UK Shares

The Halifax share dealing fees structure is set to benefit long-term investors who don’t make any trades. With a standard Halifax share dealing online account, you pay £12.50 per trade for shares, funds, ETFs, and investment trusts.

It goes without saying that this is expensive. After all, fellow UK high street bank Barclays allows you to trade at just £6. However, the bank also charges an annual fee – which Halifax doesn’t.

- You deposit £900 into your Halifax account – paying nothing in transaction fees

- You buy £300 worth of shares in HSBC, £300 in GlaxoSmithKline, and £300 in ASOS

- This is three separate trades – so you pay £37.50 (3 x £12.50)

- You also need to pay 0.5% stamp duty when you buy the shares – which is an extra £4.50

- Whenever you get around to selling your shares, you again need to pay £12.50

- As such, that’s a further £37.50

Halifax doesn’t charge deposit or withdrawal fees, which is helpful for keeping costs down. As noted above, you can lower the trading commission fee to £2 per trade by using the broker’s regular investing feature. The £2 per trade commission applies when you set up monthly investments in a specific share or fund.

Fees on International Shares

If you are interested in adding some international shares to your Halifax portfolio, you will pay the same flat fee as discussed above.

However, if this wasn’t expensive enough, you also need to pay a foreign exchange fee. Halifax puts this at 1.25% at both ends of the trade. As such, you pay 1.25% when you buy international shares and again when you sell them.

Once again making the comparison with a low-cost broker, its commission-free offering also covers 16 international markets. This means that you won’t get hit with FX fees. Crucially, this is because you pay 0.5% when you first make a deposit – with GBP subsequently being converted to USD.

Other Investment Fees

Importantly, Halifax’s ready-made portfolios come with their own additional fees. The exact charge varies according to which of the three portfolios you invest in, but is around 0.65% of your investment. For SIPP accounts, you will pay £22.50 per quarter for accounts with less than £50,000 or £45 per quarter for accounts with more than £50,000.

Halifax Dividends

If you decide to add some dividend stocks to your Halifax share dealing portfolio, you will be entitled to your share. As and when the receptive company or ETF releases the funds, this will be reflected in your Halifax account. This is then available for withdrawal back to your bank account.

Halifax Share Dealing Platform and Trading Tools

Our Halifax share dealing review found that the broker offers an easy to use trading platform with a handful of tools, but there is very little that stands out about this broker’s platform. Perhaps most notably, Halifax’s trading platform is available only through a web interface. This broker doesn’t offer a mobile trading app, even though the banking branch of Halifax has its own app.

The best place to start is the Halifax Shares Centre, which is an online dashboard where you can monitor top gainers and losers in the FTSE 100 along with market conditions in the US and Europe. This dashboard isn’t laid out all that well, as you have to scroll down the page to get an idea of what’s happening in the global market. It also doesn’t display your watchlists – those are in a different area of Halifax’s online trading platform.

The news feed is slightly better, although this too is in its own section of the online platform rather than integrated into the main shares dashboard. You can find market-wide headlines as well as company-specific stories written by analysts at Lloyds, Halifax, and the Bank of Scotland.

The Halifax online share dealing account also offers an ‘Investment Ideas’ section on its site, although this is focused more on investor education than on helping you find specific shares to invest in. You’ll find articles explaining the benefits of different types of investing accounts and offering advice on how to invest in specific market sectors. To be sure, there are some stock picks in these articles, but it’s not exactly the most popular tool for figuring out what shares to invest in.

Perhaps the feature that Halifax offers are its search tools for funds, ETFs, and investment trusts. These are three different, but similar tools. You can filter among the products available for trading through Halifax by risk rating (on a scale from 1 to 7), by Morningstar’s star rating of funds, and by the market sector that the fund covers.

You can also filter by provider and by whether funds are focused on price appreciation or dividend generation. While the interface for the search tool could be more seamless, the number of parameters you can screen by is a major help when looking for new investments through Halifax.

Halifax Share Dealing App

Halifax offers a mobile app for its core retail banking service. In turn, if you have an iOS device, you can use the app to access your share dealing account. However, the Android version of the app does not yet give you access – with Halifax noting that this will be launched soon.

This is a major flaw of Halifax when you consider just how big mobile investing apps are these days. After all, you never know when an investment opportunity might arise – so it’s crucial to have access to your share dealing account at all times.

Halifax Share Dealing Account Types

Halifax offers several share dealing accounts to choose from.

This includes:

Standard Share Dealing Account

This is the standard share dealing account that allows you to invest in stocks, ETFs, and funds.

Stocks and Shares ISA

You can also open a Stocks and Shares ISA at Halifax. The first £20,000 that you invest in each financial year will be exempt from capital gains and dividends tax.

SIPPs

If you are looking to invest money into your retirement pot, you’ll be pleased to know that Halifax also offers SIPPs. Much like ISAs, this comes with tax-efficient benefits. But, your money is locked into a SIPP until you reach the age of retirement, so do bear this in mind.

Halifax Share Dealing Demo Account

Halifax does not offer a demo account of any sort – which is particularly disappointing if you are a newbie. Instead, you will need to invest with real pounds and pence from the very get-go.

Research and Analysis at Halifax

The research and analysis tools available on Halifax share dealing are also fairly limited. For the most part, investors are limited to technical price charts. Halifax does an alright job with these, offering a simple browser-based interface and upwards of 90 popular technical indicators.

However, the drawing tools aren’t all that exciting and investors don’t have free rein to modify the parameters underlying the built-in indicators.

Unfortunately, our Halifax share dealing review found that it doesn’t provide traders with much fundamental information about shares traded through the platform. Given that the broker’s pricing structure makes it suited for long-term investors – who often look at fundamental rather than technical data – this is a disappointing oversight.

Payments at Halifax

Halifax only offers a few basic payment methods for funding your investment account. You can make a bank transfer or wire, or pay by debit card. The Halifax online share dealing does not accept credit cards or online payments from an e-wallet. Helpfully, there are no fees for deposits or withdrawal with this broker.

Halifax Contact and Customer Service

Halifax is a full-service bank, lending firm, and investment service, so the customer service is very robust. There’s a dedicated phone number for investment accounts and Halifax customer services are available from 8 am to 5 pm Monday to Friday.

You can also get in contact with the company over Twitter or visit a Halifax branch in person for immediate service (most branches are open 9 am to 3:30 pm Monday to Friday). Halifax is based in West Yorkshire and its parent company, Lloyds, is based in London.

Halifax contact number: 0345 835 5726

Halifax address: Halifax, PO Box 548, Leeds, LS1 1WU

Is Halifax Online Share Dealing Safe?

Halifax is part of Lloyds, one of the largest, oldest, and most trusted financial institutions in the UK. Lloyds, and Halifax along with it, are regulated by the UK’s Financial Conduct Authority.

Plus, since Lloyds trades on the London Stock Exchange, its financial data is made public quarterly and pored over by analysts.

In the unlikely event that Halifax does run into financial trouble in the future, all investment accounts are backed by the UK’s Financial Services Compensation Scheme. This insures your Halifax share dealing account for up to £85,000.

However, it is important to remember that the FSCS does not protect you from falling investments. That is to say, if you lose money because the value of your shares has decreased, the investment decision was your responsibility.

The Verdict

Having carried out our Halifax share dealing review, we think there are other options than Halifax for the majority of UK investors. The big draw to this broker is the fact that Halifax online share dealing accounts are free of monthly fees. But, that advantage is offset to a significant degree by the pricey £12.50 per-trade commission that Halifax share dealing charges. For anyone who places more than a few trades per year, Halifax ends up being more costly than many of its competitors.

On top of that, we weren’t particularly impressed by Halifax’s range of investments. The broker offers enough tradable assets for most investors – including access to European and US exchanges and more than 2,000 mutual funds – but it doesn’t offer share trading in emerging markets and its fund list is less extensive than those of competitors.

The fact that there isn’t a Halifax share dealing app for Android is also a significant negative for this broker. This is a near-necessity in today’s mobile-first world. While you can access the Halifax web interface from your smartphone, it isn’t all that seamless even on a desktop and the included tools are mostly mediocre.