Saxo Bank Review – Fees, Features, Pros and Cons Revealed

Saxo Bank is an online stock broker that was first founded in 1992. It is backed by a Denmark financial institution of the same name, albeit, the platform is fully regulated in the UK market.

Saxo Bank offers a wider variety of trading investment products – including shares, ETFs, and bonds. You can also access leveraged CFD products – such as forex, commodities, futures, and options.

But, is Saxo Bank the right online stock broker for you?

In this review, we explore Saxo Bank from top to bottom. We cover everything you need to know before opening an account with the broker – such as platform fees, regulation, tradable markets, payment methods, account minimums, and more.

What is Saxo Bank?

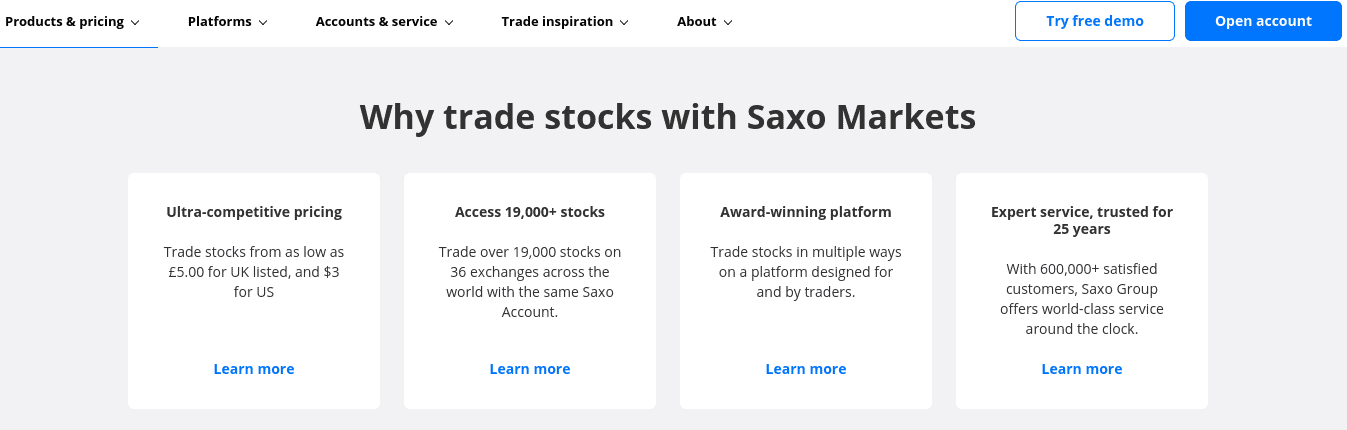

In total, this includes over 40,000 financial markets. This covers almost 20,000 stocks and shares – which is more than any other UK stock broker that we have previously come across.

Not only does this include shares listed in the UK, but 36 other exchanges and markets. Additionally, you will also have access to a huge selection of exchange-traded funds (ETFs) and bonds.

Both of these asset classes are ideal if you are looking to invest in a more hands-off, passive manner. At the other end of the spectrum, Saxo Bank also provides a platform for those that wish to trade actively. This is because you will have the opportunity to trade thousands of contracts-for-differences (CFDs) from the comfort of your home. This includes everything from forex, commodities like gold and oil, indices, bonds, and stock CFDs.

When it comes to cost-effectiveness, pricing at Saxo Bank can really vary depending on the specific market. But, UK stocks can be purchased from as low as £8 per trade, US stocks have a headline rate of $10. If you’re keen on managed portfolios at Saxo Bank, this will cost you in the region of 0.95% per year. In terms of safety, Saxo Bank is a regulated investment house that holds a variety of licenses. At the forefront of this is a license issued by the UK’s Financial Conduct Authority (FCA).

What Shares Can You Buy on Saxo Bank?

As we briefly mentioned above, Saxo Bank offers a share dealing platform that contains almost 20,000 stocks. This is huge. In order to gain a full understanding of what companies, markets, and exchanges you will have access to – let’s break the Saxo Bank stock department down a bit further.

UK Stocks and Shares

It goes without saying that Saxo Bank offers a huge selection of UK shares. This does, of course, include each and every constituent of the FTSE 100. This means that you will be able to buy shares in firms like AstraZeneca, British American Tobacco, Barclays, Royal Mail, BP, BT, and Tesco.

Outside of the main FTSE 100 Index, you will also have access to less liquid firms. While this doesn’t include the AIM (Alternative Investment Market) – you can easily buy FTSE 250 and FTSE 350 shares at Saxo Bank. Take note, by buying UK shares at Saxo Bank, you will be entitled to dividends.

As and when the respective company makes a payment, the funds will be reflected in your Saxo Bank balance. In addition to this, if a stock held in your Saxo Bank portfolio initiates a share split, once again this will be reflected in your account.

US Stocks and Shares

A lot of investors in the UK are attracted by US stocks as there are hundreds of globally recognized brands to choose from. For example, you’ve got the likes of Amazon, Apple, Facebook, Paypal, Visa, Ford Motors, and Disney.

If this is something that interested you, Saxo Bank gives you access to the two main US exchanges. This consists of the New York Stock Exchange and the NASDAQ.

Other International Shares

Outside of the UK and US markets, Saxo Bank gives you access to heaps of other exchanges. This includes companies listed in Europe, North America, and Asia-Pacific.

For a full break down of the many countries and markets that you can access with a Saxo Bank share dealing account – check out the list below:

- AMS – Euronext Amsterdam

- ASX – Australian Securities Exchange

- BRU – Euronext Brussels

- CSE – NASDAQ OMX Copenhagen

- CSE_FN-DK – NASDAQ OMX Copenhagen (First North)

- CSE_INV – NASDAQ OMX Copenhagen (Investment trusts)

- FFT – Deutsche Borse (Frankfurt Floor)

- FSE – Deutsche Börse (XETRA)

- HKEX – Hong Kong Exchanges

- HSE – NASDAQ OMX Helsinki

- ISE – Euronext Dublin

- JSE – Johannesburg Stock Exchange

- LISB – Euronext Lisbon

- MIL – Borsa Italiana/Milan Stock Exchange

- OSE – Oslo Børs/Oslo Stock Exchange

- PAR – Euronext Paris

- PRA – Prague Stock Exchange

- SGX-ST – Singapore Exchange

- SIBE – BME Spanish Exchanges

- SSE – NASDAQ OMX Stockholm

- SSE_FN-SE – NASDAQ OMX Stockholm (First North)

- SWX – SIX Swiss Exchange

- SWX_BND_ETF – SIX Swiss Exchange ETFs on Bonds of the Swiss Conf

- SWX_ETF – SIX Swiss Exchange (ETFs)

- TSE – Toronto Stock Exchange

- TSX – TSX Venture Exchange

- TYO – Tokyo Stock Exchange

- VIE – Wiener Börse/Vienna Stock Exchange

- VX – SIX Swiss Exchange (Blue-Chip)

- WSE – Warsaw Stock Exchange

- XETR_ETF – Deutsche Börse (Indices & ETFs)

- XETR_STARS – Deutsche Börse (XETRA Stars)

While discussing each and every supported exchange is beyond the remit of this Saxo Bank review, there are several notable additions that are worth a quick mention. For example, we like the fact that you will have access to the Toronto Stock Exchange in Canada. This is where some of the world’s most exciting cannabis stocks are listed.

We also like that you will have access to the emerging markets. For example, you can buy shares in companies listed in South Africa (Johannesburg Stock Exchange) and the Czech Republic (Prague Stock Exchange),

Penny Shares

We were also pleasantly surprised to see that Saxo Bank gives you access to penny shares. For those unaware, penny shares are companies that trade outside of major public exchanges. This is because they usually possess super-small market capitalizations or they are completely new in their respective field.

Either way, most penny share trading is facilitated via the OTC (Over-the-Counter) markets. This means that as a UK retail client, you will find it very difficult to get your hands on such shares. However, this isn’t the case when using Saxo Bank – as the platform gives you access to the two main penny share OTC markets.

This includes:

- Pink Sheets

- OTC Bulletin Board

Take note, if you do decide to buy Penny Shares at Saxo Bank, you should remember that this segment is fraught with risk. Crucially, while every now and then we see a penny share one day make it big, most end up losing money in the long run.

ETFs

Outside of the stocks and shares department at Saxo Bank, you can also invest in ETFs. Many investors in the UK take this route, as it allows you to invest passively. After all, by making a single investment into your chosen ETF, the provider will buy and sell hundreds of assets on your behalf.

At Saxo Bank, you will have over 3,000 ETFs to choose from. These ETFs are listed across 30 different stock exchanges. Once again, this ensures that by using Saxo Bank for your investing needs, you can easily diversify to mitigate your risk.

Some of the most popular ETF markets that you will find at Saxo Bank are listed below:

- iShares Core Global Aggregate Bond UCITS ETF

- iShares Ageing Population UCITS ETF

- Xtrackers II USD Asia ex-Japan Corporate Bond UCIT

- Amundi ETF Nasdaq-100 UCITS ETF – B

- SPDR S&P Pan Asia Dividend Aristocrats UCITS ETF

- Xtrackers Harvest CSI300 UCITS ETF

- Invesco AT1 Capital Bond UCITS ETF

- Invesco Markets II PLC Invesco AT1 Capital BondETF

- L&G Gold Mining UCITS ETF

- L&G Battery Value-Chain Go UCITS ETF

To find your chosen ETF at the platform, you can either search for it directly or use the filter option.

Bonds

If you’re looking to invest in passive instruments like bonds, Saxo Bank has you covered. This includes over 5,000+ bonds from heaps of UK and international markets. For example, government-issued and corporate bonds can be purchased in the US, Latin American, Asia, and the Middle East.

Managed Portfolios

On top of being able to buy shares, ETFs, and bonds on a do-it-yourself basis, Saxo Bank also offers managed portfolios. In simple terms, this means that Saxo Bank will create a ready-made investment portfolio for you. The specific assets and markets that you will have added to your portfolio will be based on your personal preferences.

That is to say, Saxo Bank will strive to match you with investments based on your financial goals and tolerance to risk. In addition to this, managed portfolios at Saxo Bank are 100% automated. This means that your portfolio will constantly be monitored to ensure it remains true to your desired risk levels.

To give you an example of what a managed portfolio at Saxo Bank looks like, check out the examples below:

Defence Portfolio (Low Risk)

If you class yourself as a ‘conservative’ investor, then you might be best suited for Saxo Bank’s Defence Portfolio. The portfolio in question is backed by leading fund provider BlackRock. Over the five 5 years, it has returned 29% – net of all fees.

In terms of the specific assets, this mainly focuses on bonds. However, there is also exposure to stocks and other asset classes via ETFs. The main drawback of this management portfolio is that you need to invest at least £10,000 to get a look in.

Aggressive Portfolio (High Risk)

As the name implies, the Aggressive Portfolio option at Saxo Bank will take a high-risk approach to investing. In turn, this should – in theory anyway, return much higher gains. This seems to be the case, as the Aggressive Portfolio has returned 42.5% over the past five years.

The vast of its investment basket contains stocks. There is, however, a small allocation of capital into bonds, too. Once again, the main downside to this management portfolio is that it requires an investment of £10,000 or more.

CFD Trading at Saxo Bank

So now that we have covered the traditional investment department at Saxo Bank, we now need to explore its CFD offering. For those unaware, CFDs are complex financial products that allow you to actively trade assets without taking ownership.

This is particularly useful if you want to speculate on the future price of physical assets like crude oil, golds, silver, and natural gas. In addition to this, CFDs also allow you to short-sell assets and trade on margin.

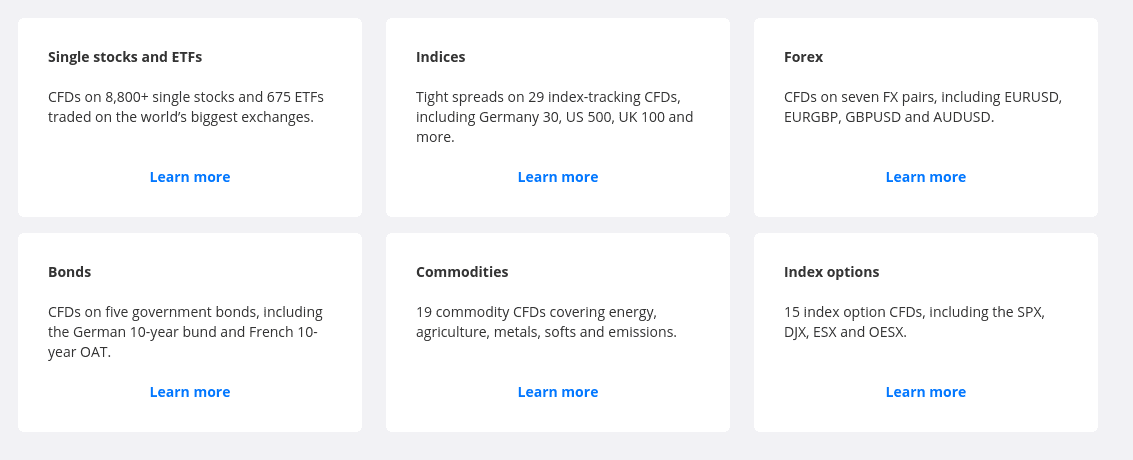

Our Saxo Bank review found that the platform gives you access to over 9,000 CFD trading markets.

This includes the following:

Forex CFDs

As the largest and most liquid trading arena globally, it makes sense that Saxo Bank offers a forex department. However, it is super-surprising that the platform gives you access to just 7 currency pairs via the CFD department.

With that being said, Saxo Bank does offer traditional forex trading markets outside of the CFD scene. This covers over 180 pairs. The key problem here is that minimum trading volumes are significant. As such, this won’t be suitable if you’re an average Joe trader.

Stock and ETFs

Although Saxo Bank falls short in the forex department, it more than makes up for it when it comes to CFD stocks and ETFs. This is because the platform offers over 8,800+ CFD markets on the former and 675 on the latter. In turn, this means that you can trade shares with leverage or engage in short-selling.

Indices

Indices allow you to trade wider stock markets – such as the FTSE 100. At Saxo Bank, you can enter buy and sell positions on 29 CFD indices. This includes the likes of the Dow Jones 30, NASDAQ 100, Germany 30, and S&P 500 Index.

Commodities

If you are looking to trade commodities from the comfort of your home, Saxo Bank offers 19 CFD markets. This covers hard metals like gold and silver, as well as energies such as oil and natural gas. There are several CFD markets for agriculture products, too.

Bonds

If you fancy trading the future value of government bonds, Saxo Bank offers five markets. This includes 10-year bonds issued by France and Germany.

Saxo Bank Fees & Commissions

So that we have covered the ins and outs of what you can invest in and trade at Saxo Bank, we now need to explore that all-important metric – fees. Due to the sheer size of financial products, exchanges, and markets offered by the platform – we have decided to break down each and every fee that you might come across.

This way, you can make an informed decision as to whether or not Saxo Bank is competitively priced for the market you wish to access.

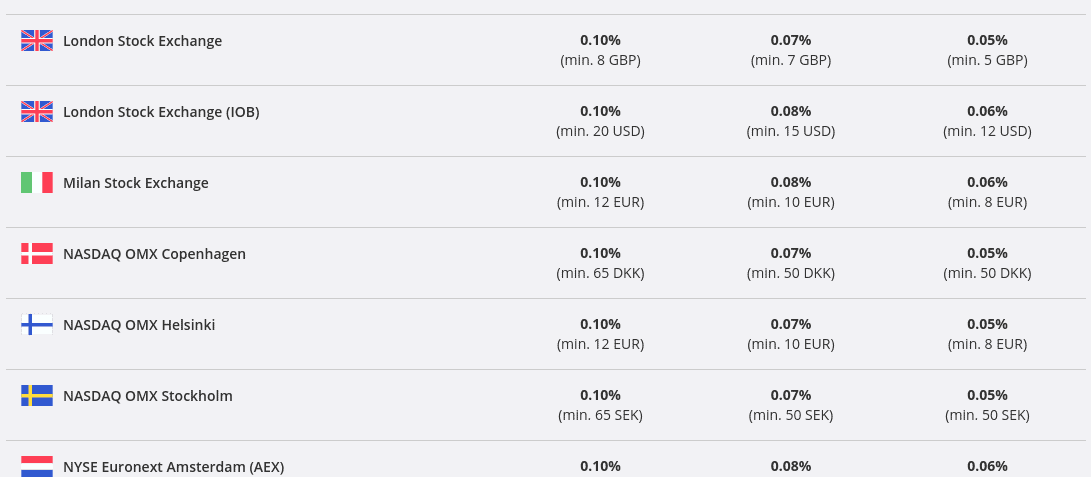

Dealing Fees on Investments

Let’s start with the dealing fees that you will pay on traditional investments like shares, bonds, and ETFs,

UK Stock Fees

Share dealing fees at Saxo Bank will depend on two key variables:

- The market you wish to buy the shares from (e.g. London Stock Exchange)

- The account type you are on

We will discuss account types later on. But, for the remainder of this Saxo Bank fees section, we will base everything on the Classic Account. The reason for this that the Platinum and VIP accounts require a minimum deposit of £200,000 and £1 million respectively. The Classic Account requires £500.

So, by buying UK shares that are listed on the London Stock Exchange, you will pay a variable fee of 0.10%. However, there is an £8 minimum in place. As such, any investment that you make of £8,000 or less will ultimately cost you £8. With this in mind, Saxo Bank is arguably better suited for those of you that wish to invest huge volumes.

For example, if you were to invest £40,000 into UK shares at the platform, your 0.10% variable fee would translate into a commission of just £40. This is very competitive.

However, if you were to invest just £500 into UK shares, a share dealing fee of £8 would translate into a real-term commission of 1.60%. This is hugely expensive. After all, you also need to factor in the 0.5% stamp duty fee that is payable on all UK shares.

US Stock Fees

If like many UK investors you’re interested in buying American shares, the fee structure at Saxo Bank is different. This is because you will need to pay a fee of $0.02 per share that you purchase. Once again, a minimum commission has been put in place by Saxo Bank – this time at $10.

Whether or not this is competitive or not will ultimately depend on the number of shares you are planning to buy. With that being said, if you end up purchasing less than 500 shares, the minimum fee of $10 will remain fixed (500 x $0.02 = $10).

ETF Fees

If you’re interested in investing in ETFs at Saxo Bank, the fees mirror those listed above. In other words, the specific commission is based on the exchange that the ETF is listed on. This means 0.10% on UK ETFs and $0.02 per ETF for those listed in the US.

Bond Fees

If you want to buy bonds at Saxo Bank, you will pay a variable fee of 0.20%. This remains the case with European and US government bonds, corporate bonds, and emerging market bonds. However, the minimum commission here is 80 euros – which again is somewhat high.

In simple terms, if you invest anything less than 40,000 euros, you will always pay a bond commission of 80 euros. For example, if you only want to buy £1,000 of UK bonds, this would amount to an approximate commission of 7.1%!

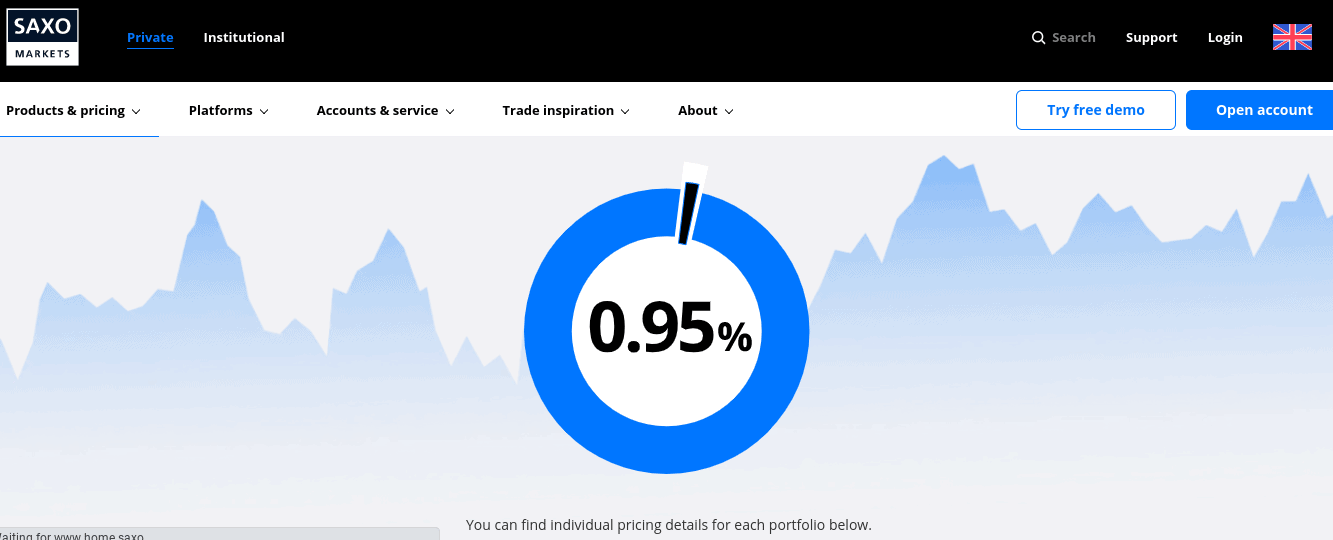

Management Portfolio Fees

Like most management portfolios in the UK investment space, Saxo Bank charges an annual percentage fee. Otherwise known as a ‘maintenance fee’ this will average 0.95% per year. However, the fee can be higher or lower than this depending on the target market. For example, the higher risk portfolios usually cost more.

This is because you will likely have investments from the emerging markets – which naturally, attract a higher commission. At the other end of the spectrum, low-risk management portfolios are cheaper – as they are centered on strong, stable, and easy-to-access asset classes.

Nevertheless, at 0.95% – this is actually very high. Sure, Saxo Bank will ensure that your investments are taken care of. Not only does this include the initial phase of building the portfolio, but rebalancing it, too. However, there are heaps of other managed portfolio providers active in the UK that come with much more competitive prices.

For example, Nutmeg – a popular UK robo advisor platform, charges an average annual fee of 0.75% for its management portfolios.

CFD Trading

When it comes to CFD trading, different fees and commissions apply to different assets and marketplaces. With thousands of CFD instruments active at Saxo Bank, we couldn’t possibly mention each and every fee.

We have, however, outlined the Saxo Bank CFD fees associated with the most traded markets globally. This at the very least will give you a ballpark figure.

- Forex: Currency pairs can be traded at Saxo Bank from as low as 0.4 pips. All fees are built into the spread.

- Options: Options – which can be traded on forex pairs, start at 3 pips.

- Indices: The FTSE 100 can be traded from just 0.85 pips.

- Commodities: Gold, oil, and other major commodities can often be traded from just $1 per lot

As you can see from the above, major CFD markets at Saxo Bank are actually quite competitive. You do, however, need to keep an eye on the minimum stake sizes – as some require large balances.

Inactivity Fee

If your Saxo Bank account is marked as dormant, you will incur an inactivity fee. This will cost you £25 if you have no active orders/investments and you fail to place a trade for three consecutive months.

If your account balance is empty, you don’t need to worry about the inactivity fee. But, if you do have a balance and your account remains dormant in the long run, you will keep incurring the £25 until it goes down to zero.

Saxo Bank Leverage

If you are planning to use Saxo Bank to trade CFD instruments, then you will have access to leverage. This means that you only need to stake a percentage of the total trade size.

For example, if you want to trade £5,000 worth of stock CFDs and you apply leverage of 1:5, you only need £1,000 in your account.

As is the case with all regulated brokers and trading platforms that serve UK clients, you will be limited in how much leverage you can apply. This is determined by the European Securities and Markets Authority (ESMA).

Therefore, the Saxo Bank leverage caps are as follows:

- 1:30 on major forex pairs like EUR/USD or GBP/USD

- 1:20 on gold, minor/exotic forex pairs, and major indices like Dow Jones

- 1:10 on non-gold commodities and minor indices

- 1:5 on stocks

With that being said, Saxo Bank does advertise leverage limits of up to 1:200 to those that fall under the scope of a ‘professional’ trader. You will, however, need to submit various documents in order to be eligible.

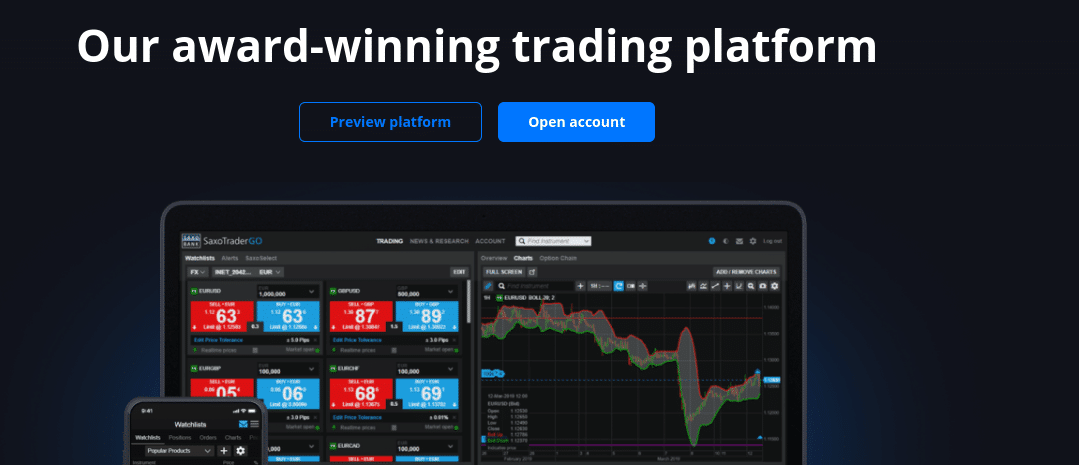

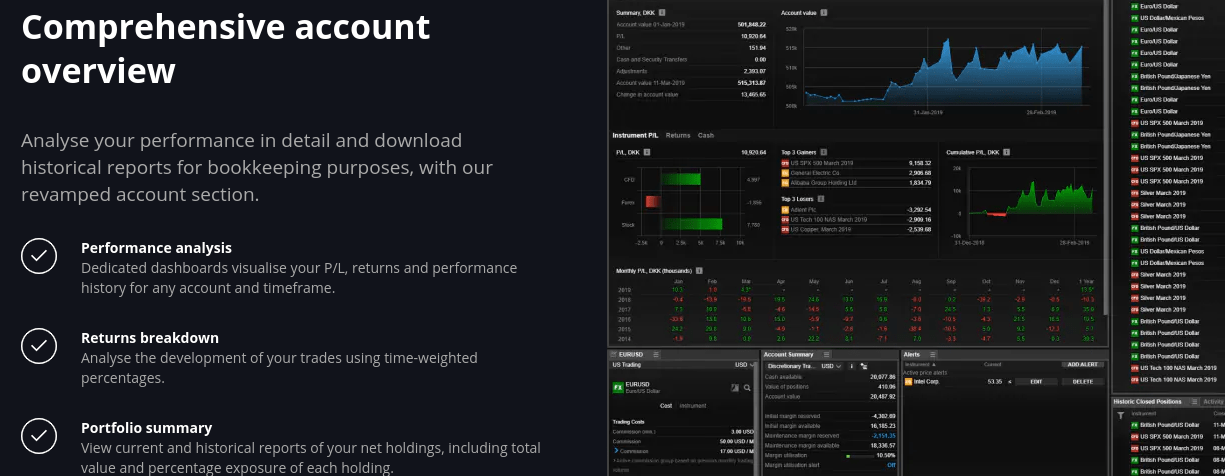

Saxo Bank Platform and Trading Tools

Saxo Bank offers two trading platforms – both of which are proprietary.

Below we explore both of these platforms in more detail:

SaxoTraderGO (Best for Non-Professional Traders)

Unless you are a professional trader that requires super-advanced tools and features, you will be best suited for the SaxoTraderGO platform. This can be accessed online via your standard web browser. However, to get the full Saxo Bank trading experience you might want to consider downloading the platform to your desktop device.

Nevertheless, the SaxoTraderGO platform comes packed with features – most of which we have summarized below:

- Multiple Order Types: You will have access to basic and advanced order types. This includes buy/sell orders, limit/market orders, stop-limits, and trailing stops. There is also an option that allows you to cancel all active and/or pending orders currently in play. This could be useful if you are scalping at Saxo Bank and need to quickly exit a bunch of positions.

- Charts and Technical Analysis: SaxoTraderGo allows you to customize your trading screen to the ‘t’. Not only does this include color schemes and the number of viewable charts, but preferred asset classes, too. In terms of technical analysis, the SaxoTraderGo platform offers over 40+ indicators and chart drawing tools.

- Options Chain: This innovative feature is great for those of you that wish to trade vanilla options. You’ll get to view option price chains and create watchlists on markets such as stocks, futures, and stocks.

- Performance Analysis: SaxoBank allows you to view your trading performance in an easy and clear way. For example, you can view gains and losses over certain periods (daily, weekly, etc) or by the financial instrument (e.g. gold or oil).

SaxoTraderPRO

As the name suggests, this Saxo Bank platform is aimed at professional traders. Although you will have access to all of the key features listed above, SaxoTraderPRO takes things to the next level.

This includes:

- Algorithmic Orders: SaxoTraderPRO allows you to place advanced order types that are backed with algorithms. In particular, this will be great for scalpers that strive to enter hundreds of buy and sell positions in a short period of time. Similarly, algorithmic orders allow you to automate some of your trading endeavors when a pre-defined condition is triggered (such as increased volatility)

- Real-Time Data and Market Depth: You can gain a full birdseye overview of what trading activity is occurring on your chosen exchange. This will show you key market movements in real-time, which can be crucial in catching new trends early. In addition to this, the SaxoTraderPRO platform gives you access to Level 2 of an order book. This does, however, come at a cost as you need to pay a periodic subscription fee.

- More Charts and Customization: SaxoTraderPRO allows you to take your customization efforts to a whole new level. You will also get more technical indicators and charting tools – subsequently allowing you to stay ahead of the curve at all times.

To clarify – and as noted by Saxo Bank itself, its PRO trading platform is only suitable for high-volume, active traders. If you are simply looking to use the broker to buy shares, ETFs, and other long-term investments – the standard SaxoTraderGO platform will be more than sufficient.

Saxo Bank App

Saxo Bank offers a fully-fledged investment app that can be downloaded on Android and iOS devices. This application is a carbon-copy of the SaxoTraderGO platform, albeit, in mobile form. The Saxo Bank app allows you to perform most account duties irrespective of where you are.

This includes:

- Placing buy and sell orders – as well as risk management positions like stop-losses and take-profits

- Deposit funds with a debit/credit card in real-time

- Check how your investment portfolio is performing

- Amend outstanding positions

- View market insights and news

Although Saxo Bank notes that you can perform chart analysis through its app, this is going to be extremely difficult on a smaller screen. As such, this is best left for the main SaxoBank web-trading platform or desktop software.

Saxo Bank Account Types

Saxo Bank offers a variety of account types. In terms of its standard investment account, there are three options – Classic, Platinum, and VIP. There are also accounts that allow you to invest via ISAs and SIPPs.

Investment Accounts

As we very briefly noted earlier, unless you are looking to invest huge amounts then you will need to opt for the Classic Account. Once again, this requires a minimum deposit of £500.

The Platinum Account, however, will require you to deposit a whopping £200,000 or more. Then you have the VIP Account, which requires £1 million.

Platinum Account will get you a 30% reduction on investment fees, while the VIP gets you industry-leading prices, plus a personal relationship manager and direct access to the Saxo Bank trading team.

ISA Accounts

For those of you interested in reducing the amount of capital gains and dividend tax that you will be liable for on your investments, Saxo Bank offers a fully-fledged Stocks and Shares ISA.

This allows you to invest £20,000 per year without needing to pay any tax on your gains. The Saxo Bank ISA gives you access to over 11,000 financial instruments – including UK and international stocks, ETFs, and bonds.

SIPP Accounts

Saxo Bank also offers SIPPs – which is great if you’re planning to build a pot for your golden years. This gives you access to the same assets as the Stocks and Shares ISA.

You will get direct access to a personal SIPP account manager and be able to select of all your investments from the online platform. As always, investing through a SIPP at Saxo Bank offers huge tax-saving benefits. But, your money will be locked away until you retire.

Saxo Bank Demo Account

Saxo Bank offers a demo account feature that takes just 1 minute to register for. This comes pre-loaded with a paper trading balance of $100,000 and remains active for 20 days. You can use the demo account on both SaxoTraderGO and SaxoTraderPRO.

The Saxo Bank demo account is suitable for several reasons, such as:

- If you’re a complete novice and want to learn the ins and outs of how online investing works before risking your own money

- If you want to to get to figure out whether the SaxoTraderGO or SaxoTraderPRO platform is right for you before making a financial commitment

- If you want to test out a new investment or trading strategy in a 100% risk-free environment.

To clarify, there is no requirement to deposit any money to gain access to the demo account.

Saxo Bank publishes regular news stories on its website. This allows you to stay up-to-date with what is happening in the financial markets. This covers most asset classes – such as shares, forex, options, and wider macro-economic developments.

Podcasts offer a super-interactive way of getting to grips with the current state of the financial markets. For example, at the time of writing this Saxo Bank review, the platform released a podcast that focused on US Treasury yields and how this might impact USD-denominated FX pairs.

The team of in-house traders at Saxo Bank regularly publish market analysis blogs. This will attempt to evaluate which way a particular asset is likely to go in both the short and long-term – based on current macro-economic conditions. This is great for coming up with trade ideas if you are currently lacking inspiration.

Although Saxo Bank is arguably more suited for those of you with a bit of experience in buying and selling investments, the platform does at the very least offer an educational department. At the forefront of this is its guides and explainers on how to become a better trader.

This covers core topics such as risk management and fundamental analysis. There are also video guides on how to effectively use the Saxo Bank trading platform and make the most of its many features and tools.

Payments at Saxo Bank

If you’re thinking about opening an account with Saxo Bank, you will need to meet a minimum deposit of £500. You have several options when it comes to payment methods.

The easiest way is to use your everyday debit or credit card. This is because the payment will be processed instantly and thus – you can start making investments straight away.

Alternatively, you can transfer funds from your UK bank account. But, this will take a few days to arrive in your Saxo Bank account. Either way, Saxo Bank does not charge any deposit fees.

Customer Service at Saxo Bank

As an old-school brokerage firm, it comes as no surprise to learn that the platform doesn’t offer live chat. This is a shame, as live chat is by far the easiest way to get instant support from an online stock broker. Nevertheless, you can contact a member of the Saxo Bank support team via email or telephone. Details are listed below.

- Email: [email protected]

- Telephone (New Accounts): 0207 151 2100

- Telephone (Existing Accounts): 0207 151 2000

Take note, the Saxo Bank customer service team only works Monday to Friday – between the hours of 9 am and 5.30 pm.

Is Saxo Bank Safe?

Although Saxo Bank might be on the pricey side and is arguably not suited for newbie investors – the platform does stand out when it comes to safety. From your perspective as a UK investor, you are covered by the Financial Conduct Authority (FCA).

This means that:

- All clients at the platform must have their identity verified by Saxo Bank. This prevents the broker from being used for illicit purposes and ensures that it remains compliant with anti-money laundering regulations.

- Saxo Bank will be audited by the FCA on a regular basis – this ensures that investors are able to buy and sell assets in a true and fair environment.

- Dedicated risk teams must be installed to ensure your money and account is kept safe at all times

- All client funds must be kept in segregated bank accounts. In simple terms, this means that Saxo Bank cannot use your money for its own day-to-day operations.

In addition to this, your Saxo Bank balances are covered by the Financial Services Compensation Scheme (FSCS). Therefore, if Saxo Bank went bust and was unable to repay what it owes you, the FSCS covers you up to the first £85,000.

While UK investors are protected by both the FCA and FSCS, we should also note that Saxo Bank is regulated in several other countries. This ensures that you have regulatory oversight on multiple fronts.

This includes:

- France

- Italy

- Switzerland

- Japan

- Australia

- Singapore

- Hong Kong

All in all, you should have concerns about using Saxo Bank from a safety perspective.

Join Saxo Bank Today – Steps Required

Although we think that there are plenty of other online stock brokers that better serve UK investors – if you want to join Saxo Bank these are the steps that you will need to follow:

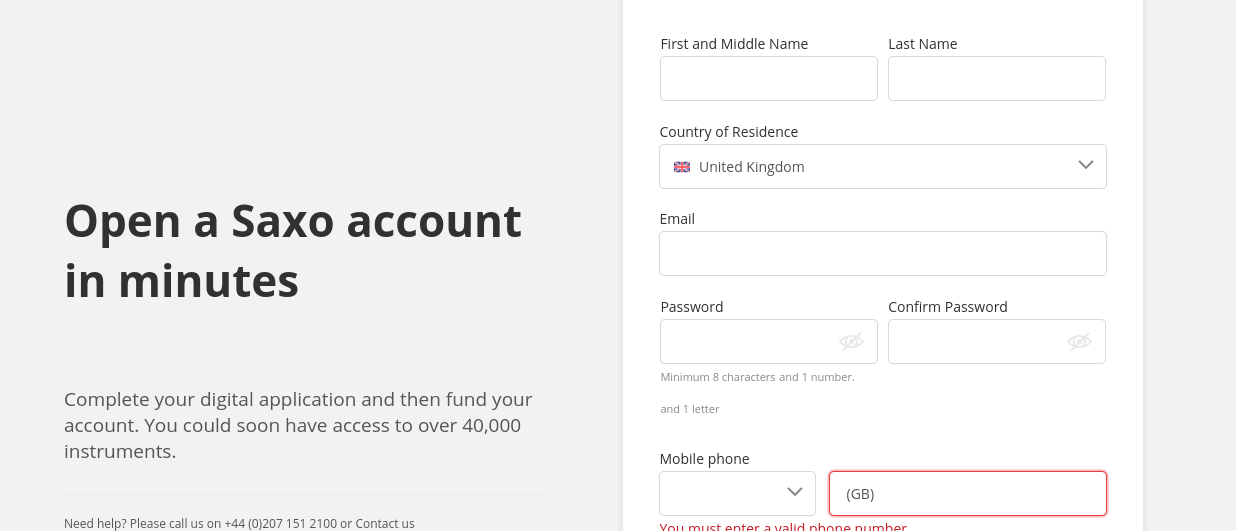

Step 1: Open an Account

As is the case with all online share dealing platforms, you will first need to open an account. Simply head over to the Saxo Bank website online or via your mobile phone and click on the ‘Open Account’ button.

Here, you will need to fill out a registration form by entering some personal and contact details, such as:

- Full Name

- Home Address

- Date of Birth

- National Insurance Number

- Phone Number

- Email Address

Step 2: Select Account Type

Unless you are looking to deposit £200,000 (Platinum Account) or £1 million (VIP Account) – you’ll need to opt for the Classic Account. As noted earlier, this comes with a minimum deposit of £500.

On the next page, you will be asked to provide some information about your financial background and prior trading experience. This is to ensure that you are not offered financial products (such as derivates) that are perceived to be too complex for your financial profile.

Step 3: Upload ID

All FCA brokers are required to perform a KYC (Know Your Customer) process. This ensures that they are able to verify your identity and thus – keep their platform safe for all investors.

As such, you will need to upload the following two documents:

- Photo ID – Passport or Driver’s License

- Proof of Residency – Bank Statement, Utility Bill, or Tax Statement

Unfortunately, you need to wait for Saxo Bank to verify your documents before you can proceed to the next step. In most cases, this can take 1-2 days.

Step 4: Deposit Funds

Once you get the all-clear from Saxo Bank on your documents, you can then deposit some funds. If you are keen to start making investments right now, opt for a debit or credit card. If you decide to transfer funds from your UK bank account, this will once again delay the process by 1-3 working days.

Step 5: Invest

As soon as your deposit has been credited by Saxo Bank, you are ready to start making investments. Choose your required platform (SaxoTraderGO or SaxoTraderPRO) and search for the asset you wish to buy or trade. Then, it’s just a case of setting up an order. This requires the total stake that you wish to risk on the investment and what price you want to enter the market at.

Saxo Bank Pros and Cons

Pros

- Heavily regulated and trusted brokerage firm

- Offers over 40,000 financial markets

- Invest in shares, ETFs, and bonds

- Trade CFDs via forex, indices, commodities, and more

- Advanced trading platform is great for professional traders

- Supports debit/credit cards

Cons

- Minimum deposit of £500 is high

- Minimum dealing fee of £8 is expensive

- Not suitable for inexperienced investors

- £10,000 minimum to invest in managed portfolios

- Does not support fractional shares

- No live chat feature

Saxo Bank Review – The Verdict

All in all, Saxo Bank is a worthy option if you are an experienced investor that is looking for a highly advanced trading platform. The platform offers over 40,000 markets across traditional shares, ETFs, and bonds – as well as leveraged CFD products. This ensures that seasoned traders have access to a highly diversified range of UK and international markets.

But, Saxo Bank won’t be the right broker for you if you are a newbie – as its proprietary trading platform is overly complex. Additionally, with a minimum deposit of £500 and share dealing fees of £8 – this is far from competitive. If you’re thinking about investing in a managed portfolio – the minimum stands at a whopping £10,000.

FAQs

What is Saxo Bank?

Saxo Bank is a Denmark-based investment house that also offers brokerage and trading services. If you're based in the UK, you can buy shares, ETFs, and bonds - as well as trade CFD instruments with leverage.

What are the Saxo Bank share dealing fees?

Saxo Bank charges a commission of 0.1% to buy UK shares. While at first glance this might sound competitive, you need to meet a minimum fee of £8. This is expensive.

What shares can you buy at Saxo Bank?

Saxo Bank offers one of the most extensive asset libraries in the UK brokerage scene. In total, you'll have access to almost 20,000 shares from dozens of markets.

What trading platforms does Saxo Bank offer?

Saxo Bank offers two platforms - both of which it built itself. This is SaxoTraderGo and SaxoTraderPRO. Both are somewhat complex to use if you are a newbie.

What is the minimum deposit at Saxo Bank?

The minimum deposit at Saxo Bank is £500. This is through the broker's Classic Account.