Spread Betting Shares UK

Most investors in the UK will look to purchase shares in the traditional sense – meaning you will likely keep hold of the stocks for several months or years. But, by ‘spread betting’ shares – you have the chance to take advantage of 0% commissions, leverage, and short-selling capabilities – and all your profits will be exempt from capital gains tax.

In this guide, we explore the pros and cons of Spread Betting Shares UK and how you can get started with some of the popular brokers in the UK.

How to Start Shares Spread Betting UK

This simple 5-step walk-through below will show you how to get started from the comfort of your home. We explain the ins and outs of how shares spread betting works in more detail further down in this guide.

- Step 1: Your first port of call will be to open an account with a UK spread betting broker that is regulated by the FCA.

- Step 2: Now that you have registered your account, you will need to deposit some funds. You can choose from a UK debit/credit card, e-wallet or any other payment method the platform offers.

- Step 3: You can search for the shares that you wish to trade via the website. For example, if you want to trade Royal Mail shares – simply enter the name of the company into the search box.

- Step 4: If you think that your chosen shares will rise in value – place a ‘long’ order. If you think the opposite – place a ‘short’ order. Enter the value of your deposit and confirm the order.

Shares Spread Betting Explained

Shares spread betting is a short-term way to speculate on the future value of stocks. This means that you will look to enter frequent trades throughout the week – targeting modest profits.

Unlike traditional share investments – spread betting positions are rarely kept open for more than a few days or weeks. In some cases, you might only even keep a position open for hours or even minutes.

With this in mind, there is a lot to learn about financial spread betting shares UK before you take the financial plunge. We clear the mist in the sections below by explaining everything there is to know about this short-term trading instrument.

What is Shares Spread Betting UK?

Shares spread betting platforms offer a popular alternative to traditional stock investments. In the case of the latter, you will simply be looking to invest in a company that you think will be worth more in years to come. Spread betting, however, is a short-term form of trading where you will be looking to speculate on the future value of the respective stock over the next few hours, days, or weeks.

For example:

- You might notice that British American Tobacco stocks have dropped by 5% over the past few days and think they are undervalued. In turn, you would head over to your chosen spread betting platform to place a long order.

- Or, you might have noticed that BP stocks are at all-time highs, and think that the shares have peaked. As such, you place a short order at your chosen spread betting platform to profit from this.

As per the above, brokers offering financial markets on spread betting shares UK, allow you to make gains from both rising and falling markets. In order words, not only can you speculate on a company’s stock price increasing, but decreasing too.

Additionally, the popular shares spread betting sites allow you to apply leverage of up to 1:5. This means that you have the chance to multiply the size of your position by a factor of 5 – so a £100 account balance would give you access to £500 in stock trading capital.

We should, however, note that spread betting shares UK operates in a different manner to traditional stock investments. This is because stock market price movements – and subsequently profits and losses, are determined in points as opposed to pounds and pence.

Sponsored ad. 75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

For example, if HSBC stocks increase by 10p – this might be reflected as 10 points at your chosen broker. In turn, if you went long at £5 per point – you would have made a profit of £50. More on this in the sections below.

How Does Shares Spread Betting Work?

We need to elaborate further on the core principles of shares spread betting UK – as there are many key differences from that of traditional stock investments.

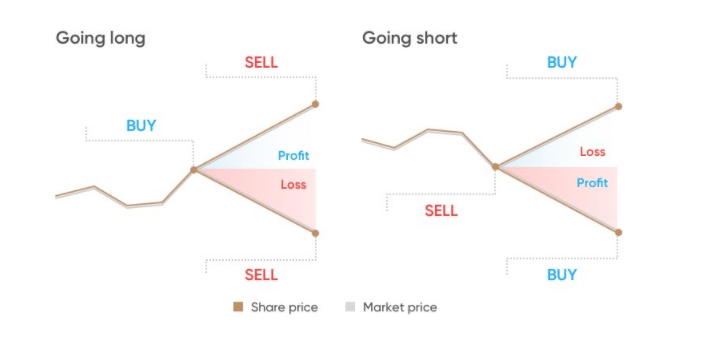

Long or Short

As we briefly covered above – shares spread betting UK sites give you the option of going long or short on your chosen stock. This simply tells the broker whether you think the share price will increase or decrease in short-term.

To clear the mist:

- Go ‘long’ if you think the share price will increase

- Go ‘short’ if you think the share price will decrease

This is a major benefit from spread betting shares UK – as traditional stock brokers only allow you to make gains if the respective company increases in value. But, when using a spread betting platform, you have the chance to also profit if you think the stocks will lose value. As this article on Basketball Insiders explains, some of the popular apps for betting also offer the chance of spread bets on sports.

Share Ownership

When you purchase shares in the traditional sense – you own stock in the company. This means that you are entitled to certain stockholder rights – such as receiving your share of any dividend payments. But, spread betting shares UK are financial derivatives.

This means that the underlying asset does not exist. Instead, all you are doing is speculating on the future value of the shares. On top of being able to short-sell and apply leverage – not owning the shares means that you will not need to pay any stamp duty tax. This saves you 0.5% from the very get-go.

Share Price Movement

In the world of spread betting shares UK – price movements are determined in ‘points’. This is very similar to conventional stock indexes like the FTSE 100 or Dow Jones – which are priced in points rather than pounds or dollars. The exact price unit will be determined by your chosen spread betting provider and the respective market.

- For example, let’s say you were trading Royal Mail – which are currently priced at 500.00p each. If the share price increases to 500.50p – that is likely to be a price movement of 50 points.

- In another example, let’s say you are trading Apple stocks. If the stocks go from $131.24 to $131.44 – that’s a price movement of 20 points.

With that said, if you are spread betting shares with a much higher valuation – then the point movement might be different.

- For example, at the time of writing, Amazon shares are priced at $3,379.39.

- Most spread betting shares UK brokers will discount the cent on the price of Amazon

- Instead, each price movement will be based on the dollar amount

- In other words, if the shares move from $3,379 to $3,381 – that’s a price movement of 2 points. The cent figure after the dollar amount would there be irrelevant.

Crucially, brokers offering markets on spread betting shares UK will always tell you the unit value of each point movement. This is important to understand, as you need to ensure that you know exactly how much you are staking on the spread betting position.

Stakes

Now that you know that spread betting shares UK markets move in points as opposed to pounds – this should make it easier to understand how stakes work. In the traditional stock trading space, you will simply specify the amount you wish to invest. For example, you might decide to invest £200 in GlaxoSmithKline shares.

However, when using a shares spread betting broker – you will need to specify your desired stake per price movement.

- For example, if you decide to risk £5 per point and the shares move by 100 points – you will either make or lose £500, depending on whether you speculated correctly or not.

- Or, if you stake 50p per point and the shares move by 50 points – that’s a profit or loss of £25.

As you can see, the more you stake per point movement, the more you stand to make or lose. This is why you need to have a firm grasp of what price movement unit the broker has set up on the share market you wish to access.

Leverage

Another major benefit of the spread betting shares UK arena is that you can always apply leverage to your positions. As per FCA regulations – retail traders in the UK can apply leverage of up to 1:5 on share derivatives. This covers both CFD trading and spread betting.

If you’re new to leverage, this is simply a multiple that boosts your stake. For example, if you used leverage of 1:4 – then your profits and losses would be magnified by a factor of 4.

An example of how leverage can be used effectively when spread betting shares UK can be found below:

- You decide to go long on Deliveroo shares as you think the stocks are undervalued

- The shares are priced at 250.00p and you stake 50p per point

- A few days later, Deliveroo shares are priced at 270.00p

- That’s a price movement of 200 points

- You staked 50p per point – so without leverage you would have made a profit of £100

- However, you applied leverage of 1:4 – so your £100 profit is boosted to £400

At first glance, it might appear that applying leverage to all of your spread betting shares UK trades is a no-brainer. After all, you may amplify the size of you’re potential gains. However, leverage will also do the same for your losses – so make sure you understand the risks involved.

Expiry Date

Once again, when you purchase shares in the conventional sense you will likely hold on to your investment for several years. In fact, you have the chance to keep hold of the shares for as long as you wish – as you own them outright.

But, when you trade shares spread betting markets – the underlying instrument will come with an expiry date. When the market does expire, your position will be closed by the broker. This is why spread betting shares UK is conducive for short-term speculation and not long-term investing.

In most cases, the range of markets offered by spread betting brokers will come with two expiry date options for you to choose from.

- Firstly, and perhaps one of the more popular option to take – is the quarterly duration spread betting market. This means that the market will remain open for three months – which gives you plenty of time to determine when is the right time to exit the trade.

- The other option is the daily funded betting market. As the name suggests, this shares spread betting market will close at the end of each trading day.

Again, you just need to make sure that you understand the expiry date attached to the market before you trade it.

Spread Betting Shares vs Stock Investing

If you’ve read our guide up to this point – then you will likely know that there are some major differences between spread betting and traditional stock investing. Both come with their pros and cons – so below we outline the main differences in a bit more detail.

- Rising and Falling Markets: When you purchase shares at a conventional online broker – you will only make money if the stocks increase in value. When spread betting shares, you get to choose whether you think the stocks will rise or fall. This gives you much more in the way of flexibility.

- Leverage: Traditional UK stock brokers do not allow you to trade with leverage when you purchase shares. That is to say, if you have £50 in your brokerage account, you can only purchase £50 worth of shares. In the case of shares spread betting, you have the chance to apply leverage of up to 1:5 – giving you an additional 400% in purchasing power.

- Dealing Fees: Most UK brokers will charge you a share dealing fee every time you buy or sell a stock. For example, Hargreaves Lansdown fees on share purchases and sales are £11.95. But, when spread betting shares UK, you likely won’t pay any commissions or dealing fees at all – as the underlying stocks do not exist.

- Tax: We discussed earlier that you need to pay 0.5% in stamp duty when you purchase UK-listed stocks. This is waivered when spread betting shares, which saves you 0.5%. Most importantly, profits from spread betting are free of capital gains tax, too. This isn’t the case with profits on traditional share purchases – which are liable for taxation.

- Trade Duration: Traditional shares can be bought and held on to for as long as you wish. However, shares spread betting is a short-term trading strategy – as markets will either expire on a daily or quarterly basis.

- Points vs Pounds: Spread betting price movements are determined by the number of points the stocks rise or fall by. This is different from traditional stock investing – whereby shares move in pounds and pence.

The points outlined above show that there are some clear differences between stock trading and shares spread betting. Ultimately, if you are a short-term trader that wishes to access leverage, short-selling, and tax-free profits – the latter is likely to be of interest.

Features of Spread Betting Shares

If you’re still unsure whether spread betting shares is the right trading strategy for you – below we explain the main features that may affect your decision to participate in spread betting shares.

Spread Betting Shares Tax

The latter is because spread betting profits are determined as ‘gambling’ winnings by HMRC. This means that they are not liable for capital gains tax.

This is the only trading sector in the UK that offers this perk. Ordinarily, any profits you make from stocks, forex, cryptocurrencies, ETFs, or any investment for that matter – are potentially taxable.

We say ‘potentially’, as all UK residents get a capital gains tax-free allowance each year. Plus, you also have ways to shield your profits from HMRC, via a SIPP or ISA. Nevertheless, these come with limits. Meaning – once you go over your annual capital gains limits – tax will be applicable. This isn’t the case with shares spread betting – as it doesn’t matter how much you make – everything is tax-free.

Access to Thousands of Share Markets

As share spread betting markets simply track the respective stock price – this allows brokers to offer a huge number of tradable instruments.

Sponsored ad. 75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

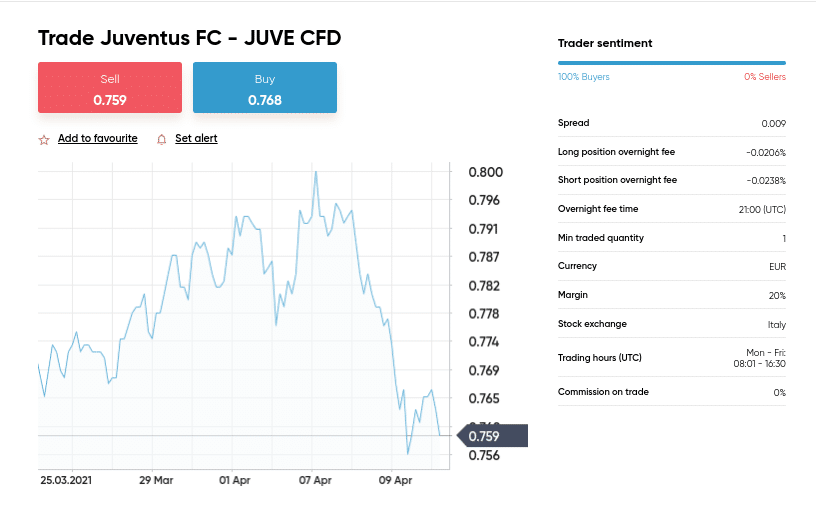

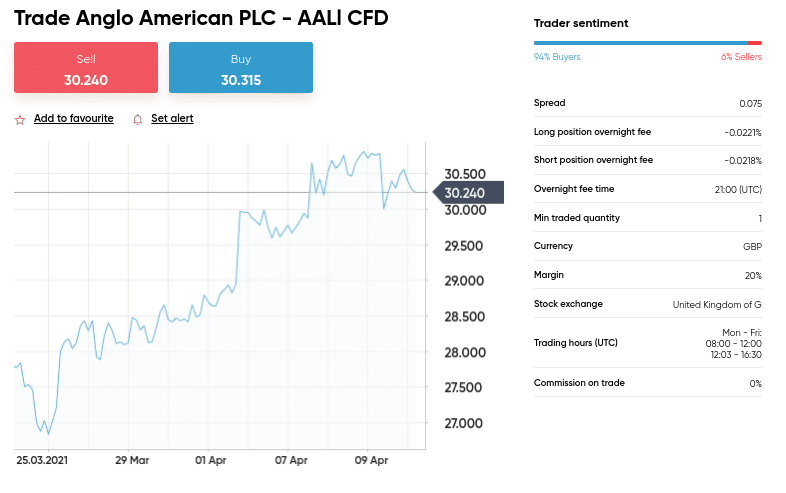

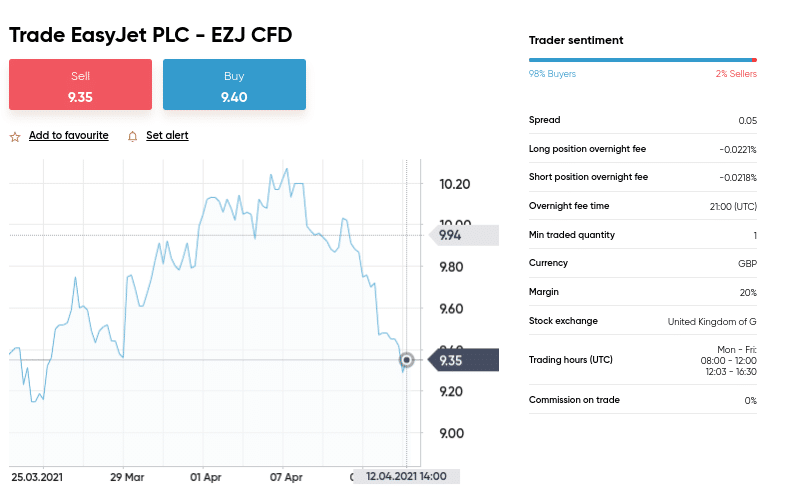

This covers the London Stock Exchange and AIM in the UK, as well as markets in the US, Singapore, Germany, Japan, and France. You may also trade shares from smaller stock exchanges based in Russia, Spain, Ireland, and Italy. This allows you to trade a diversified range of share markets – rather than having to stick with FTSE 100 entrants.

One Option is to Start With Small Stakes

A lot of UK stock brokers require you to deposit hundreds of pounds to get started with an investment. You might also find that you are required to purchase a minimum number of shares – which can make the process unviable for those on a budget.

But, when using a spread betting shares UK broker – account minimums are often very small.

Profit When the Markets are Falling

In early 2020 – the global stock markets lost anywhere between 30% and 50% in the space of a few weeks. By using a traditional stock broker, the only options on the table would have been to sit tight or cash out your shares. Crucially, by instead using a shares spread betting broker – you could have profited from this market crash by going short.

In doing so, you would have made a sizable profit. This once again illustrates why the spread betting shares UK scene is so popular with seasoned traders – as you can make a profit irrespective of how the wider markets are performing.

No Commissions

The vast majority of spread betting platforms in the UK allow you to trade shares without paying any dealing fees or commissions. This means that you have the chance to enter and exit as many share trading markets as you wish without getting hammered by brokerage charges.

Spread Betting Shares Strategies

Spread betting shares UK is a short-term trading arena – so you need to have a number of entry and exit strategies in place before you get started.

Below we discuss some of the popular spread betting shares strategies to consider if you are a beginner in this trading field.

Risk Management Strategy

Irrespective of whether you are a newbie or seasoned spread betting trader – it is imperative that you always have a risk management strategy in place. This simply means that you are able to trade in a risk-averse way by keeping your potential losses in check.

After all, even the most successful spread betting traders encounter losses. But, what sets these traders apart is that they know how to trade without taking too much risk. As a beginner, you can try to achieve this goal by ensuring you always have a stop-loss and take-profit order deployed on your spread betting positions.

For those unaware:

- Stop-Loss Order: This allows you to specify a specific stock price that you want the spread betting broker to close your position. For example, let’s suppose that you stake £5 per point. You don’t want to lose more than £100 on the trade – so you set your stop-loss order at 20 points. This means that the broker will close your trade if your spread betting position goes against you by 20 points. Crucially, this ensures that the most you can lose is £100.

- Take-Profit Order: At the other end of the scale, you also need to think about locking in your profits when a target price point has been met. For example, on a stake of £5 per point, you might want to target a profit of £200. As such, you simply need to set up a take-profit order at 40 points.

Once you have placed both a take-profit and stop-loss order on your shares spread betting position – users can then allow the trade to play out. That is to say, you don’t need to sit at your laptop for hours or days on end waiting to close the trade manually. Instead, this will happen automatically when either your stop-loss or take-profit target is triggered.

Market Sentiment Strategy

If you are able to gauge the wider market sentiment – making gains from your shares spread betting endeavors can be a lot easier to achieve. For example, in the midst of the coronavirus pandemic in early 2020 – the market sentiment was centered on fear.

This led to some of the biggest companies in the world losing more than 50% in market valuation. More specifically, certain sectors were hit harder than others.

- For example, while global travel put to a standstill – oil stocks like BP and Royal Dutch Shell took a major beating. In turn, you could have made a profit from this by going short at your chosen shares spread betting broker.

- In another example, market sentiment on airline stocks such as Easyjet has continued to thrive over the past few months – with the UK’s vaccine rollout exceeding expectations. As such, Easyjet shares have increased by over 91% in the past 6 months alone.

Again, by gauging this market sentiment yourself – you have the chance to place sensible orders at your chosen shares spread betting site without needing to have an understanding of technical analysis.

Hedging Strategy

Spread betting is one of the most effective ways to hedge – in terms of cost, liquidity, and convenience. Hedging is a strategy employed to mitigate the risks of an investment going against you.

- For example, let’s suppose that you owned a number of BT shares

- Your investment has performed well so far – but you are worried about rumors of a huge regulatory fine

- If the fine does come to fruition – you know that this will impact the value of BT shares

- To counter this uncertainty – you could short sell BT at a shares spread betting platform

In doing so, you are covering both potential outcomes.

- If BT does receive a major regulatory fine and the stocks plummet – these losses will be countered by your spread betting short position

- If BT escapes a fine, the shares will likely increase. This will counter the losses you encounter on your spread betting short position.

Ultimately, it takes just seconds to set up a shares spread betting position – meaning that any time you are concerned by market uncertainty – you always have the option of hedging.

Popular Spread Betting Shares Platform

If you want to spread bet shares from the comfort of your home – you first need to find a broker that meets your needs. There are a handful of options in the UK market – all of which are regulated by the FCA. You do, however, need to look at what share spread betting markets are supported and how much you will be charged to trade.

Below we review two popular spread betting share sites in the UK.

1. Pepperstone

Pepperstone allows you to trade with leverage and benefit from short-selling facilities. If you are a professional trader and meet the requirements set out by the FCA – you will get leverage of up to 1:500. If not, you will be capped by the 1:5 limit offered by UK retail traders. In terms of supported markets, Pepperstone gives you access to four major exchanges.

In the US, this covers the NYSE and NASDAQ – meaning you can trade shares like Apple, IBM, Facebook, and Tesla. Other tradable exchanges include Germany and Australia.

| Broker | Commission | Inactivity Fee | Deposit Fee | Withdrawal Fees |

| Pepperstone | £0.02 per 0.01 lot or 0.0035% | None | FREE | $5 (about £4) |

75.3% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

How to Start Spread Betting Shares

If you are ready to benefit from tax-free share spread betting markets and want to get started with an account right now – follow the steps outlined below.

Create a Spread Betting Shares Account

Getting started takes a matter of minutes. Simply make your way to your brokerage’s website and begin the sign-up process. This will open a sign-up form and you’ll be required to enter your name, email address, as well as choose a username and password for your new trading account.

Verification

Users may be required to complete a simple KYC process, if they invest with a regulated broker. Upload a copy of your passport or driving license as proof of identity, and a copy of a recent utility bill or bank statement as proof of address.

Deposit Funds

With a fully verified account, you’re one step closer to start trading a range of assets with the click of a button. Depending on the broker you choose, you can transfer funds using a debit card, credit card, bank wire transfer, as well as e-wallets such as PayPal, Neteller and Skrill.

Choose your preferred payment method and deposit your funds into the account.

Place Shares Spread Betting Order

With a funded account, you are now ready to place your first spread betting trade. Search the name of the asset or spread at the search bar on your platform’s homepage.

Once you know which shares you wish to spread bet – you need to choose from a long or sell position. This tells the site whether you think the shares will rise or fall in value.

You then need to enter your stake per point, and ideally – set up a stop-loss and take-profit order to mitigate your risks.

To complete the process – confirm your spread betting position.

Conclusion

Although spread betting shares UK won’t be for all investor profiles – the arena offers plenty of features that you won’t find in the traditional stock brokerage scene. At the forefront of this, is being to choose from a long or short position, apply leverage, and trade without paying any commission.

Furthermore, the shares spread betting markets are free of capital gains and stamp duty tax – meaning all profits are yours to keep. If you’re ready to try a spread betting shares UK broker today – you should choose a reliable broker that will cater to your investing needs & requirements.

FAQs

Is shares spread betting legal in UK?

What is a daily funded bet in shares spread betting?

How do you make money from shares spread betting?

What shares can you spread bet?