How to Buy Whitbread Shares UK – with 0% Commission

Whitbread PLC (WTB) is behind a number of leading UK-based hospitality brands – including the likes of Premier Inn, Beefeater, Brewers Fayre, and Thyme. The firm is publicly listed on the London Stock Exchange – so buying Whitbread shares from the comfort of your home could not be easier.

In this guide, we walk you through the step-by-step process of how to buy Whitbread shares UK from a commission-free stock broker.

-

-

Step 1: Find a UK Stock Broker to Buy Whitbread Shares

Naturally, as Whitbread is listed on the London Stock Exchange, hundreds of UK brokers allow you to invest online.You do, however, need to explore what fees and commissions the broker charges, what payment types are supported, and whether or not the provider is regulated by the FCA.

Below you will find a small selection of the best stock brokers UK to buy Whitbread shares today.

Step 2: Research Whitbread Shares

Whitbread is involved in the UK hospitality sector – with a strong focus on hotels and pubs. With that said, you’ll be investing in a sector that has been heavily impacted by the coronavirus pandemic. As such, it’s important that you do lots of independent research before you buy Whitbread shares.

In the sections below, we help clear the mist by outlining the most important considerations that need to be made before you add Whitbread stocks to your investment portfolio.

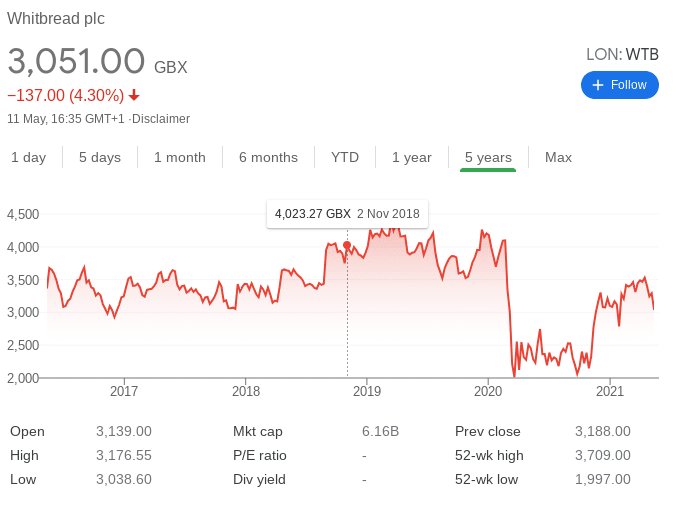

Whitbread Share Price History & Market Capitalisation

Launched in 1742, Whitbread has a long-standing history in the UK hospitality sector. As a public company, the firm first saw its shares listed on the London Stock Exchange way back in 1948. With a market cap of over £6 billion, Whitbread is also a constituent of the FTSE 100 index.

In terms of its stock market history, it’s been somewhat of a bumpy road for the firm over the past five years. For example, between May 2006 and February 2020, Whitbread shares enjoyed a slow and steady upward trajectory – going from 3,366p to highs of 4,097p.

However, then came the COVID-19 pandemic and the shares fell off a cliff. In fact, in the space of just 1 month, Whitbread shares dropped to lows of 1,997p – translating into a rapid decline of 51%. This huge capitulation was the case across the wider UK hospitality sector and ultimately – was it no fault of Whitbread itself.

On the flip side, those that were able to look past the pandemic in March 2020 by investing at lows of 1,997p are now looking at superb gains. This is because, at the time of writing in May 2021, Whitbread shares are trading at 3,051p. This equates to gains of 52% in just over 13 months. Crucially, Whitbread shares still have a long way to go to get back to pre-COVID levels of 4,097p. For this to happen, the stocks would require a further upside of 34%.

Whitbread EPS and P/E Ratio

Financial ratios are completely skewed at present in the case of Whitbread, owing to its share price collapse since the pandemic began. Nevertheless, as per its 2021 fiscal posting, Whitbread reported an EPS (Earnings Per Share) of -4.82. In the two years prior, this stood at 1.25 and 0.83, respectively.

In terms of its P/E (Price-to-Earnings) ratio, the most recent figures we have available to us are based on the firm’s 2020 end of year report. This put the Whitbread P/E to The London Stock 27.92 – down from 42.13 the year prior. We’ll need to wait for the 2021 end of year results to assess where its most recent P/E stands.

Whitbread Shares Dividend Information

Whitbread was historically a solid dividend payer before the pandemic. In terms of yields, this stood at 2.50%, 3.10%, and 2.40% in 2017, 2018, and 2019 respectively. However, like a lot of companies operating within the UK hospitality sector, dividends are currently on hold.

According to the Whitbread board, this will remain the case for as long as its revolving credit facility waiver is in place – which is expected to expire in Q1 2023. A return to its dividend policy could come soon – but this will ultimately depend on how quickly Whitbread is able to recover from the impact of extended lock restrictions.

Should I Buy Whitbread Shares?

So now that we have explored the firm’s stock price history, we now need to look at the fundamentals. That is to say, the sections below will explore the main factors that might have an impact on the future Whitbread stock price.

UK Economy is Reopening

After an extended lockdown period – where the vast bulk of Whitbread hotels and bars remained closed – there is finally light at the end of the tunnel. In the coming weeks, it is hoped that that wider restrictions in the hospitality sector will be lifted. This is in direct correlation with the UK’s successful vaccine rollout.

This will, of course, have a major impact on Whitbread – especially when the UK tourism sector reopens. After all, the firm is currently behind over 800 hotels which consist of over 79,000 rooms.

Discounted Shares

We mentioned earlier that Whitbread shares have recovered by over 52% since their lows of 1,997p in March 2021. With that said, the shares still need to increase by a further 34% to get back to pre-pandemic levels of 4,097p. As such, you still have the chance to buy Whitbread shares at a discounted price.

Expanding Into International Markets

While the pandemic has been devastating for Whitbread, this hasn’t hindered its international objectives. In fact, Whitbread has since entered the German hospitality market – which currently consists of 30 hotels and 5,000+ rooms.

New Normal

Perhaps the biggest threat to Whitbread over the coming months and years is with respect to the ‘New Normal’. That is to say, although the UK and European hospitality sector is slowly but surely reopening, it remains to be seen how new restrictions and guidelines will impact hotels and bars.

You then have the growing costs involved with enhanced hygiene requirements, which is likely to be a major blow to Whitbread if its hotel occupancy rates remain low.

Whitbread Shares Buy or Sell?

There is no getting away from the fact that Whitbread – like the vast bulk of hospitality providers, has had a horrid time since the pandemic began. But, there is light at the end of the tunnel and thus – you can still buy Whitbread shares at an attractive price. Based on current share prices, there is still a further upside of 34% on the table for Whitbread to get back to pre-COVID levels of 4,097p.

Buy Whitbread Shares With Zero Commission

This guide has explained the ease with which you can buy Whitbread shares online in the UK. The most challenging part is finding a top-rated online broker to complete the investment with.

FAQs

What is Whitbread?

Launched way back in 1742, Whitbread is behind a number of leading UK-based hotels and pub chains. This includes the Premier Inn, Beefeater, Brewers Fayre, Thyme, and Cookhouse & Pub. Whitbread also has 30 hotels in Germany.

What stock exchange are Whitbread shares listed on?

Whitbread is listed on the London Stock Exchange (LSE) - where it's been since 1948. The firm is also a constituent of the FTSE 100 index.

Does Whitbread pay dividends?

Before the pandemic came to fruition, Whitbread was a solid dividend payer. Unfortunately, dividends are currently on hold. Management has suggested that this could be the case until Q1 2023.

Where can you buy Whitbread shares?

If you're wondering how to buy Whitbread shares in the UK, you'll need to open an account with a trusted stock broker.

Does Whitbread own Pizza Hut?

Whitbread sold its position in Pizza Hut back in 2006.

Who is the Chief Executive Director of Whitbread?

Alison Brittain is the current CEO of Whitbread and has held the positon since 2016.

Can I invest in Whitbread shares via an ISA or SIPP?

Whitbread shares - like all UK and international stocks, can be added to your ISA or SIPP account. You will, of course, need to ensure that your chosen ISA/SIPP provider offers access to Whitbread shares.

Kane Pepi

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Academically, Kane holds a Bachelor’s Degree in Finance, a Master’s Degree in Financial Crime, and he is currently engaged in a Doctorate Degree researching the money laundering threats of the blockchain economy. Kane is also behind peer-reviewed publications - which includes an in-depth study into the relationship between money laundering and UK bookmakers. You will also find Kane’s material at websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2026 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up