How to Buy Travis Perkins Shares UK – With 0% Commission

Travis Perkins PLC (TPK) is a major UK building merchant. The company is publicly-owned and is traded on the London Stock Exchange. Travis Perkins is also a constituent of the FTSE 250 index – with a current market valuation of £3.4 billion.

In this guide, we explain how to buy Travis Perkins shares online in the UK. This includes a breakdown of the best UK brokers to buy the stocks from and a full Layman’s walkthrough of how to buy Travis Perkins shares in the fastest and most cost-effective way.

-

-

Step 1: Find a UK Stock Broker to Buy Travis Perkins Shares

As Travis Perkins is a major UK homebuilder with a multi-billion pound market capitalization, there are heaps of share dealing sites that allow you to buy its share.

In particular, you’ll want to sign up with a broker that is regulated by the FCA, offers low-cost commissions, and supports your preferred deposit and withdrawal method.

To help point you in the right direction, below we have listed two of the best UK stock brokers to buy Travis Perkins shares.

Step 2: Research Travis Perkins Shares

It is worth taking a step back before you proceed to buy shares of Travis Perkins. After all, we are currently living in uncertain times with the ongoing COVID saga.

As such, the sections below will outline some of the most important factors that you need to consider before making an investment. This includes the firm’s share price history, dividend information, and what the future holds for the British building merchant.

What is Travis Perkins plc?

Travis Perkins is one of the most established UK building merchants – with the firm tracing its roots back to the late 18th century. The company is involved primarily in supply materials to the construction industry, albeit, it also offers home improvement retailer services.

Its portfolio of goods covers tens of thousands of merchant products and DIY tools – which are available across more than 560 UK stores. Travis Perkins is also behind UK retailer Wicks, which was acquired for £950 million in 2004.

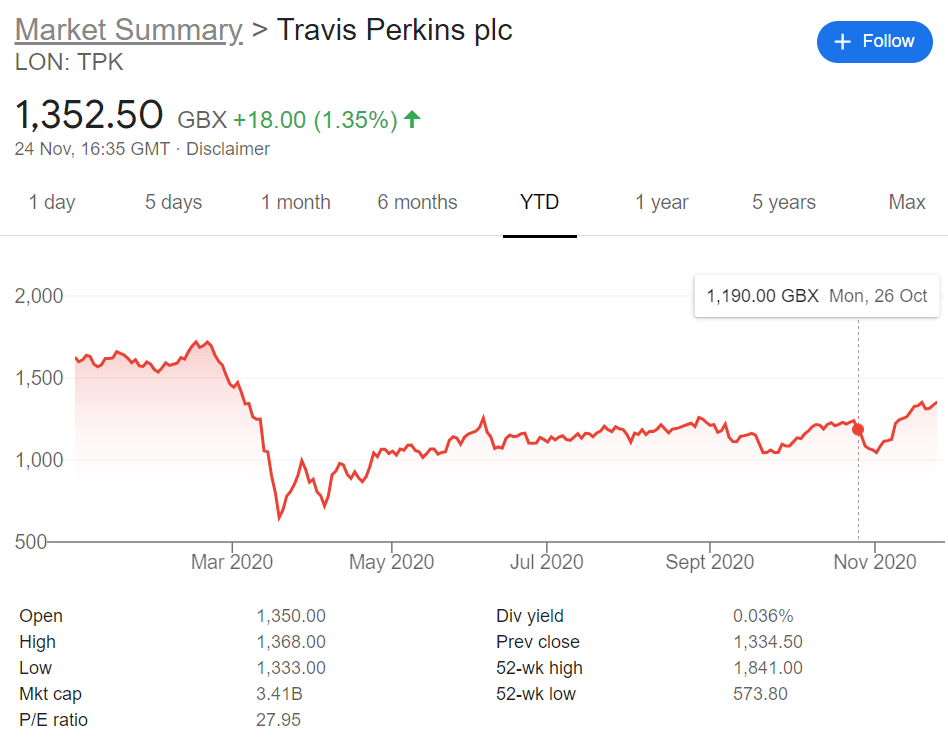

Travis Perkins Share Price History & Market Capitalisation

Travis Perkins first took the company public in the 1980s. Back then, the shares were trading on the London Stock Exchange at just under 190p. The shares then went on an upward trajectory that lasted for almost two decades – subsequently peaking at over 1,550p in 2007.

Then, like the rest of the UK construction and real estate sectors, Travis Perkins shares were hit hard by the impending financial crisis that was to follow. In fact, the shares hit lows of 230p-ish in the following year, representing a huge decline of over 85% in just 12 months.

Fortunately, the shares then took a turn in the right direction. Over the course of the following 7 years, Travis Perkins stocks rewarded investors handsomely. The stocks hit peaks in 2005 of 2,200p – meaning a growth of over 800% from their 2008 lows.

With that said, Travis Perkins shares have since taken a turn for the worse. For example, the stocks entered 2020 at 1,627p. This means that the shares were worth 25% more than 5 years prior. And of course – Travis Perkins was also heavily impacted by the Coronavirus pandemic.

This resulted in the shares hitting 52-week lows of 573p – translating into year-to-date losses of 64%. With that being said, were you been shrewd enough to buy Travis Perkins shares during their lows of March 2020, you would now be looking at gains at 135% – based on current prices of 1,352p.

Travis Perkins EPS and P/E Ratio

In its most recent financial year, Travis Perkins reported earnings per share of 112.70p. This was down from the 114.50p it achieved in the year prior. In terms of its P/E ratio, this jumped from 9.30 to 14.20 – as per its most recent filing.

At the time of writing and based on current prices, its P/E ratio stands at 27. This could illustrate that the shares are beginning to move into the overvalued territory.

Travis Perkins Shares Dividend Information

It might not surprise you to learn that in the midst of the pandemic, management at Travis Perkins canceled its full-year dividend. Initially, it had planned to pay a dividend yield of 33p per share.

Management explained that this was a result of the firm looking to protect its balance sheet and subsequently retain its free cash flow position.

As such, the only financial returns that you will have at your disposal by buying Travis Perkins shares is that of an increased stock price.

Should I Buy Travis Perkins Shares?

Now that we have covered the firm’s share price action and current dividend policy, we are now going to look at what the future holds for Travis Perkins.

Recovery Since March has Been Good

First and foremost, it goes without saying that Travis Perkins shares took a complete nosedive in Q1 2020 – with the stocks dropping by over 64% in the space of two months. On the other hand, it is notable that shares have recovered to the 1,300p+ region. This means that Travis Perkins stocks have grown by over 135% since March.

Buying Back £250 of Debt

It was recently announced that the board at Travis Perkins has decided to re-purchase £250 million of debt. This consists of corporate bonds that were not due to be repaid until next year. As such, this suggests that Travis Perkins has more than enough cash flow to reduce its debt burden.

Liquidity at Just Under a £1 Billion

Leading on from the above section, we should also note that Travis Perkins has access to just under £1 billion in liquidity. This is crucial during a time where uncertainty remains an ongoing issue. After all, the longer that the UK is in lockdown, the longer revenues at Travis Perkins continue to be hindered.

Wickes and Toolstation Performing Well

Although its Q3 earnings reported noted that wider sales are down, two of its key subsidiaries Wickes and Toolstation, performed really well during the quarter. The latter, for example, saw growth of just over 25% in comparison to the prior year.

Travis Perkins Shares Buy or Sell?

Travis Perkins isn’t the most exciting stock investment available in the UK right now. If anything, you might have missed the boat. This is because you could have purchased Travis Perkins shares for just 575p in March.

Considering the stocks are now moving northwards of 1,300p – they could be somewhat overvalued. In fact, with a P/E ratio of 27 – this doesn’t offer the most attractive investment proposition.

On the flip side, it is important to remember that Travis Perkins shares hit 52-week highs of 1,841p before the pandemic came to fruition. If that represented your medium-term target, that would amount to a required increase of 36%.

The Verdict?

This guide has illustrated that buying Travis Perkins shares online in the UK is easy. All you need is a good broker that offers access to the FTSE 250 at competitive fees.

The platform also waivers the 0.5% stamp duty fee that you would ordinarily be charged on a UK share purchase.

FAQs

Are Travis Perkins shares a good buy?

It remains to be seen for the short-to-medium future holds for Travis Perkins. Not only is the building merchant heavily impacted by the wider lockdown measures, but the uncertainties of Brexit, too.

What stock exchanges are Travis Perkins shares listed on?

Travis Perkins is listed on the London Stock Exchange and forms part of the FTSE 250 index.

What companies does Travis Perkins own?

Travis Perkins own several well-know brands - including but not limited to Keyline, Wickes, Toolstation, and Benchmarx.

Does Travis Perkins dividends?

Historically, Travis Perkins was a consistent dividend payer. However, alongside many other FTSE firms operating in the same industry, Travis Perkins canceled its full-year dividend as per the impact of the pandemic.

How much is Travis Perkins valued at?

At the time of writing, Travis Perkins is valued at just over £3.4 billion.

Who is the Chief Executive of Travis Perkins?

As of August 2019 - the chief executive of Travis Perkins is Nick Roberts.

Can I invest in Travis Perkins via an ISA or SIPP?

Yes, if your chosen stock broker offers ISAs or SIPPs, you can add Travis Perkins shares to the respective portfolio.

Kane Pepi

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Academically, Kane holds a Bachelor’s Degree in Finance, a Master’s Degree in Financial Crime, and he is currently engaged in a Doctorate Degree researching the money laundering threats of the blockchain economy. Kane is also behind peer-reviewed publications - which includes an in-depth study into the relationship between money laundering and UK bookmakers. You will also find Kane’s material at websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2026 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up