How to Buy Stagecoach Shares UK – with 0% Commission

Transit operator Stagecoach Group plc has been hit hard by the coronavirus pandemic. The company saw ridership on its buses and trams drop by more than 80% in the United Kingdom, and nearly entirely during the national lockdown. The same story played out around the world, severely hampering Stagecoach’s ability to create revenue this year.

However, there have been signs of light for Stagecoach. This company received subsidies from the UK government to keep public transport running, which has helped it survive the year without taking on new debt. On top of that, the company reported in October that it has restored over 90% of its bus service and that consumer demand is bouncing back faster than expected.

So, is now the right time to buy Stagecoach shares? We’ll take a closer look at this stock and explain how to buy Stagecoach shares in the UK with no commission.

-

-

Step 1: Find a UK Stock Broker That Offers Stagecoach Shares

Stagecoach is a UK bus operator and former rail franchise operator that is a constituent of the FTSE 100 index on the London Stock Exchange (LSE), so most UK stock brokers offer trading on this company’s shares. That said, there are a couple additional things to consider when choosing the right broker for your needs.

Stagecoach is a UK bus operator and former rail franchise operator that is a constituent of the FTSE 100 index on the London Stock Exchange (LSE), so most UK stock brokers offer trading on this company’s shares. That said, there are a couple additional things to consider when choosing the right broker for your needs.To start, look at the price. We recommend 0% commission stock brokers, since eliminating commissions can save you a lot of money in the long run.

You should also consider the trading tools your broker provides. Technical charts, analyst research, and news feeds are all important for successful trading.

Finally, look closely at factors like regulation and customer support. It’s important to know that your broker will be there when you need help and that the platform is trustworthy.

With that in mind, let’s take a closer look at two of the top UK brokers you can use to buy Stagecoach shares today.

1. Fineco Bank – Commission-free Trading on Thousands of Shares

Fineco Bank isn’t the most well-known broker in the UK, but this Italian bank and CFD broker has been around for more than 20 years. Although it’s a relatively new player in the UK, there’s a lot to like about Fineco. To start, you can trade thousands of shares – including nearly all of the stocks on the FTSE 100 – as CFDs with 0% commission.

Fineco Bank isn’t the most well-known broker in the UK, but this Italian bank and CFD broker has been around for more than 20 years. Although it’s a relatively new player in the UK, there’s a lot to like about Fineco. To start, you can trade thousands of shares – including nearly all of the stocks on the FTSE 100 – as CFDs with 0% commission.Fineco Bank also offers share dealing, although this isn’t commission-free. UK share deals cost £2.95 each, while US share deals cost $3.95 each. In addition, Fineco offers commission-free forex trading, commodity trading, index trading, and bond trading through CFDs.

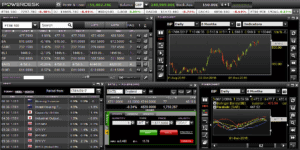

One of the best things about this broker is its trading platform, PowerDesk. The PowerDesk software comes with dozens of built-in technical indicators and a market news feed. Plus, the platform is extremely flexible, allowing you to examine multiple charts simultaneously and take advantage of a second monitor if you have one.

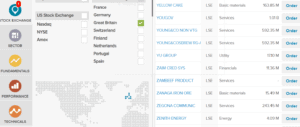

Fineco has some additional research tools, such as a stock screener. The broker also has frequent webinars led by its analyst team, which are good opportunities to find out more about top stocks.

Fineco Bank is regulated by the Bank of Italy and is a publicly traded company, so it should be considered highly trustworthy. The broker offers support from 8 am to 9 pm Monday to Friday by phone, email, and live chat.

Pros

- Trade any company in the FTSE 100

- 0% commission share CFD trades

- PowerDesk trading platform

- Stock screener and research tools

- Regulated by the Bank of Italy

Cons

- Commissions for share dealing

Your capital is at risk.

Step 2: Research Stagecoach Shares

Before you buy Stagecoach shares in the UK, it’s important to know as much as possible about this company. So, let’s examine this company’s history and the outlook for Stagecoach shares in the aftermath of the COVID-19 pandemic.

Stagecoach Share Price History & Market Capitalisation

Stagecoach was formed in Perth, Scotland in 1976 and became a major player in UK transportation in the early 1980s as the national bus system was deregulated. Stagecoach grew throughout the 1980s and 1990s, taking over an increasing share of local bus lines in the UK and moving into the UK rail industry. The company also expanded internationally to the US, Europe, Australia, and New Zealand.

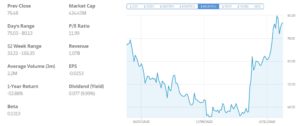

Stagecoach shares began trading on the London Stock Exchange in 1995 at a price of 42 pence apiece. The shares’ fortunes followed the broader fortunes of the UK stock market, peaking in 1998 and 2008 before falling due to the ensuing recessions. From a low of 111 pence in the wake of the 2008 market crash, Stagecoach shares exploded in value to over 400 pence by 2015.

However, Stagecoach shares have been in a decline for the past five years, in part because the company sunk money into rail services that failed to turn a profit. At the start of 2020, Stagecoach shares were trading at just 160 pence. By the middle of the UK lockdown, the share price had tumbled to a low of just 51 pence. The stock continued to slide throughout the summer, ultimately bottoming at 32 pence in November.

Stagecoach shares bounced on news of promising COVID-19 vaccines from Pfizer and Moderna. The company’s shares are currently trading at 78 pence, a more than 100% gain in the span of just a few weeks.

At the current share price, Stagecoach has a market cap of £435 million. The company reported earnings per share (EPS) of 22.1 pence in 2019, although the 2020 EPS is expected to be much lower and analysts are expecting an EPS of 7.8 pence next year.

Based on 2019 earnings, Stagecoach’s price-to-earnings (P/E) ratio is a very attractive 3.5. If you calculate a forward P/E based on expected 2021 earnings, the P/E ratio is still just 10.

Stagecoach Shares Dividend Information

Stagecoach paid out a dividend yield of 7.7 pence per share in 2018 and 2019, which equated to a yield between 5% and 7%. This company has long been considered a reliable dividend stock in the UK.

However, Stagecoach canceled its dividend for 2020, as did many other companies in the FTSE 100. It’s not clear if or when this dividend will return – it is unlikely to return before 2022 at the earliest.

Should I Buy Stagecoach?

Stagecoach shares have been battered by the coronavirus pandemic, which came at the end of a five-year run of disappointing earnings for the company. While Stagecoach’s performance over the past several years is less than confidence inspiring, there are several reasons to think that Stagecoach is an excellent value investment right now.

Stagecoach Shares are Still Cheap

Although Stagecoach shares have more than doubled in value since the start of November, this company is still trading at an extreme discount. There is every reason to believe that Stagecoach could match its 2019 earnings by 2022, which means that investors today could pick up shares of this company at just 3.5 times future earnings.

Even if you base your analysis off of the 7.8 pence EPS that analysts expect next year, Stagecoach shares are trading with a P/E ratio around 10. That makes it an undervalued stock no matter what way you look at it.

Ultimately, Stagecoach is only a good stock if the company can maintain or grow its earnings over the long term. But based on fundamental valuation alone, Stagecoach looks extremely underpriced right now.

Ridership is Recovering

One important thing that investors largely ignored in October was the good news in Stagecoach’s most recent market report. By that time, the company had restored 93% of its normal coach service and revenue from ridership was back to more than 50% of normal.

While those are terrible numbers in the absence of a pandemic, in the context of COVID-19 they’re quite impressive. Even during the height of the pandemic, Stagecoach has managed to keep its bus lines running and to bring in a reasonable chunk of its normal revenue. Notably, Stagecoach has fared much better than most airlines, which took on new debt and are burning through cash every day.

To be sure, the latest lockdown will hurt ridership in the short-term. But over the long-term, Stagecoach’s rapid recovery points to a more sustained bounce in ridership into 2021 and beyond. That will help Stagecoach improve its earnings situation more quickly so that investors can see a return in the next few years.

Re-focusing on Coach

The other important thing that Stagecoach has going for it is that it finally has a direction again. For several years, the company was mired in investments in rail service that didn’t pan out into a profitable business division. Stagecoach made clear at the end of 2019 that it would no longer be pursuing new rail services.

That’s good news for investors because the company’s bus and coach lines are far more profitable. Stagecoach has done an extremely good job at cutting coach costs and maximising revenue per customer. So, a renewed focus on bus and coach service could produce better profit margins for Stagecoach in 2021 compared to 2019.

Stagecoach Shares Buy or Sell?

Stagecoach isn’t a blockbuster company by any means. The company was hit hard by the COVID-19 pandemic and has experienced years of losses from its core business that have hurt the share price.

That said, we think that the market has largely overreacted to Stagecoach’s problems in the wake of the pandemic. Stagecoach has managed to get through the crisis without taking on new debt and has already seen ridership return to more than 50% of normal.

Despite that, Stagecoach shares are trading at just 10 times the company’s expected 2021 earnings. That’s an attractive value in any situation, and it only helps that a quick vaccination campaign could see Stagecoach perform even better next year. At the current valuation, we think that Stagecoach represents a bargain opportunity that will pay off nicely for patient investors.

The Verdict

Transportation company Stagecoach has faced a difficult year, with the coronavirus shutting down leisure coach travel and limiting ridership on intra-city bus lines. However, the company is poised for a relatively rapid recovery next year and the share price doesn’t yet reflect that potential. That creates a value opportunity for patient investors, who can pick up Stagecoach shares now at a very cheap price and benefit as the company regains its footing in the years ahead.

FAQs

What is Stagecoach’s stock ticker symbol?

Stagecoach trades on the London Stock Exchange under the ticker symbol ‘SGC.’

Who is Stagecoach’s current chief executive?

The current chief executive director of Stagecoach is Martin Griffiths, who has led the company since 2013. Ross Paterson is the company's finance director.

Can I buy Stagecoach shares in an ISA or SIPP?

Yes, you can buy Stagecoach shares in an ISA or SIPP. Most UK brokers offer trading on this company’s shares, but keep in mind that these accounts have rules around deposits and withdrawals.

What bus brands does Stagecoach own?

Stagecoach owns a number of coach and no-frills brands including: Stagecoach Express, Stagecoach Gold, Oxford Tube, Magic Bus, and Megabus.

How much revenue does Stagecoach produce?

Stagecoach generated £1.9 billion in 2019, although the company expects that to fall by more than 50% for 2020.

Michael Graw

Michael Graw is a freelance journalist based in Bellingham, Washington. He covers finance, trading, and technology. His work has been published on numerous high-profile websites that cover the intersection of markets, global news, and emerging tech. In addition to covering financial markets, Michael’s work focuses on science, the environment, and global change. He holds a Ph.D. in Oceanography from Oregon State University and worked with environmental non-profits across the US to bridge the gap between scientific research and coastal communities. Michael’s science journalism has been featured in high-profile online publications such as Salon and Pacific Standardas well as numerous print magazines over the course of his six-year career as a writer. He has also won accolades as a photographer and videographer for his work covering communities on both coasts of the US. Other publications Michael has written for include TechRadar, Tom’s Guide, StockApps, and LearnBonds.View all posts by Michael GrawWARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2026 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up

Although Stagecoach shares have more than doubled in value since the start of November, this company is still trading at an extreme discount. There is every reason to believe that Stagecoach could match its 2019 earnings by 2022, which means that investors today could pick up shares of this company at just 3.5 times future earnings.

Although Stagecoach shares have more than doubled in value since the start of November, this company is still trading at an extreme discount. There is every reason to believe that Stagecoach could match its 2019 earnings by 2022, which means that investors today could pick up shares of this company at just 3.5 times future earnings. One important thing that investors largely ignored in October was the good news in Stagecoach’s most recent market report. By that time, the company had restored 93% of its normal coach service and revenue from ridership was back to more than 50% of normal.

One important thing that investors largely ignored in October was the good news in Stagecoach’s most recent market report. By that time, the company had restored 93% of its normal coach service and revenue from ridership was back to more than 50% of normal.