Spread Betting vs CFD Trading – Which is Best?

Spread betting and CFD trading are very similar, insofar that your primary goal is to speculate on the future value of an asset like stocks, gold, oil, or forex. However, there are some key differences, particularly when it comes to how your earnings are taxed.

In this Spread Betting vs CFD Trading Guide – we explore the key differences between the two so that you can make an informed decision as to which is suitable for your financial goals.

Spread Betting vs CFD Trading Main Differences

If you’re strapped for time and are simply looking for the main Spread Betting vs CFD Trading differences – check out the quickfire bullet points below.

- CFD profits are subjected to capital gains tax. As spread betting is defined as ‘gambling’ – all profits are tax-exempt.

- When accessing a financial spread betting market – the instrument will always come with an expiry date. CFDs don’t, so you may hold on to your position for as long as you wish.

- Spread betting profits and losses are calculated on a ‘stake-per-point’ basis. CFD profits and losses are based on the difference between the price you enter and exit the underlying market at.

Spread Betting vs CFD Trading Comparison

For a more comprehensive Spread Betting vs CFD Trading comparison – check out the table below.

| Spread Betting | CFD Trading |

| All profits are exempt from capital gains tax (CGT). |

Your CFD trading gains are taxed the same as any other investment gains

|

| You have the option to apply leverage within the remit of FCA regulations. |

You have the option to apply leverage within the remit of FCA regulations.

|

| You may go long or short on your chosen market |

You may go long or short on your chosen market

|

| Stakes are based on a monetary value per point – e.g. £1 per point price movement |

Stakes are a flat – e.g. £100 buy order

|

| No stamp duty applicable | No stamp duty applicable |

| Prices track the underlying asset like-for-like |

Prices track the underlying asset like-for-like

|

| Commissions are usually built into the spread |

Commissions are usually built into the spread

|

Once again, we’ll explain the core benefits and drawbacks of both spread betting and CFD trading in the sections below.

CFD vs Spread Betting – How They Work

Let’s be clear – both spread betting and CFDs (Contracts for Difference) are suited for those that wish to trade on a short-term basis. You won’t own the underlying asset and thus – neither trading instrument should be viewed as a long-term investment.

Instead, you’ll be looking to enter and exit the market over the course of a few days, hours, or even minutes.

Let’s unravel the key fundamentals of CFD vs Spread Betting in greater detail:

Ownership and Pricing

To reiterate – when you trade at a spread betting or CFD platform – you are not purchasing or investing in the asset. Instead, you are simply looking to speculate whether the price of the asset will rise or fall. The CFD instrument, therefore, will track the real-time market price of the financial asset.

For example:

- Let’s say that Brent Crude Oil is priced at $54.50 per barrel

- At your chosen spread betting or CFD trading platform – oil is also priced at $54.50 per barrel

- Three hours later, the Brent Crude Oil benchmark is quoting $56.20 per barrel in the open market

- Naturally, your spread betting or CFD trading platform is also quoting $56.20 per barrel

As you can see, if the real market price of the asset increases, as will your spread betting or CFD instrument. Crucially, this allows you to gain access to your chosen market without needing to take ownership. In particular, both trading instruments are valuable for speculating on difficult-to-reach assets – such as oil, gold, silver, indices, or agricultural products.

Stakes, Profits, and Losses

Perhaps one of the main differences that our Spread Betting vs CFD Trading Guide found, is the way in which profits and losses are calculated. This is an important element to understand – as you will be risking your hard-earned money.

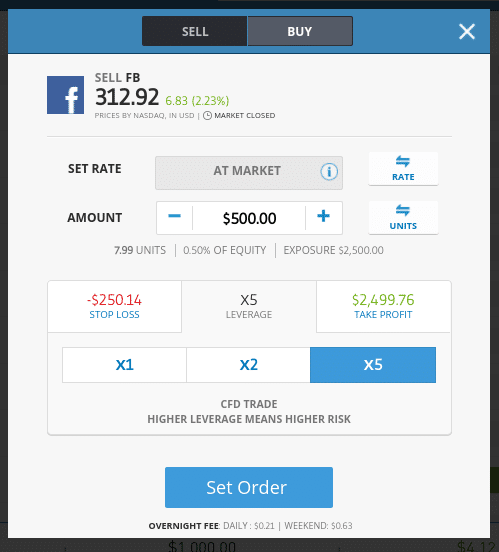

CFD Trading

CFD profits and losses are a lot easier to quantify if you’re just getting started in the world of online trading. This is because you simply need to enter a stake when placing your required order. Then, your profits and losses will be determined by the percentage figure that you were right or wrong by – multiplied against your stake.

For example:

- Let’s say that you stake £500 on a gold CFD

- When you place your CFD trade – gold is priced at $1,500 per ounce

- A few days later – gold is now priced at $1,650

- This represents an increase of 10%

- You staked £500 – so on gains of 10% you make a total profit of £50

Take note – and as we discuss in more detail shortly, keeping a CFD trading or spread betting position open overnight will result in additional fees.

Spread Betting

When it comes to calculating stakes, profits and losses in the spread betting arena – things are slightly more complex. This is because unlike CFD trading – you won’t specify an ‘all-in’ stake. Instead, you need to specify how much you wish to stake ‘per point’.

Before we get to that – it’s crucial that we explain how the point system works when using a spread betting platform.

- When an asset moves up and down in value, spread betting brokers illustrate this movement in points

- The specific unit of points will depend on the market in question

- For simplicity, let’s say that you are trading Tesla stocks – which are priced at $700 each

- On this market, we will say that 1 point equates to 1 cent

- So, if Tesla stocks go from $700 to $700.50 – that’s 50 cents or 50 points

- Similarly, if Tesla stocks then move down to $700.20 – that’s 30 points

It’s always important to check the unit of each point movement for the market you are trading. Nevertheless, when you set up a spread betting trade, you’ll need to enter the amount you wish to risk for each point movement.

To clear the mist, let’s expand on the example above:

- You are confident that Tesla stocks are overvalued and thus – you place a sell order with your chosen spread betting platform

- You want to risk £1 per point in this trade

- To recap – 1 point equates to 1 cent

- You place a sell order at $700 per Tesla stock

- A few hours later, Tesla stocks are being quoted at $698

- This means that the stocks have dropped in value by 200 points

- You staked £1 per point – so your profit amounts to £200

In the above example, you can cash out your gains by placing a buy order. If, however, you entered the trade with a buy order, you would need to cash out with a sell order.

Long or Short Positions

When you purchase shares at a traditional online stock broker, you do so because you think the asset will rise in value. This is no different from purchasing cryptocurrencies, ETFs, mutual funds, gold, and any other asset for that matter. However, for short-term traders – this doesn’t offer enough flexibility.

75.3% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

Leverage

An additional benefit that our Spread Betting vs CFD Trading Guide identified is that both mediums allow you to apply leverage. This means that you have the option to boost the value of your trade. In the UK, leveraged products are now governed by the FCA – which mirrors the previous guidelines provided by the European Securities and Markets Authority (ESMA).

For those unaware – leverage limits that both spread betting and CFD trading platforms must implement are as follows:

- Major forex pairs – 1:30

- Minor forex pairs, gold, and major indices – 1:20

- Non-gold commodities and minor indices – 1:10

- Stocks – 1:5

You might notice that cryptocurrencies are missing from the above list. Previously, you could trade cryptocurrency via both spread betting and CFD platforms at leverage of 1:2. However, as of January 1st, 2021 – UK retail clients can no longer access cryptocurrency derivative products – which includes both spread betting and CFD instruments.

Nevertheless, if you’ve never applied leverage to an online trade – see the below example.

- You are looking to trade HSBC stocks – which are currently priced at £4.30 per share

- You think the stocks will rise to place a buy order at a stake of £2 per point

- Each point on this market is represented by a movement of 1p

- You are extra confident on this trade – so apply leverage of 1:5

- A few hours later, HSBC stocks have risen to £4.50 – so that’s an increase of 20 points

- On a stake of £2 per point – you are looking at gains of £40

- However, you applied leverage of 1:5 – so your £40 profit is amplified to £200

When applying leverage to a CFD trade, the fundamentals are exactly the same as the example above. That is to say, your profits and losses are multiplied by the amount of leverage you apply – which in this case, was a factor of 5x.

Spread Betting vs CFD – Tax

Before you enter the online trading scene it is crucial that you have a firm understanding of what tax laws you might be subjected to. Of course, you are advised to seek guidance from a qualified tax professional. But, if you’re looking for a brief overview of how Spread Betting vs CFD trading works in terms of taxation – check out the sections below.

Spread Betting is Tax-Free

Without a doubt, the overarching benefit of choosing spread betting over CFD trading is that all profits are tax-free. As we briefly mentioned earlier, this is because spread betting falls within the remit of gambling. As you might know, all gambling winnings in the UK have been exempt from tax since 2010. This means that all gains made from your spread betting endeavors are yours to keep.

CFD Trading is Liable for Capital Gains Tax

Unfortunately, CFD traders do not benefit from the same tax features as spread bettors. Put simply, any gains that you may make from your CFD trading endeavors are liable for capital gains tax. This works exactly the same as when you invest in traditional assets like stocks or ETFs.

That is to say, the tax is calculated on the profit you make from the trade and not the amount you invest.

For example:

- Let’s say you make 10% gains on a £500 CFD trade

- The capital gains amount to £50

- At the end of the tax year, you would need to calculate your total profit (or loss)

- If you ended the year in profit, this will be liable for capital gains tax

It is important to note that all UK residents are given a tax-free allowance each year when it comes to capital gains. In the 2020/21 tax year, this amounts to £12,300.

In other words, as long as you do not make capital gains of more than £12,300 in the respective tax year – you won’t owe anything to HMRC (across all investments and assets). Once again, speak with a qualified accountant when attempting to assess your tax liabilities.

No Stamp Duty

Irrespective of whether you opt for spread betting or CFD trading – you will not be liable for stamp duty tax. Ordinarilly, UK investors are required to pay stamp duty of 0.5% when purchasing securities that are listed on the London Stock Exchange. However, when trading CFDs or spread betting instruments – you don’t own the underlying asset. As such, stamp duty tax is not applicable.

Spread Betting vs CFD – Fees

This part of our Spread Betting vs CFD Trading Guide is of the utmost importance – as fees and commissions can be a bit more complex than traditional investing.

To ensure you have a firm grasp of what fees you will be required to pay – check out the sections below.

Commissions

We should note that the vast majority of CFD trading and spread betting platforms allow you to trade on a commission-free basis. The respective platform will instead make money from the ‘spread’ – which we cover next.

However, commission-free trading is offered by all online platforms. For example, UK-based platform IG – which offers both spread betting and CFD trading, charges a variable commission on stock derivatives.

The fee will vary, but when trading UK-listed stock derivatives, the fee amounts to 0.10%. Although this sounds minute, IG has installed a £10 minimum commission. This makes the platform highly unviable for those looking to stake small amounts.

Spreads

Of course – commission-free trading platforms are in the business of making money. As such, they typically achieve this goal via the spread.

Not to be confusing with ‘spread betting, the spread is the difference between the buy (bid) and sell (ask) price of an asset. This gap in pricing is calculated in percentage terms. With that said, CFD trading platforms often display the spread in ‘pips’ while at spread betting brokers it’s shown in ‘points’.

Either way, assessing the spread in percentage terms is much easier – as per the below example.

- Let’s suppose that you are trading Royal Mail stocks

- Your spread betting/ CFD trading platform is quoting a ‘buy’ price of £4.52

- The platform is quoting a ‘sell’ price of £4.50

- In percentage terms, this amounts to a spread of 0.44%

In simple terms, this means that – irrespective of whether you go long or short on Royal Mail stocks, you will enter the trade at a loss of 0.44%. Put another way – you need to see your position make gains of 0.44% to break even on the trade. Anything above 0.44% will amount to actual profit.

Overnight Funding

This particular fee is arguably the most important to be aware of – as it relates to a charge that kicks in for each day you keep your position open. This is the case across both CFD trading and spread betting.

In a nutshell, overnight funding is a small interest fee that you pay when your position is kept open past a certain time. The specific time will depend on which platform you have signed up with.

- For example, your chosen broker might have a cut-off point of 11 pm.

- This means that any positions that haven’t been closed after 11 pm will attract an overnight funding fee.

- This will be the case for each subsequent day that the position remains open past 11 pm.

The key problem is that the underlying overnight funding fee calculation is super complex. There are many variables that this is based on – such as current BOE interest rates, the asset or market you are trading, whether or not you apply leverage, and whether you are long or short.

Spread Betting vs CFD – Expiry Dates

When attempting to understand the difference between spread betting and CFD trading – you also need to have a firm grasp of asset expiry dates.

First and foremost, when trading CFDs, there is no expiry date attached to the instrument you are trading. In theory, this means that you can hold on to your position for as long as you wish – whether that’s in terms of hours, days, weeks, or months. However – as we explained in the section above – each subsequent day your position is kept open, an overnight funding fee will kick in.

- In the case of spread betting, markets will always come with an expiry date.

- The timeframe will clearly be displayed by your chosen spread betting broker, albeit, this might be on a daily, weekly, or quarterly basis.

- If you’re a day trader – then the fact that spread betting instruments expire will be irrelevant to your trading strategy.

- However, if you are more of a swing trader that likes the flexibility of keeping positions open for slightly longer – do bear this in mind.

For those unaware, if you are holding a spread betting position that does expire – this simply means that the trade will be closed by your chosen broker. If you wish to stay in the market – you would need to open a new trade.

Spread Betting vs CFD – Regulation

On the one hand, spread betting profits are classified as gambling winnings. However, the wider spread betting industry is not regulated by the UK Gambling Commission. On the contrary – and much like CFD trading, spread betting is regulated by the Financial Conduct Authority (FCA).

This means that your chosen CFD or spread betting platform must follow a wide range of regulatory demands – such as:

- Limiting retail investors to leverage caps (see above for a breakdown of asset-by-asset limits)

- All spread betting and CFD brokers must verify your identity when you first open a trading account

- Platforms must be transparent on fees and commissions

- Your capital must be ringfenced in segregated bank accounts

Although not a rule of thumb – the vast majority of UK-based CFD trading and spread betting platforms will also be covered by the Financial Services Compensation Scheme (FSCS). This means that if a worst-case scenario occurred – whereby the broker went bankrupt – your funds would be protected up to the first £85,000.

Popular Spread Betting Platforms

If you’ve read our Spread Betting vs CFD Trading Guide up to this point and you know which financial instrument is most suited for your objectives – you will need to choose a trusted broker.

Irrespective of which option you prefer – you need to look at a variety of metrics before joining a trading platform. This includes supported markets, fees, spreads, commissions, leverage, payments, customer support, and regulation.

In the sections below, we review two popular spread betting platforms available to use in the UK.

1. Pepperstone

As you likely know, both of these platforms come packed with advanced order types, technical indicators, and chart drawing tools. Pepperstone also allows users to perform in-depth analytical research.

If, however, you are classed as a professional trader – you’ll be offered leverage of up to 1:500. When it comes to tradable markets, Pepperstone offers a vast range of spread betting assets. This is inclusive of stocks, forex, commodities, and indices. In terms of fees, everything is built into the spread – meaning that there are no commissions to pay.

An additional use case of using Pepperstone is that the platform is a ‘no dealer execution’ broker. In simple terms, this means that there is no conflict of interest between Pepperstone and its clients – as the broker does not trade against open positions. Finally, Pepperstone is authorized and regulated by the FCA – so your capital is safe.

| Broker | Commission | Inactivity Fee | Deposit Fee | Withdrawal Fees |

| Pepperstone | £0.02 per 0.01 lot or 0.0035% | None | FREE | $5 (about £4) |

75.3% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

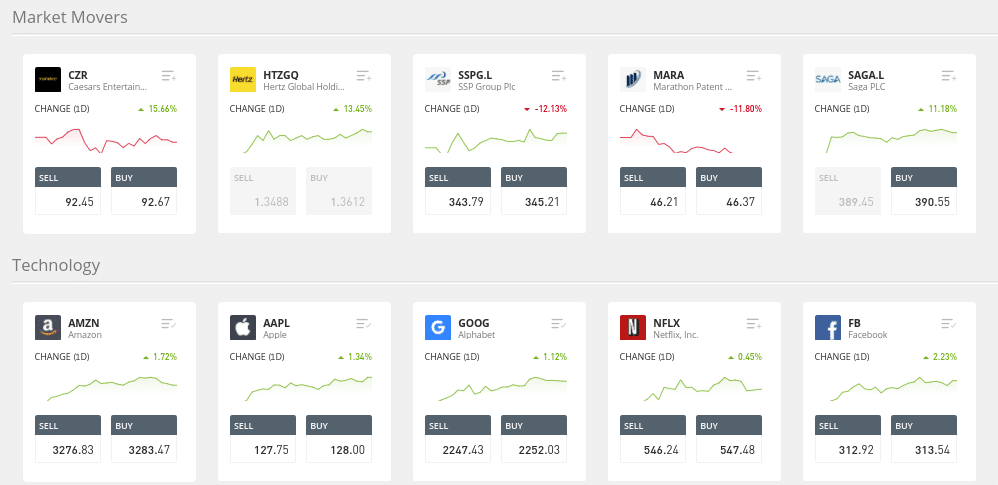

Popular CFD Trading Platforms

So now that we have reviewed some popular spread betting brokers in the UK – we are now going to discuss which CFD trading platforms available in the UK.

1. Libertex

Earlier in this guide on Spread Betting vs CFD Trading – we noted that all platforms in this space charge a spread. However, the one exception to this rule is Libertex – which is a ZERO spread broker. This means that all its supported markets come with the same bid and ask price – so it’s only a small commission that you need to factor in.

On many markets, Libertex actually waivers commissions. If a commission is charged, this is typically well below 0.1%. Libertex is also a valuable CFD trading platform if you are planning to use MT4, where you can download MT4 for Mac or MT5. Both third-party platforms are supported via an online web-trader, desktop software, or a mobile app.

You won’t be short of CFD trading markets when using Libertex – with the platform offering heaps of stocks, energies, ETFs, hard metals, currencies, and more. All markets are inclusive of leverage and a choice between a buy and sell order. The minimum deposit at Libertex is a reasonable £100. With that said, all subsequent deposits are reduced to a minimum of just £10. You can use a debit/credit card, e-wallet, or UK bank account to get trading funds into Libertex.

Libertex offers a wide variety of guides and user-friendly explainers that aim to make you a better all-round trader. If you haven’t heard of Libertex and are wondering whether or not the CFD trading platform is safe – you shouldn’t be. The provider has been operational in the online trading scene since the late 1990s and is fully authorized to serve UK traders.

| Broker | Commission | Inactivity Fee | Deposit Fee | Withdrawal Fees |

| Libertex | zero spread | 10 Euros | FREE | Differs per payment method |

86% of retail investor accounts lose money when trading CFDs with this provider.

Conclusion

This comprehensive guide has explained the key difference between spread betting and CFD trading. We have also shown users with the possible exchanges that allow you to trade in CFD and spread betting platforms.