How to Buy Severn Trent Shares UK – With 0% Commission

Severn Trent has been one of the few companies in the UK to be largely unaffected by the coronavirus pandemic. In March, the company declared that it had seen ‘no material change’ from the sudden cessation of normal business activity and the implementation of lockdowns in the UK.

Now, as we emerge from the coronavirus pandemic, Severn Trent is looking increasingly attractive as a conservative investment. Severn Trent shares may not offer the same excitement as shares of companies in, say, the travel industry. But the company offers stability in the market at a time when it’s sorely needed.

Interested in investing in Severn Trent? We’ll show you how to buy Severn Trent shares in the UK with no commission and take a closer look at why we think this company is a buy right now.

Step 1: Find a UK Stock Broker That Offers Severn Trent Shares

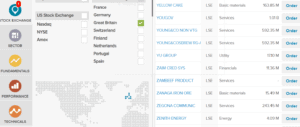

Since you have your pick of brokers, it’s important to look at other factors that should influence your decision as to what platform to choose. We recommend looking for a low-cost broker that offers 0% trade commissions and minimal account fees. On top of that, keep an eye out for robust trading tools that can help you manage risk, find profitable trading opportunities, and stay one step ahead of the market.

With that in mind, let’s take a closer look at two of the best brokers you can use to buy Severn Trent shares today:

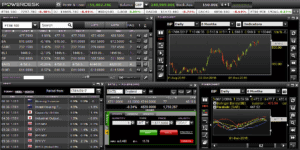

1. Fineco Bank – Commission-free CFD Trading for Thousands of Shares

To start, Fineco Bank offers a truly enormous selection of shares to choose from. You can buy Severn Trent shares, shares of virtually any other company in the FTSE 100, or shares from across Europe and the US. All share CFD trades are commission-free and carry no additional spreads. If you want to buy shares outright, you’ll pay £2.95 per UK share deal and $3.95 per US share deal.

The broker offers a mobile stock trading app, which is handy for staying on top of the markets on the go. It’s not quite as powerful as PowerDesk, but you can monitor your watchlists and analyse basic charts on any iOS or Android device. Fineco Bank also has tools like a global stock screener and access to analyst research to help you trade more profitably.

Fineco Bank is regulated by the Bank of Italy and is a publicly traded company on the Milan Stock Exchange. In addition, all UK accounts are protected under the Financial Services Compensation Scheme for up to £85,000. The broker offers customer support 5 days a week, although it’s not available 24 hours a day.

Pros

Cons

Your capital is at risk.

Step 2: Research Severn Trent Shares

Severn Trent is one of the biggest companies in the UK. However, size alone isn’t a reason you should invest in this company right now. Before you buy shares, it’s important to know what the future is likely to hold for this company.

So, let’s dive into Severn Trent’s history and take a look at whether this company is a buy right now.

Severn Trent Share Price History & Market Capitalisation

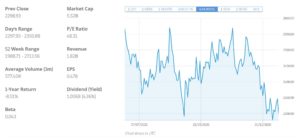

Severn Trent’s share price has grown relatively steadily since that time, with pullbacks largely confined to periods of recession in the overall UK stock market. From 1995 to 2008, the company’s share price grew from £6.15 to over £14. The share price then grew to £24.75 by 2017 on news that Severn Trent would be allowed to enter the newly deregulated business water market.

Severn Trent’s share price dipped during 2018 and 2019 as the idea of re-nationalising household water distribution took hold in the Labour Party. The Conservative victory in the 2019 election put an end to that idea, sending Severn Trent shares to an all-time high of £27.16 at the start of 2020.

The company’s shares dropped sharply with the rest of the FTSE 100 in March when the COVID-19 pandemic hit. However, Severn Trent released a statement at the end of March noting that it expected ‘no material change’ to its business as a result of the pandemic. Shares quickly recovered from a low of under £20 in March to around £25 by May.

For much of the year since then, Severn Trent shares have bounced around the £25 level. The company reported first-half results at the end of September and noted that profits dropped by 21%, in line with analyst expectations. Severn Trent shares have dropped slightly on the news and are now trading around £23 apiece.

Still, Severn Trent has a massive market cap of £5.52 billion. The company reported an earnings per share (EPS) of 66.70 pence for the year ending in March 2020 and has an anticipated forward price-to-earnings (P/E) ratio of 20.6.

Severn Trent Shares Dividend Information

Severn Trent has long been considered one of the best dividend stocks in the UK. The company has grown its dividend year after year and did not change its dividend payout in response to the coronavirus. Currently, the dividend yield sits at 4.2%.

One thing to note, however, is that in the past Severn Trent had targeted dividend growth of 4% over inflation in the past. Going forward, the company has changed its dividend policy to keep up with inflation only. That change is a response to financial pressure from new regulations.

Still, a 4.2% dividend that grows with inflation is very attractive for income investing.

Should I Buy Severn Trent?

Looking ahead, Severn Trent does face headwinds from those new regulations. Ofwat has limited the financial gains that water companies like Severn Trent can make until at least 2025, while simultaneously lifting the performance targets that the company has to meet to remain in good standing. That may squeeze Severn Trent’s profitability for a few years.

However, the key thing is that almost no analyst sees this impacting Severn Trent’s dividend more than it already has. Absent a more substantial change in water regulation in the UK (the threat of nationalisation appears to be largely past), investors should expect a steady 4.2% dividend from this company that rises in line with inflation.

The only other thing to bear in mind about Severn Trent is that it isn’t an undervalued stock. The company has a forward P/E of 20.6, which is on the pricey side for a business with very little growth potential.

Severn Trent is a reliable dividend investment. For investors looking for a low risk, long term investment, it’s one of the best stocks in the UK. For investors who are looking for high risk high reward investments, Severn Trent is probably an unexciting prospect.

Severn Trent Shares: Buy or Sell?

Severn Trent has been one of the few companies in the UK to escape the effects of the coronavirus pandemic. The water utility’s business has continued apace, and the share price is only down slightly from where it stood at the start of the year.

Going forward, analysts don’t expect much about Severn Trent’s business to change. Profitability may take a slight hit thanks to new regulations from Ofwat, but that shouldn’t impact the company’s attractive 4.2% dividend yield.

Overall, we think Severn Trent is a conservative and comparatively low risk investment in today’s volatile market environment. If you’re more interested in stability and consistent income than explosive growth in the post-pandemic world, Severn Trent shares are an excellent choice. Buying Severn Trent shares is also a good way to diversify your portfolio if you’re heavily invested in higher risk growth stocks.

The Verdict

UK water utility Severn Trent has been one of the most stable companies in the FTSE 100 this year. The company’s business has been virtually unaffected by the coronavirus pandemic, which is something that few other UK corporations can claim. While Severn Trent faces regulatory headwinds in years to come, this company remains an excellent dividend stock and a strong choice for long term investors.

FAQs

What is Severn Trent’s stock ticker symbol?

Severn Trent trades on the London Stock Exchange under the ticker symbol ‘SVT.’

Who is Severn Trent’s current chief executive?

The current CEO of Severn Trent is Olivia Ruth Garfield. She has been at the company’s helm since 2014.

Can I buy Severn Trent shares in an ISA or SIPP?

Yes, most ISAs and SIPPs allow you to purchase shares of Severn Trent. Keep in mind that ISAs and SIPPs have restrictions on how much you can deposit each year.

Can I buy Severn Trent through an ETF or investment trust?

Since Severn Trent is one of the largest companies in the UK and a member of the FTSE 100, shares of this company are included in almost every major UK-focused ETF and investment trust.

Is Severn Trent considered a low-risk investment?

Buying shares of a compan always carries some risk. However, if you’re looking specifically at UK companies, Severn Trent is one of the safest. It’s not only a utility, which has relatively fixed demand over time, but also is one of the largest companies in the UK.

What is Severn Trent’s dividend yield?

Severn Trent currently pays out a dividend yield of 4.2%.