How to Buy Santander Shares UK

If you are based in the UK and looking to buy shares of Banco Santander SA, more commonly known as just Santander, there are lots of regulated online stockbrokers that allow you to do this with ease. That is largely because this massive bank has several listings on top stock exchanges worldwide and ranks as the 17th largest bank in the world in terms of total assets.

In this guide, we’ll show how to buy Santander shares in the UK. We also discuss the best share dealing platforms to do that and analyze the Santander share price performance and fundamentals of the company.

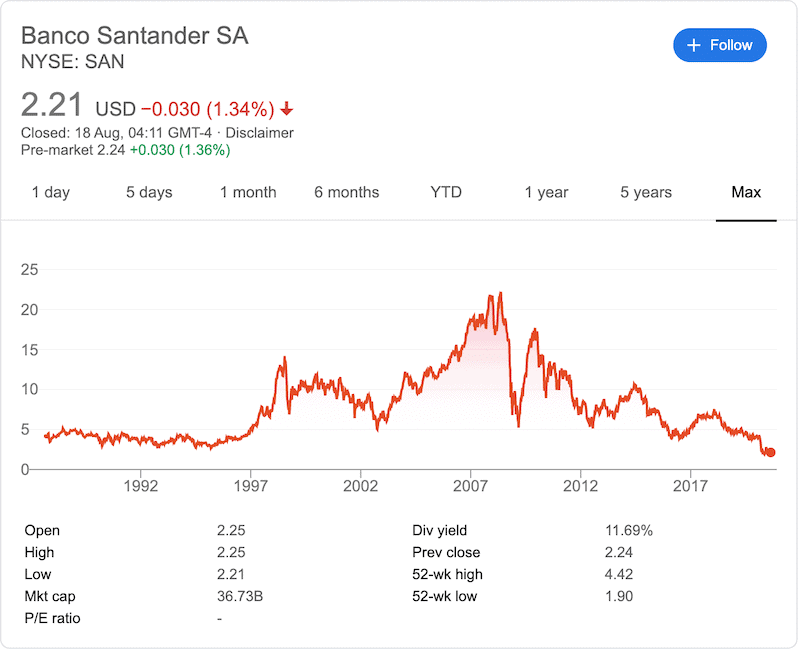

However, you need to ensure that your broker is regulated by the FCA and that you will get the lowest trading commissions and the best trading tools. To help you get started, below we recommend the best FCA brokers that allow to buy Santander shares in the UK. Plus500 does not charge any trading fees. Instead, it takes its payment through the spread of the buy and sell price. On top of that, deposits and withdrawals are free too, however, you may have to pay an inactivity fee of $10 per quarter after 3 months of inactivity. Plus500 offers its own proprietary user-friendly trading platform that can be accessed via a web browser or the Plus500 stock trading app. You can also get notifications on your phone or to your inbox on a particular asset if the price drops or rise. In terms of safety and regulation, Plus500 is not only regulated in the United Kingdom by the Financial Conduct Authority (FCA) but it is also a publicly listed company on the London Stock Exchange. To start, you can deposit a minimum of £100 with a UK debit/credit card, bank account, or e-wallet. Pros: Cons: 72% of retail investor accounts lose money when trading CFDs with this provider. Whether you’re investing in Santander or other banks like Lloyds, HSBC or Metro Bank, it’s always important to analyse the company’s current situation and future outlook. In this section, we analyze the Santander share price history and the reasons why you should or shouldn’t invest in stocks of Santander. Bear in mind that we will focus on Santander shares on the New York Stock Exchange as it is the benchmark and most liquid share listing of this bank. Banco Santander was established 163 years ago in 1857 as Banco de Santander. The combined bank, BSCH, was formed in 1999 following a merger of Banco Santander SA (founded 1857) and Banco Central Hispano. It has a strong presence in Europe and Latin America and in the early 21st century, the group has extended operations across North America and Asia. Nowadays, Santander is one of the Eurozone’s leading banks and is among the top 20 financial institutions worldwide in terms of market capitalization and revenues. With more than $1.4 trillion worth of assets under management, Santander is also one of the largest firms globally. In terms of its share price history, Santander reached its all-time high of $21.77 back in May 2008. Shares dropped as the 2008 global financial crisis hit markets across the world and since then, the share trades in a downward trending channel. Since the beginning of 2020, the Santander share price declined by -48.64%, largely due to the COVID-19 pandemic. With that said, the Santander share is trading at historically low levels and valuation metrics show that its share may be undervalued. The banks’ earnings over the next few years are expected to grow by 47%, indicating the strength of the company and the positive future prospects. Further, Santander has a Price/Earnings (PE) ratio of 4.16, which compares favorably to the S&P500 average of 15.81 as well as the banking sector of around 9.49. This indicates that the share may be underpriced, particularly in the short term. Santander has been an attractive dividend share for investors as they are entitled to an annual dividend. The bank offers a high dividend yield and a long history of paying dividends so investors are typically drawn to this company. The current dividend yield for Banco Santander S.A is 3.69% which is above the banking industry average yield of 2.66%. There was, however, an announcement by the bank to cancel the interim dividend charged against 2020 and suspend 2020 dividends until the impact of the COVID-19 crisis becomes more clear. The bank’s management announced that it will review whether to resume dividend payments in October. Nevertheless, it is crucial to do your research before making an investment. As such, below we list some of the reasons why you might want to consider adding Santander to your portfolio. At the time of writing, Santander shares in the US are worth $2.21. This represents a year to date decrease of 48.64% and the lowest territory since the 80s of the previous century. With that in mind, the bank is in a relatively strong financial position. The financial stability and growth prospects of Santander demonstrate its potential to recover from its historically low levels of the share price. The fundamentals show that Santander is currently a solid choice for value investors. Its Price per Earnings (P/E) ratio is extremely low at just 4.59 and the company’s current price to book ratio, which is a metric to compare a firm’s market capitalization to its book value, is 0.37 as of August 17, 2020. Generally, a low P/B ratio could mean the share is undervalued. Unlike other companies that have been hit by various factors, Santander has not encountered any severe problems and is still one of Europe’s largest banks and . Sure, it was a massive shock when the bank announced a second-quarter loss of 12.25 billion, its first quarterly loss since 2005, however, as shares are down more than 85% over the last ten years, it seems like there’s huge upside potential at current pricing levels. At CNN Business, 24 analysts offering 1-Year price forecasts for Santander have a median target of $2.84, with a high price target of $3.80 and a low price target of $2.00. Though Banco Santander might be a good investment for those who are looking for solid income in the form of dividends payment investors, there are plenty of other factors to consider before investing in this company. One of the main factors to consider is how the banking sector will be influenced by the global economic downturn caused by the COVID-19 crisis. Investors should also expect a confusing earning report from Santander in Q3, but one that may be critical for Santander’s share price. In the current condition, it’s hard to see the share price falling strongly as Santander is quite a defensive stock and may have reached its bottom. A free fall of almost 85% in the last ten years sent the price down to an all-time low that values shares at substantially low cost. While the majority of investors will prefer to steer clear, those with a high tolerance for risk might find a great investment opportunity. Ultimately, Santander shares are worth just a fraction of what they were before the coronavirus pandemic emerged. As such, you can still purchase the shares at a favorable price and take advantage of the company’s positive future outlook. In summary, there’s one question to answer – whether Santander is trading at its actual value, or is it currently undervalued? The fundamentals may indicate that it is likely to be trading at a discount even when considering the current turmoil in the markets. While large scale banks must adapt quickly to function during and after the Covid-19, we have learned in the 2008 economic crisis that measures will be taken to protect banks and large financial institutions. These Banks like Santander are critical to global recovery from the COVID-19 financial crisis. On top of that, it’s hard to imagine a scenario that Spain or the EU would allow it to actually fail.

Santander is listed on on the stock exchanges of Spain, New York, London, Lisbon, Mexico, Sao Paulo, Buenos Aires, and Milan.

Yes, Santander normally pays an annual dividend for its shareholders. However, the Spanish bank has recently announced that it is scrapping its final dividend for 2019 due to uncertainty caused by the Covid-19 pandemic.

Yes, you can. If you own a Santander CFD contract you will receive a dividend if you own it the day before the ex-dividend date.

Yes, Santander is a component of the Euro Stoxx 50 stock market index, the Ibex 35 Index, Euro Stoxx Banks index, Bloomberg Europe 500 Banks, and Bloomberg World Banks WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site. Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy. Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. BuyShares.co.uk © 2026 All Rights Reserved. UK Company No. 11705811.

Step 1: Find a UK Stock Broker That Offers Banco Santander Shares

1. Plus – Trade Santander CFDs with Tight Spreads

Step 2: Research Santander Shares

How Much Are Santander Shares Worth? Santander Share Price History

Santander Shares Dividend Information

Should I Buy Santander Shares?

Banco Santander Shares May Be Undervalued

Huge Upside Potential

Should I Sell my Santander Shares?

The Verdict

FAQs

What stock exchange is Santander listed on?

Does Santander pay dividends?

Can I collect Santander dividends when trading CFDs?

Is Santander a component of stock indices?

Tom Chen