10 Popular Robo Advisors Among UK Investors

Robo advisors are the latest craze in the online investment space. Put simply, the phenomenon – which is backed by artificial intelligence, allows you to invest in a somewhat passive manner.

On top of discussing popular robo advisors available to UK investors, we’ll also explain how the process works and what you need to do to get started today.

Key takeaways on robo advisors in UK

- Robo advisors allow you to invest money in stocks, ETFs, mutual funds and bonds in a passive way.

- You can choose different investment plans based on your risk appetite

- There are both micro investing robo advisors for investing small amounts in fractional shares, as well as robo advisors that you can invest thousands of pounds in

List of Robo Advisor in UK

Here’s the list of popular robo advisor UK platforms that we think rule the roost in this particular investment space.

- Nutmeg

- MoneyFarm

- Wealthify

- Moneybox

- Scalable Capital

- eVestor

- Wealthsimple

- Vanguard Digital Advisor

- Morgan Stanley

Cryptocurrency is now one of the most popular financial assets and offers the potential for huge growth and big returns in a quicker time than traditional stocks. Investing in crypto to diversify is also an effective way to hedge a portfolio over the long term. However, the volatility of crypto means there are some risks, so make sure you do your research before investing.

- Read more and start investing in crypto now.

UK Robo Advisors Reviewed

Finding a robo advisor UK for your financial goals is not an easy task. This is because you need to look at two key metrics. Firstly, you need to look at the robo-advice trading platform itself. For example, how much does the provider charge to buy and sell assets, and what instruments can you invest in?

Secondly – and perhaps most importantly, you then need to spend some time exploring the robo advisor technology itself. After all, the robo advisor will be investing on your behalf, so you need to feel confident that it isn’t going to blow your entire account balance in a single week of trading.

To save you countless hours of research, below we review UK robo advisors currently in the market.

1. Nutmeg

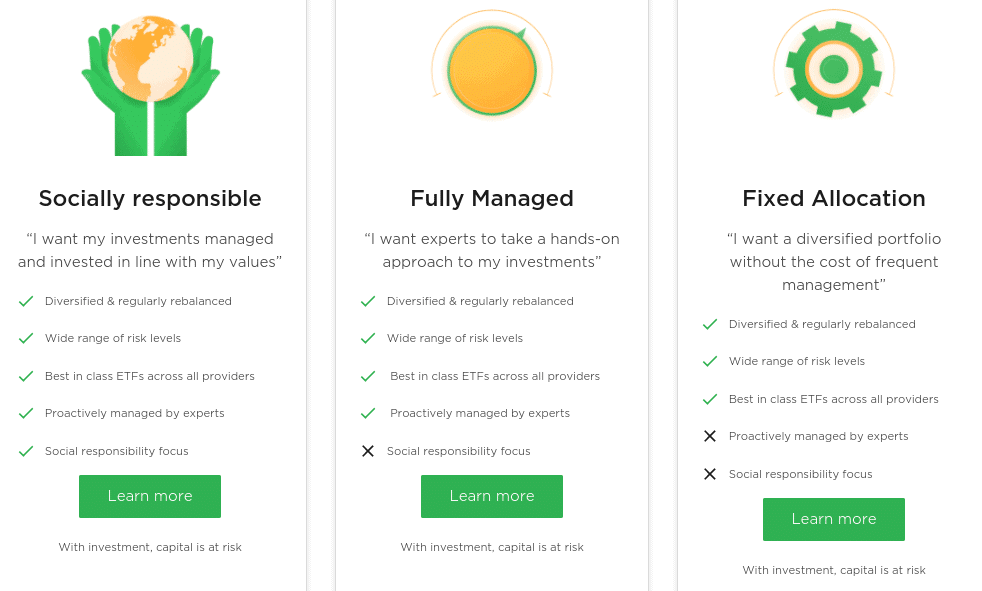

A simple example would be an ETF that tracks the FTSE 100 – meaning that your portfolio will contain all 100 shares that make up the index. Nevertheless, there are two main plans that you can choose from – ‘Fully Managed’ or ‘Fixed Allocation’. Both plans will initially require you to answer some a brief questionnaire about your investment goals and risk appetite. This is standard practice in the UK robo advisor space, as the algorithmic methodology needs to get a feel for what type of investor you are. Starting with the fully managed account, this will cost you 0.75% per year in maintenance fees.

If, however, you invest over £100,000 – this drops to 0.35%. The main attraction of this investment account type is that you will have the backing of the Nutmeg in-house investment team. That is to say, they will keep an eye on your portfolio and make suitable changes as and when they feel the time is right. In the case of the fixed allocation portfolio, this relies exclusively on the robo-advice technology – meaning that there is no human intervention.

In turn, this means that the costs are much lower. For balances under £100,000 this amounts to 0.45% annually, and 0.25% for anything above. In terms of performance, this depends on the account type and your risk tolerance profile. But, to give you an idea – Nutmeg notes that on its fully managed account, a risk rating of 5/10 has returned 43.7% over the past 7 years. The lower-cost fixed allocation plan – with a risk rating of 3/5, returned 13.3% over the past 5 years.

As such, When it comes to account minimums, you will need to start off with a deposit of at least £500. However, if the deposit is less than £5,000 – then you will need to commit to a £100 monthly direct debit. As such, this UK robo advisor could be suited for those looking to engage in a serious, long-term investment plan. Outside of robo advisor services, Nutmeg also offers Lifetime, Junior, and Stocks and Shares ISAs. Finally, Nutmeg is licensed by the FCA and partnered with the FSCS.

|

Annual Account Fee |

Average Annual Investment Cost |

Minimum Deposit |

| 0.75% | 0.19% | £500 |

Sponsored ad. Your capital is at risk

2. MoneyFarm

With that said, it has 7 different portfolios on offers – all of which are highly diversified. Each managed portfolio comes with a different risk rating – running from 1 (lowest risk) to 7 (highest risk). Naturally, this will influence the types of ETFs that are added to your portfolio. For example, when investing in portfolio 2, 38% of your basket will consist of cash and short-term government bonds.

17% sits in developed market equities and 12% in investment-grade corporate bonds. The portfolio in question has returned 16.59% – net of fees, since 2016. At the other end of the spectrum, portfolio 7 will give you exposure to much riskier markets. For example, 65.8% of the basket is held in developed market equities. With that said, much of the focus here is on UK and US stocks, so it’s not an overly reckless portfolio.

You’ll also have 11% in developed market government bonds and 8% in high-yield and emerging market bonds. This portfolio option at MoneyFarm has returned a huge 50.12% – net of fees, since 2016. When it comes to fees, this UK robo advisor offers a tiered system. For anything below the £10,000 mark, you’ll pay 0.75% annually. Although this matches Nutmeg’s entry-level advisory fee, you can get this down to 0.60% or 0.50% when investing more than £10,000 or £50,000, respectively.

The lowest rate on offer – which again mirrors Nutmeg, is 0.35%. For this, you’ll need to have £100,000 invested in the platform. In terms of account minimums, this stands at £5,000. Or, you can elect to set up a monthly direct debit and a smaller lump sum investment of £1,500.

|

Annual Account Fee |

Average Annual Investment Cost |

Minimum Deposit |

| 0.75% | 0.20% | £1,500 |

Sponsored ad. Your capital is at risk

3. Wealthify

Furthermore the ‘Adventurous’ plan has the sole aim of maximizing returns. All portfolios – irrespective of the risk level, focus on funds as opposed to individual equities. This ensures that you have access to a broad portfolio of assets and marketplaces.

Interestingly, the adventurous plan- which is supposed to return the highest gains, hasn’t always performed well. For example, the financial year spanning July 2019-20, it returned just 0.48%. This is far below what you should expect from a robo advisor platform – especially when opting to take the highest risk. In comparison, the cautious plan returns 2.54% during the same period. Again, these returns are relatively modest – so this is something you need to consider by joining Wealthify.

Although this UK robot advisor platform allows you to get started with no account minimums, we should note that fees are on the high-side. For example, you will pay 0.60% per year regardless of how much you invest. However, there are also investment costs to take into account – which Wealthify notes come out at an average of 0.22%. In terms of safety, your Wealthify funds are protected by the FSCS up to the first £85,000 and the platform is regulated and authorized by the FCA.

|

Annual Account Fee |

Average Annual Investment Cost |

Minimum Deposit |

| 0.60% | 0.16% | £1 |

Sponsored ad. Your capital is at risk

4. Moneybox

Moneybox is a UK-based robo advisor platform that offers a fully-fledged investment app. Opening an account with this provider takes just minutes, and the minimum investment stands at just £1.

Once again, this is okay if you are interested in UK robo advisors but want to start off with small stakes. Moneybox offers three different portfolio plans – Cautious, Balanced, and Adventurous. As the names imply, each managed portfolio is based on risk. With that said, all Moneybox portfolios invest in track funds. This includes the likes of the Fidelity Index World Fund and iShares Global Property Equity.

The specific weighting of each fund will depend on your chosen plan. For example, the cautious plan will have 40% weighted to a Legal & General Cash Trust, while the other two don’t touch cash investments at all. What we also like about Moneybox is that it offers several savings accounts as well as ISAs.

The mobile app even allows you to round up your debit card purchases to the nearest pound (or more) – with the balance being invested into your chosen portfolio. For example, if you purchase a coffee for £2.10 – the app will take £3 from your account and invest the £0.90 difference.

When it comes to pricing, there are three fees that you need to take into account. Firstly, there is a monthly token payment of £1, albeit, this is waved for the first three months. You then have the annual platform fee of 0.45%, which is charged monthly. Finally, MoneyBox charges an annual fund cost of between 0.12% and 0.30% – depending on the assets you hold in your portfolio. With that in mind, you could pay anywhere from 0.57% and 0.75% per year at Moneybox, plus £12.

|

Annual Account Fee |

Average Annual Investment Cost |

Minimum Deposit |

| £1 per month + 0.45% | 0.12%-0.30% | £1 |

Sponsored ad. Your capital is at risk

5. Scalable Capital

Scalable Capital offers exposure to a vastly diversified and broad range of markets. In fact, your basket could contain investment options from over 90 different countries. All represented by ETFs, this includes everything from shares, government and corporate bonds, real estate, commodities, and cash.

A large number of ETFs utilized by the team at Scalable Capital are backed by Vanguard and iShares. As such, you will benefit from providers that in most cases – offer very competitive maintenance fees. While we are on the subject of fees, you will pay 0.75% annually for as long as you keep your Scalable Capital account open.

You will also need to pay an average ETF cost of 0.16% – taking your total annual cost to 0.91%. This can be slightly higher or lower depending on the portfolio that is built for you.

|

Annual Account Fee |

Average Annual Investment Cost |

Minimum Deposit |

| 0.75% | 0.16% | £10,000 |

Sponsored ad. Your capital is at risk

6. eVestor

In addition to this, eVestor allows you to invest in a low-cost environment. For example, you will pay an annual fee of just £4.90 for every £1,000 that you invest. In total, there are three portfolios to choose from at this platform – low, medium, and high risk.

All three portfolios have finished the year in the green since the platform was launched in 2015 – apart from 2018 which resulted in a small loss. This loss ranged from 0.58% to 3.12% – depending on the plan. However, profits in the other four years have more than made up for this. For example, the high-risk plan netted 21.99% in 2019 and 11.16% in 2017. It also made a huge 28.25% in 2016 – making the 3.12% loss of 2018 look somewhat minute.

The platform saw a 17.8% return in 2016 and 11.57% in 2019. In terms of where your money will go, eVestor focuses on four main asset classes – bonds, shares, property, and cash. All of these assets are accessed via funds – which is industry-standard in the UK robo advisor space. eVestor has no exit fee – meaning that you can take your cash out whenever you like without being penalized.

With that said, it remains to be seen why a suggested withdrawal timeframe of 10 working days is given – with the added footnote of “however we can’t guarantee a timeframe”. In terms of funding your account, the only option is to set up a direct debit. If you like the sound of eVestor, there is also a mobile app. You can download this free of charge from the Google Play and Apple stores.

|

Annual Account Fee |

Average Annual Investment Cost |

Minimum Deposit |

| 0.49% | 0.15% | £1 |

Sponsored ad. Your capital is at risk

7. Wealthsimple

First and foremost, its robo advisor offering gives you heaps of portfolios to choose from. As always, this is based on the risk vs reward ratio that you wish to deploy. Some of the markets that you might have added to your portfolio include global company bonds, emerging market government bonds, UK stocks, North American stocks, European stocks, Asian stocks, and emerging markets stocks. The specific weighting will, of course, depend on which risk level you opt for.

Either way, Wealthsimple is a UK robo advisor platform. Plus, getting started rarely takes more than a few minutes and you can complete the account application online or via your mobile phone. When it comes to pricing, this depends on which plan you sign up for. With that said, unless you are planning to invest more than £100,000 – you will be placed onto the basic account. This comes with a fixed annual fee of 0.7% – plus an average fund charge of 0.2%.

There is no minimum balance at Wealthsimple, and you can fund your account with a UK debit card or bank transfer. There are no fees to deposit or withdraw funds. A core feature that we really like at Wealthsimple is its dividend reinvestment policy. By switching this on, all stock and ETF dividends will be automatically reinjecting into your portfolio. This allows you to grow your money faster via compound interest.

|

Annual Account Fee |

Average Annual Investment Cost |

Minimum Deposit |

| 0.70% | 0.20% | None |

Sponsored ad. Your capital is at risk

8. Vanguard Digital Advisor

That’s because the Vanguard Digital Advisor invests your money in Vanguard’s funds. You’ll answer some questions so Vanguard can gauge your risk tolerance, and then the software will suggest a balance between 4 funds: the Total Stock Market ETF (VTI), the Total International Stock ETF (VXUS), the Total Bond Market ETF (BND), and the Total International Bond Market ETF (BNDX). These funds have an average investment expense ratio of just 0.05%.

You’ll need at least $3,000 to get started with Vanguard Digital Advisor and the platform is only available in the US right now. That said, the service charges an annual management fee of only 0.15% – making it one of the most affordable options in our list of robo advisors. There are also no deposit or withdrawal fees to worry about.

|

Annual Account Fee |

Average Annual Investment Cost |

Minimum Deposit |

| 0.15% | 0.05% | $3,000 |

Sponsored ad. Your capital is at risk

9. Morgan Stanley

Of course, Morgan Stanley does offer standard portfolios that are grouped by risk tolerance.

The Morgan Stanley personal finance robo advisor also stands out for offering features like automated rebalancing and tax-loss harvesting. These tools help ensure that your portfolio is performing consistently over time and that you’re maximising your investment returns. You can see exactly what’s happening in your account at any time using the Morgan Stanley robo advisor app.

The one downside to this platform is that it can be pricey. Morgan Stanley charges a 0.30% management fee per month – not per year, like most other platforms on our list of robo advisors. In addition, the themed portfolios have relatively high fund fees.

|

Annual Account Fee |

Average Annual Investment Cost |

Minimum Deposit |

| 0.30% | 0.25% | $5,000 |

Sponsored ad. Your capital is at risk

What is a Robo Advisor?

So now that we have discussed some popular robo advisor UK platforms currently offering their services – we now need to explain how the investment process actually works. In a nutshell, robo advisors allow you to invest in a passive manner. This is because the underlying technology – which is typically backed by artificial intelligence, will determine which assets to invest in. In addition to this, the robo advisor will rebalance your portfolio for you.

This means that it will determine which shares to buy and sell – and when. Crucially, the vast majority of UK robo advisors take a risk-based approach to invest. That is to say, when you first open an account you will be asked a range of questions about your financial goals and appetite for risk. In doing so, the robo advisor technology will build a portfolio based on your answers.

In terms of what you will be investing in, most of the robo advisor UK platforms stick with ETFs and index funds. This means that each individual fund will contain dozens, hundreds, or in some cases – thousands of assets. This can include shares, bonds, government securities, or cold-hold cash.

The specific weighting of your portfolio – alongside the markets and economies that it targets, will depend on your risk profile. Either way, once you make an investment into your chosen UK robo advisor, you won’t need to lift a finger.

What Can You Invest in with a Robo Advisor?

Some robo advisors allow you to invest in a wide variety of assets. Let’s take a look at the different types of investment that are available at robo advisor UK platforms.

ETFs

ETFs (exchange-traded funds) are essentially baskets of assets like stocks.

Robo-advisors put your money in ETFs because they’re professionally designed and managed by dedicated fund managers. They’re also relatively low-cost and give you exposure to a wide range of assets in a single trade. That helps to keep trading fees to a minimum, making it cheaper for you to open a robo advisor account.

It’s worth taking a close look not only at what ETFs a UK robo advisor will invest your money in, but also what’s in those funds. Many ETFs simply own all the stocks in a market index like the S&P 500. Others might own all the stocks in a specific market sector, and others might invest in different types of bonds. More recently, ETFs that invest in cryptocurrencies and forex have grown in popularity. However, none of the platforms in our list of robo advisors offer these because of their relatively high risk.

Stocks

Most robo advisory services don’t invest in individual stocks. Stock trading adds costs in spreads and commissions, and your risk is higher when you’re only invested in a handful of companies.

However, if you want to trade individual stocks as part of your portfolio, you can do so with a stock app.

Bonds

As we noted, many robo advisors offer bond ETFs. Bonds are generally considered less risky than stocks, and they provide fixed income that can be reinvested into your portfolio. As you age, many robo advisors will automatically shift more of your money into bond ETFs to reduce your investment risk.

Robo Advisor Features

Still not sure whether robo advisors are the right investment mechanism for you? If so, below we discuss some of the main benefits of opting for a UK robo advisor platform.

Most investors in the UK will opt for a DIY trading account. This simply means that you will be required to pick which stocks to invest in – and when. While this does add a ‘thrill’ to the investment process, it does mean that you are 100% responsible for the assets you buy and sell.

Crucially, knowing which companies or bonds to invest in is a challenging process that requires years of prior experience. This includes a requirement to understand fundamental research – such as being able to interpret company earnings reports.

100% Passive

Once you invest money into a robo advisor, you can sit back and allow the technology to do its thing. As noted above, this is because the robo advisor makes all investment decisions on your behalf.

This alleviates the need to perform any research and ultimately – keep up to date with the financial markets. Instead, the underlying algorithm will buy and sell assets based on market conditions. In addition to this, we should note that by using a robo advisor, you do not need to worry about the emotional side of trading.

That is to say, the robo advisor will not make reckless investment decisions and does not suffer from fatigue! This means that it can analyze the markets on a 24/7 basis in a risk-averse manner.

Invest Based on Your Appetite for Risk

The main concept of UK robo advisor platforms is that you get to invest in markets that mirror your appetite for risk. This is crucial, as each portfolio will have its own risk vs reward ratio.

At the other end of the spectrum, higher-risk portfolios will likely give you exposure to the emerging markets and low-cap stocks. Ultimately, the level of risk that you take is your decision to make.

Liquid Investment

In the vast majority of cases, UK robo advisors will give you instant access to your cash. That is to say, as soon as you want to withdraw money out, there is rarely a lock-in period to meet. This can be beneficial if you need access to fast cash.

Drawbacks of Robo Advisors

While there are many benefits of investing in robo advisors, several drawbacks also need to be considered.

Limited Flexibility

One of the main disadvantages of using UK investment robo advisors is that you are afforded little in the way of flexibility. This is because the robo advisor will determine which assets to invest in on your behalf.

As such, you won’t be able to add individual stocks or bonds to your portfolio. This can be problematic if you have your eye on a particular investment. If this is the case, you will need to open an account with a share dealing platform that allows you to invest on a DIY basis.

More Costly Than Funds

On the one hand, when you invest in a robo advisor – it’s all-but-certain that your portfolio will be packed to the rafters with ETFs and index funds. While this isn’t an issuer per-say, we should note that the costs to access these funds are higher when you invest via a robo advisor. In fact, you’ll often pay in the region of 0.75% above the respective fee that the ETF provider charges.

If, for example, you were to invest in ETFs – you wouldn’t pay any dealing fees at all. On the other hand, it is important to remember that UK robo advisors will rebalance your portfolio automatically. This isn’t a privilege you will get when investing in an ETF or index fund yourself.

No Guarantee That You Will Make Money

As is the case with any investment vehicle, there is no guarantee that you will make money by investing in a UK robo advisor. On the contrary, there is every chance that you could get back less than you initially invested.

In particular, you will be entrusted your money with an algorithm that will be making investment decisions for you. Even if the algorithm has a proven track record, past performance is never a 100% indicator of future results.

Can Robo Advisors Beat the Market?

In general, even the UK robo advisors don’t beat the market very often. That’s because robo advisors don’t often pick individual stocks to try to beat the market. Instead, their aim is to give you broad, diversified exposure to the UK and global markets. So, most robo-advisors are trying to match market returns.

That said, you may see an uptick in robo advisor performance during years when the market is down. That’s because robo advisors try to limit your downside risk by investing in safe-haven assets like bonds. In many cases, robo advisor portfolios will fall less than the broader markets during pullbacks.

Robo Advisor Fees Comparison

Before signing up for a robo advisor UK, it is imperative that you have a firm understanding of what fees you will pay. Before reviewing our robo advisor comparison table, let’s briefly explain the main fees that you will come across when investing in a UK robo advisor.

- Platform Fee: This is the fee charged by your chosen robo advisor to access its platform. This will almost always be expressed as an annual percentage fee and charged against the amount you invest. For example, if you were to invest £1,000 and the robo advisor charges 0.70%, you’d pay £7 per year.

- Fund Fee: This is the fee that the respective ETF or index fund provider charges. This is subsequently passed on to your – the investor. The specific fee can vary wildly sending on the fund, albeit, it rarely exceeds 0.5% annually.

Below you will find a robo advisor comparison table that shows the fees charged by robo advisor UK platforms.

| Robo Advisor UK | Platform Fee From | Fund Fee | Minimum Deposit |

| Nutmeg | 0.75% | Built into platform fee | £5,000 lump sum or £500 + direct debit |

| MoneyFarm | 0.75% | Built into platform fee |

£5,000 lump sum or £1,500 + direct debit

|

| Wealthify | 0.60% | 0.22% (average) | £0 |

| Moneybox | 0.45% + £1 per month | 0.12% – 0.30% | £1 |

| Scalable Capital | 0.75% | 0.16% (average) | £10,000 |

| eVestor | 0.49% (average) | Built into platform fee | £1 |

| Wealthsimple | 0.70% | 0.20% (average) | £0 |

| Vanguard Digital Advisor | 0.15% | 0.05% (average) | $3,000 |

| Morgan Stanley | 0.30% | 0.25% (average) | $5,000 |

As always, fees can change at the drop of a hat – so always check for yourself before opening an account.

Important Facts about UK Robo Advisors

Although we have already sourced UK robo advisors available in the market, this isn’t to say that our chosen providers are right for you. As such, there might come a time where you need to perform some independent research before choosing a platform to sign up with.

With this in mind, below we have listed a range of important metrics that need to be considered before you sign up.

FCA and FSCS Protections

In addition to this, you should only use a provider that is partnered with the Financial Services Compensation Scheme (FSCS).

For those unaware, this protected some, or all, of your capital if the platform went bust. This is capped at £85,000 in cash balances and £50,000 on your investments.

Minimum Investment

It goes without saying that you need to ensure the minimum investment amount falls within your personal budget. As we have uncovered in our list of robo advisors, this can vary quite wildly.

For example, the likes of Wealthsimple and MoneyFarm have no minimum deposit in place at all. At the other end of the spectrum, Scalable Capital requires a minimum deposit of £10,000.

Fees

Fees are also an important component that you need to assess before choosing a robo advisor UK. As we covered above, this is typically split into platform fees and fund fees. Some providers will build both fees into a single percentage rate.

All in all, you’ll likely find that robo advisors charged in the region of 0.75% per year. While most providers do not charge anything to deposit or withdraw funds, it’s good to check this just in case.

User Experience

If you are turning to robo advisors because you want to invest in the financial markets but you have little to no experience, then you will want to make sure that the platform is suited for newbies.

In other words, you’ll want the process of signing up, depositing funds, and choosing a portfolio to be a seamless one. With the exception of Scalable Capital, all of the UK robo advisors listed on this page offer an all-round service.

Accessible Markets

You do, of course, also need to assess where the robo advisor is going to place your money. As we have discussed throughout the guide, the standard procedure is to invest purely in funds.

With that said, while some platforms give you access to thousands of markets, some are much more limited.

Past Performance

As we also say, past performance is no guarantee of future results. However, past performance is still an important metric to look at before making an investment. This is especially the case when picking a robo advisor platform and a suitable portfolio for your attitude to risk.

Conclusion

Robo advisors UK are considered by some to be trustworthy. Nearly all of the robo advisors keep your funds in a segregated account with a regulated brokerage or bank. Robo-advisors that are also brokers, are directly regulated by the Financial Conduct Authority. In many cases, the robo advisor doesn’t even have permission to withdraw your funds – it only has the authority to change what you’re invested in, not to move money between accounts.

Many robo advisors UK are backed by the Financial Services Compensation Scheme (FSCS). This insures your account for up to £85,000 in the event that the platform runs into financial trouble or goes out of business.