How to Buy Next Shares Online in the UK

Next is a major UK clothing retailer that has since expanded into the online space. With a market capitalization of over £7 billion, Next is a fully-fledged constituent of the FTSE 100 index. As such, there are hundreds of online stock brokers that allow you to invest in Next at the click of a button.

In this guide, we show you how to buy Next shares in the quickest and cheapest way. On top of discussing the best online brokers to do this with, we also explore whether or not Next represents a viable addition to your share dealing portfolio.

-

-

Step 1: Find a UK Stock Broker to Buy Next Shares

As Next is listed on the FTSE 100 index, it makes sense that you can buy its shares from multiple online brokers. But, knowing which platform to go with can take time. For example, you need to check how much the broker charges in commission, and whether or not it is licensed with the FCA.

To point you in the right direction, below we have listed a small selection of stock brokers that allow you to buy Next shares in a safe and cost-effective environment.

Step 2: Research Next Plc Shares

Although at first glance you might think that Next represents a good investment, it is important to take a step back. After all, there is no guarantee that Next shares will increase in value over time. On the contrary, there is every chance that you can lose money, whether you’re investing in Next or other companies like Boohoo shares.

With this in mind, we would suggest reading through the following sections to gain a better understanding of what the future holds for Next shares.

Next Share Price History

Next is a UK retailer that specializes in fashion for men, women, and children. The retailer is primarily based on the UK high street, with over 500 stores. Next also has exposure in several overseas markets. Across Asia, the Middle East, and Europe – the firm has over 200 stores in operation. Its portfolio of UK and international shops are supported by over 40,000 employees. In terms of its shares, Next became a publicly-listed organization in the mid-1980s.

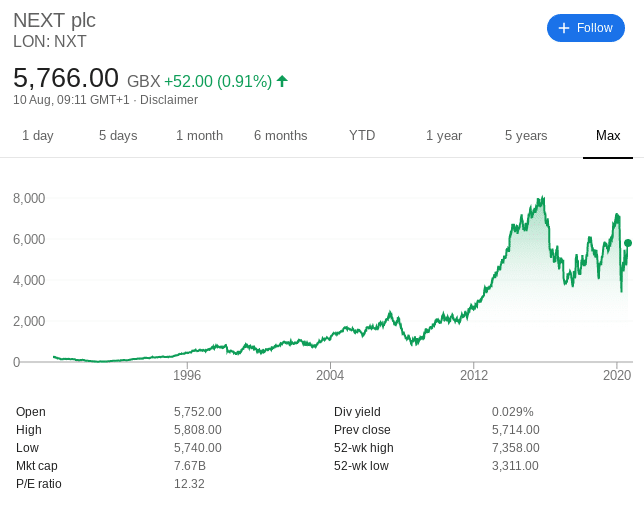

It was listed on the London Stock Exchange, which is where the shares remain today. At the time of writing, the firm has a market capitalization of over £7.6 billion. As a result, it is a major UK company that forms part of the FTSE 100 index. Taking a trip down memory lane, Next shares were priced at just 252p in 1988. Had you bought the shares back then, you would now be looking to unprecedented gains.

For example, the shares hit a stock price of just under 8,000p in 2015. This works out at an ROI of over 3,000%. In more recent times, the stocks have since cooled-off. For example, Next went on a downward trajectory after its 2015 peak, hitting lows of around 3,800p. However, the fortunes of the company quickly made a U-turn back in the right direction, with Next shares hitting 7,358p in January 2020. However, what was to follow was the wider impact of the COV-19 pandemic.

After all, with government lockdowns present both in the UK and overseas, Next stores remained closed for a number of months. In turn, the value of its share hit 52-week lows of 3,311p in March. In just two months, this represents a decline of over 55%. On the flip side, it is crucial to note that Next shares have bounced back very, very quickly. At the time of writing, the Next share price is 5,772p. This translates into a recovery of over 74% in the space of four and a half months.

Next Shares Dividend Information

If you’re seeking value shares that also generate income, you’ll be pleased to know that Next has a long-standing history of meeting its dividend distribution policy. However, that was until the coronavirus pandemic came to fruition. In response, management at Next was forced to suspend dividends until further notice.

The company also announced that it would be postponing its much-anticipated share buyback scheme. Although this is no doubt a frustration for stockholders, it is important to remember that virtually all Next stores were closed during the wider lockdown, so revenue generation was left exclusively to its online business.

Should I Buy Next Shares?

As important as it is to look at the historical value of Next shares, investors are more concerned with the here and now. That is to say, does Next represent a good investment based on its current share price? To help answer this question, below we discuss some of the key points that you need to consider before you buy Next shares.

Positive COV-19 Recovery

On the one hand, it was nothing short of a capitulation for Next shares once the coronavirus pandemic came into full force. This does make sense when you consider the firm’s core business division – high street retail stores. As a result, Next plc shares dropped by 55% in the space in the just two and a half months.

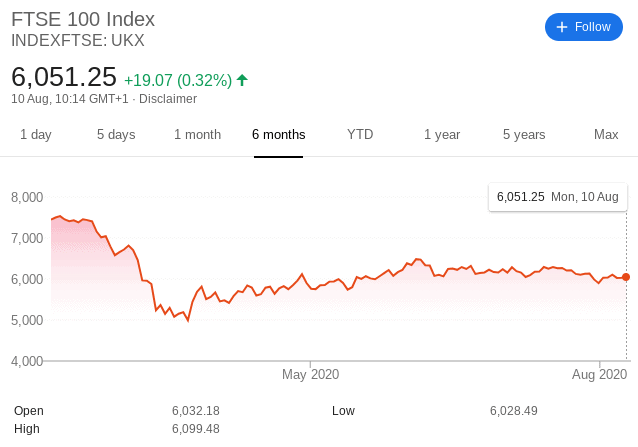

However, those that kept faith in the firm by purchasing shares towards their March 2020 lows are now looking at exceptional gains. This is because Next shares have since recovered by over 74%. To illustrate just how positive this is for Next shareholders, it is important to compare the firm’s recovery with the wider FTSE 100 index. During the same period, the index has covered by just 16%.

This means that Next has outperformed the UK stock markets by a considerable amount. Looking at one of the firm’s main competitors on the high street – Marks and Spencer, its recovery is even more impressive. This is because Marks and Spencer shares went from 2020 lows of 73p to a current share price of 106p. Although this still represents gains of 45%, the recovery is much smaller in comparison to Next.

Sales not as Unfavorable as the Markets had Anticipated

Leading on from the above section, much of the recovery seen by Next in response to the COV-19 pandemic is due to the firm’s better-than-expected results. That is to say, sales at Next were not as heavily impacted by the lockdown as the markets had anticipated. For example, management at Next recently announced that it expects 2020 sales to hit the £195 million-mark.

The markets had projected just £120 million. In Q2 specifically, sales were down 28%. However, Next itself had projected a drop in excess of 56%. In its online division, sales were actually up 9% in Q2. Naturally, an increase in online sales was something experienced by most high street retailers, so it will interesting to see what the figures present in Q3.

Growing Online Business

The general consensus is that Next is well position to weather the ongoing coronavirus storm. At the forefront of this is the firm’s ever-growing investment into its online division. Management understands that online retail is slowly but surely leaving bulky, expensive high street stores behind.

As such, Next has been increasing its exposure to the online sector for some time now. Crucially, this means that the potential of a re-visit to lockdown shouldn’t hurt Next as much as its main competitors. This became evident in how quickly the shares recovered.

Efficient Stock Management

Stock management is one of the biggest threats facing UK retailers at present. In simple terms, a reduction in sales means that retailers are sitting on increased levels of stock. This ultimately acts as a major drag on cash flow recourses. However, in the case of Next, its most recent earnings report noted that surplus stock levels are up just 1% in comparison to the prior year.

Buyback and Next Shares Dividends Will Resume in the Future

Not only do you have the chance to buy Next shares at a major discount (in comparison to pre-COV-19 prices), but you can also position yourself nicely for a return to the firm’s stock buyback and dividend plans.

Regarding the former, there was a much-anticipated share buyback in the making before the COV-19 pandemic came to light.

This can be highly beneficial for shareholders, as it typically results in an increase in stock price. Although it remains to be seen when this will be the case, it is hoped that the buyback scheme will come into play within the next 1-2 years.

Additionally, Next has a long-standing history of paying dividends. Although it was forced to suspend its distribution policy in Q2 2020, this won’t be the case forever.

The Verdict

In summary, the wider FTSE 100 has had a rough time since the COV-19 pandemic came to fruition. This is especially the case for those active on the UK high street. However, the recovery seen by Next since its share hit lows of 3,311p has been remarkable.

In fact – at a current price of 5,772p – Next shares have increased by over 74% since March. There is still room for movement, too – as Next shares were priced at 7,358p in January.

FAQs

How much were Next shares when the firm first went public?

Next went public in the mid-1980s. Back then, you could have got your hands on the shares at around the 252p-mark.

What stock exchange is Next listed on?

With its headquarters in the UK, Next has its primary listing on the London Stock Exchange. With a market capitalization of well over £7 billion, it is also a constituent of the FTSE 100.

Does Next pay dividends?

Next had a long-standing track record of paying dividends before the COV-19 lockdown. However, management had to suspend dividends in Q2. This will remain the case until further notice.

Why are Next shares so expensive?

At a current stock price of 5,772p, this actually makes Next one of the most expensive shares on the FTSE 100. However, this won't be an issue when using an online broker that supported fractional ownership.

Where can I buy Next shares?

You can buy shares in Next online from a broker that gives you access to the London Stock Exchange.

Kane Pepi

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Academically, Kane holds a Bachelor’s Degree in Finance, a Master’s Degree in Financial Crime, and he is currently engaged in a Doctorate Degree researching the money laundering threats of the blockchain economy. Kane is also behind peer-reviewed publications - which includes an in-depth study into the relationship between money laundering and UK bookmakers. You will also find Kane’s material at websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2026 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up

As Next is listed on the FTSE 100 index, it makes sense that you can buy its shares from multiple online brokers. But, knowing which platform to go with can take time. For example, you need to check how much the broker charges in commission, and whether or not it is licensed with the FCA.

As Next is listed on the FTSE 100 index, it makes sense that you can buy its shares from multiple online brokers. But, knowing which platform to go with can take time. For example, you need to check how much the broker charges in commission, and whether or not it is licensed with the FCA.

Not only do you have the chance to buy Next shares at a major discount (in comparison to pre-COV-19 prices), but you can also position yourself nicely for a return to the firm’s stock buyback and dividend plans.

Not only do you have the chance to buy Next shares at a major discount (in comparison to pre-COV-19 prices), but you can also position yourself nicely for a return to the firm’s stock buyback and dividend plans.