Oracle released its fiscal fourth-quarter 2021 earnings yesterday after the US markets closed. However, the shares are sharply lower in US premarket price action today despite the company posting better-than-expected results.

Oracle reported revenues of $11.2 billion in the quarter, which were 7.5% higher than the corresponding period in 2020. The revenues were ahead of the $11 billion that analysts were expecting. Also, the revenue growth was the highest in six years. Over the last many years, Oracle has been plagued by sagging growth which is reflected in its share price as well as valuations.

However, things seem to be getting on track for the company and its sales have increased for the last four fiscal quarters. They had fallen on a yearly basis in the previous two fiscal years.

Oracle shares are outperforming in 2021

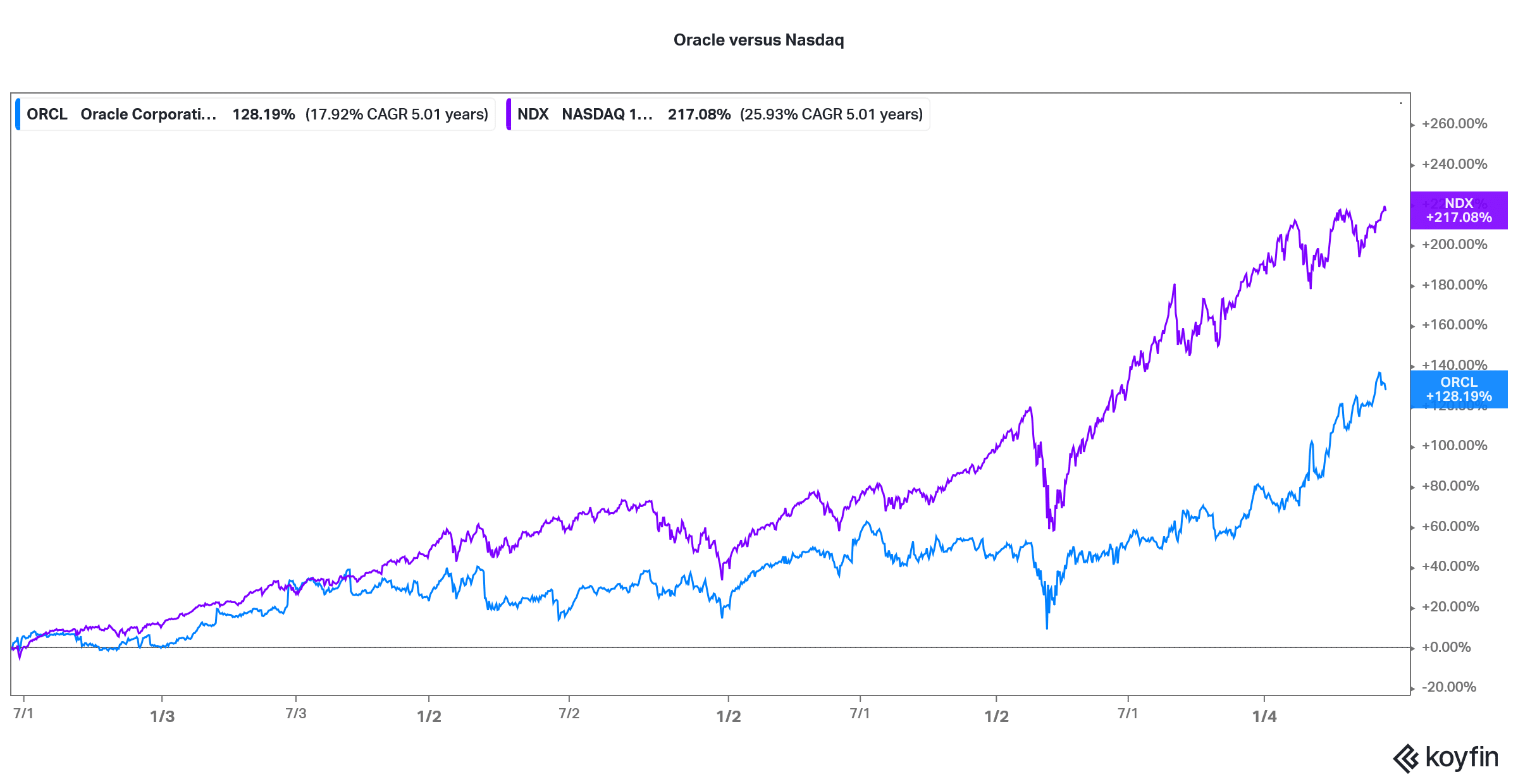

Oracle shares have risen at a CAGR of 17.9% over the last five years which is far below the 25.9% CAGR of the Nasdaq 100 Index. However, the shares are outperforming in 2021 as investors have poured money into value shares while ditching high growth companies amid the rise in US interest rates.

Earnings beat estimates

Along with the topline, Oracle managed to beat the bottomline estimates also. The company posted adjusted EPS of $1.54 in the quarter which was higher than the $1.31 that analysts were expecting. The company also declared a cash dividend of $0.32 which will be payable next month.

Oracle management sounded upbeat on the results. “Our Q4 performance was absolutely outstanding with total revenue beating guidance by nearly $200 million, and non-GAAP earnings per share beating guidance by $0.24,” said Oracle CEO, Safra Catz. She added, “Our multi-billion dollar Fusion and NetSuite cloud applications businesses saw dramatic increases in their already rapid revenue growth rates.”

Why are Oracle shares falling?

Generally, shares tend to rise after the earnings beat which looks quite decent in Oracle’s case. However, the shares were trading lower in premarkets today. The anomaly could be due to some investors taking profits after the rally in 2021. Also, Oracle’s guidance might have spooked markets. The company expects revenues to increase between 3-5% in the fiscal fourth quarter. For the full year, the company expects sales growth to be higher than the previous fiscal year where revenues had increased 3.6%.

Guidance

Also, the company plans to scale up investments. “We are going to invest back in the business at a greater rate,” said Catz on the cloud business. The increase in investments will fuel the growth in the cloud business but will also weigh on profitability. Oracle expects to post EPS between $0.94-$0.98 in the fiscal first quarter of 2022 which is below the $1.03 that analysts were expecting.

Also, while Oracle’s cloud revenues have been rising the company is still a distant competitor in the cloud computing market where Amazon is the dominant player. Cloud operations are the most profitable vertical for Amazon and are the cash engine for the business. Oracle also expects the growing cloud business to add to its profitability and said that it is “fundamentally a more profitable business” as compared to its legacy business.

Meanwhile, Oracle is doubling down on its cloud investments. “We expect to roughly double our cloud capex spend in FY 2022 to nearly $4 billion,” said Catz. She added, “We are confident that the increased return in the cloud business more than justifies this increased investment, and our margins will expand over time.”

Oracle share repurchases

Oracle repurchased $8 billion worth of its shares in the fiscal fourth quarter which took its repurchases in the fiscal year to $21 billion. In the absence of investment opportunities, The company has been resorting to massive repurchases and in the last ten years, it has lowered its outstanding shares by 44%. Other US tech companies like Apple have also been repurchasing their shares in massive quantities that help them increase the EPS by lowering the outstanding share count.

Oracle shares were 4.5% lower in US premarket price action today. The shares have a 52-week trading range of $50.91 to $85.03. The shares are facing resistance near higher price levels as its valuation now seems to bake most of the positives.

The company needed a stellar set of numbers to keep the momentum going but what we have are mixed earnings, and the shares are reacting to that.

Question & Answers (0)