Over the last 18 months, chipmakers and PC companies have seen a revival in demand after the COVID-19 pandemic increased the pace of digitization. Almost all the companies in the industry have talked about a supply shortfall and companies have been able to sell everything that they can produce.

Now, almost two years after the COVID-19 pandemic began, Wall Street analysts are having second thoughts about chipmakers as well as PC companies. Why’s Wall Street getting bearish on these names and should investors buy or sell these companies?

Chipmakers could see demand pressure

Semiconductors is a cyclical industry. Over the last 18 months, chipmakers benefited from higher prices as demand outstripped supply. Also, to meet the increased demand chipmakers announced billions of dollars of new investment into foundries that produce these chips. Goldman Sachs has now raised concern over the demand outlook for chip companies.

It said, “Semiconductor market growth has historically correlated with global GDP given its exposure to consumer spending (on smartphones, PCs, cars, and other consumer products/devices) as well as enterprise IT spending (on server/compute, networking, and storage applications).”

The brokerage added, “While semiconductor industry revenue has rebounded sharply off the lows in 2Q20 partially supported by an accommodating fiscal and monetary policy environment, looking ahead, we now expect a more challenging backdrop with our economists forecasting 1) rising inflation, 2) higher interest rates, and 3) ultimately, a moderation in global GDP growth from 6.3% in 2021 to 3.2% in 2022.”

Goldman Sachs downgraded chipmakers

Goldman Sachs downgraded chipmakers including Qorvo, Teradyne, and Microchip Technology. However, it maintained its rating on AMD while removing the stock from its conviction buy list.

Separately, the company also downgraded PC maker Dell. It cited the demand pull forward low-end customers and potential degradation in demand from high-end consumers to support its thesis. It also believes that discounting would be back in the industry which would hit the margins. If the sales of PCs come down, it would also hit the demand outlook for chipmakers.

Notably, JPMorgan had also echoed similar views as the brokerage removed Apple from its focus list warning of a slowdown in consumer spending. It, however, maintained its overweight rating on the stock. Rising interest rates and multi-decade high inflation is expected to negatively impact the demand for non-discretionary products.

Morgan Stanley also downgraded PC makers

Morgan Stanley analyst Erik Woodring also downgraded HP and Dell amid concerns over demand. “With a PC supply/demand rebalance nearing, return-to-work trends normalizing, and a more cautious macro outlook likely to negatively impact 2022 hardware spending, we cut our PC market forecast and downgrade HPQ to Underweight (from Equal-weight) and DELL to Equal-weight (from Overweight),” said Woodring in his note.

He added, “We believe our late cycle thesis remains intact and expect Hardware fundamentals to deteriorate in 2022 as net income revisions flatten and growing macro uncertainty increases the potential of negative hardware budget cuts.”

Barclays downgraded chipmaker AMD

Barclays is also forecasting a slowdown in end-market demand for chipmaker AMD and downgraded from overweight to neutral and slashed the target price from $148 to $115. “We would rather move to the sidelines until we have better clarity as to the magnitude of these corrections and what the competitive landscape will look like as INTC catches up and ARM takes more share,” said Barclays analyst Blayne Curtis. She added, “The core issue here is what will be AMD’s growth trajectory coming out of this potential correction.”

Curtis also said that “We understand the argument that the number of PCs per person/household should increase due to prolonged hybrid working, but we don’t believe that trend is enough to sustain the market at these levels.”

Meanwhile, not all share Barclays’ pessimism about AMD and Rosenblatt is of the view that the shares are a good buy after the crash. It is also not too concerned about the demand outlook and expects the company to meet its 30% topline growth projection in 2022.

The global economic outlook looks hazy

Meanwhile, the global economic outlook is looking hazy. On the one hand, we have slowing growth in the developed world after the bounce that we saw in 2021. Chinese economic outlook is also dampened by the growing COVID-19 cases in the country. The country is following a strict policy and shuts down cities to prevent the spread of the virus.

Also, for chipmakers, there could be a period where we could see supply outstrip demand. Chipmakers have outlined billions of dollars of new investments to build new plants and these would start coming online soon. If the demand outlook deteriorates as many analysts are forecasting, it could lead to a supply surplus.

Yield curve inversion

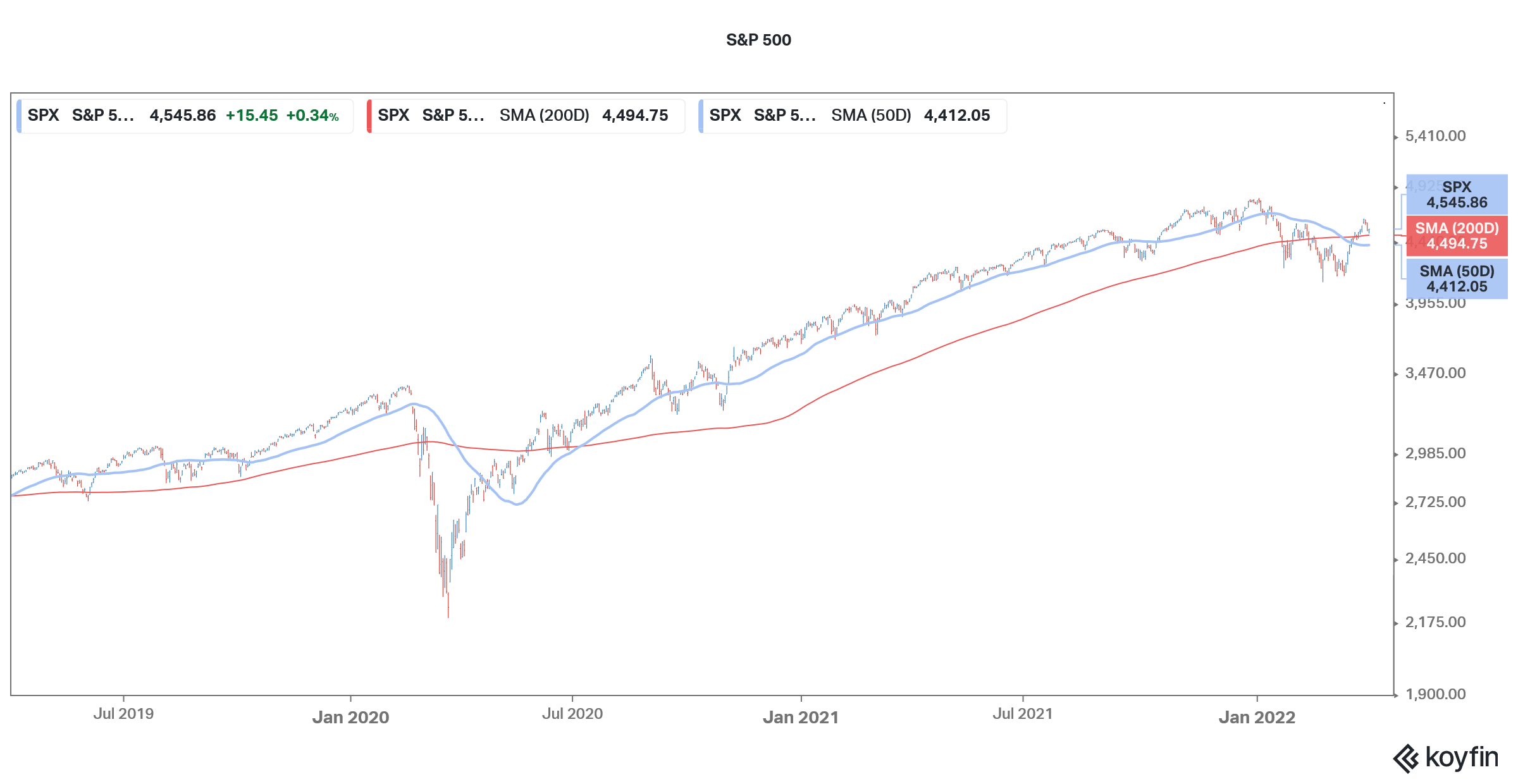

Recession fears have been ignited by the recent inversion in the US yield curve. While some analysts see it as a sign of an imminent recession especially as the Fed aggressively raises rates in 2022, many others don’t see a recession on the horizon. Tony Dwyer, an analyst at Canaccord Genuity said that “All of this Yield Curve and recession talk is within the context of a ground war in Europe, spiking inflation, and global growth uncertainty.” He added, “We continue to believe that despite the many headwinds, the excess liquidity and proper Yield Curve point to a positive growth environment, albeit a slower one.”

Tom Lee of Fundstrat Global Advisors is of the view that US share markets have bottomed and there could be a risk-on rally in the second half of 2022. If Lee’s views materialize, chipmakers could see a sharp rally in the second half of the year.

Also, if you are looking at investing for the long term, chipmakers look an attractive asset class. Over the long term, digital transformation, growing sales of advanced gadgets, and the pivot towards electric and autonomous cars would drive the sales for chipmakers.

Question & Answers (0)