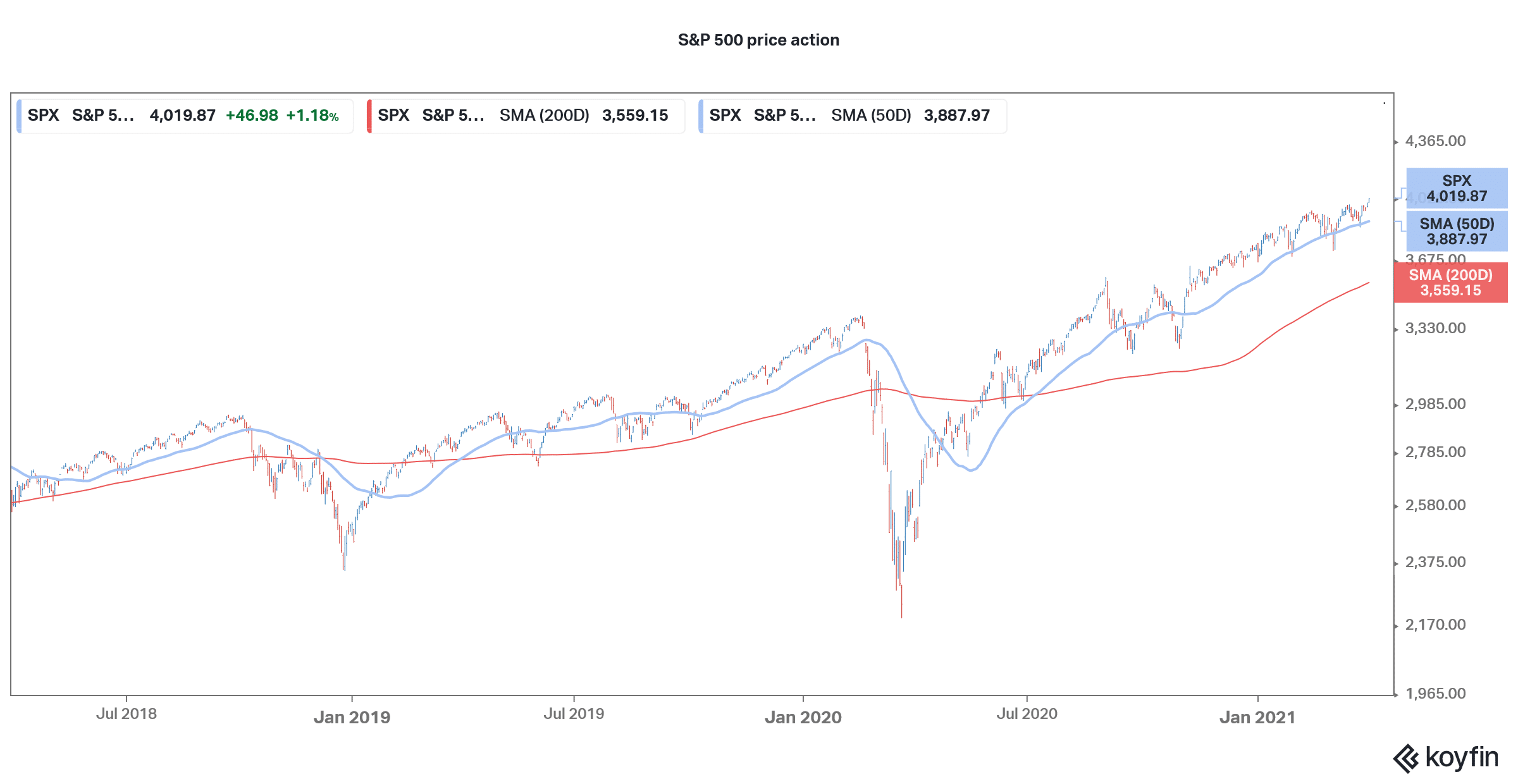

The first quarter earnings season would soon commence. Here’s what investors can expect from corporate earnings season in the quarter that was best characterised by the sectoral shift from growth and tech to value and cyclical shares.

According to the estimates compiled by Refinitev, analysts expect S&P 500 earnings to rise 24.2% in the first quarter of 2021. If analyst estimates turn out to be true, it would be the highest quarterly increase for S&P 500 profits since the third quarter of 2018.

S&P 500 earnings estimates

In the fourth quarter of 2020, S&P 500 blended earnings had increased by around 3% reversing the sharp fall in the previous three quarters where the COVID-19 pandemic took a toll on companies’ bottomline.

Meanwhile, the expected sharp rise in first quarter profitability should also be seen in the light of the lower base effect. In the first quarter of 2020, S&P 500 earnings had fallen by around 14.6% and it was the worst quarter since the third quarter of 2009.

Meanwhile, analysts have been getting incrementally positive about S&P 500 and during the first quarter, they increased the S&P 500 first quarter earnings estimate by 6% to $39.86 according to FactSet. This is based on the bottom-up estimates by aggregating the earnings estimates for all S&P 500 constituents.

Analysts have raised S&P earnings estimates

Here it is worth noting that generally, S&P 500 earnings estimates for the quarter tend to fall during the quarter. Also, this is the highest percentage increase in earnings estimates since the third quarter of 2018. That quarter, President Trump’s tax cut help left corporate profitability.

According to FactSet, “During the past five years (20 quarters), the bottom-up EPS estimate has recorded an average decline of 4.2% during a quarter.” The metric is similar for the last ten years while on average S&P 500 blended earnings estimates have fallen 5.1% during the last 15 years. Therefore, analysts raising the blended earnings estimates of the S&P 500 during the first quarter of 2021 is quite significant.

Analysts might have overestimated the economic impact of COVID-19

The anomaly is also reflective of the general pessimism among analysts and an overestimation of the COVID-19’s impact on the corporate bottomline. Here it is worth noting that over the last two quarters, the percentage of companies reporting positive earnings surprise is more than the historical average which further highlights that analysts have been a little too pessimistic on corporate profitability.

Energy prices bounced back in the first quarter

Also, if we deep dive into the sectoral data, we find that analysts have on average increased their earnings estimates for energy companies by 123%.

Energy prices bounced back during the quarter which prompted analysts to revise upwards their earnings estimates for the sector. Financial stocks saw the second highest upward revision in earnings estimates during the quarter while materials stocks were the third. Like energy, material prices were also strong in the quarter and analysts revised up their earnings estimates.

Which sectors are analysts most bullish?

The healthcare sector of the S&P 500 has the most buy recommendations at 63%. Information technology and energy are the other two sectors where analysts are most bullish on and 61% of analysts on an average rate the companies in these two sectors as a buy.

Analysts are most bearish on the consumer staples sector and only 44% of analysts rate the companies in the sector as a buy. Real estate is another sector where analysts are bearish and only 47% of them have rated companies in the sector as a buy.

What else to watch in first quarter earnings

During the earnings call, it would be crucial to see what the companies have to say on the growth outlook as the economy has by and large reopened. Markets would watch the performance of high growth tech companies whose shares have been under pressure this year amid concerns over valuations.

If tech companies report tepid growth rates, bears would fancy their chances. However, bulls might take charge if the growth and outlook are rosy. The first quarter earnings season would be a “moment of truth” for the sectoral shift from growth to value shares.

Also, analysts would watch the comments from companies that benefited from the gradual reopening of the economy. It would be interesting to see what the managements have to say on consumer behaviour after the reopening.

Watch out for dividends

Also, this quarter many companies especially Ford and General Motors might take a relook at their dividends. Both these companies had suspended dividends last year amid the uncertainty over the COVID-19 pandemic. Now, with automotive sales soaring, investors would expect a restoration of dividends. Ford had previously hinted that it would take a decision on dividend during the spring. Energy companies that had lowered their dividends last year might also think of increasing them this earnings season.

Global chip shortage

Finally, global chip shortage could feature prominently during the first quarter earnings call. Chip shortage is leading to supply-side bottlenecks in many industries especially the automotive sector where companies like Ford and NIO had to temporarily halt production.

Meanwhile, the bar is set high for the first quarter earnings season looking at the record increase in earnings estimates. This would also mean that the risk of corporate earnings falling short of estimates is relatively higher.

Randy Frederick, vice president of trading and derivatives for Charles Schwab also hold similar views. “When the expectations bar has been raised as much as it has, then I think that it sets up for some disappointments and that could cause the market to potentially stall out,” said Frederick.

The S&P 500 hit a record high recently and now the baton would lie with corporate earnings to justify the rally.

Question & Answers (0)