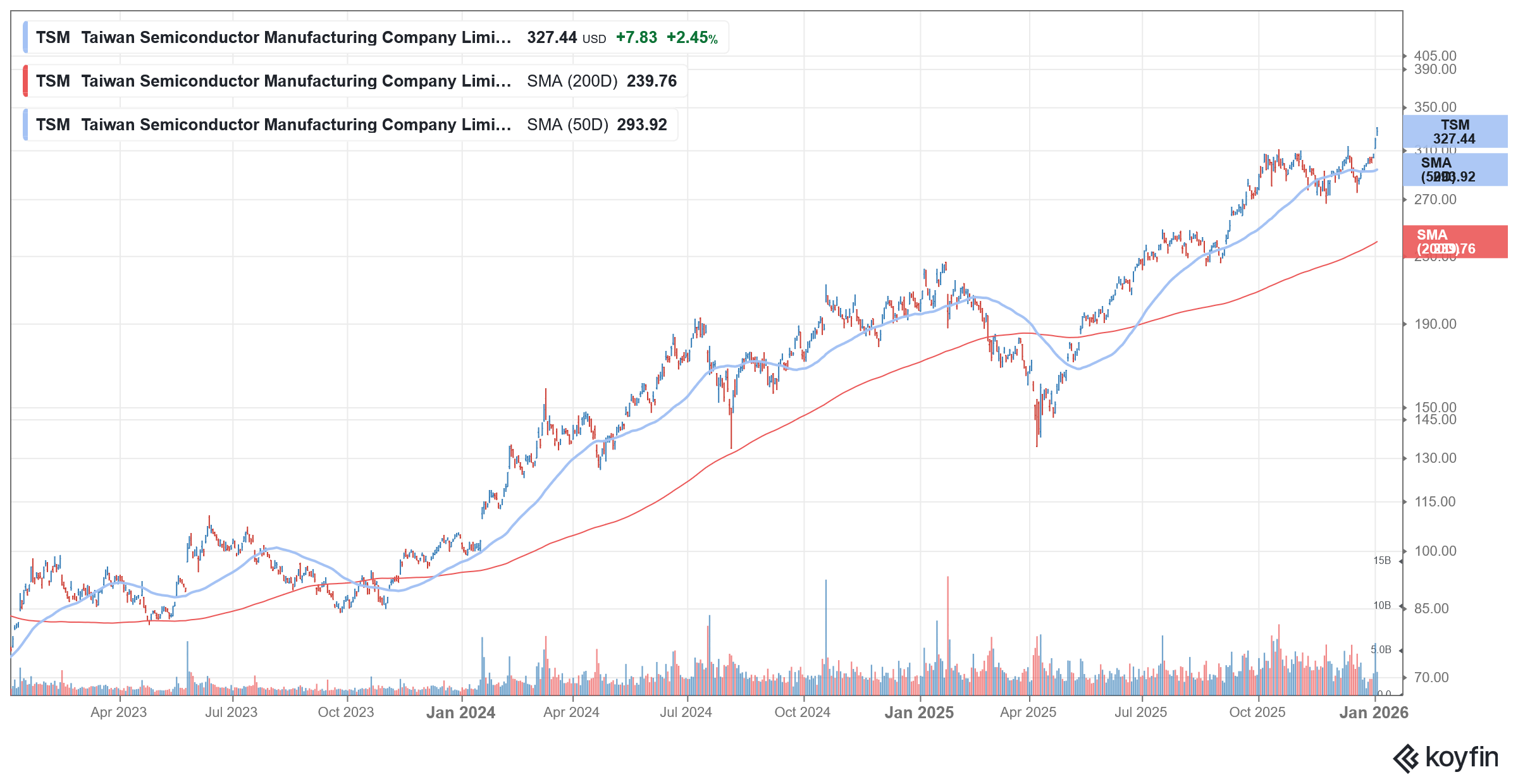

TSMC shares rose to a record high today after Goldman Sachs raised its target price to NT$2,330, citing yet another year of strong growth for the chip manufacturing company amid the artificial intelligence (AI) boom.

Goldman analysts, led by Bruce Lu, argued that the market is still underestimating the structural shift caused by AI

Goldman Sachs raises its target price on TSMC

The brokerage gave the following rationale for raising TSMC’s target price.

- Capacity Tightness through 2027: Goldman expects demand for 3nm and 5nm wafers to remain “fully loaded.” They cite “exponential growth in token consumption” (the processing power required for large language models) as the primary reason silicon demand consistently outstrips supply.

- Dominance in Advanced Packaging: The report highlighted CoWoS (Chip-on-Wafer-on-Substrate) technology as a critical bottleneck. Goldman significantly raised its shipment forecasts for CoWoS to over 2.3 million wafers by 2027, reflecting massive demand from primary customers like Nvidia and Apple.

- Pricing Power & Margin Expansion: Despite the high costs of expanding manufacturing in Arizona, Japan, and Germany, Goldman believes TSMC’s pricing power will offset any dilution. They expect TSMC to implement price increases of 7%–8% for its most advanced nodes in 2026.

To keep up with demand from customers like Nvidia, Apple, and AMD, TSMC has been forced to increase its spending. For 2025, they targeted a capital budget of $40–$42 billion. Goldman Sachs estimates that this could scale even higher, reaching $150 billion over the 2026–2028 period as they prep for mass production of 2nm chips.

Other Brokerages Are Also Turning Bullish on TSMC

While Goldman Sachs’ target price is the new Street-high for TSMC, other brokerages have also been turning incrementally bullish on the company.

Morgan Stanley (led by analyst Charlie Chan) recently raised their target to NT$1,888. AI. They estimate that by 2029, AI chip foundry services will account for 43% of TSMC’s total revenue (approx. $107 billion). According to Morgan Stanley, TSMC remains “attractive” at 16x 2026 earnings, suggesting that even with recent rallies, the share isn’t yet in a “bubble” compared to historical tech peaks.

In a note last week, Bernstein said, “For leading-edge semiconductor, capacity from TSMC is the king.” While analysts, including Mark Li, wrote that 2026 “is still all about AI,” they said that investors should “focus on quality” given worries of a bubble.

However, JPMorgan has a cautious stance on TSMC. The firm’s concern isn’t demand, which they acknowledge is “insatiable,” but rather profitability at overseas fabs. They have cautioned that the costs of operating in Arizona and Germany could weigh on gross margins, potentially keeping them closer to 53%–55% rather than the 60%+ that Goldman is forecasting.

TSMC produces the bulk of AI chips globally

Notably, Taiwan, particularly TSMC, produces the bulk of AI chips globally. The strategic importance of semiconductors has increased as they are used in the production of many goods, ranging from cars to gadgets. The COVID-19 pandemic exposed the vulnerabilities in the global supply chain, and since then, several countries have been looking to onshore ship production.

As a cornerstone of the AI boom, semiconductors have surged in strategic importance. This rise, coupled with escalating geopolitical tensions, has placed a spotlight on the technological advantages of key players in the chip supply chain, such as TSMC and other industry leaders.

The Trump administration has been looking to increase domestic chip production and reduce reliance on imports from Taiwan. Taiwan is resisting pressure from the Trump administration to produce half of the chips it sells in the United States domestically. President Donald Trump has been pushing for the onshoring of chip production and wants TSMC to commit to increasing its manufacturing footprint in the country.

Trump reportedly pushed TSMC to invest in Intel

Previously, there were reports that Trump pushed TSMC to invest in Intel as part of the trade deal. TSMC is a competitor to Intel, and both companies use different technologies to produce chips.

Meanwhile, in August, the US government formalized an $8.9 billion investment in Intel, securing an approximately 10% equity stake. This funding is largely derived from grants originally awarded under the U.S. CHIPS and Science Act, which aims to bolster domestic semiconductor manufacturing. The investment is a clear indication of Washington’s commitment to ensuring a resilient, U.S.-based supply chain for advanced semiconductors.

SoftBank and Nvidia invested in Intel

Japanese technology investment group SoftBank Group also committed a $2 billion capital injection in August, further supporting Intel’s financial standing and turnaround efforts under CEO Lip-Bu Tan.

In September, Nvidia announced a $5 billion investment in Intel as part of a strategic partnership. The collaboration is focused on jointly developing multiple generations of custom data center and PC products, accelerating AI and accelerated computing applications by integrating NVIDIA’s NVLink with Intel’s CPU and manufacturing platforms.

US-China chip war

There has been an apparent AI chip war between the US and China, and the former has been looking to curb China’s progress in AI by restricting exports of advanced AI chips. However, there have been apprehensions that China has been circumventing the US ban through transshipments. The country is also looking at domestic companies to reduce its reliance on US companies.

In a major escalation, the Chinese government has reportedly issued directives requiring all state-funded data center projects to exclusively use domestically manufactured AI chips. Projects less than 30% complete have reportedly been ordered to remove any installed foreign-made chips or cancel pending orders.

This policy immediately benefits Chinese tech giants like Huawei (with its Ascend series), Cambricon Technologies, and Biren Technology, providing them with a guaranteed stream of high-volume orders necessary to scale production, improve their technology, and become cost-competitive.

TSMC to release earnings later this month

TSMC is scheduled to release its earnings later this month. The company’s financial performance was quite strong last year amid the demand for AI chips, and it revised its full-year 2025 revenue growth forecast upward to the mid-30% range in U.S. dollar terms. This was a significant jump from the earlier 20% growth projections made at the start of the year.

Question & Answers (0)