Nvidia and Advanced Micro Devices (AMD) have agreed to pay 15% of their China sales to the US government. This unprecedented arrangement is reportedly a condition for the companies to receive export licenses, allowing them to sell advanced artificial intelligence (AI) chips to the Chinese market despite existing export controls.

President Donald Trump confirmed the reports at his press conference yesterday and said that while he was pushing for a 20% revenue, he lowered it to 15% after negotiations with Nvidia CEO Jensen Huang.

Nvidia and AMD to pay 15% of their China sales to the US government

“We follow rules the U.S. government sets for our participation in worldwide markets. While we haven’t shipped H20 to China for months, we hope export control rules will let America compete in China and worldwide,” said Nvidia in its statement to media houses.

The company added, “America cannot repeat 5G and lose telecommunication leadership. America’s AI tech stack can be the world’s standard if we race.”

The US had clamped down on AI chip exports to China

Notably, the US, first under the Biden administration and then under the Trump administration, restricted the exports of high-power AI chips to China over national security concerns, fearing their dual military use. With Trump allowing H20 exports to China, many are questioning the national security implications.

“You either have a national security problem or you don’t,” said Deborah Elms, head of trade policy at the Hinrich Foundation. She added, “If you have a 15% payment, it doesn’t somehow eliminate the national security issue.”

Some lawmakers have been critical of allowing Nvidia H20 exports

Some US lawmakers also spoke against the US allowing Nvidia to export its H20 chips to China. John Moolenaar (R), the head of a House of Representatives panel on China, last month sent a letter to Commerce Secretary Howard Lutnick criticizing the move to allow H20 exports. The letter said, “The H20, which is a cost-effective and powerful AI inference chip, far surpasses China’s indigenous capability and would therefore provide a substantial increase to China’s AI development.

Similarly, a group of 20 security specialists also cautioned against allowing H20 exports to China, in their letter to Lutnick. The letter said, “Chips optimized for AI inference will not simply power consumer products or factory logistics; they will enable autonomous weapons systems, intelligence surveillance platforms, and rapid advances in battlefield decision-making.”

Trump plays down national security risk

Trump has meanwhile tried to allay fears over H20 exports to China being a national security issue and termed the H20 “obsolete” and an “old chip that China already has.” Referring to Nvidia’s advanced Blackwell chips, Trump said, “The Blackwell is super-duper advanced. I wouldn’t make a deal with that.”

He added, “That’s the latest and the greatest in the world. Nobody has it. They won’t have it for five years.”

China urges domestic firms to shun Nvidia H20

Meanwhile, Blomberg reported that China has asked domestic firms to shun the H20 chips, especially for government-related purposes. Previously, China’s Cyberspace Administration officials recently met Nvidia executives in Beijing over potential national security risks posed by the H20 GPU. The CAC said that it requested Nvidia “to clarify and submit relevant supporting documentation regarding security risks, including potential vulnerabilities and backdoors, associated with its H20 computing chips sold to China.”

As expected, Nvidia vehemently denied allegations of its chips having a “backdoor.” In its statement, the company said, “Cybersecurity is critically important to us. NVIDIA does not have ‘backdoors’ in our chips that would give anyone a remote way to access or control them.”

There has been an apparent AI chip war between the US and China, and the former has been looking to curb China’s progress in AI by restricting exports of advanced AI chips. However, there have been apprehensions that China has been circumventing the US ban through transshipments.

Earlier this year, there were reports that a draft rule from the US Commerce Department aims to tighten controls on shipments of powerful AI processors, such as those made by Nvidia, to these two Southeast Asian nations. The concern stems from the possibility that these chips, once in Malaysia or Thailand, could be rerouted or provide remote access to AI computing power for Chinese entities.

Nvidia fears Huawei will take its market share in China

Nvidia has said that US export control restrictions have “failed” and are instead counterproductive as they are spurring innovation in the country.

Huang has repeatedly stated that if the US restricts its own technology companies from operating in China, Huawei is well-positioned to fill that void. He believes that Huawei will effectively “have China covered” in terms of AI technology, building out its ecosystem. This highlights his concern that US sanctions, rather than hindering China’s AI development, might accelerate Huawei’s rise as a domestic alternative.

What do the new rules mean for Nvidia?

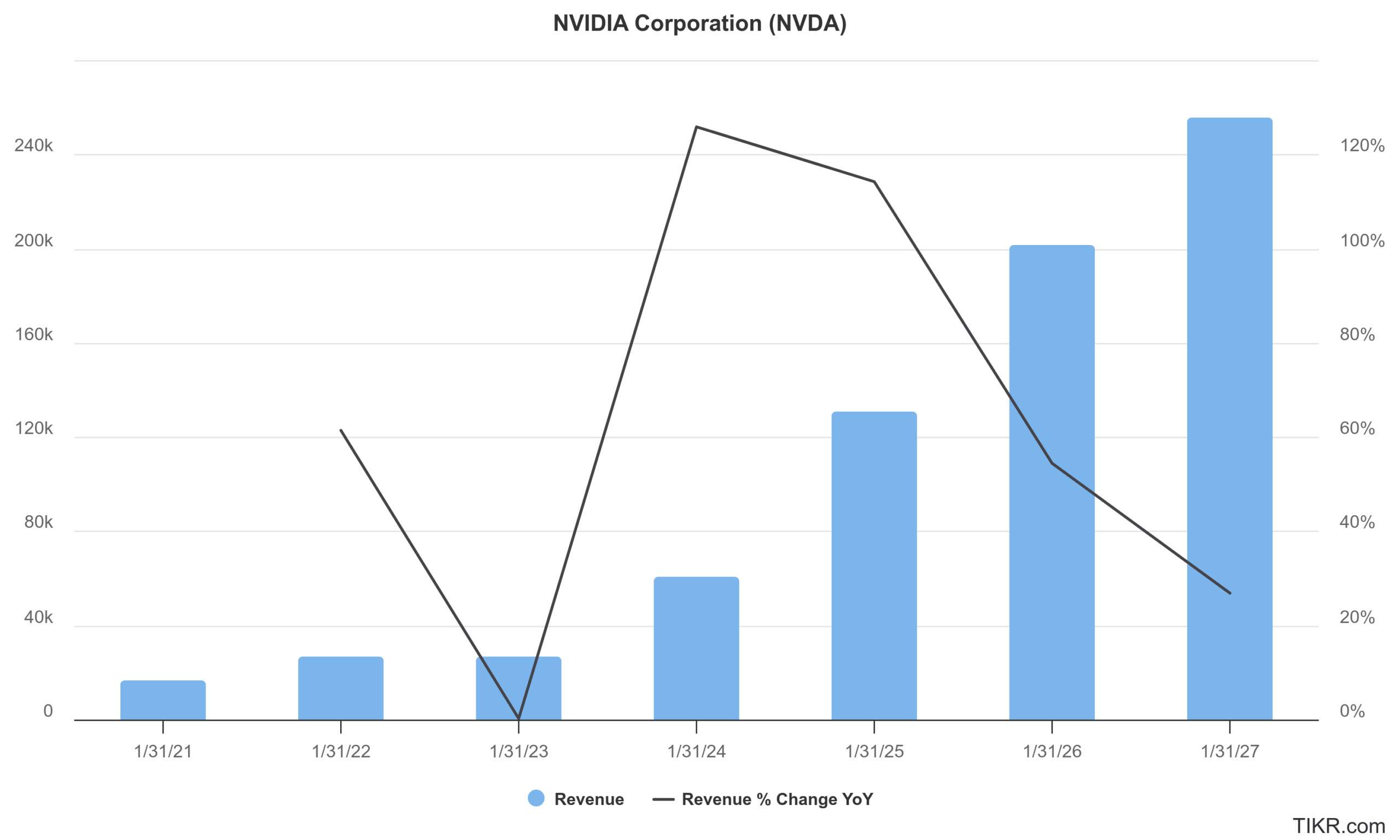

Nvidia has lost business in China due to US export restrictions. During their fiscal Q1 2026 earnings call in May, Nvidia CFO Colette Kress said that the company incurred a revenue loss of $2.5 billion in the quarter due to the H20 export ban to China and forecast a revenue loss of $8 billion in the second quarter.

“Losing access to the China AI accelerator market, which we believe will grow to nearly $50 billion, would have a material adverse impact on our business going forward and benefit our foreign competitors in China and worldwide.”

Parting with 15% of its China revenues would shave off billions of dollars from Nvidia’s sales, assuming the chip returns to the revenue run rate before the ban. Nvidia stock closed only slightly lower yesterday despite the news.

“From an investor perspective, it’s still a net positive, 85% of the revenue is better than zero,” Ben Barringer, global technology analyst at Quilter Cheviot, told CNBC.

Cheviot added, “The question will be whether Nvidia and AMD adjust their prices by 15% to account for the levy, but ultimately it’s better that they can sell into the market rather than hand the market over entirely to Huawei.”

Question & Answers (0)