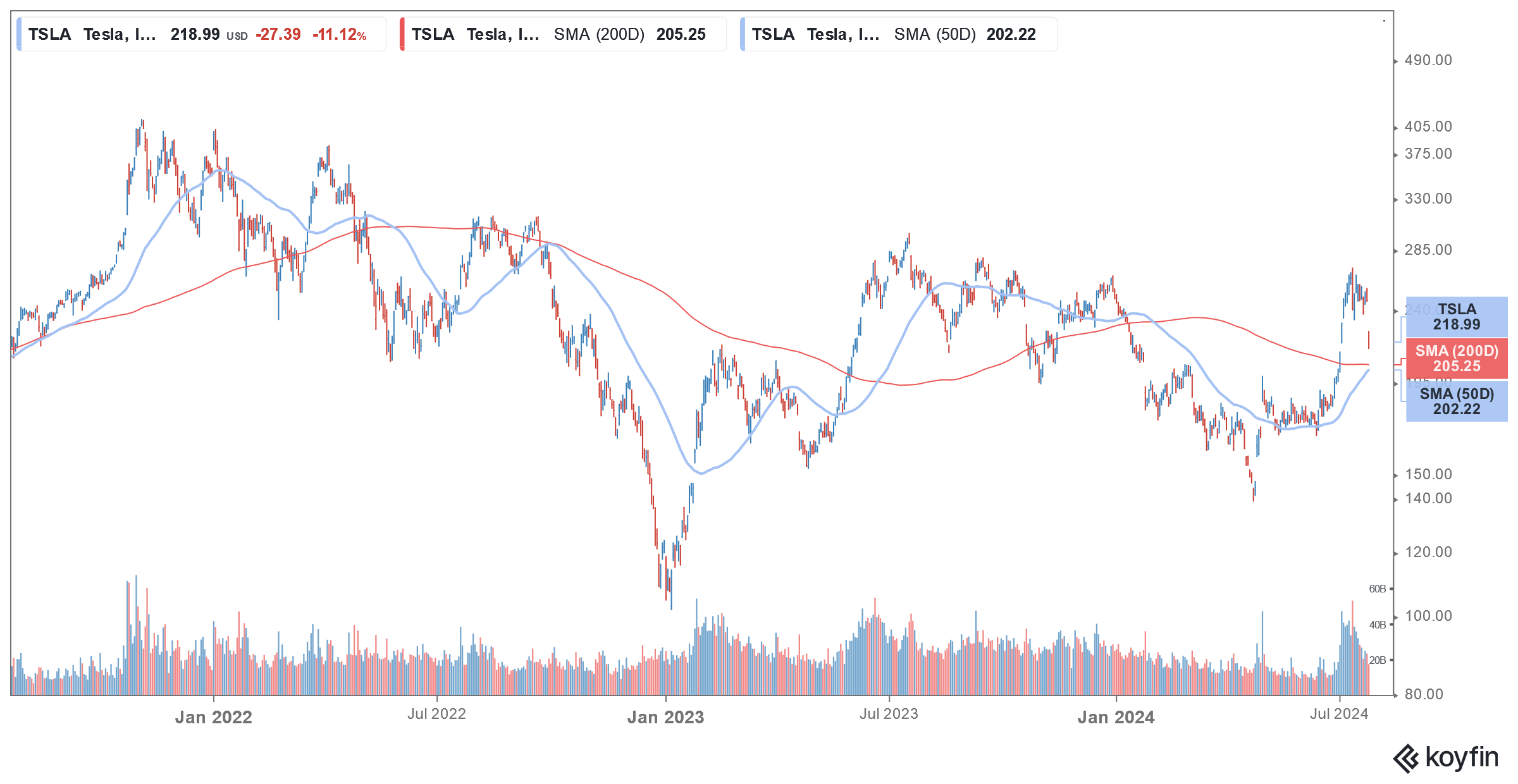

Tesla shares (NYSE: TSLA) are trading over 12% lower today after the company reported a mixed set of numbers for Q2 that failed to impress investors. Here are the key takeaways from the electric vehicle (EV) giant’s Q2 earnings.

Tesla reported revenues of $25.50 billion in Q2 which was 2% higher YoY and ahead of the $24.77 billion that analysts expected. Notably, the company’s revenues rose YoY despite a fall in shipments and price cuts. The revenue beat seems driven by higher sales of regulatory credit and record sales of the energy segment.

While Tesla remains the biggest seller of electric cars in the US by a margin, its market share has dipped below 50% in Q2 per a report from Cox Automotive. Notably, Tesla’s deliveries have fallen YoY for two consecutive quarters and the Elon Musk-run company has failed to boost shipments despite cutting prices.

Tesla posted mixed Q2 earnings

While Tesla’s Q2 revenues were ahead of consensus estimates, its adjusted EPS of 52 cents fell short of the 62 cents that analysts were expecting. The company’s operating margin was 6.3% which while being higher than the Q1 trough of 5.5% is still well below what it was posting about a year back.

Meanwhile, despite continued capex, Tesla posted a positive free cash flow of $1.3 billion in the quarter and ended Q2 with cash and investments of $30.7 billion.

Key takeaways from TSLA’s Q2 earnings

Musk said that the company has delayed the robotaxi unveil by two months and the event would now be held on October 10 as the company makes more improvements to the vehicle.

He added, “And we’re also going to show up a couple of other things. So moving it back a few months allowed us to improve the Robotaxi as well as adding a couple of other things for the product unveil.”

Commenting on the timeline of the first robotaxi ride, Musk said, “I would be shocked if we cannot do it next year.”

Commenting on the Optimus humanoid, Musk said these robots are already performing some tasks in Tesla’s factory and early next year the company should start limited production of production Version 1 which again would be deployed internally within the company.

He however added, “But we expect to have several thousand Optimus robots produced and doing useful things by the end of next year in the Tesla factories. And then in 2026, ramping up production quite a bit.”

Analysts react to Tesla earnings

RBC Capital Markets global autos analyst Tom Narayan said that if not for the regulatory credit, Tesla’s earnings would have looked a lot worse. He is also apprehensive about Donald Trump withdrawing the incentives for electric vehicles and said, “the bigger issue is if they go after the IRA (Inflation Reduction Act) in the $7,500 credit, that would be a problem.”

Commenting on the robotaxi, Narayan said, “I know they said it had some design issues, but I do wonder, and many investors wonder if it has to do with them trying to get regulatory approvals to launch a service similar to, let’s say, Waymo or Cruise have.

He added, “When they eventually unveil this, I think they’ll want details on timing, profitability, and they’ll want something within six months to a year, not ten years down the road.”

Tesla Bears See More Downside

Bernstein analyst Toni Sacconaghi who is among the biggest Tesla bears, maintained his underperform rating on Tesla. “Tesla’s auto business does not appear to have found a bottom in terms of margins, we continue to expect little to no growth in 2024 and 2025, and believe that in general growth stocks only work when they grow,” said Sacconaghi who has a $120 target price on TSLA.

Goldman Sachs analyst Mark Delaney who has a neutral rating on Tesla lowered the target price. In his note, he said, “Until Tesla is able to begin production of new lower cost models, which the company expects in 1H25, we believe pricing/incentives could remain a key demand lever and weigh on margin.”

New Street and Cantor Fitzgerald are among the brokerages that downgraded Tesla shares after the earnings report. “We see limited (and unreliable) valuation upside, and limited risks of material positive revisions on that time horizon,” said New Street analyst Pierre Ferragu in a note.

EV price war

EV demand hasn’t been as strong as markets expected prompting companies to readjust their production plans. For instance, both Ford and General Motors which have committed billions of dollars towards building EV plants are delaying their investments. Startup EV companies have been under even severe stress and are grappling with continued cash burn. Several startup EV companies have either gone bankrupt or are on the verge of doing so.

Tesla, which was once looking to grow deliveries at a CAGR of 50% over the long term has missed that milestone for two consecutive years.

While the company has been quite vocal that it would prioritize deliveries over margins, for now, it has been found wanting on both.

Question & Answers (0)