Standard Life Aberdeen shares are tumbling today in London stock trading activity. It follows the asset management firm reporting a strong drop in its profitability as fund outflows from 2019 weighed on the growth of its fee-based revenues.

By the end of its 2020 fiscal year, SLA saw its revenues fall by 13% as the amount of assets managed by the firm have been slashed recently, accompanied by a decline in the market value of financial securities worldwide amid the pandemic.

During this period, the firm’s total assets under management dropped to £534.6 billion, representing a 2% drop compared to 2019.

A portion of this drop is explained by a large scheduled withdrawal from Lloyds Banking Group (LLOY) and a shift to lower-fee asset management solutions and products from other clients.

Meanwhile, adjusted profits before taxes landed at £487 million, resulting in a 17% drop compared to 2019’s figure, with the company citing the revenue drop as the primary driver for this slide in its profitability.

The firm effectively distributed a total of 14.6p per share in dividends last year and expects to pay a similar figure to shareholders in 2021, representing a dividend yield of 4.8% based on today’s market price.

Despite this attractive yield, market participants seem to be reacting negatively to the report, as the price of Standard Life Aberdeen (SLA) shares are plunging almost 5% today at 302.6p per share.

SLA plans to unify its brand across its global network

One notable strategic initiative from SLA consists comes in the shape of the unification of its brand throughout its global network. As part of this effort, the firm has decided to sell its Standard Life brand to the Phoenix Group – a move that will also simplify the sale of its insurance business.

SLA is now preparing to launch a new brand that will represent all of its customer-facing operations, this being among the firm’s boldest moves lately to turn around its current situation.

Aside from this initiative, SLA’s Chief Executive Stephen Bird also aims to perform cost reductions across the firm’s three business segments, targeting a cost/income ratio of 70% by 2023.

The top executive highlighted that the firm’s strong capital is perhaps the most important variable in its favor, as it gives the business enough flexibility to perform these changes without endangering its solvency.

That said, the head of SLA warned investors that achieving these ambitious goals will result in a temporary increase in certain costs via restructuring expenses.

What’s next for Standard Life Aberdeen shares?

The market’s response to today’s announcements is not too encouraging, possibly reflecting a certain degree of skepticism among market participants as to SLA’s capacity to achieve these goals in a matter of three years.

One important element to take into account is the fact that the firm still has to prove that it can attract inflows from new customers, especially as SLA is increasingly relying on its largest client – the Phoenix Group – which accounted for almost 33% of the company’s assets under management.

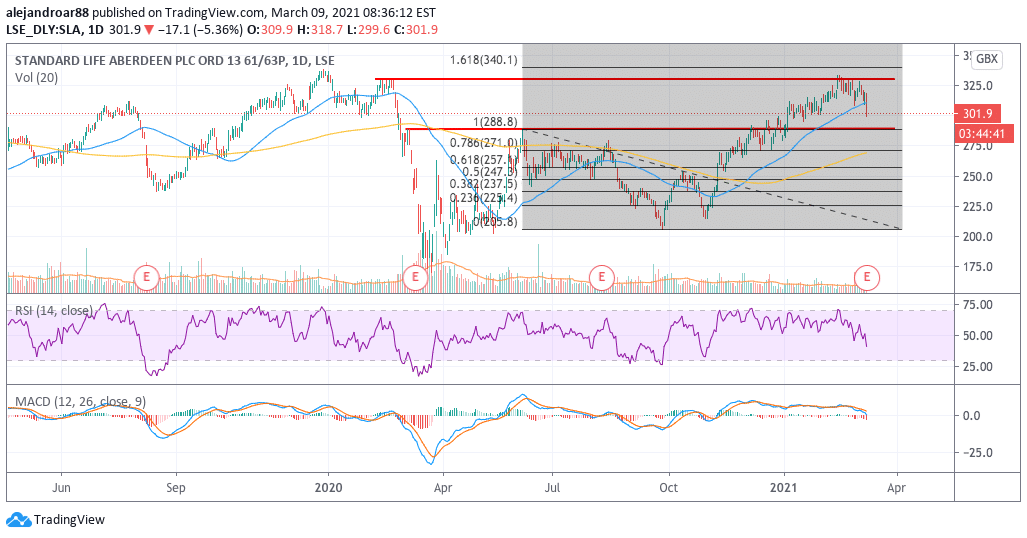

Meanwhile, from a technical standpoint, the short-term outlook for SLA shares seems overly bearish, with the stock price crossing below its short-term moving averages this morning while both the RSI and the MACD are currently on a downtrend.

The negative momentum could end up pushing the stock price to its June highs of 290p per share on short notice while a move below this level might signal the beginning of a sustained downtrend.

This level coincides with the stock’s 100-day moving average while the next threshold would be the 200-day moving average at 270p.

A move below these long-term averages seems unlikely at this point as the company’s financial solvency and performance remain decent despite some of these headwinds. Therefore, if the price were to move near or below those levels, traders could see that event as a buying opportunity – especially if one expects that the 2021 dividend of 14.6p will be distributed as expected.

Question & Answers (0)