The pound sterling is opening lower against the US dollar this morning, down 0.09% at 1.3029 so far during the European forex trading session, although it is gaining 0.13% against the euro at 1.1037.

The British currency is holding steady at the 1.30 level despite a negative backdrop that includes upcoming announcements from UK’s Prime Minister Boris Johnson about further lockdowns in the country as coronavirus cases continue to grow.

Meanwhile, a document from the Bank of England in which the financial institution asks banks if they are prepared to face the challenges of negative interest rates is also influencing today’s forex activity – although the question intends to address technological issues primarily rather than financial preparedness.

The coronavirus front continues to play a key role in shaping the value of the pound

Daily virus cases in the United Kingdom remain on the rise, with the country reporting as much as 17.5 thousand contagions – its highest daily tally since the pandemic started – on 8 October according to virus tracking website Worldometers.

Cases have been growing at an accelerated rate since early September, jumping from an average of 1,500 per day to 14,000 as of yesterday.

Deaths resulting from the virus have also seen an uptick in the past few weeks, growing almost 7-fold since the start of September, from 10 daily deaths to as much as 70.

Prime Minister Boris Johnson is expected to inform the House of Commons about a potential three-tier system that would qualify different areas of the country based on the severity of their outbreaks.

Depending on the graveness of the situation, different quarantine measures will be imposed, going from mild restrictions to potential business closures and travel halts.

Another wave of lockdowns has been long feared by investors, although it seems unlikely that such measures will extend to the degree of those imposed during the months of February and March – during the peak of the first wave of the pandemic.

Meanwhile, the pound sterling could see a sharper downturn if lockdown measures turn out to be harsher than expected, as they could ultimately lead to the need for more fiscal and monetary relief.

Are negative interest rates fully priced in the value of the pound?

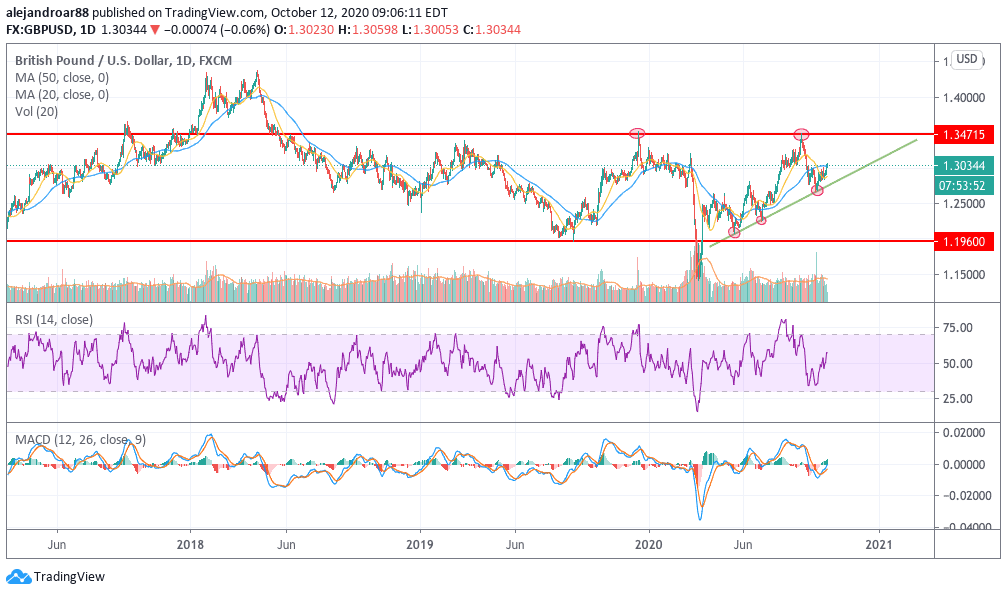

The pound sterling has been on an uptrend against the US dollar since its strong March rebound, as the US government has gone above and beyond in its effort to assist their domestic economy by injection trillions of dollars via fiscal and monetary stimulus.

The United Kingdom has been more conservative in this regard, which has created upside for the British currency – at least for now.

However, the prospect of negative interest rates along with an uncertain path in Brexit talks appears to be putting a lid on the value of the pound, as it has failed to climb above the 1.34 – 1.35 level during the year.

At this point, it is safe to say that market participants have already weighed a negative interest rate environment in their assessments, although the possibility of a no-deal Brexit may not be fully priced in.

It is important to note that the MACD oscillator for the GBP/USD pair has sent a buy signal already and it is also approaching positive territory – which means that there could be more upside ahead for the pound in the next few weeks as its positive momentum continues – possibly on the back of an upcoming stimulus bill from US Congress.

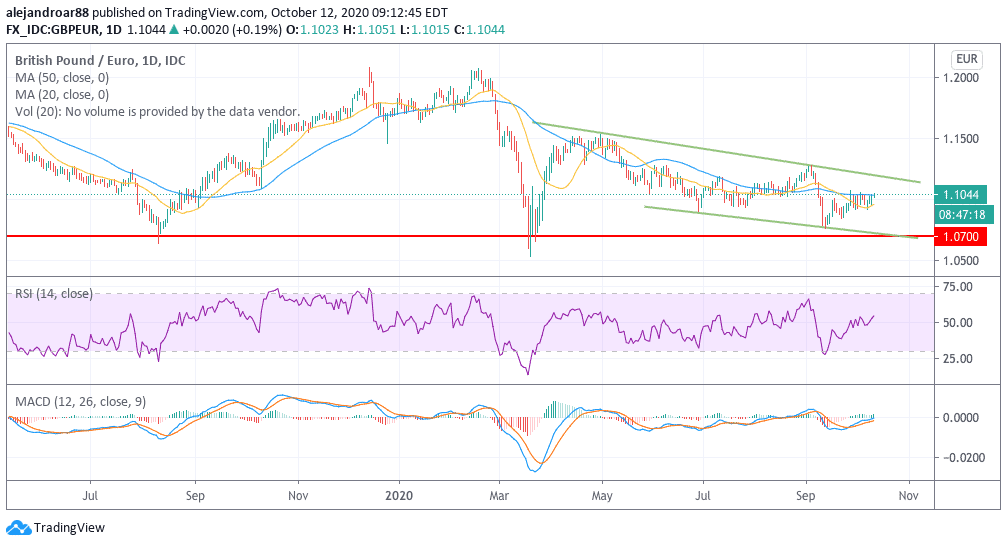

Meanwhile, the pound has also rebounded off the lower trend line seen in the chart against the euro, although it remains on a downward price channel. Given the uncertainties that still surround Brexit talks at the moment, it is hard to forecast where will the currency land in the next few weeks – although the MACD is also sending a buy signal on growing positive momentum.

Question & Answers (0)