Pets at Home Group (PETS) shares are taking a breather today, losing 2.5% at 380p after a positive trading update pushed the stock almost 28% higher yesterday on weaker technical indicators.

The company indicated increased momentum for its business during the second quarter of 2020, which resulted in double-digit like-for-like growth in its retail and veterinary assistance operations.

Pets at Home (PETS) management stated that they believe the business has been seeing a normalization in the demand for its products and services as the UK has progressively reopened its economy after pandemic lockdowns.

However, the materialization of a second wave of the virus in the country could still threaten the company’s short-term results, although the management still thinks that, despite those risks, the business will still manage to exceed the market’s profit outlook for the year.

David Madden, an analyst for CMC Markets, commented: “Demand for pets jumped on account of the lockdown so Pet At Homes services are likely to be in high demand for months ahead”.

Moreover, analysts from investment bank Liberum said: “Today’s update supports our view that Pets at Home looks set to be an overall COVID beneficiary, delivering one of the strongest recoveries we have seen since the initial disruption”.

Are Pets at Home shares overvalued at these levels?

According to Pets at Home trading update, the company expects to report a full-year post-IFRS pre-tax profit of £73m, which means the company is currently being valued at 20 times its pre-tax earnings.

That said, if we deduct the effect of taxes, that valuation multiple could go as high as 30, which is significantly higher than the 14 – 15 price-to-earnings ratio of the FTSE 100 index as a whole.

That comparison doesn’t necessarily indicate that Pets at Home shares are overvalued but it does reflect the significant optimism that market players are putting on the company’s future and even on its short-term outlook, considering the risks associated with the pandemic and especially now that virus cases have been spiking in the country.

Moreover, Pets at Home full-year earnings guidance – although positive – would not reflect a sustained improvement of its underlying business, as the company managed to turn higher levels of profitability during 2018 and 2019 and has actually shown a downtrend in its profit levels in the past three years.

Are Pet at Home shares a buy or a sell from a technical standpoint?

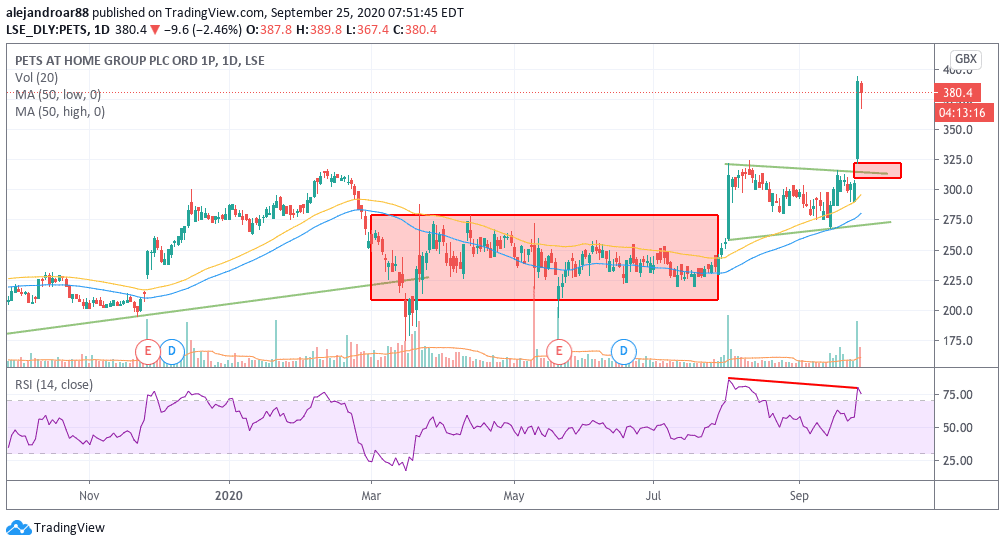

The latest price action in Pets at Home shares is showing weakness in the recent uptrend despite the fact that the stock has jumped significantly in the past few weeks, moving from 225p to almost 400p as of yesterday’s closing.

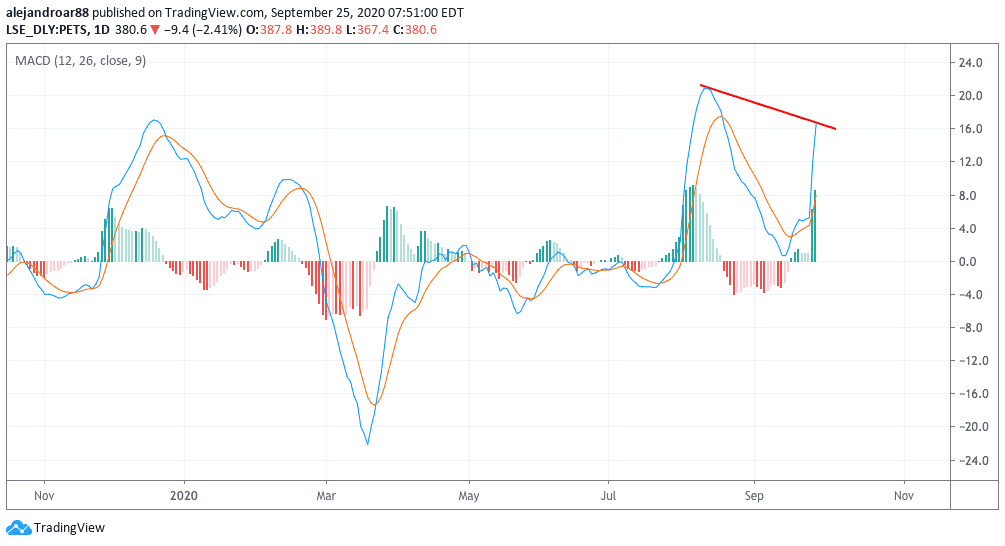

In this regard, the latest moves could have pushed the stock price too high too fast as indicated by the RSI and the MACD oscillators, both of which are posting lower highs despite the fact that the stock jumped roughly 30% in a single day.

This is creating a bearish divergence in both indicators, a trading signal that points to a potential upcoming drop in the price of the shares in the short run.

Moreover, the current valuation of Pets at Home seems to be a bit overstretched when compared to the market as a whole, especially in the context of a highly uncertain environment such as the one the UK is in right now.

Another bull run seems highly unlikely at the moment and history shows that PETS shares have performed negatively right after they have reached overbought levels.

Question & Answers (0)