Nvidia (NYSE: NVDA) was the most bought stock by retail investors in 2024, a position that Tesla held for the previous two years. Retail investors spent almost $30 billion on buying the chip designing giant this year amid soaring sales of its artificial intelligence (AI) chips.

According to Vanda Research, Tesla was the second most bought stock in 2024 with retail investors pouring nearly $15 billion into the company. Advanced Micro Devices was the third stock on the list of most 5 traded securities with retail investors putting in just under $10 billion into the chipmaker. SPDR S&P 500 ETF and Invesco QQQ Trust ETF were the other two securities on the list.

According to Marco Iachini, senior vice president at Vanda Research, “Nvidia turned out to be the one stock that kind of stole the show from Tesla because of impressive price gains.” Iachini added, “The performance speaks for itself.”

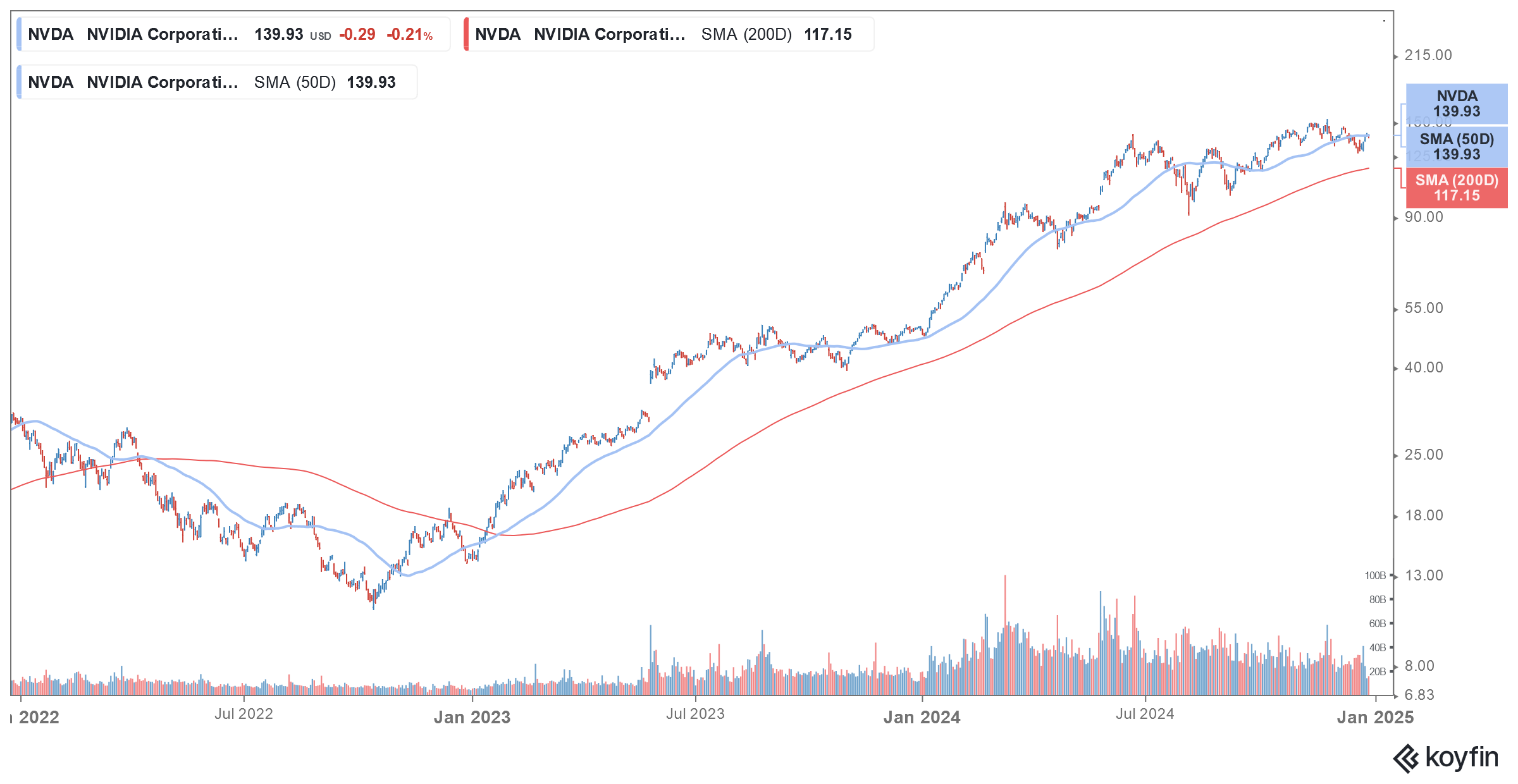

Nvidia shares skyrocketed in 2024

2024 was a pivotal year for Nvidia as it became only the third US company to command a market cap of over $3 trillion joining the league of Apple and Microsoft. It also briefly became the world’s largest company and is currently the second-largest enterprise behind Apple.

“Nvidia really stands out in terms of how quickly retail investors became such a big part of the ownership stake,” said Gil Luria, head of technology research at D.A. Davidson. Notably, Nvidia wasn’t on the list of the top 5 most traded securities in both 2021 and 2022. However, it was fourth on the list last year as retail investors bought into its AI story.

NVDA’s revenues and profits have skyrocketed over the last two years amid the nearly unending appetite for its AI chips. Nvidia has a dominant market share in the AI chip market and now gets the bulk of its revenues from selling these. Historically, the Gaming segment was Nvidia’s biggest segment but the Data Center segment which sells AI chips has now dwarfed that segment amid the stellar growth.

NVDA is the third-best-performing S&P 500 constituent

Nvidia is up around 182% this year and is the third-best-performing S&P 500 constituent behind Palantir and Vistara. It was the best-performing S&P 500 share last year as it saw a rerating amid the AI pivot. While many tech companies are still struggling with monetizing their AI investments, Nvidia is raking in billions of dollars selling its AI chips.

While a section of the market has been apprehensive about Nvidia and compares the AI euphoria to the dot com bubble, analysts are generally bullish on NVDA shares.

Bank of America named Nvidia a top pick for 2025

Bank of America analyst Vivek Arya named Nvidia a top pick for 2025. “In the first half, [artificial intelligence] investments and NVDA Blackwell deployments driven by US cloud customers sustain momentum in AI semis,” said Arya in his note.

He added, “However, in the 2H, interest could shift to less-crowded auto/industrial chipmakers on inventory replenishment and pick-up in auto production assuming a global economic recovery.”

Notably, during the fiscal Q3 2025 earnings call last month, Nvidia said that the demand for its Blackwell chips is stronger than what it had expected.

Brokerages see more gains in Nvidia next year

Morgan Stanley also shares the optimism and has NVDA as a top pick for 2025. “We have tended to be most enthusiastic on Nvidia when the near-term data points appear mixed, but underlying dynamics are very strong,” said analyst Joseph Moore. He added, “We think we are approaching that point now … there are a number of concerns here, some of which are overstated, some of which are anxiety inducing short term, but we believe irrelevant longer term.”

Wolfe Research also listed NVDA as its top idea for 2025 and said that it “remains one of our favorite names in semis as well as we expect its strong competitive position in AI will drive strong demand/pricing leverage for its datacenter [graphics processing units] over the next several years.”

Piper Sandler also named NVDA as its best idea for 2025 as brokerages expect the shares to keep rising in 2025 and continue their parabolic rally.

Competitors are coming up with AI chips

Meanwhile, while Nvidia has a dominant market share in the AI chip market other companies are also coming up with competing products. Amazon for instance offers Trainium2 and expects to launch Trainium3 next year. Among others, the ecommerce giant has signed up Apple as a customer for its AI chips.

While there are concerns over competition eventually catching up, the AI chip market is expected to stay strong. Phil Panaro of Boston Consulting Group predicts that Nvidia’s quarterly revenues will top $35 billion by the end of this decade which for context is higher than its full fiscal year 2023 revenues.

Nvidia’s revenues have been growing at a stellar pace and have jumped 6x between fiscal year 2020 and 2024. Not many companies of NVDA’s size have been able to grow their topline by that quantum.

However, while Nvidia has been beating estimates for the last few quarters the size of the beat hasn’t been enough to trigger massive rallies in its shares. In fact, there have been instances when the shares fell despite the earnings beat as markets expect “great” not “good” numbers from the Jensen Huang-led company.

Question & Answers (0)