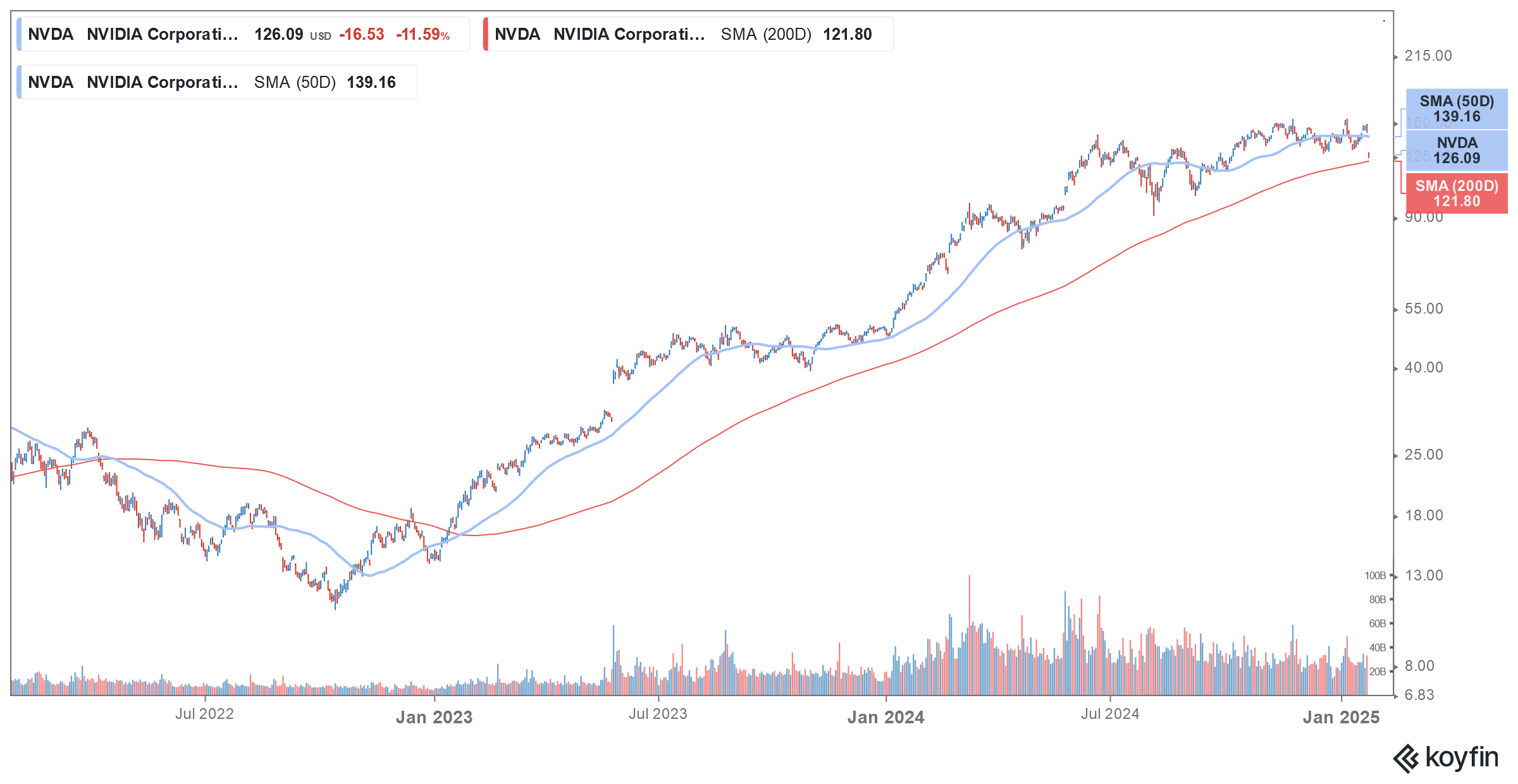

Nvidia shares are down sharply in early US price action today amid reports that Chinese artificial intelligence startup DeepSeek’s AI artificial intelligence (AI) model is offering a much better value proposition as compared to those from US giants like OpenAI that happen to be big buyers of Nvidia chips.

Nvidia shares have rallied handsomely over the last two years amid the AI pivot. The company’s AI chips have been in high demand and led to a sharp rise in its revenues and profits. Nvidia’s revenues have been growing at a stellar pace and have jumped 6x between fiscal year 2020 and 2024. Not many companies of NVDA’s size have been able to grow their topline by that quantum.

DeepSeek’s AI model triggers US tech sell-off

However, there are now concerns over the sustainability of these revenues as DeepSeek’s open-source model is offering models that are comparable to those offered by Western companies at a fraction of the price.

DeepSeek’s AI model also raises doubt over the dominance of US tech giants in AI models. Incidentally, the US barred exports of Nvidia’s high-end AI chips to China over concerns that they might also be used for military purposes. However, DeepSeek managed to achieve the feat despite US sanctions. We saw something similar with Huawei which not only survived US sanctions but has now emerged as Apple’s biggest competitor in the Chinese market. Meanwhile, tech names like Meta Platforms and Alphabet which are pouring billions of dollars every quarter towards their AI capex are trading sharply lower today.

Analysts on Nvidia shares

Wall Street analysts don’t seem too perturbed by DeepSeek’s AI model. Citi analyst Atif Malik maintained his buy rating on Nvidia. In his note, Malik said, “While the dominance of the US companies on the most advanced AI models could be potentially challenged, that said, we estimate that in an inevitably more restrictive environment, US’ access to more advanced chips is an advantage. Thus, we don’t expect leading AI companies would move away from more advanced GPUs.”

Cantor analyst CJ Muse advised buying Nvidia shares on the dip. “Following release of DeepSeek’s V3 LLM, there has been great angst as to the impact for compute demand, and therefore, fears of peak spending on GPUs. We think this view is farthest from the truth and that the announcement is actually very bullish with AGI seemingly closer to reality and Jevons Paradox almost certainly leading to the AI industry wanting more compute, not less,” said Muse on his note.

Bernstein analyst Stacy Rasgon also echoed similar views and advised investors to not buy the doomsday scenario. While Rasgon finds DeepSeek’s AI model “fantastic” she doubts if it was built for as low as $5 million as the company claims.

Roth Capital has a word of caution

However, Roth analyst Rohit Kulkarni had a word of warning, “Are U.S. companies (incl. Stargate) spending a bit too much on AI data centers? Yes, we are afraid so. We believe ‘necessity is the mother of invention’, and U.S. companies have likely fallen into the fallacy of access to unlimited capital…As 2025 progresses, we believe investors will begin to ask U.S. Big Tech hard questions on ways they are exploring to optimize AI capital intensity.”

Notably, US tech giants are spending heavily on AI and a big chunk of their capex is going towards buying Nvidia chips. Meta Platforms has already announced that it is increasing its capex to up to $65 billion in 2025 and more tech companies are expected to follow suit when they report their December quarter earnings.

Nvidia has a dominant share in the AI chip market

Meanwhile, while Nvidia has a dominant market share in the AI chip market other companies are also coming up with competing products. Amazon for instance offers Trainium2 and expects to launch Trainium3 next year. Among others, the ecommerce giant has signed up Apple as a customer for its AI chips.

While there are concerns over competition eventually catching up, the AI chip market is expected to stay strong. Phil Panaro of Boston Consulting Group predicts that Nvidia’s quarterly revenues will top $35 billion by the end of this decade which for context is higher than its full fiscal year 2023 revenues.

US tech shares fall

US tech shares, especially the “Magnificent 7” that include Nvidia, Apple, Amazon, Meta Platforms, Alphabet, Microsoft, and Tesla have been the biggest driver of the US market rally over the last two years. The S&P 500 Index posted over 20% gains in both 2023 and 2024 amid the tech rally.

However, the rally in US tech shares, including Nvidia is getting tested now as DeepSeek’s AI model could change the landscape for AI models.

As Charu Chanana, chief investment strategist at investment platform Saxo said, “U.S. tech companies are trading at premium valuations, with major AI players like Nvidia, Microsoft, and Alphabet commanding forward [price-to-earnings] multiples far above historical averages.”

Chanana added, “With these stocks priced for perfection, even minor disruptions, such as DeepSeek proving advanced AI can be built without top-tier chips, could weigh heavily on share prices.”

All said, while DeepSeek’s AI model has led to a US tech sell-off with Nvidia shares down in double digits in early trade, it might also further ignite the US-China AI war. The world’s two biggest economies have been fighting for AI dominance and while so far the US seemed to have the upper hand, DeepSeek’s AI model shows that the race is still wide open.

Question & Answers (0)