Leading Chinese electric vehicle (EV) companies have released their September deliveries. While NIO and Xpeng Motors delivered a record number of EVs in the month, BYD reported a yearly fall in shipments, its first since March 2024. Here are the key takeaways from Chinese EV companies’ September deliveries.

NIO delivered record EVs in September

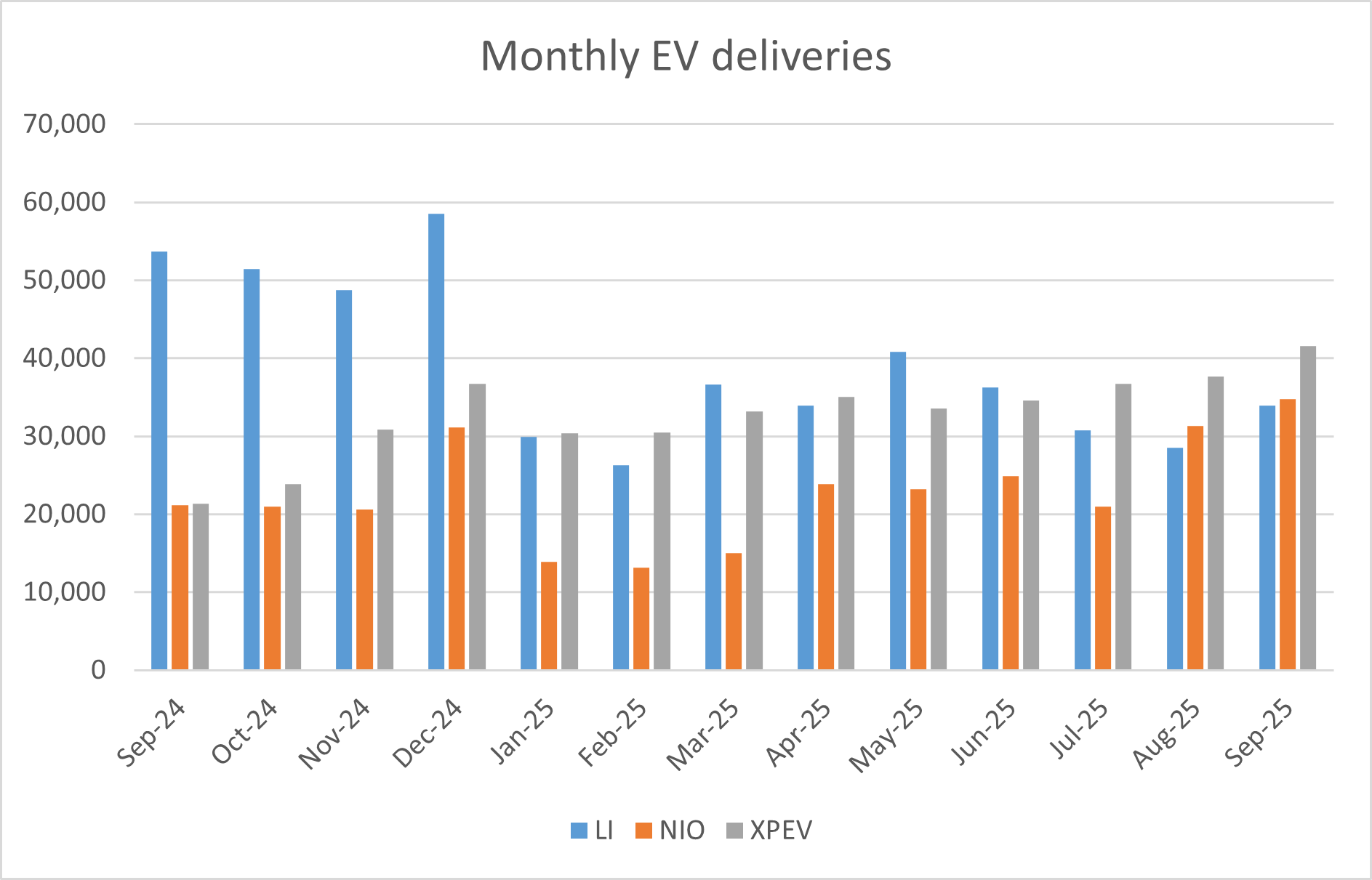

NIO reported a new monthly delivery record of 34,749 vehicles in September, marking a substantial increase of 64.1% year-over-year. This was the second consecutive month that the company set a new record, which helped propel its quarterly deliveries to a record high of 87,071 vehicles.

The record was largely fueled by its newer, more family-oriented ONVO brand, which delivered 15,246 vehicles, surpassing the deliveries of the premium NIO main brand (13,728 vehicles) for the first time in a quarter. The small, high-end FIREFLY brand also contributed with 5,775 deliveries.

The company’s cumulative EV deliveries stood at 872,785 at the end of September.

Xpeng Motors delivered a record number of EVs in Q3

Xpeng also achieved a significant milestone, delivering a record 41,581 EVs in September, a jump of approximately 95% year-over-year. It was the third consecutive month that it posted record deliveries, and the September figure marked the first time the company surpassed the 40,000 monthly delivery mark.

Xpeng Motors deliveries have been quite strong this year, led by the success of new models like the Mona M03. In the first nine months of the year, its EV deliveries increased over threefold to 313,196 units, while cumulative deliveries surpassed the milestone of 900,000 units. Based on the sales momentum, the company appears on track to reach 1 million units in cumulative sales by the end of this year.

Xpeng’s EVs are gaining traction in global markets

Xpeng Motors is expanding aggressively in the global market, and last month, CEO He Xiaopeng said that it plans to launch its mass market Mona brand outside the Chinese market in 2026.

Speaking with CNBC, He said, “In 2026 you can expect a variety of Mona products launched into the Chinese and European markets, as well as in the rest of the world.”

The Xpeng CEO added, “I believe by then, what we launch will be very proven and very excellent vehicles.”

Xpeng Motors plans to expand its presence in 60 countries by the end of 2025, a goal He said the company has already met. Notably, Chinese EV companies have been able to expand globally despite facing tariffs in several countries. Europe is a case in point here, and despite the E.U. tariffs, Chinese EV companies now outsell Tesla, which has been present in that market for much longer and even has a Gigafactory in Germany.

European buyers are shunning Tesla EVs

Tesla’s sales have been falling sharply in Europe in recent months as many buyers have shunned Tesla vehicles due to CEO Elon Musk’s political activities, in particular his support for far-right politicians pretty much across the world, including in Europe.

Meanwhile, Xpeng Motors has touted the possibility of acquiring other EV companies, and in the CNBC interview, He said, “I think if we have the opportunity, then we want to acquire some companies.” He added, “For us, it’s a good thing to do. Manufacturing companies and EV companies are always possible.”

Notably, given the EV industry turmoil, several companies have gone bankrupt. However, many of them have manufacturing assets that can be utilized by other automakers. For instance, Lucid Motors acquired some assets from Nikola that went bankrupt amid burgeoning cash burn.

Li Auto’s deliveries continue to fall

Li Auto’s sales, meanwhile, continued to plummet and fell 37% YoY to 33,951 units in September. The company’s sales have disappointed in recent months, and while at its peak, Li Auto was selling more cars than NIO and Xpeng Motors combined, its deliveries trailed both these companies individually last month.

The Zeekr Group, which includes both Zeekr and Lynk & Co brands, delivered 51,159 vehicles in August, a YoY rise of 8.5%. Specifically, the Zeekr brand delivered 18,257 vehicles, while the remaining deliveries were for Lynk.

Notably, Zeekr, which went public last year, is merging with its parent Geely Motors, and the transaction is expected to be completed in the current quarter.

BYD reported a fall in deliveries

Meanwhile, BYD, which is the world’s biggest seller of new energy vehicles (NEVs), delivered 396,270 NEVs in September, 5.5% lower than the corresponding month last year and the first monthly decline since March 2024.

The decline was led by a 25% decline in plug-in hybrid vehicle (PHEV) sales, whose deliveries came in at 188,010. A saving grace was a 24.3% YoY rise in battery electric vehicle deliveries, whose sales came in at 205,050.

BYD expected to sell more EVs than Tesla in 2025

While BYD’s overall sales have been tepid, its BEV sales have been strong, and the company looks to grab the title of the world’s largest seller of EVs from Tesla this year.

Berkshire has exited BYD

Notably, in a move that marks the end of a legendary investment chapter, Berkshire Hathaway has fully sold its stake in BYD, a holding that grew from a modest initial investment into one of the conglomerate’s most profitable international wagers.

The divestment, which began in 2022 and concluded recently, brings to a close a 17-year-long partnership that was a testament to the foresight of the late Charlie Munger, Warren Buffett’s long-time business partner.

Berkshire’s journey with BYD began in 2008, when the company was a relatively unknown battery manufacturer. At the urging of Charlie Munger, Berkshire invested $230 million for 225 million shares, acquiring a 10% stake in the Shenzhen-based company. While the move seemed out of character for Buffett’s typical investment playbook, Munger defended it, calling BYD founder Wang Chuanfu a “damn miracle.”

That assessment proved remarkably accurate. Over the next decade and a half, BYD’s shares surged by thousands of percent, as the company transformed into a global powerhouse in electric vehicles and batteries. The original $230 million investment swelled to a peak value of nearly $9 billion, delivering an extraordinary return that underscored the brilliance of the initial call.

Berkshire’s decision to exit was not abrupt. The company began trimming its position in August 2022, capitalising on a significant run-up in BYD’s stock price. The sell-down was gradual, and by mid-2024, Berkshire’s holdings had fallen below the 5% disclosure threshold in Hong Kong, allowing subsequent sales to go unreported. The final confirmation of the full exit came from a quarterly filing by Berkshire Hathaway Energy, which listed the value of its BYD stake as zero as of March 31, 2025.

Question & Answers (0)