Netflix shares were trading sharply lower in the US premarket today after it reported tepid subscriber growth in the first quarter of 2021, even as its topline and bottomline came in ahead of estimates.

Netflix reported revenues of $7.16 billion in the quarter, which was slightly higher than the $7.13 billion that analysts were projecting. The revenues increased 24.2% in the quarter and the growth rate improved from the 21.5% and 22.7% topline growth that it had reported in the previous two quarters. The company’s sales in the first quarter increased in line with the guidance provided by the management.

Netflix earnings beat estimates

Netflix reported diluted EPS of $3.75 in the first quarter of 2021 as compared to $1.19 in the fourth quarter of 2020 and $1.57 in the first quarter of 2020. The metric was far ahead of the $2.97 that analysts polled by Refinitiv were expecting.

Meanwhile, despite beating on both the topline and the bottomline performance in the quarter, its all-important subscriber growth numbers were way below estimates.

Netflix reports tepid subscriber growth numbers

The streaming giant added 3.98 million global paid subscribers in the quarter, which was lower than the 6.2 million that analysts were expecting and also below the 6 million that the company had projected previously. The subscriber growth fell sharply during the quarter and the company had 207.64 million paying subscribers globally at the end of March.

“We believe paid membership growth slowed due to the big Covid-19 pull forward in 2020 and a lighter content slate in the first half of this year, due to Covid-19 production delays,” said the company in its release.

Meanwhile, the average revenue per membership increased 5% year over year in the quarter on a currency-neutral basis.

Netflix guidance was also tepid

Netflix expects to add just 1 million net paid subscribers in the second quarter of 2021, which would be the slowest growth that we’ve seen from the company in quite some time. It expects its revenues to rise 18.8% year-over-year in the second quarter and diluted EPS to almost double over the period. However, it expects its second quarter EPS to be lower than it reported in the first quarter.

Meanwhile, Netflix sees a stronger performance in the second half of the year. “We continue to anticipate a strong second half with the return of new seasons of some of our biggest hits and an exciting film lineup,” said the company in the release. It added: “In the short-term, there is some uncertainty from Covid-19; in the long-term, the rise of streaming to replace linear TV around the world is the clear trend in entertainment.”

Disney is reporting stronger comps

While Netflix’s growth rates have been falling, Disney, which has restructured its business to put streaming at the centre, has been reporting strong comps. During its investors day event in December, Disney announced aggressive plans to scale up its streaming service. It said that it expects Disney+ subscriber numbers to rise three-fold by fiscal 2024 to between 230-260 million. After accounting for Hulu and ESPN+ subscribers, the company expects to have been 300-350 million subscribers by the end of 2024.

Disney’s subscriber growth is rising fast

Disney reported 146 million subscribers in the fiscal first quarter of 2021. While being a late entrant to the streaming industry. The global subscribers for Disney+ were 94.9 million as of 2 January 2021. In contrast, Disney+ had 86.8 million subscribers as of 2 December and 73.7 million at the end of September. While Disney has the advantage of a lower base effect as compared to Netflix, it is slowly catching up with the company.

Competition is intensifying in the streaming industry

Meanwhile, competition is intensifying in the streaming industry and several mainstream and legacy companies such as Discovery are also betting on streaming. For its part, Netflix said that lower subscriber growth in the first quarter was not due to higher competition.

“We don’t believe competitive intensity materially changed in the quarter or was a material factor in the variance as the over-forecast was across all of our regions,” it said in the release.

In an apparent reference to many of the streaming peers that have low revenue per subscriber, Netflix said in the release, “When comparing services, subscriber figures alone tell only part of the story (given bundles, discounts and other promotions) so it’s important to also focus on engagement and revenue as key indicators of success.”

Netflix expects to be cash flow neutral in 2021

In the first quarter, Netflix generated free cash flows of $692 million as compared to $162 million in the corresponding quarter in 2020. Higher free cash flows were due to lower spending on content. Netflix expects to be nearly cash breakeven in 2021 and to turn free cash flow positive thereafter. The company does not see the need to raise capital to fund its operations.

Password sharing has been a big challenge for streaming companies like Netflix, as it leads to a loss of revenue from potential subscribers. During the earnings call, COO Greg Peters said the company is “making sure the people who are using a Netflix account are the ones who are authorized to do so.”

“We’ll test many things, but we’ll never roll something out that feels like turning the screws,” said Co-CEO Reed Hastings on the measures taken to stop the menace of password sharing. He added, “It’s got to feel like it makes sense to consumers, that they understand.”

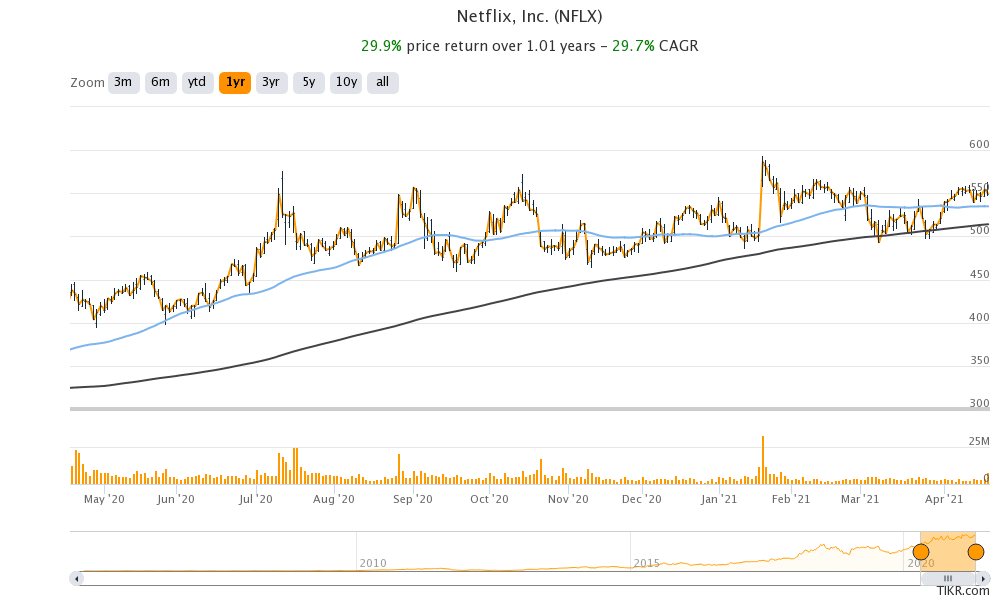

Netflix shares tumble

Netflix share was trading almost 8% lower in US premarket trading today at $506. The share has a 52-week trading range of $393.60-$593.29. The company has a market capitalisation of $243 billion and the share is trading at an NTM (next-12 months) enterprise value to EBITDA multiple of 8.5x. With growth rates slowing down and competition heating up in the streaming industry, Netflix may have a tough time justifying its high valuation multiples.

Question & Answers (0)