Chinese electric vehicle (EV) companies have released their November 2025 delivery numbers. Here are the key takeaways and the performance of some of the major players.

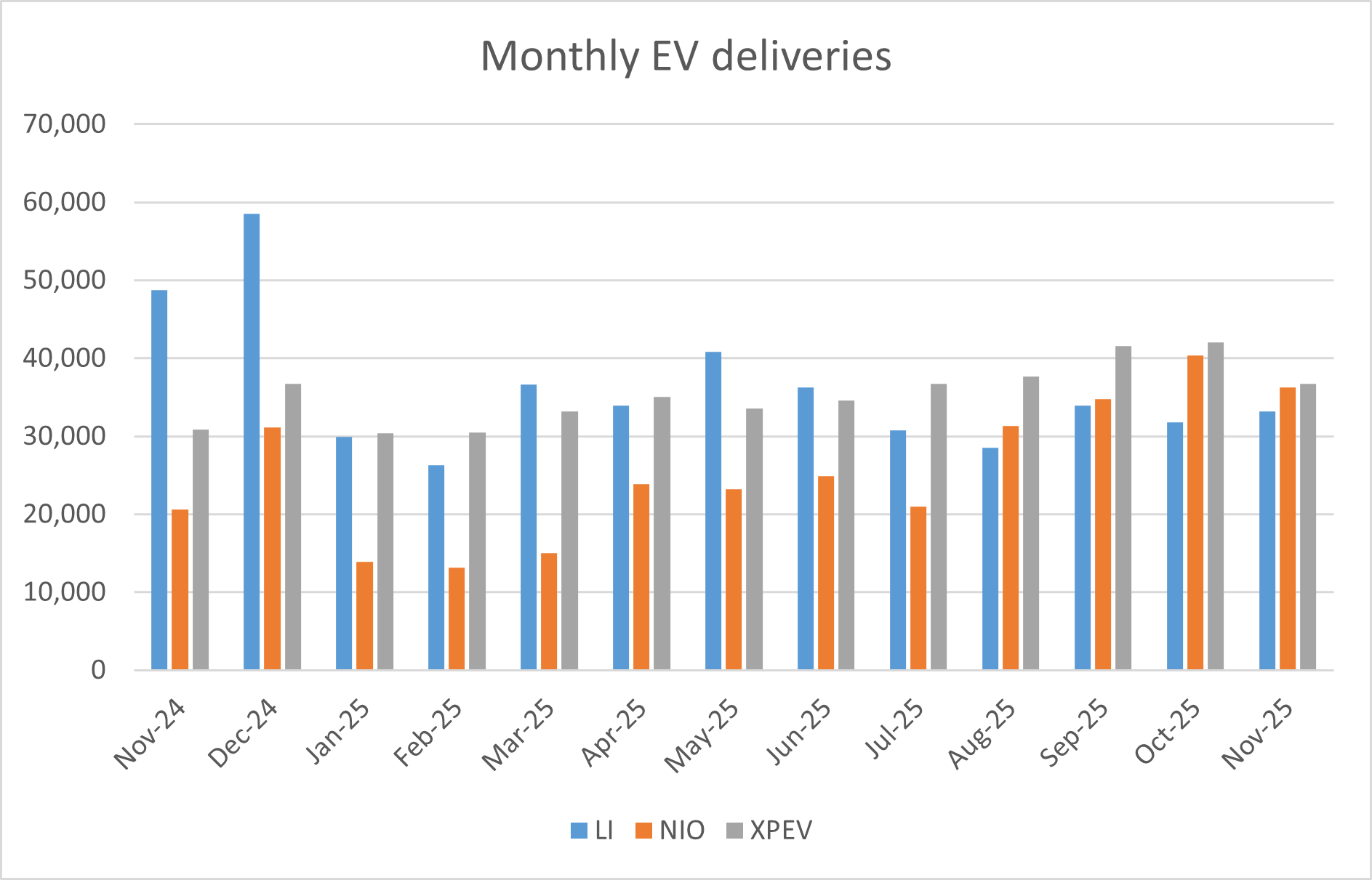

NIO reported 36,275 vehicles delivered across its three brands (NIO, ONVO, and FIREFLY). While this represents a robust 76.3% year-over-year (YoY) increase, it marks a significant sequential decline of approximately 10% from the record 40,397 units delivered in October. The company’s cumulative deliveries stood at 949,457 at the end of November

NIO lowered its Q4 delivery guidance

Notably, during their Q3 2025 earnings call, NIO lowered its fourth-quarter forecast to a range of 120,000 to 125,000 vehicles, down from an earlier target of 150,000 units. CEO William Li attributed the necessity of lowering Q4 guidance to an “unforeseen” drop in sector-wide orders following the phase-out of vehicle trade-in subsidies in certain Chinese cities. This headwind, affecting overall consumer demand, makes a massive December surge more difficult.

Meanwhile, to meet the low end of its guidance, it would need to deliver 43,328 EVs in December, which would be a new record high. NIO shares are trading lower today after the tepid delivery report. The shares fell after Q3 2025 earnings, even as vehicle margin dramatically improved to 14.7% (up from 10.3% in Q2 2025), reaching its highest point in three years. However, the Q4 delivery guidance cut more than offset an otherwise strong earnings report.

Xpeng Motors also reported a fall in EV deliveries

Xpeng Motors is also trading lower today as its deliveries also fell sequentially. The company delivered 36,728 EVs in November, up 19% YoY, which took its YTD deliveries to 391,937, while the cumulative deliveries were 982,338. Both NIO and Xpeng Motors are closing in on the 1 million cumulative delivery milestone and look set to hit that level in December.

While Xpeng Motors’ domestic EV sales were soft, its overseas deliveries are up 95% YoY in the first 11 months of the year, which is a massive vote of confidence in its globalization strategy. Xpeng has actively expanded into new markets across Europe, Asia, and Africa throughout 2025, seeking to diversify its revenue streams and reduce reliance on the increasingly competitive domestic market

Meanwhile, like Tesla, Xpeng Motors has also been positioning itself as an AI play, and last month it hosted its 2025 XPENG AI Day, showcasing breakthroughs in “Physical AI,” including VLA 2.0 (Intelligent Driving), Robotaxi, and the Next-Gen IRON humanoid robot. The company noted that its advanced driver-assistance system, XNGP, reached an 84% urban driving monthly active user penetration rate in November, demonstrating strong consumer adoption of its core technology.

Notably, Xpeng Motors CEO He Xiaopeng said that its autonomous software requires less human intervention than Tesla’s full self-driving (FSD). He added, “Next month, I will go to the U.S. to compare [Xpeng’s latest system] to FSD again.”

Xpeng Motors Doubles Down on Physical AI

Xpeng has announced it will open its proprietary, partly autonomous driving system to other car manufacturers globally. This pivot transforms Xpeng from solely a car seller into a technology platform, positioning it as a leading supplier of artificial intelligence for the future of mobility.

The significance of this announcement was immediately underscored by the revelation of Xpeng’s first major client: Volkswagen. The German automotive giant is set to integrate Xpeng’s advanced driver-assist technology into its upcoming electric vehicles for the Chinese market, starting in 2026. This collaboration extends an existing partnership between the two companies and marks the first time a major Western brand has licensed a full autonomous-driving system from a Chinese manufacturer.

Licensing the VLA system and its Turing AI chips opens up a lucrative business-to-business (B2B) revenue stream, diversifying the company’s income beyond just car sales. Partnering with an established global powerhouse like Volkswagen provides significant validation and credibility for Xpeng’s technology on the world stage.

Li Auto’s deliveries continue to underwhelm

Li Auto, meanwhile, continued to underwhelm and delivered 33,181 vehicles last month. The results indicate a slight sequential recovery month-over-month, but extend a six-month streak of year-over-year contraction, underscoring the intense competition and recent product challenges facing the premium Extended-Range Electric Vehicle (EREV) pioneer.

Geely’s group EV deliveries rose 12.3% to 102,602 units as it surpassed the monthly milestone of 100,000 EV deliveries. Group PHEV sales surged over 177% to 85,196 units, and the company cemented its position as the second largest new energy vehicle (NEV) seller in China after market leader BYD.

The Chinese EV market is very competitive

Notably, the Chinese EV market is quite competitive, and some of the tech companies have also pivoted to the growing industry. These include Xiaomi, which announced that its November 2025 deliveries once again exceeded the 40,000-unit threshold. This marks the third consecutive month that the company has maintained this high volume, successfully navigated market competition, and demonstrated strong manufacturing scale-up, primarily driven by the success of its models like the Xiaomi YU7 SUV.

BYD’s EV sales soar

BYD delivered 480,186 NEVs last month. This figure represents the highest monthly sales volume for BYD this year, demonstrating an 8.7% increase from October. However, it is the third consecutive month where the company’s deliveries have fallen on a yearly basis.

As has been the case for the last few months, EV sales were a bright spot in November, with BYD reporting almost a 20% YoY increase in shipments. However, the rise was more than offset by the 22.4% fall in PHEV deliveries.

Notably, Q3 2025 marked BYD’s first quarterly revenue decline in over five years, which was accompanied by an almost 33% plunge in third-quarter profit. In a clear sign of the mounting challenges, BYD had previously slashed its 2025 sales target by about 16%, from 5.5 million to 4.6 million units. This is the first time in years the company has reined in its ambitions.

In a move that marks the end of a legendary investment chapter, earlier this year Berkshire Hathaway disclosed that it has fully sold its stake in BYD, a holding that grew from a modest initial investment into one of the conglomerate’s most profitable international wagers.

The divestment, which began in 2022, brings to a close a 17-year-long partnership that was a testament to the foresight of the late Charlie Munger, Warren Buffett’s long-time business partner.

Question & Answers (0)