Chinese EV (electric vehicle) companies including Zeekr, NIO, Xpeng Motors, and Li Auto have reported their May deliveries. Here are the key takeaways from the reports and what they tell us about the health of the world’s largest EV market.

Zeekr which is backed by Geely went public in the US last month. It priced the issue at the top end of the guidance and issued more shares than initially planned.

The Chinese EV company sold 21 million shares in the IPO and raised $441 million from the offering. Geely, which also owns the UK’s Lotus and Sweden’s Volvo would continue to hold over a 50% controlling stake in Zeekr post the IPO.

Zeekr delivered 18,616 EVs in May, 114.5% higher than the corresponding month last year and 15.7% above April’s record 16,089 deliveries.

The company delivered 67,764 vehicles in the first five months of 2024, up 111.7% YoY. Its cumulative deliveries reached 264,397 at the end of May.

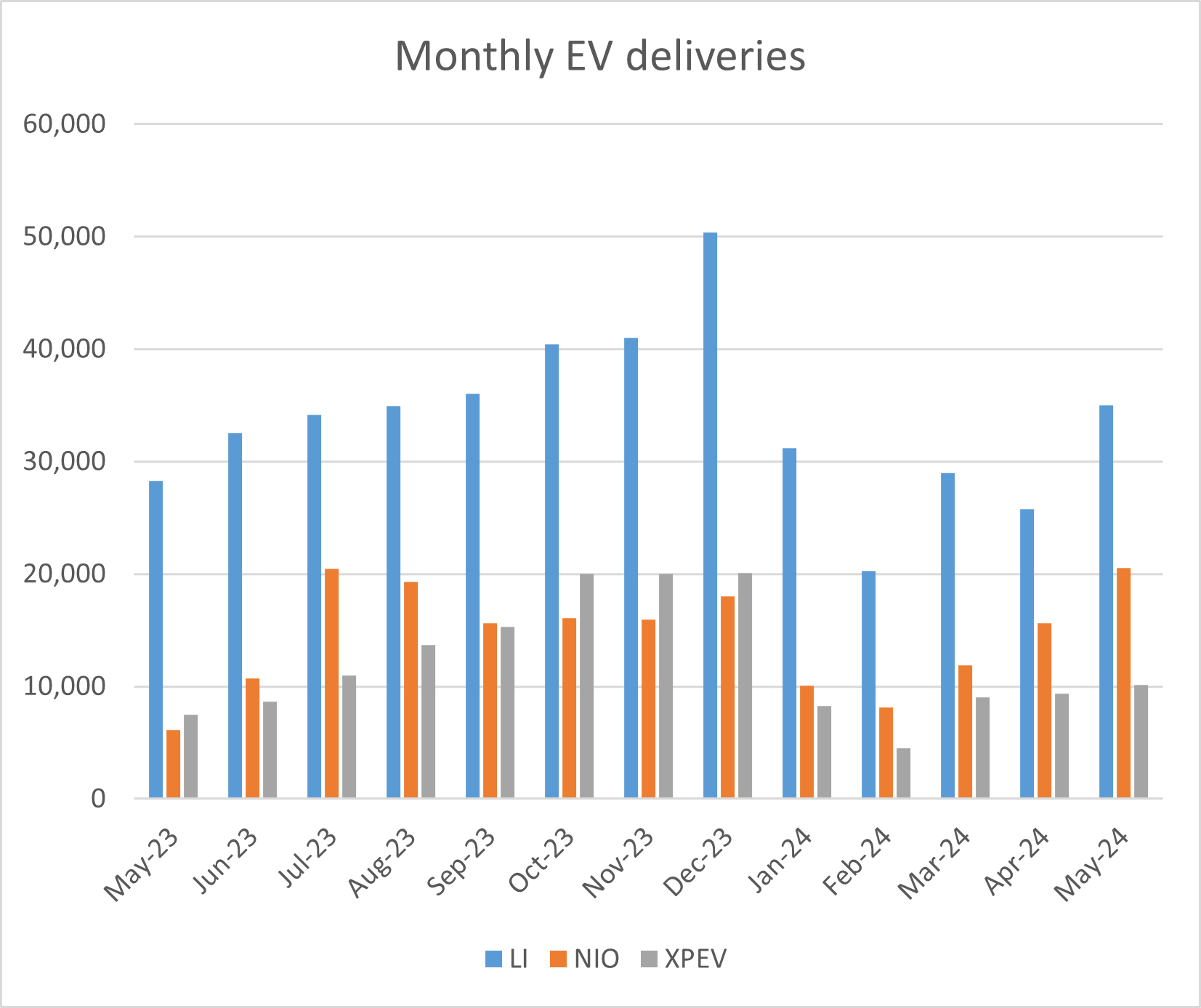

NIO’s deliveries reached a record high

NIO delivered 20,544 vehicles in May 2024, a YoY rise of 233.8% and a new monthly record for the Chinese EV company.

It has delivered 66,217 vehicles so far in 2024, which is 51% higher than the corresponding period last year. NIO’s cumulative deliveries reached 515,811 at the end of May and it hit the milestone of surpassing 500,000 cumulative deliveries.

NIO shares have crashed

Earlier this year, NIO shares fell to the lowest level since June 2020 amid the growing pessimism towards Chinese shares. Notably, 2020 was a pivotal year for NIO share and from surviving a bankruptcy scare in Q1 2020, the share went on to gain over 1,110%. The share hit their all-time high in early 2021 and its market cap topped $100 billion.

Since then, the share has been in a freefall, and after closing in the red for three consecutive years, it is down 36% in 2024 despite having rebounded from the lows. Other Chinese EV shares have also tanked amid the pessimism towards Chinese companies.

Xpeng Motors’ EV deliveries topped 10,000

Xpeng Motors delivered 10,146 EVs in May which was 35% higher than the corresponding month last year and 8% higher than the previous month. It was a 2024 high for the company and the first time this year that its monthly deliveries topped 10,000.

Its YTD deliveries have hit 41,360 which is 26% higher than the corresponding period in 2023. The company’s cumulative deliveries reached 441,671 at the end of May.

In its release, Xpeng Motors said, “In May, the monthly active user penetration rate of XNGP in urban driving scenarios reached 84%. Also, by May 2024, the accredited XNGP on-road test mileage by XPENG R&D team exceeded 6.46 million kilometers, bringing the Company closer to achieving XNGP’s full nationwide road coverage by the third quarter of this year.”

Xpeng Motors expects its EV deliveries to rise in the back half

Xpeng Motors expects its deliveries to rise in the back half of the year as it launches the low-cost model Mona in collaboration with Chinese ride-hailing giant Didi. It has also partnered with Volkswagen to produce EV models for the Chinese market.

Li Auto’s deliveries rose to 2024 high

Li Auto delivered 35,020 vehicles in May which was 23.8% higher YoY. Its cumulative deliveries reached 774,571 at the end of May. It has become the first Chinese new energy vehicle company to deliver over 700,000 vehicles.

In its release, it said, “Our market share in the RMB200,000 and higher NEV market continues to experience healthy year-over-year growth, expanding to 13.5% for the period between January to April and strengthening our top position among Chinese auto brands. We remain cognizant of the challenges we face and will proactively embrace changes, push the boundaries for growth, and continue to create better products and services for our users.”

Li Auto forecast deliveries between 105,000-110,000 in the second quarter. It already delivered 25,787 vehicles in April so the upper end of the guidance implies deliveries of 49,193 vehicles in June.

After a tepid response to its MEGA MPV – which was its first battery electric car – Li Auto has trimmed its 2024 delivery guidance to between 560,000-640,000.

BYD is yet to report its deliveries

BYD is yet to deliver its May delivery report. The Chinese auto giant delivered 313,245 vehicles in April. The company’s deliveries rose 49% YoY and 3.6% on a monthly basis. Its battery electric vehicle (BEV) sales were 134,465, down 3.9% as compared to March. However, plug-in hybrid vehicle (PHEV) sales rose 9.8% over the period to 177,583.

In Q4 2023, BYD became the biggest EV seller globally and snatched the crown that Tesla held for years. However, in Q1 2024, Tesla reclaimed the title despite reporting an 8.5% YoY fall in its deliveries.

The US has increased tariffs on EV imports from China

Last month, US President Joe Biden increased the tariffs on EV imports from China from 25% to 100%. Speaking at the VivaTech conference in Paris, Musk opposed these tariffs and said, “Neither Tesla nor I asked for these tariffs.” He added, “In fact, I was surprised when they were announced.”

Notably, China is the second biggest market for Tesla after the US. The company has a Gigafactory in Beijing which is regarded as the company’s most efficient plant.

Meanwhile, while Musk might not agree to tariffs being imposed on Chinese EVs (likely to remain in the good books of the Chinese leadership), countries globally are worried about Chinese EVs flooding their markets.

Chinese EV companies are especially facing the heat in Europe and the EU is contemplating imposing tariffs on imports of EVs from China.

Question & Answers (0)