Shares of London-based chemicals and sustainable energy company Johnson Matthey were trading lower in early price action today after the company released its earnings for the fiscal year 2021.

The company reported revenues of £15.6 billion in the fiscal year ended 31 March which it attributed to higher precious metal prices. However, the company’s operating profit fell 17% over the period to £323 million. According to Johnson Matthey, higher administrative expenses and higher impairment charges negatively impacted the operating profit despite higher revenues.

Johnson Matthey reported lower profits

The fall in operating profits also flowed through to the company’s bottomline and its EPS fell 20% in the year. Meanwhile, its operating cash flows increased by £171 million to reach £769 million. Higher operating cash flows were due to working capital management. The company is also considering a dividend hike and in July it will propose a final dividend of 50p which along with the interim dividend would take the total dividend for the year to 70p—26% higher than the last year. The dividend would imply a forward dividend yield of 2.23% which looks healthy.

Johnson Matthey is partnering with fuel cell companies

“Following a challenging first half, we recovered strongly in the second half helped by a strong recovery in our end markets and higher precious metal prices,” said Johnson Matthey CEO Robert MacLeod. He also added, “We began entering into partnerships to advance the commercialisation of eLNO and secured new customer wins in Fuel Cells.”

In a related piece of news, yesterday Johnson Matthey announced a partnership with US fuel cell company Plug Power. “The collaboration will focus on the development, validation and incorporation of JM’s advanced materials in Plug Power’s leading electrolyser systems. The companies will also investigate the development of a closed loop recycling system for the critical platinum group metals (pgm) used as catalysts in these systems,” said Johnson Matthey in its release.

Fuel cell shares spiked in 2020

Notably, fuel cell companies rose sharply in 2020 after Joe Biden’s election as the US president triggered a buying spree in all green energy shares. However, fuel cell shares including Plug Power have looked weak this year as markets have been apprehensive of the soaring valuations. Nonetheless, the outlook for fuel cell companies as well as other companies in the ecosystem looks positive even as Tesla’s CEO Elon Musk is not convinced about the future of fuel cells.

Johnson Matthey guidance

Coming back to Johnson Matthey earnings, the management sounded cautiously optimistic on the outlook for the fiscal year 2022. It said that “the current year has started well with a continuation of the strength seen in the second half of 2020/21.” However, it cautioned that “end market demand remains uncertain and subject to COVID-19 developments around the world, with the potential for supply chain disruption for some of our automotive customers.”

While the higher profit guidance looks positive, the commentary over automotive customers seems to be dampening sentiments.

Global chip shortage

It’s worth noting that the global automotive industry is grappling with a severe ship shortage which is also taking a toll on their suppliers also. Ford is possibly the worst affected by the chip shortage and America’s second-largest automaker expects to lose half of its second-quarter production due to the chip shortage. NIO also gave tepid delivery guidance for the second quarter amid the worsening chip shortage situation.

Johnson Matthey increased the 2022 capex budget

Johnson Matthey expects “low to mid teens growth in underlying operating performance at constant precious metal prices and constant currency” in the current fiscal year. It expects its capex at £600 million in the year. Commenting on the higher capex, Johnson Matthey said that “This reflects increased investment as planned into battery materials, which is on track and in line with previous expectations, investment in our pgm refineries to increase the resilience and capacity of these assets and investment in our hydrogen activities.”

Higher commodity prices

Both platinum and rhodium are expected to be in a supply deficit in 2021 which would support their prices in the medium term. However, higher prices for key raw materials including steel, PGMs, and copper is also leading to cost-push inflation for automakers.

Higher commodity prices, especially that of energy, are leading to higher inflation. Rising inflation and a possible tightening by central banks is arguably the biggest risk for share markets currently.

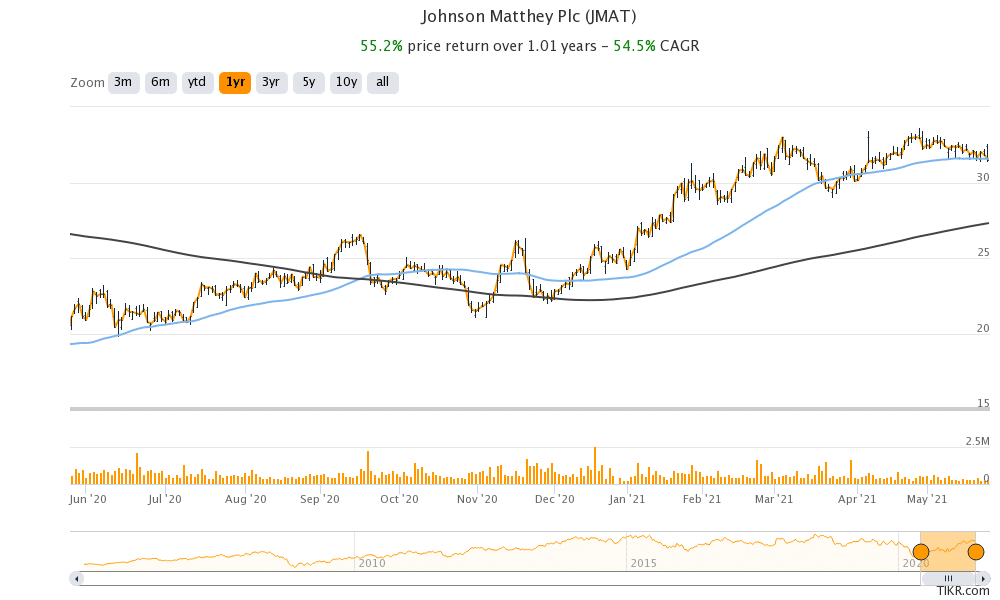

Johnson Matthey shares have gained almost 30% this year and are outperforming the FTSE 100 by a wide margin. The shares were trading 2% lower at 3,087p at 11 AM London time today even as the FTSE 100 was flat for the day. Johnson Matthey shares have a 52-week trading range of 1,978p-3,363p.

Question & Answers (0)