Tesla released its Q1 earnings on Tuesday after the close of market hours. Here we’ll look at the key takeaways from that report and how analysts reacted to Tesla’s Q1 earnings.

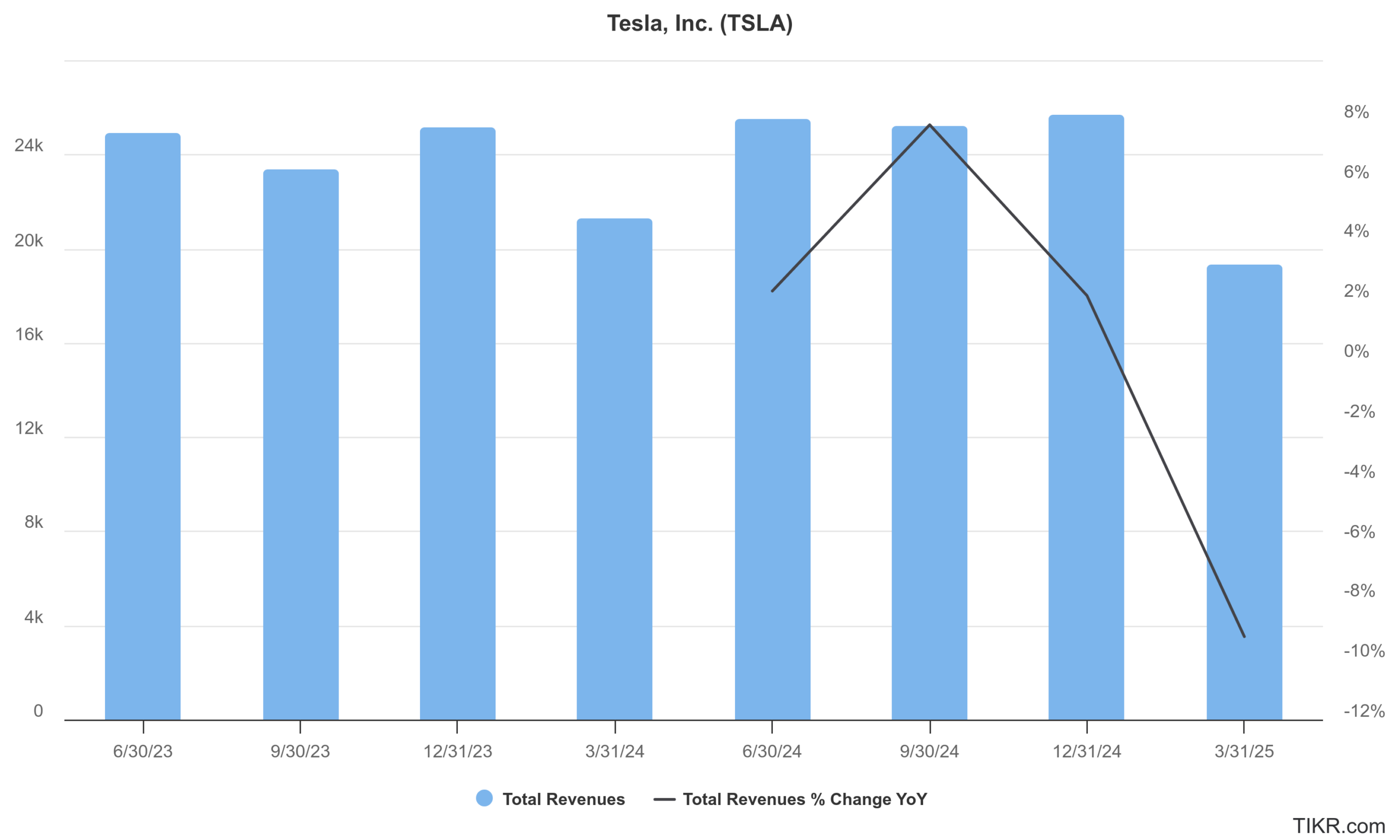

Tesla’s Q1 revenues plummeted 9% YoY to $19.34 billion. The fall in revenues is not surprising as the company’s shipments had tanked 13% in the quarter. Moreover, Tesla has been lowering car prices to spur sales which negatively impacted its average selling prices. Overall, Tesla’s automotive revenues fell 20% in the quarter.

Tesla’s Q1 revenues trailed estimates

Tesla’s Energy segment posted revenues of $2.73 billion in Q1, which was 67% higher than the corresponding quarter last year. Moreover, Tesla said that the segment’s gross profit rose to a record in the quarter.

Services and other revenues totalled $2.64 billion in Q1, 15% higher YoY. The segment includes revenues from autonomous driving and full-self driving subscriptions which CEO Elon Musk believes will rise significantly in coming years.

Meanwhile, Tesla’s Q1 revenues fell significantly short of the $21.1 billion that analysts were expecting. Moreover, its per-share earnings came in at 27 cents, which was also below the 39 cents that analysts were modelling. However, despite missing on both the topline and bottomline, Tesla’s shares closed over 5% higher yesterday amid the sharp rise in US markets.

Musk to spend more time at Tesla

During the earnings call, Musk began his commentary by talking about his stint with President Donald Trump’s Department of Government Efficiency (DOGE) and the “blowback” for that association.

However, in what was reassuring for investors, Musk said, “So I think I’ll continue to spend a day or 2 per week on government matters for as long as the President would like me to do so, and as long as it is useful. But starting next month, I will be allocating far more of my time to Tesla. And now that the major work of establishing the Department of Government Efficiency is done.”

Long-time Tesla bull Dan Ives, who had slashed his target price days ahead of the report, termed Musk stepping back from DOGE as a “turning point” for the company. “Musk recommitting as CEO at Tesla and basically leaving his DOGE role over the next month is the biggest and best possible news Tesla investors could have heard last night,” said Ives in his report.

Ives, however, cautioned, “The brand damage caused by Musk in the White House/DOGE over the past few months will not go away just by this move and some of the damage will be stained forever in Europe and the U.S.,”

He, meanwhile, emphasized, “But this was the time to close one dark chapter and open a brighter one for the Tesla story with autonomous and robotics front and center.”

Tesla’s sales in Europe have plunged

Notably, while Tesla’s Q1 sales were weak pretty much across the regions where it sells its vehicles, the weakness in Europe particularly stands out and the company’s sales plunged in key markets last quarter. For instance, Tesla’s market share in France fell to 1.63% Q1 2025 as compared to 2.55% in the corresponding quarter last year. Similarly, its sales in key markets like Germany, Sweden, and Denmark fell by over half in Q1.

Commenting on Tesla’s weak sales in Europe, Ben Nelmes, chief executive of research group New AutoMotive, said, “Tesla’s weak numbers in Europe are the result of a combination of factors.”

Nelmes, who believes Musk’s support for far right parties including Germany’s AfD added, “The company has failed to develop models that can compete on price. On top of this, the CEO’s involvement in U.S. politics is alienating many consumers.”

JPMorgan says rise in Tesla’s shares not linked to its earnings

Meanwhile, JPMorgan, which is among the most bearish on Tesla believes that the rise in the shares post Q1 earnings release is disconnected to the financial performance, “The move higher in Tesla shares bore no relation whatsoever to the company’s financial performance in the quarter just completed or to its outlook for growth in the coming year,” said JPMorgan analyst Ryan Brinkman in his note.

Taking a swipe at Tesla and Musk, he added, “Perhaps it was management’s statement that it had identified an achievable path to becoming worth more than the world’s five most valuable companies taken together.”

“Or maybe it was management’s belief that just one of its products has by itself the potential to generate ‘north of $10 trillion in revenue,'” added Brinkman, referring to Musk’s comments about its Optimus humanoids.

Notably, Musk has made many bold predictions in the past, but most of these haven’t come true. For instance, in 2019, he talked about the possibility of a million robotaxis by the next year, which, in hindsight, we know did not happen.

The billionaire made a similar observation during Tesla’s Q1 earnings call and said, “I predict that there will be millions of Teslas operating fully autonomously in the second half of next year.”

Musk on FSD

Musk has made many predictions about Tesla reaching full autonomy, but the company’s full self-driving is still not L4 fully autonomous. Even in the robotaxi testing that’s set to begin in Austin this fall, Tesla would deploy remote operators for assistance.

The very name FSD (full self driving) has been contentious as the software is not fully autonomous as the name might wrongly suggest.

Analysts trim Tesla’s target price

Meanwhile, multiple analysts trimmed Tesla’s target price following the Q1 report. Goldman Sachs for instance cut the target price from $260 to $235 and said, “We still see downside risk to consensus estimates over the intermediate term given tariff costs and end demand considerations, and we lower our estimates to reflect reduced vehicle volumes (due to company comments implying new models planned to launch later this year may be less unique than we’d expected) and higher opex.”

Cantor also lowered Tesla’s target price from $425 to $355 and while it sees Musk spending more time at the company as a positive, it sees short term pressure on the shares. “Still, we become a bit more conservative in the near-term amidst global macro uncertainties, tariff impact on current and future demand (and on energy storage business), and some backlash in the consumer behavior/brand damage from Elon’s polarizing politics,” said Cantor analysts in their note.

CFRA downgraded TSLA

CFRA downgraded Tesla from a buy to hold while slashing their target price to $260. The brokerage believes that Tesla’s EPS might not reach 2023 levels by 2027. Notably, Tesla’s earnings have fallen amid the price war and its once industry leading operating margin fell to a mere 2.1% in Q1. Moreover, if not for the income from regulatory credits Tesla would have posted a net loss in the quarter.

Question & Answers (0)