European markets – as tracked by the pan-European STOXX 600 index – are heading to close the week with strong gains after economic sentiment readings surpassed analysts’ estimates for the month, while vaccinations in the eurozone continue to advance at a fast pace.

So far today, the German DAX Index and the French CAC 40 Index are leading the upticks on a regional scale as they are advancing 0.68% each at 15,507 and 6,481 respectively. Meanwhile, the Italian FTSE MIB and the United Kingdom’s FTSE 100 index – also known as the footsie – are also trading 0.3% higher.

Moreover, the STOXX 600 is trading 0.65% higher at 449.3 while surging to its highest levels on record while posting an accumulated 1.15% weekly gain.

The latest release of the European Commission’s sentiment readings showed that overall economic sentiment improved during May, with the indicator landing at 114.5 for the month – a figure that exceeded analysts’ estimates of 112.1 for the period while also resulting in a significant jump compared to last month’s reading of 110.5.

Sentiment in the services sector improved dramatically as well, with the indicator for this individual segment of the economy landing at 11.3 – up from a 2.2 reading the previous month while also surpassing economists’ forecasts of 7.5 for the period.

Meanwhile, most of the results from the monthly survey applied to the financial services sector showed that sentiment within this industry has improved significantly compared to a month ago.

Readings from financial institutions in regards to the evolution of expected demand, confidence about economic conditions, and overall assessment of the business situation all showed a positive outlook for the region for the coming months.

Financials leading the rally. Energy and materials lagging

A heat map of the STOXX 600 index shows that the financial sector is leading today’s uptick in the benchmark as it is advancing 0.93% so far in mid-day stock trading action followed by the technology and non-cyclical segment of the market. Meanwhile, energy and materials are capping the positive performance of the index as they are advancing slightly by 0.3% and 0.2% this morning.

Notably, shares of Nokia (NOKIA) are advancing 4.6% today at EUR 4.3 as the company has become a favorite among retail traders from the popular Reddit forum WallStreetBets. These so-called ‘meme stocks’ and potential short-squeeze plays have been in high demand for the week, with shares of AMC Entertainment (AMC) and GameStop (GME) – also WSB favorites – advancing as much as 160% and 48% respectively for the week based on pre-market quotes.

“Improving expectations underscore a rapid rebound in economic activity in the coming quarters as economies reopen”, said analysts from TS Lombard to Reuters this morning.

What’s next for European markets?

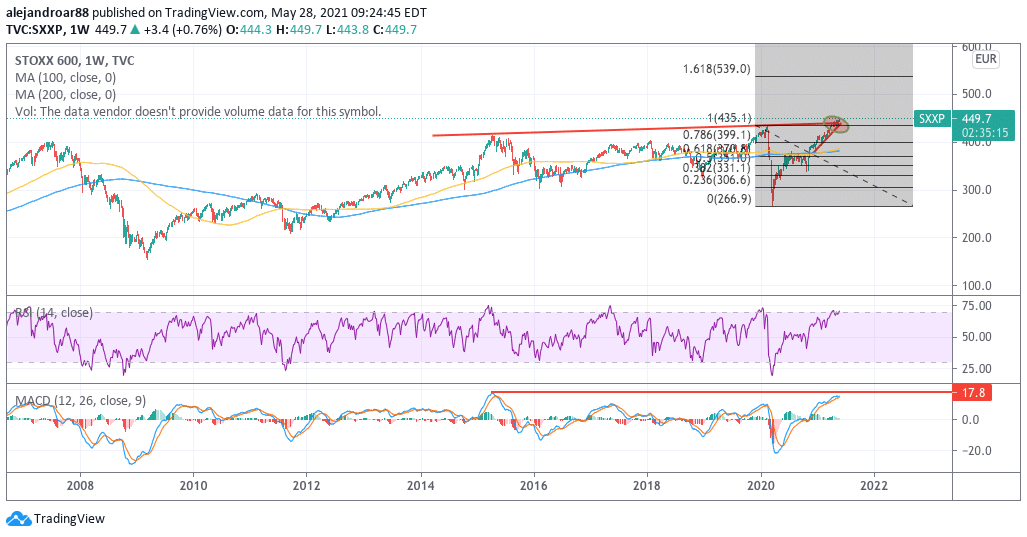

Using the STOXX 600 index as a potential gauge of the overall performance of European stocks we see that this break is particularly promising as it could result in the beginning of a bullish cycle for European stocks.

The weekly chart above shows that this break is coming on the back of a series of higher lows posted by the price action since the November vaccine-prompted uptick. This pattern reinforces the view that this could be a long-lasting break rather than a bull trap and this opens up the possibility for huge upside with a first target set at EUR 539 for SXXP.

Moreover, the weekly MACD is surging to its highest levels in roughly six years while the index’s long-term moving averages have just posted a golden cross.

The combination of these technical signals reinforce a bullish outlook for the index as Europe could start to play catch-up with American markets while traders could start to rotate toward foreign equities to ease their exposure to the lofty valuations seen in North America.

Question & Answers (0)