Deliveroo (ROO) shares slipped lower in early London price action after the release of a trading update for the first quarter of 2021 – its first as a publicly-traded company.

The company went public earlier this year in a lacklustre debut. The company had to lower the initial IPO price amid multiple concerns, ranging from a sell-off in growth stocks to a strike from some riders and worries over a dual ownership structure that gives its CEO Will Shu more than half of the voting rights.

Deliveroo trading update

The trading update showed total group orders surged 114% year over year to 71 million, while the gross total value (or GTV) increased 130% over the period to £1.65 billion. The company’s monthly active user base increased 91% to 7.1 million in the quarter.

Deliveroo’s growth rate has been increasing in each of the last five quarters. Its global orders increased 27%, 45%, 65%, and 77% in the previous four quarters and the first quarter 2021 order growth rate surpassed the rates witnessed in the previous four quarters.

The UK reports strong results

In its core UK market, Deliveroo’s total orders increased 121% year over year to 34 million. The GTV per order also rose 10% over the period and the total GTV grew 142% to £852 million in the first quarter. The company’s performance in the UK market was better as compared to its international operations. It attributed strong UK performance to the addition of new customers.

The company intends to reach two-thirds of the UK population by the end of 2021. It consumer population coverage was 53% at the beginning of the year, which increased to 60% in the first quarter as the company added six million people to its coverage in the quarter.

International growth

Deliveroo’s international orders jumped 108% to 37 million in the first quarter of 2021 while the GTV per order increased 6% to £21.4. The total GTV increased 119% as compared to the corresponding quarter in 2020, to £794 million.

Sounding optimistic on the performance, Shu said “Demand has been strong in both the UK&I and International markets driven by record new consumer growth and sustained engagement from our existing consumers.”

Deliveroo increases its rider and restaurant base

Deliveroo had 100,00 riders globally on its platform at the end of the first quarter of 2021 and more than 117,000 restaurant partners. Deliveroo continues to increase its restaurant partners to offer a wide choice to its users.

Employee policies

Globally, workers in the gig economy have been raising their voice over low pay and poor working conditions. However, gig economy companies like Deliveroo treat their riders as contractors and not employees. If its riders were designated as employees it would entail higher expenses because of higher compensation and other benefits such as holiday pay for the riders.

Many institutional investors, as well as activists, have been critical of Deliveroo over its policies towards contractors. EdenTree described Deliveroo as “best characterised as a race to the bottom with employees in the main treated as disposable assets – which is the very antithesis of a sustainable business model”.

Meanwhile, in its trading update, Deliveroo said that its rider satisfaction in the UK was at an all-time high of 89% in the quarter. However, according to a report from the Bureau of Investigative Journalism, one in three Deliveroo couriers made less than £8.72 per hour, the minimum UK wage for those above 25. For its part, Deliveroo claims that on average its riders earn £10 per hour.

Guidance

While Deliveroo reported strong sets of numbers in the first quarter of 2021, its guidance spooked markets. It maintained its 2021 guidance of GTV growth between 30-40% and a gross profit margin as a percentage of GTV at 7.5-8%.

The company was circumspect about the growth that it witnessed in the first quarter and said “It is difficult to say how much of this growth has been driven by the special circumstances of the current lockdown restrictions in some of our markets.”

Commenting on the outlook, it added: “The Company continues to operate in an uncertain environment given that the timing and impact of these restrictions being lifted in the coming weeks and months remain unknown. Deliveroo expects the rate of growth to decelerate as lockdowns ease, but the extent of the deceleration remains uncertain.”

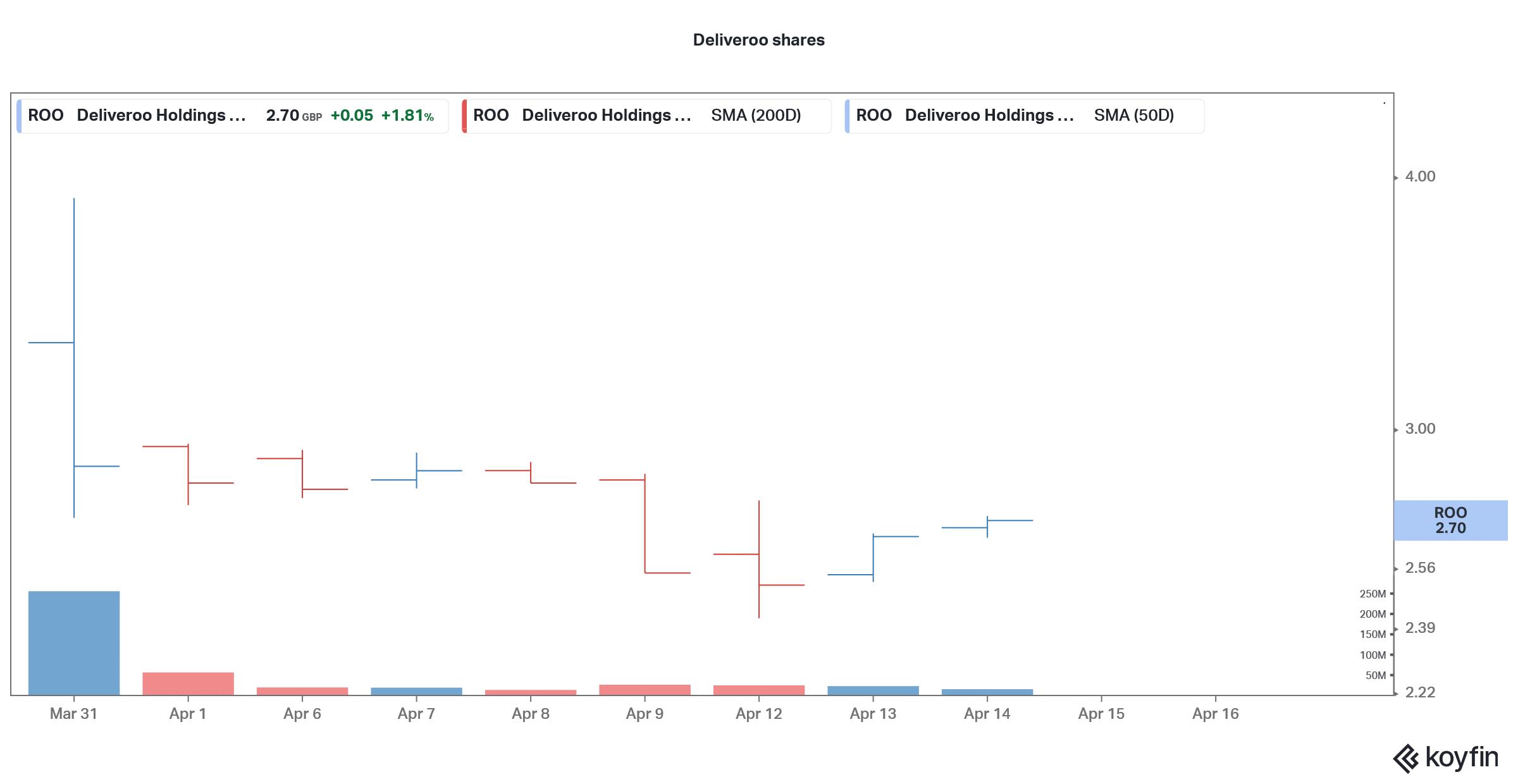

Deliveroo shares tumble

Deliveroo shares were trading 1.6% lower at 265.76p. The shares are not far away from their 52-week lows of 241.70p hit earlier this week as the company’s dismal run as a publicly-traded company continues.

Question & Answers (0)