Chinese EV companies including NIO, Xpeng Motors, and Li Auto are trading higher today after reporting their June deliveries. Zeekr how is trading lower as markets seem disappointed with its report. Here are the key takeaways from their monthly delivery reports.

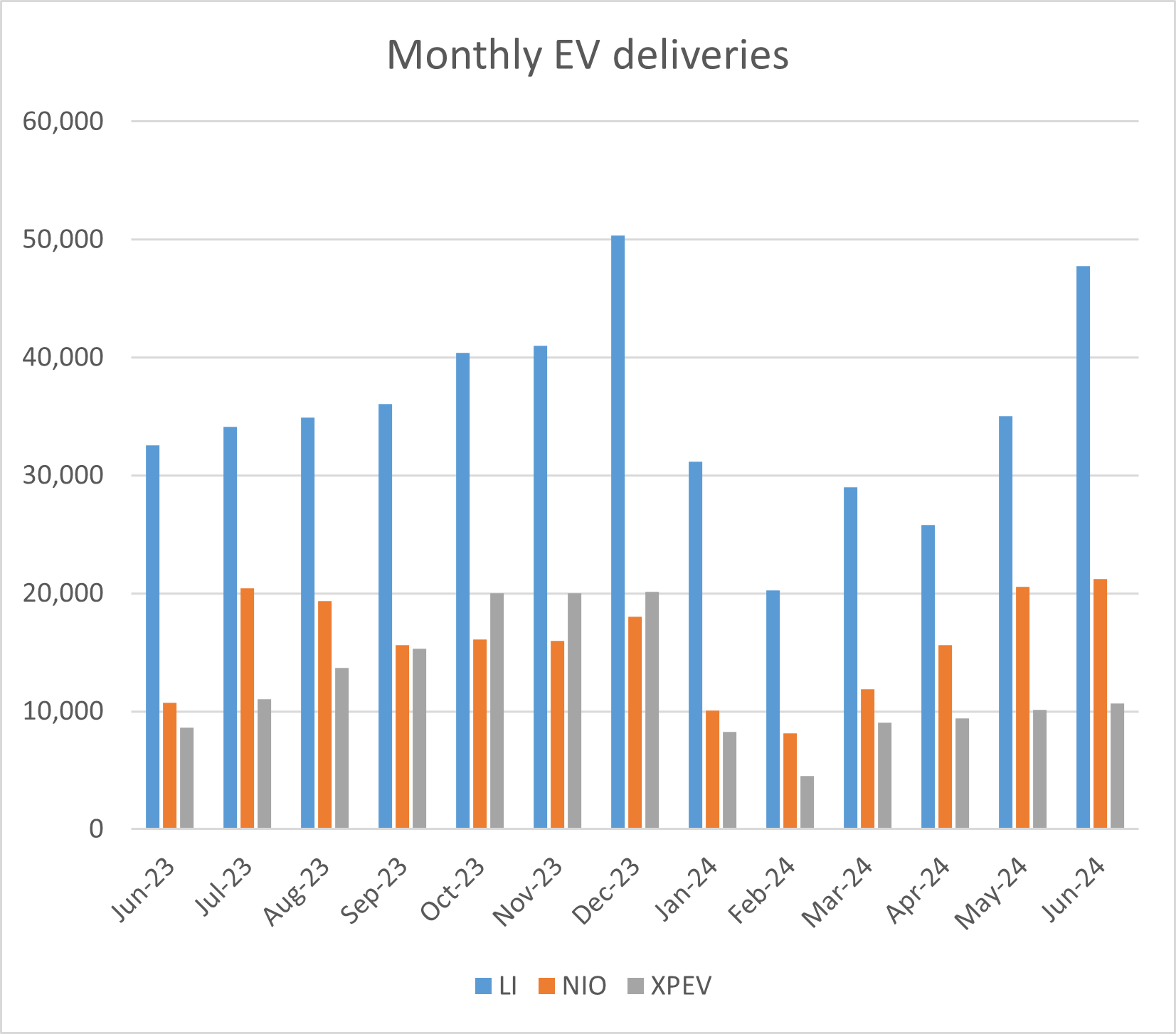

NIO delivered 21,209 vehicles in June 2024, a YoY rise of 98.1% and a new monthly record for the Chinese EV company. It was the second consecutive month when its deliveries topped 20,000,

NIO has delivered 87,426 vehicles so far in 2024, which is 51% higher than the corresponding period last year. NIO’s cumulative deliveries reached 537,020 at the end of June. While the company’s deliveries were tepid in the first quarter of 2024, they rose 144% YoY to 57,373 units in Q2. The results were better than the 54,000-56,000 deliveries that NIO had guided for and the shares are trading higher today.

NIO shares fell after Q1 earnings

Last month, NIO shares fell after the company reported dismal Q1 earnings. The Chinese EV company reported revenues of $1.37 billion in the quarter which was 7% lower than the corresponding quarter last year and fell short of the $1.44 billion that analysts expected.

The company’s gross margin was 4.9% in Q1 and while it was higher than the 1.5% it reported in Q1 2023, it was below the 7.5% it achieved in Q4 2023. Meanwhile, while NIO’s Q1 revenues fell short of estimates, its net loss was narrower than expected.

Xpeng Motors’ EV deliveries top 10,000

Xpeng Motors delivered 10,668 EVs in June which was 24% higher YoY and 5% higher as compared to May. In the first half of 2024, the company’s EV deliveries totalled 52,028 units which was 26% higher YoY. Xpeng Motors’ cumulative deliveries reached 452,359 at the end of June.

While Xpeng Motors’ EV deliveries have sagged the company has been making progress in its autonomous driving business. In its release, it said, “The monthly active user penetration rate of XNGP in urban driving scenarios reached 84%. In July, XNGP will achieve the milestone of nationwide availability on all public roads through a significant OTA update, with more end-to-end large model applications being implemented.”

Xpeng Motors expects its deliveries to rise in the back half of the year as it launches the low-cost model Mona in collaboration with Chinese ride-hailing giant Didi. It has also partnered with Volkswagen to produce EV models for the Chinese market. However, the company’s deliveries have largely disappointed in 2024.

Li Auto’s deliveries rebound in 2024

Li Auto delivered 47,774 vehicles in June which was 46.7% higher than the corresponding month last year. The company’s Q2 deliveries were 108,581 while the cumulative deliveries reached 822,345. Its cumulative deliveries are the highest among emerging Chinese new energy vehicle (NEV) companies and the company now looks on track to hit the milestone of 1 million cumulative deliveries.

In his prepared remarks, Li Auto’s CEO Xiang Li said, “In June, our sales momentum continued to increase, with monthly deliveries exceeding 40,000 vehicles in total and surpassing 20,000 vehicles for Li L6 alone. Since the second quarter, Li Auto has reclaimed the top spot in sales among China’s emerging new energy auto brands, and has become the sales champion of Chinese auto brands in the RMB200,000 and higher NEV market, driven by the launch of our new model, Li L6, and the improvement of store efficiency.”

BYD’s deliveries rise to a record high

BYD which sells both battery electric vehicles (BEV) and plug-in hybrid vehicles delivered a record 341,658 cars in June. The rise was led by a record 195,032 PHEV sales. Incidentally, the company’s PHEV sales have hit record highs for four consecutive months. Its BEV deliveries were 145,179 in June and while the metric rose 13.2% YoY it fell almost 1% as compared to June.

In the second quarter, the company’s NEV sales rose 40.2% YoY to 986,720 units. Of these BEV sales were 426,039 units and while sales rose almost 21% it could trail that of Tesla which has reclaimed its title as the biggest EV seller after losing it to BYD last year.

However, in terms of total deliveries, BYD is now far ahead of Tesla.

Zeekr’s shares fall even as EV deliveries rise

Zeekr delivered 20,106 EVs in June 89% higher than the corresponding month last year. The company delivered 87,870 vehicles in the first six months of 2024, up 86% YoY. Its cumulative deliveries reached 284,503 at the end of June.

Zeekr which is backed by Geely went public in the US in May. It priced the issue at the top end of the guidance and issued more shares than initially planned. However, the shares have since fallen amid the broad-based selling in Chinese EV shares.

Chinese EV companies face tariffs in the EU and US

In May, the US increased the tariffs on EV imports from China to a massive 100%. Last month, the EU imposed tariffs of upto 38.1% on EV imports from China. The duties would be on top of the 10% tariff these imports already attract. These tariffs are a headwind for Chinese EV companies that are battling a slowdown and price war domestically.

Question & Answers (0)