Chinese electric vehicle (EV) companies have reported their deliveries for April. Here are the key takeaways from their reports.

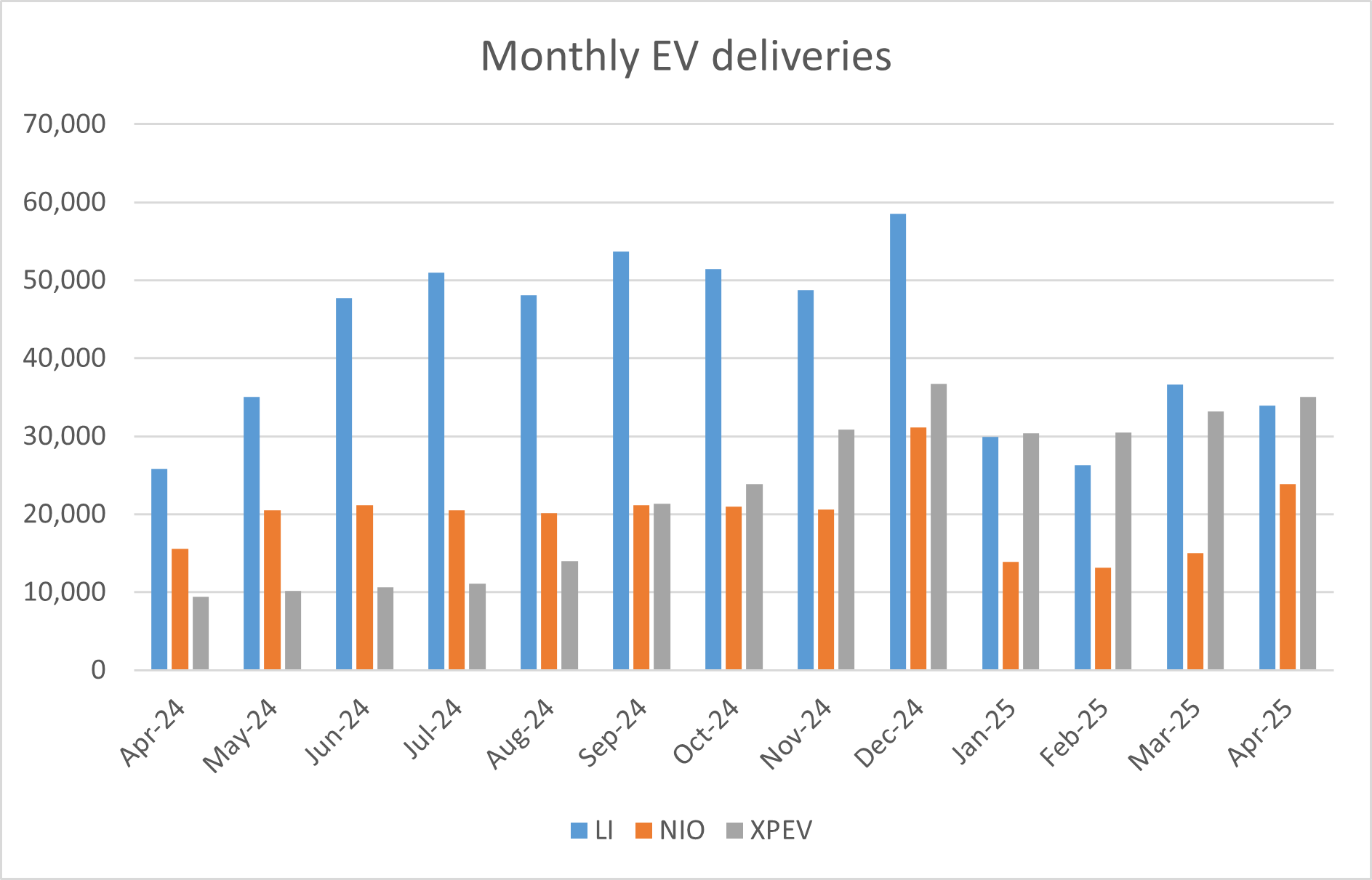

NIO reported EV deliveries of 23,900 in April, which was 53% higher YoY. In the first four months of 2025, its EV deliveries rose 44.5% to 65,994, while its cumulative deliveries rose to 773,558. It started delivering its ET9 in late March, but did not provide its sales breakdown in its release.

Looking at the breakup, the company delivered 19,269 vehicles of its eponymous premium brand NIO while 4,400 vehicles from its family-oriented smart electric vehicle brand ONVO, and some initial deliveries of the new small vehicle brand Firefly, whose deliveries commenced in late April. The company expects to launch the Firefly model in global markets in the “near future.”

NIO is set to launch new EV models in 2025

Notably, NIO is looking to launch several new models this year, which some analysts believe would help propel its EV deliveries. Earlier this week, Citi put NIO on a 30-day “catalyst watch,” and analyst Jeff Chung expects the company’s Q2 EV deliveries to rise by 50% sequentially. “After [the] Shanghai auto show, we expect NIO to launch new models much earlier than consensus expected,” said Chung in his note.

Meanwhile, NIO shares opened slightly lower in US markets after previously trading in the green in pre-market.

Xpeng Motors’ EV deliveries top 30,000 again.

Xpeng Motors delivered 35,045 EVs in April which was 273% higher YoY. Moreover, the company’s deliveries have topped 30,000 for the six consecutive months, thanks to strong demand for its Mona MO3 whose cumulative deliveries topped 100,000 in the month. Moreover, its P7+ achieved the production milestone of 50,000 in five months of its launch.

It delivered 129,053 vehicles in the first four months of 2025, which is 313% higher than the corresponding quarter last year. While the rise is admittedly coming from a lower base, as the company’s deliveries were quite subdued in the first half of 2024, the numbers are nonetheless quite reassuring.

Xpeng Motors’ cumulative EV deliveries were 719,452 at the end of April, and the company reached the milestone of 700,000 deliveries during the month. The company is also looking to launch extended-range electric vehicles (EREVs), which are quite popular as they come with a generator that can extend the battery’s range.

Xpeng Motors also has autonomous driving capabilities, which are among the most advanced in China. In its release, Xpeng Motors said that in April, its XNGP achieved a monthly active user penetration rate of 84% in urban driving.

The company officially launched its ADAS Insurance Service on April 28. “Priced at RMB 239 per year, this service offers additional coverage when NGP is in operation and is made available to all XPENG models through partnership with leading insurance providers in China,” said the company in its release.

Li Auto’s April deliveries

Li Auto delivered 33,939 vehicles in April which is 31.6% higher than the corresponding month last year. Its cumulative deliveries reached 1,260,675 at the end of April which is the highest among emerging new energy vehicle (NEV) companies in China.

Zeekr delivered 41,316 vehicles in April. Of these, the Zeekr brand accounted for 13,727 vehicles while Lynk & Co brand delivered 27,589 vehicles.

BYD’s EV deliveries soar

BYD sells both BEVs (battery electric vehicles) and PHEVs (plug-in hybrid vehicles) and is the biggest global seller in the combined category.

In April, BYD sold 380,089 NEVs. The company’s BEV deliveries rose 45.6% YoY to 195,740, while PHEV sales fell 0.4% over the period to 176,875. After a gap of many months, BYD’s BEV deliveries were ahead of hybrid sales. BYD sold more EVs than Tesla in Q1 and looks set to grab the title of the world’s biggest EV seller in 2025. Notably, BYD’s 2024 revenues were ahead of Tesla as it reached the milestone of hitting $100 billion in revenues.

While BYD’s shipments have soared in 2025, Tesla’s EV deliveries fell 13% YoY in Q1. The company’s revenues fell 9% in Q1, and it missed estimates for both the topline and bottomline.

Meanwhile, BYD sold 79,086 vehicles in international markets in April, which marks record deliveries for a fifth straight month. While several countries, especially the EU, have clamped down on EV imports from China to protect their domestic industries, Chinese EV companies haven’t pared back their ambitions and continue to target export markets aggressively.

Tesla CEO Elon Musk has been all praise for Chinese EV companies and the country’s EV ecosystem. During Tesla’s Q4 2023 earnings call earlier last year he said, “Frankly, I think, if there are not trade barriers established, they will pretty much demolish most other companies in the world.”

He added, “The Chinese car companies are the most competitive car companies in the world. So, I think they will have significant success outside of China depending on what kind of tariffs or trade barriers are established.”

BYD launched new charging technology in March

In March, BYD unveiled its “Super e-Platform” technology, which is capable of peak charging speeds of 1,000 kilowatts and will allow cars to achieve a range of 400 kilometers in only 5 minutes.

Fast charging, access to more charging stations, and a higher range are among the factors that can boost EV adoption and get more fence-sitters into buying an electric car. Importantly, a battery is the most important hardware component of an EV and is the costliest as well.

Earlier this year, BYD released an assisted driving system named “DiPilot” in partnership with DeepSeek. The Chinese AI (artificial intelligence) startup created waves with its low-cost AI model, which performed better than models from OpenAI and Meta Platforms on some parameters. BYD would offer assisted driving for free and would become the only automaker offering these features in cars priced below $10,000.

While one may argue that players like Tesla and Xpeng Motors offer a more advanced version of autonomous driving, BYD offering assisted driving for free has raised fears about other companies’ ability to charge premium pricing for their self-driving features.

Question & Answers (0)