Chinese electric vehicle (EV) companies have released their September deliveries with Li Auto, BYD, Xpeng Motors, and Zeekr reporting record deliveries. Tesla would also soon release its Q3 deliveries as the US EV giant reports its deliveries on a quarterly basis, unlike Chinese peers which do it on a monthly basis. Here are the key takeaways from Chinese EV companies’ September deliveries.

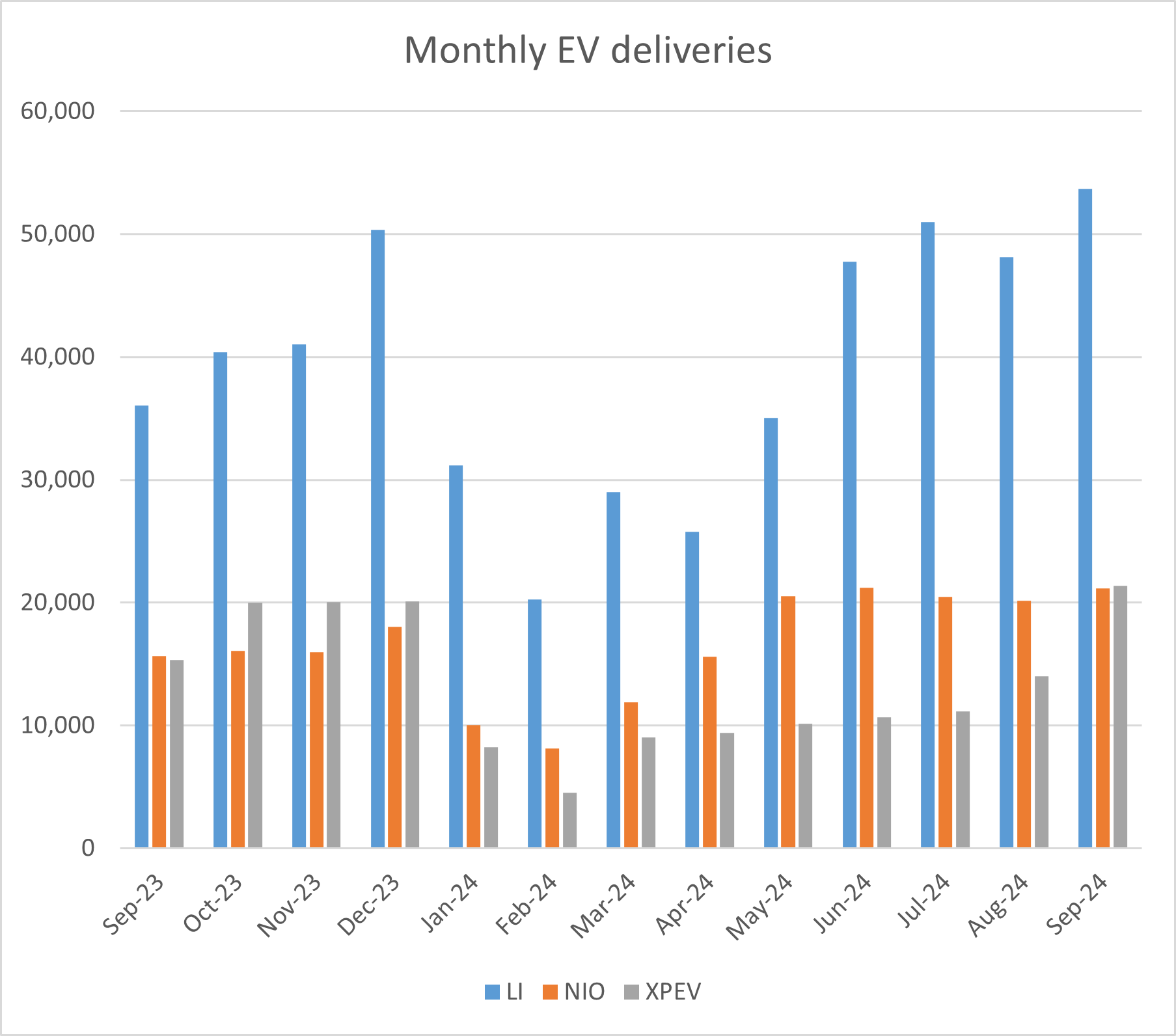

NIO delivered 21,181 vehicles in September which was 35.4% higher YoY. The company delivered 61,855 vehicles in the third quarter which was up 11.6% YoY and within the company’s guidance of 61,000 and 63,000. NIO’s deliveries have been over 20,000 for five consecutive months now and its cumulative delivered reached 598,875 at the end of September.

NIO bagged strategic investment

Notably, NIO shares soared yesterday after the Chinese EV company announced a strategic investment of $500 million from strategic investors. Previously, UAE’s CYVN Holdings invested almost $3 billion in NIO which helped strengthen the company’s balance sheet.

NIO’s financial performance improved in Q2 and its gross margin jumped to 9.7% which was almost twice what it generated in the previous quarter. Also, the margins improved considerably from the corresponding quarter last year when the Chinese EV company could barely manage a 1% gross margin. Its vehicle gross margin also soared to 12.2% which the company attributed to “cost optimizations.”

In absolute terms, NIO’s gross profits came in at $232.4 million in Q2 which was over 246% higher YoY. The company’s net loss also narrowed to $694.4 million in the quarter.

Xpeng Motors’ EV deliveries soar to record highs

Xpeng Motors’ EV deliveries rose 39% YoY to a record 21,352 units in September, and the company delivered over 10,000 units of its budget Mona MO3 model during the month. In its release, Xpeng Motors said, “With a broad array of superior configurations and competitive pricing, XPENG MONA M03 has experienced a significant increase in orders since its market launch. XPENG and supply chain partners are sparing no effort to prepare for XPENG MONA M03’s further production ramp-up.”

The Chinese EV company delivered 46,533 units in Q3 which was 16% higher YoY. The company’s cumulative deliveries stood at 498,892 units at the end of September and it has inched close to the milestone of 500,000 cumulative EV deliveries.

Zeekr also delivered a record number of vehicles in September

Zeekr, which is backed by Geely, delivered a record 21,33 EVs in September which was 77% higher YoY. In the first nine months of the year, its deliveries rose 81% to 142,873 while its cumulative deliveries stand at 339,506.

Zeekr is the latest addition to US-listed Chinese EV companies and went public in May through a traditional IPO. In August, Zeekr said that its new batteries can go from 10% to 80% charge in a mere 10.5 minutes. According to the company, it can achieve the feat in 30 minutes when the temperature drops to -10 degrees Celsius. Tesla Model 3 on the other hand can charge upto 175 miles in 15 minutes.

Fast charging, access to more charging stations, and a higher range are among the factors that can boost EV adoption and get more fence-sitters into buying an electric car. Importantly, a battery is the most important hardware component of an EV and is the costliest as well.

Li Auto’s deliveries rose to a new record high

Li Auto delivered 53,709 vehicles in September 2024 which was up 48.9% YoY and 5% higher than its previous record in July. The company delivered 341,812 vehicles in the first nine months of 2024, and its cumulative deliveries reached 975,176 at the end of September.

“Since the beginning of the third quarter, the top three brands have captured over 50% of the RMB200,000 and above NEV market. Notably, Li Auto accounted for over 17% of market share in this segment, ranking first among Chinese automotive brands,” said Li Auto in its release.

BYD also reported an increase in EV deliveries

BYD, which sells both hybrids and EVs reported total deliveries of 419,426 in September which was not only a record high but the first time since the company’s monthly deliveries topped 400,000. As has been the case for the last many months, the growth was mostly led by sales of plug-in hybrids (PHEVs) whose deliveries soared to a new record high of 252,657. EV sales also rose 9.1% YoY to 164,956.

Chinese EV shares soared last week

Notably, Chinese EV shares soared last week as Chinese markets had their best week since 2008 amid the country’s massive stimulus. The Chinese central bank lowered its 7-day reverse repurchase rate by 20 basis points to 1.5%. It also lowered the reserve requirement ratio for banks by 50 basis points which would make more funds available for lending.

The People’s Bank of China said that the reserve ratio cut will “create a good monetary and financial environment for China’s stable economic growth and high-quality development.” Governor Pan Gongsheng said that the PBOC would cut the RRR by between 25 basis points to 50 basis points by the end of 2024.

As China struggles to meet its 2024 GDP growth target of 5%, the country is looking at fiscal measures to revive the economy. According to a Reuters report, the country is looking to issue sovereign bonds worth around $284 billion to raise funds.

Specifically, the government is looking to support its ailing housing sector where sales have stagnated. The Communist Party politburo said, that officials “will respond to people’s concerns, adjust home purchase restriction policies, lower existing mortgage rates and improve land, fiscal, tax and financial policies as soon as possible to push forward the new model of property development.”

Chinese EV shares are meanwhile trading on a mixed note today despite stellar deliveries. Markets next look forward to Tesla’s Q3 delivery report to gauge whether the company also witnessed the sales bump that its China-based peers witnessed in September.

Question & Answers (0)