Carrefour shares are slipping today after a proposed merger with Canadian firm Alimentation Couche-Tard fell apart amid the French government’s opposition to the deal.

Shares of the French retail giant are retreating 6% at EUR 15.59 per share in mid-day stock trading activity following the release of a joint statement from the two companies on Saturday.

However, the firms agreed to examine explore other opportunities like “operational partnerships” in areas such as fuel, pooled purchasing, private labels, and product distribution.

The prospect of a merger between the firms buoyed market players on 13 January, after the release of a statement from Carrefour saying that the company had been approached by Couche-Tard, although discussions were still “very preliminary” back then.

The French government quickly reacted to the news, with the country’s Finance Minister Bruno Le Maire strongly opposing the deal – reportedly valued at $20 billion – as the top official highlighted that food distribution is a “strategic” matter for France while saying that although the “no” was a polite one, it was also a final one.

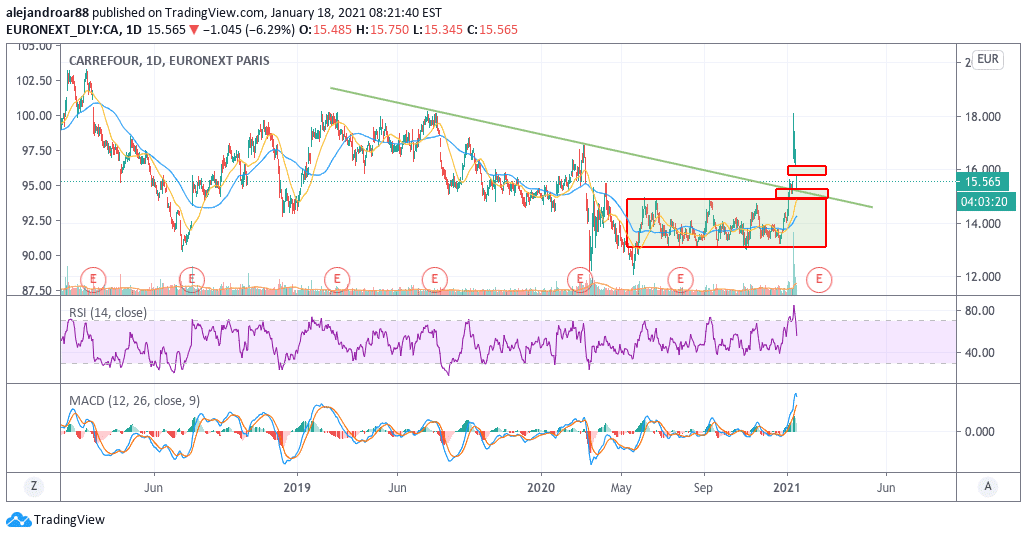

So far today, Carrefour shares have already given up all of their merger-related gains from the January uptick, while the French government’s opposition to the deal might discourage investors moving forward as this kind of transaction seems to be off the table for the retailer.

Meanwhile, according to an exclusive report from Reuters, the 24-hour rejection of the deal has disgruntled some business leaders in the country and could effectively tarnish President Emmanuel Macro’s pro-business image a year ahead of the country’s presidential election.

How did Carrefour shares perform during 2020?

Carrefour shares lost nearly 5% of their value during 2020, as a persisting virus situation in France weighed on the financial performance of the company during the year.

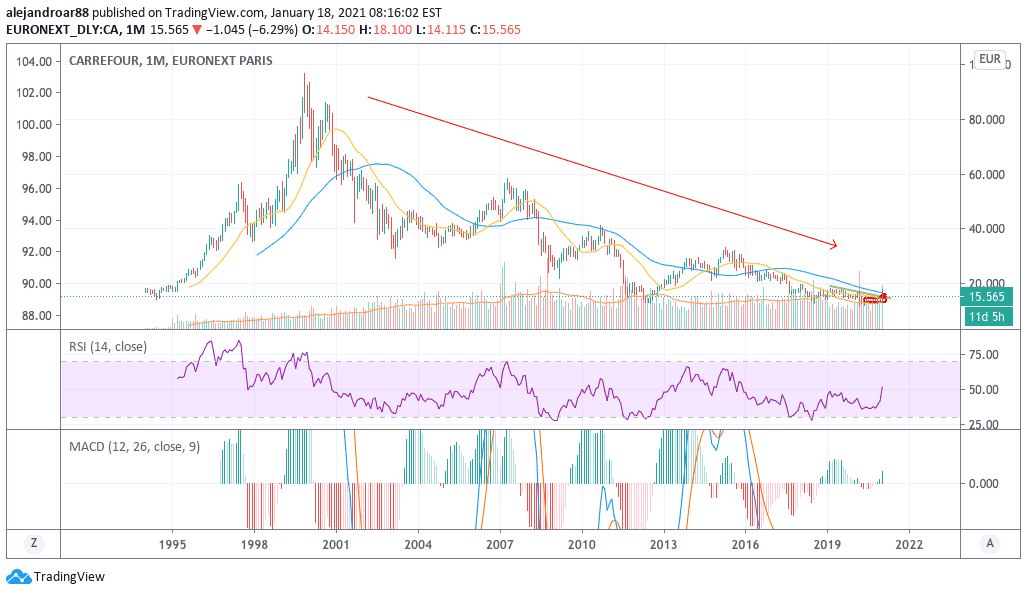

Meanwhile, the firm’s shares have been consistently dropping since they peaked in the late 1990s, moving from roughly EUR 100 back then to as little as EUR 16 as of today.

Carrefour’s revenues have been trending lower for years as well, as growing competition from online retailers has affected the business top-line while a large debt burden of approximately €20 billion keeps weighing on the company’s long-term outlook.

Meanwhile, the company will be reporting its financial results for the fourth quarter of 2020 along with its full-year 2020 financial performance on 18 February.

What’s next for Carrefour shares?

Carrefour shares have been on a downward spiral since the stock peaked in November 1999, with the share price failing to post a fresh monthly high since then.

The fact that this downtrend has not yet shown any signs of a reversion in such a long period reflects the deterioration of the company’s financial situation and possibly the potential decay of its business model, as online retailers keep gaining territory.

Meanwhile, the daily chart above shows how the price action has already retreated to its pre-merger levels, leaving a bearish gap in the process that could now cap any further advances in the stock in the short term.

That said, it is unclear if market chatter about the merger could have been the driving force behind the latest uptick in the stock price. If that were to be the case, it would be plausible to expect that Carrefour shares could re-enter the consolidation rectangle shown in the chart above.

On the other hand, this rectangle could also end up serving as support for further upward movements, as vaccines continue to be rolled out in France and across Europe, which would help the company in recovering at least partially from the virus blow.

Question & Answers (0)