BT Group shares are up 2% this afternoon at 103.8p, making the stock one of the few bright spots on the FTSE 100 index today, after the company raised the lower-end of its forecasted adjusted EBITDA range for the year.

BT’s improved guidance was announced as part of the firm’s earnings report covering the first half of 2020, where the telecom giant reported an 8% drop in revenues with sales landing at £10.59 billion amid the pandemic, as a result of lower revenues from the firm’s BT Sports segment and a decline in the demand coming from business customers.

The firm’s statutory operating profit took a 13% hit during the first six months of 2020, landing at £1.57 billion, down from a previous £1.80 billion BT reported during the same period a year ago.

On the other hand, adjusted EBITDA for the period ended at £3.72 billion, down 5% from a year before, while normalized free cash flow – a non-IFRS measure – dropped 30% as well, ending the six-month period at £422 million.

The firm raised its adjusted EBITDA guidance for this year to a £7.3 billion to £7.5 billion range, up from a previous forecast that anticipated £7.2 billion to £7.5 billion.

BT’s management also announced that it plans to resume its dividend payments – which were slashed this year amid the pandemic – during the 2021/2022 fiscal year, with a preliminary target set at 7.7p per share.

The firm’s net debt, on the other hand, stood at £11.3 billion with the group currently holding a total of £6.5 billion in cash and equivalents.

Finally, BT Group’s profit after taxes ended the six-month period at £856 million, with basic earnings per share landing at 8.6p, both down 20% compared a year ago.

How have BT Group shares performed so far this year?

Although today’s improved guidance has helped lift BT Group (BT) shares, the stock still has a long way to go before it can climb back to its pre-pandemic levels as BT has lost almost 90% of its value since the year started.

The firm’s modernization programme, which has already saved £352 million during the first half of the year, is perhaps one of the most promising projects that could drive BT Group shares higher, as long as the management aims to deliver its promised £1 to £2 billion annual savings by 2025.

The management remains committed to slash its operating costs by simplifying BT’s organizational structure, along with other measures, and only this semester the firm reduced a total of 3,600 full-time jobs across the group.

Moreover, the firm’s Openreach project, which aims to increase BT’s fibre optics coverage in the UK, keeps advancing at a fast pace, as the firm managed to add 67 new locations during the last quarter, with a total number of 560 locations now covered as result of this effort.

Additionally, BT has the most extensive 5G network in the UK with 112 towns and cities covered by the firm’s infrastructure, which positions the company favorably to serve customers when the full-range of benefits coming from this technology start to unroll for end users.

What’s next for BT shares in the short run?

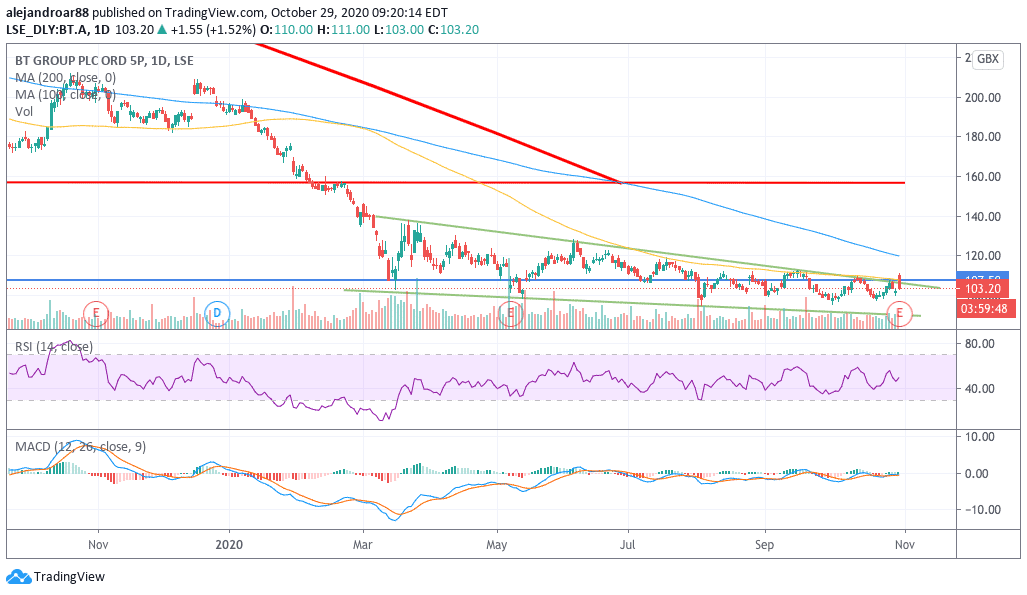

The daily chart above shows how today’s price action is lifting BT shares above a downward price channel that emerged off the March lows, with a potential first target set at 120p – the stock’s 200-day simple moving average.

Although the shares remain 20% below that line, a move towards those levels seems plausible given the business positive outlook over the coming years and its strong balance sheet.

That said, one of the most worrying variables at the moment that could weigh on BT’s advance is the resurgence of the virus in the UK and other important countries in Europe, as this could have a negative prolonged impact on the business’ sports segment while the demand from business consumers could also rebound at a slower pace than expected.

In that context, although today’s jump in the value of the shares seems promising, the short-term outlook remains bearish given the unfavorable backdrop.

Question & Answers (0)