The Financial Conduct Authority (FCA), the United Kingdom’s top financial watchdog, has effectively banned Binance Markets Ltd from offering its services to clients within the country in what is the latest in a series of attempts from regulators to force exchanges to follow their rules.

On 26 June, the regulatory agency announced that Binance Markets Ltd, a subsidiary of the Binance Group, was “not permitted to undertake any regulated activity in the UK”, citing the firm’s failure to comply with the regulator’s requirements as the primary cause for the ban.

Meanwhile, the FCA emphasized that no subsidiary owned or operated by Binance has authorisation from the agency to offer these kinds of services while the institution instructed the website to display a warning where they state that they cannot offer any financial products or services to UK-based investors.

Regardless of the warning, UK investors will likely continue to access Binance’s platform as the company is a foreign entity based in the Cayman Islands that has managed to dodge regulator’s bans across the world due to the decentralized nature of cryptocurrencies.

However, it might get more difficult for customers to deposit and withdraw money into and from the exchange to their domestic accounts as payment processing companies that aid the firm in performing transfers to customers could be forced to stop providing their services amid concerns about increased regulatory scrutiny.

This is not the first time that Binance faces a regulatory crackdown in a top-tier jurisdiction such as the UK since Japanese authorities have also warned the firm about operating in the country without following local regulations while the company announced three days ago that it would stop offering its services to users in Ontario, Canada after facing a ban from the Ontario Securities Commission (OSC).

Binance’s formal operations in the United Kingdom were announced in June 2020 with the acquisition of Binance.UK, a cryptocurrency trading platform that would be operated by Binance Markets Limited. The acquisition would allow British investors to buy and sell cryptocurrencies by using pounds and euros.

The head of the unit back then was Teana Baker-Taylor. However, the top executive seems to have resigned from her post in October last year according to her LinkedIn account.

How did the cryptocurrency market react to the news?

The price of Bitcoin was unfazed by this latest development on the regulatory front as the decentralized nature of the blockchain continues to allow users to trade cryptocurrencies without having to go through a regulated exchange.

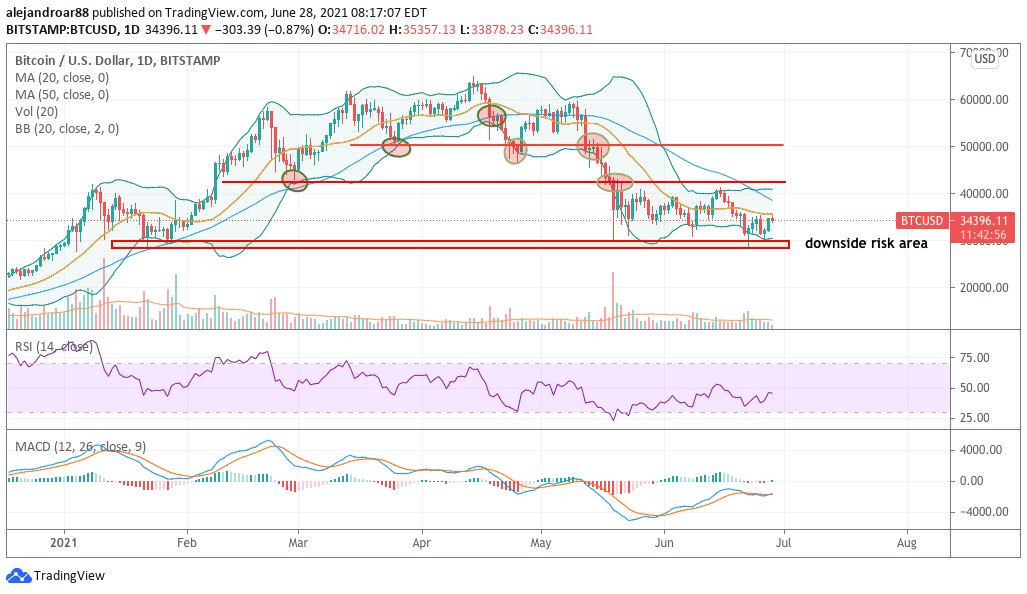

The price of Bitcoin (BTC) closed last week 2.5% lower at $34,699 per coin after a last-minute 7.5% jump that took place on Sunday. During this same period, cryptocurrencies as a whole shed 7% of their value, with the total market capitalisation of the entire ecosystem shedding almost $100 billion after sliding from $1.476 trillion to $1.372 trillion.

This increasingly hostile attitude from multiple regulatory watchdogs shows how governments around the world are increasingly concerned about the independent nature of cryptocurrency exchanges as they operate under no supervision – a situation that exposes investors to fraud and scam.

On 25 June, a notable incident took place in South Africa as the founders of cryptocurrency exchange Africrypt disappeared with approximately $3.6 billion from investors only two months after warning customers about an alleged “hack”.

Back then, the firm had alerted investors not to contact authorities as that could “slow down” the recovery of the funds. Cryptocurrencies are not officially recognized as a financial asset by South African laws and, therefore, the country’s regulator might not be able to enforce customer’s claims.

What’s next for Binance?

The fact that Binance Markets Ltd was banned from offering its services to customers in the United Kingdom doesn’t necessarily prevent British investors from accessing the space as peer-to-peer transactions could also be performed to buy these digital assets.

In this kind of transaction, two individuals agree to exchange their fiat currency for a certain token such as Ethereum (ETH) or Tether (USDT) that they can later convert into virtually any token they want.

Question & Answers (0)