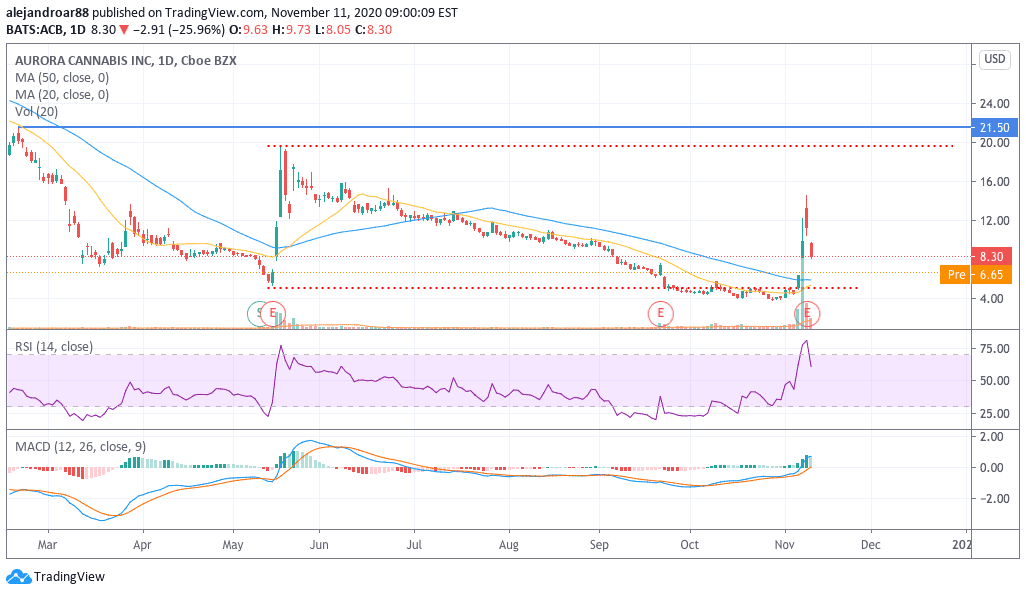

Aurora Cannabis saw its shares plunge 26% yesterday to $8.3 per share while also trading 17% lower in pre-market stock trading activity on Wall Street at $6.9 per share. The moves follow negative investor reaction to a potentially dilutive share offering.

Shares of the Canadian cannabis producer posted significant gains last Thursday and Friday as the legalization of marijuana was passed by voters in five different states of the United States including Arizona and New Jersey – an event that lifted the shares of ACB as much as 220% as the legal market for cannabidiol (CBD – doesn’t contain the psychoactive compound tetrahydrocannabinol, known by the acronym THC) products keeps expanding.

Investors had seemed to have embraced Aurora’s latest quarterly results, as shares advanced 14.5% on Monday following the release of the firm’s financial report covering the three months ended on September 30. The company’s sales slipped by 8% during the three-month period compared to a year ago amid a loss of market share in key categories within the consumer dried cannabis segment.

The firm also reported a net loss of CAD$109 million, in contrast with the CAD$7.4 million in gains it reported a year before. This resulted in a loss of CAD$ 0.92 per share – which is almost four times the CAD$ 0.24 estimate that analysts had for the quarter.

That said, the numbers were better on a quarter-on-quarter basis, as sales only slipped 1% compared to the previous quarter, while losses shrunk as the firm took heavy impairment charges during the fourth quarter of 2020 including a CAD$1.6 billion charge on intangibles and goodwill.

So, why are Aurora Cannabis shares dropping these past two days?

The answer is a proposed share offering announced by the company less than 24 hours ago, with the firm now planning to raise as much as USD$125 million through the sale of more than 16 million common shares. The new issue will come with an extra warrant that entitles the holder to purchase one-half of another share at an exercise price of $9 per share. The warrants can be exercised during the 40 months that follow the offering’s closing date.

As of today, Aurora Cannabis (ACB) has 160.66 million shares outstanding. By adding the 16.66 million shares resulting from this offering along with another 8.33 million shares coming from the warrants – once they are exercised – the number of outstanding shares would climb to as much as 185.65 million shares.

The ordinary shares are being valued at $7.50 while the warrants have an exercise price of $9.00 per share. Taking that into account, and based on Aurora’s market capitalization on 9 October – a day before the announcement – we could say that the firm’s shares were diluted to $10.36 per share if all those new shares were to be incorporated into the firm’s market capitalization immediately.

However, the fact that the firm valued its shares below the market price – $5 per share after accounting for the extra one-half warrant – has probably prompted market players to revisit their short-term valuations as well.

What’s next for Aurora Cannabis shares?

The share offering is the most important news affecting the value of Aurora Cannabis shares at the moment, as it is fair to say that market players have already digested the numbers the company posted during its quarterly earnings call.

It is unclear how the share price will behave in the following sessions as a result of the news, as the latest bull run seems to have faded as a result of this dilutive action.

The $5 to $4 price points will be key levels to watch over the next few sessions as the range have provided a good floor for the stock in the last few weeks. A strong rebound off these levels could potentially result in some short-term upside for day traders.

Question & Answers (0)