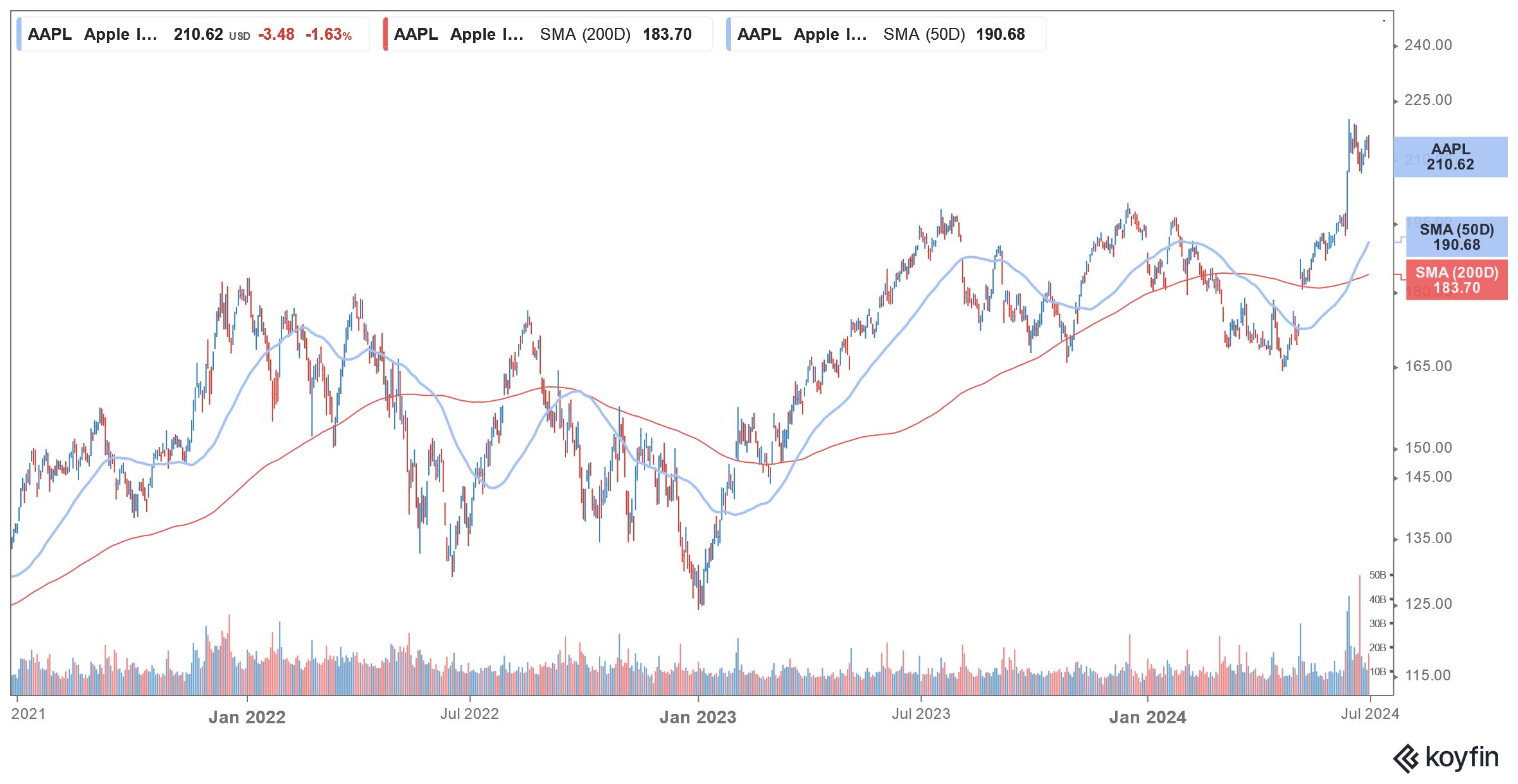

Apple shares rose double digits in June which helped the iPhone maker turn positive for the year and gain nearly 10% in the first half of the year. After a strong June performance, analysts see the good run continuing in the back half of the year also.

Apple was having a terrible year and in January itself three brokerages downgraded the shares. It was the worst-performing share of the “Magnificent 7” group last year and despite the June gains it is the second-worst constituent in the first half of 2024. Tesla of course is the worst performing of the lot as the Elon Musk-run company continues to struggle with sagging topline and bottomline.

Apple WWDC helped lift market sentiments

Coming back to Apple, in June, it held its Worldwide Developer Conference (WWDC) that helped lift market sentiments. Apple revealed its “Apple Intelligence” at the event which helped trigger a rally in its share price. The company also reclaimed its $3 trillion market cap as investors gave a thumbs up to its artificial intelligence (AI) efforts.

It also announced a partnership with ChatGPT and the announcements helped dispel the fears that the Tim Cook-run company lagged tech peers in its AI efforts. While Apple has come off its June highs, analysts expect the shares to rise in the second half of the year.

Analysts see more gains from AAPL shares

On Friday, Oppenheimer maintained its overweight rating on AAPL shares and raised its target price to $250. The brokerage joined the long list of firms that have raised Apple’s target price following the WWDC announcements.

Notably, several Wall Street analysts believe that AI enhancements would lead to a supercycle and have bumped up Apple’s target price. JPMorgan analyst Samik Chatterjee for instance raised his target price from $225 to $245.

Bank of America also sees Apple’s rally continuing in the second half of the year. In its note, the brokerage said, “2024 Apple Services deep dive: AI to be an incremental lever for growth. We present an update to our Services deep dive. Based on our bottom-up revenue buildout, we expect Services rev to drive the company’s overall margin higher. We view low double-digit growth as sustainable in F24-26.”

Bernstein also reiterated its outperform rating and said that Apple is now no longer seen as a laggard in its AI efforts.

Rosenblatt upgraded Apple to a buy

Last week, Rosenblatt upgraded Apple shares to a buy from neutral and assigned a $260 target price. Notably, Apple has put a lot of emphasis on privacy and security while rolling out its AI features which could help the company stand out.

In his note, Rosenblatt analyst Barton Crockett said “One could reasonably argue that the strong consumer interest in privacy favors Apple. That’s because Apple, unlike AI predecessors, has put privacy front and center as part of its AI marketing push and architecture.”

He added, “Apple laid out what it called a Private Cloud Compute architecture that keeps personal information on personal devices, and does not allow non-permissioned release of that information to anyone else, including Apple and third party LLMs.”

Rolling out AI won’t be that easy for AAPL

Meanwhile, rolling out AI features won’t be easy for Apple, especially in international markets and it is also facing issues in the European Union and China, its two biggest markets outside the US.

Apple said that Apple Intelligence, iPhone Mirroring, and enhancements to its SharePlay screen-sharing service won’t be available in the EU this year, blaming the “regulatory uncertainties” arising from the region’s Digital Markets Act (DMA) regulation that was passed last year.

“Specifically, we are concerned that the interoperability requirements of the DMA could force us to compromise the integrity of our products in ways that risk user privacy and data security. We are committed to collaborating with the European Commission in an attempt to find a solution that would enable us to deliver these features to our EU customers without compromising their safety,” said Apple in its release.

Apple might need to partner with a Chinese company for AI

Meanwhile, the next challenge that Apple could face might come from Greater China, a region that accounted for $72.6 billion of its sales in the last fiscal year. Notably, AAPL has partnered with ChatGPT which is not available in China. The Wall Street Journal reported that Apple is in talks with Chinese tech companies like Amazon, Baidu, and Baichuan AI for partnership in the Chinese market.

China has been even more protective of the data of its citizens. It has banned government employees from using Apple’s iPhone and the Cupertino-based company removed Meta Platforms’ apps from the Chinese App Store earlier this month on orders from the government. Meta’s apps like WhatsApp and Threads were anyways mostly inaccessible to Chinese users but Apple removing them from the App Store makes it even tougher to access these apps in the country.

Meanwhile, despite the troubles in rolling out AI features, analysts see AAPL shares continuing their momentum in the back half of the year on hopes that these features would help propel iPhone sales that have otherwise sagged.

Question & Answers (0)