Tesla (NYSE: TSLA) will release its Q1 delivery report next week. Ahead of that release, several analysts have reset Tesla’s target price anticipating a fall in deliveries.

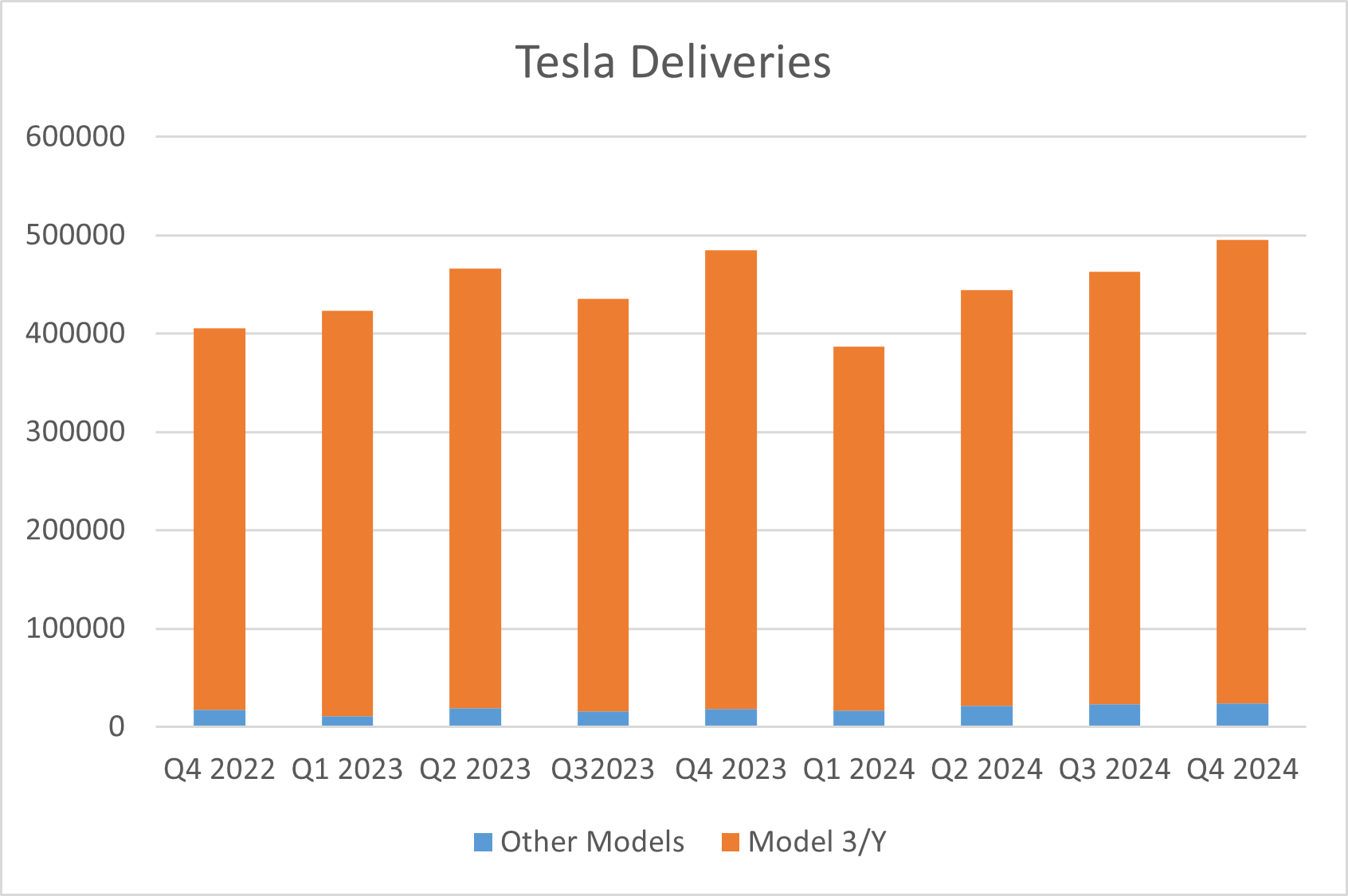

Current estimates call for Tesla’s Q1 deliveries to come in at 418,000 which is around 8% higher than the corresponding quarter last year but below what it delivered in the final quarter of the year. Notably, analysts have been revising down Tesla’s delivery estimates and estimated the number to be 464,000 at the beginning of the year which would have meant a YoY rise of 20%.

The fall in Tesla’s deliveries at the beginning of the year is not surprising as it tends to push deliveries towards the end of the year, including through promotions. Moreover, the Elon Musk-run company has refreshed its Model Y – its best-selling model – so some buyers might have deferred purchases to get the latest model.

However, there are fears of a “buyers strike” as Musk’s politics haven’t gelled well with many potential Tesla buyers. Meanwhile, Tesla’s China sales fell at a time when BYD’s deliveries have been strong in the world’s biggest market for electric cars.

TSLA expects a YoY rise in deliveries

Tesla does not provide quarterly forecast for deliveries but in its Q4 2024 shareholder deck it said, “With the advancements in vehicle autonomy and the introduction of new products, we expect the vehicle business to return to growth in 2025.” The guidance was a lot less optimistic than the up to 30% delivery growth that Musk predicted last year.

Incidentally, the Tesla CEO was optimistic that the company’s deliveries would grow YoY in 2024 but it ended up shipping fewer cars than the previous year marking the first year of annual revenue decline in history.

Tesla’s deliveries in Europe and China have fallen

While we don’t have much data for Tesla’s sales in the US which is by far its biggest market, things have been bleak in China and Europe. The company’s sales fell 43% YoY in Europe in the first two months as it lost market share. In China too while players like BYD and Xpeng Motors reported stellar deliveries for February despite Lunar New Year Holidays, Tesla’s sales fell to a two-year low in February.

In February, BYD sold 322,876 NEVs, which took its total deliveries in the first two months of the year to 623,384 – a YoY rise of 92.5%. The Chinese EV giant’s revenues topped $100 billion in 2024 which was ahead of Tesla. BYD already sells a lot more cars than Tesla and looks set to become the biggest seller of battery electric cars also.

The Chinese EV market is anyways the most competitive globally and foreign and domestic companies compete aggressively for a pie of the world’s biggest market for electric cars. With Chinese EV companies coming up with compelling product propositions at attractive prices, foreign automakers like Tesla could face a bumpy road ahead.

Amid Tesla’s sales woes in China and Europe, several analysts have lowered their delivery estimates. While JPMorgan lowered its estimate from 444,000 to 355,000, Guggenheim slashed it from 405,000 to 358,000.

Deutsche Bank lowered Tesla’s target price

While JPMorgan and Guggenheim are bearish on Tesla even some of the bulls have lowered their forecast. Deutsche Bank analyst Edison Yu lowered Tesla’s Q1 delivery estimate to between 340,000-350,000 which is well below consensus estimate. The analyst reiterated his buy rating on TSLA while cutting the price target to $345 from $420.

“Our view is that Tesla’s stock has been under pressure recently driven by much weaker auto volumes, broader de-rating in growth assets (e.g., Mag 7), and to some extent, political/policy uncertainty,” said Yu in his note. He added, “As we have seen over the years, rarely anything at Tesla happens in a straight line and we would not expect robotaxi or humanoid to be linear.”

HSBC slashed Tesla’s target price

Yesterday, HSBC slashed Tesla’s target price from $165 to $130 which implies the shares falling more than 50% from these levels. “The seeds for the current sales weakness pre-date the recent brand issues,” said analyst Micheal Tyndall in his note.

He added, “Tesla eschews many of the industry norms (holding list prices firm, making regular facelifts and model renewals) and has to date seen only minimal impact, but tougher competition and brand erosion is likely to see the impact of its strategy hurt more.”

Notably, TSLA has been banking on products like autonomous driving and robotaxi but they have been running quite late. According to Tyndall, “Delays have been a constant theme at Tesla, whereas the competitive threats continue to grow. We see a longer and less certain timeline than the current valuation reflects.”

Autonomous driving

Moreover, the competition is ramping up in the autonomous driving space. Last month, BYD released an assisted driving system named “DiPilot” in partnership with DeepSeek. The Chinese AI (artificial intelligence) startup created waves with its low-cost AI model, which performed better than models from OpenAI and Meta Platforms on some parameters. BYD would offer assisted driving for free and would become the only automaker offering these features in cars priced below $10,000.

Chinese EV startup Zeekr also said that it would offer autonomous driving for free While one may argue that players like Tesla and Xpeng Motors offer a more advanced version of autonomous driving, BYD offering assisted driving for free has raised fears about other companies’ ability to charge premium pricing for their self-driving features.

Musk sees humanoids as a long-term growth driver but Chinese companies are fast catching up. Reyk Knuhtsen, analyst at SemiAnalysis, an independent research and analysis company specializing in semiconductors and AI, “China has the potential to replicate its disruptive impact from the EV industry in the humanoid space. However, this time the disruption could extend far beyond a single industry, potentially transforming the labor force itself.”

Question & Answers (0)