AMC Entertainment shares were higher in US premarket price action today after releasing its first-quarter earnings. While the world’s largest cinema chain company reported a massive loss in the quarter, markets are bullish on the reopening story.

AMC Entertainment’s revenues fell 84% year over year to $148.3 million in the quarter. That said, it would not be prudent to compare revenues to the pre-pandemic period as cinemas are only gradually reopening.

AMC Entertainment only reopened most of its movie theatres in the US market towards the end of March, although they managed to do good business during the Easter weekend. The company’s first-quarter revenues were higher than the fourth quarter, reflecting incremental improvement.

AMC provides an update on theatres

During the first-quarter earnings release, AMC Entertainment provided a lot of data points related to the business. At the end of March, 99% of the company’s theatres in the US were open with seating capacity varying between 15-60%.

However, internationally only 27% of its theatres had reopened at the end of the quarter and that too with limited seating capacity. Notably, while the US economy has now almost fully reopened, large parts of the world are still taking a gradual approach to reopening.

AMC Entertainment’s CEO Adam Aron lauded the vaccination drives in Europe, the US, and the Middle East that have helped the company successfully reopen the cinemas albeit with safety protocols. It particularly lauded the vaccination drive in the US.

“We started 2021 with the same conviction, drive and commitment that saw AMC successfully navigate the most challenging 12-month period in AMC’s century-long history,” said Aron. He added, “We finally can now say that we are looking at an increasingly favorable environment for movie-going and for AMC as a company over the coming few months.”

70 million people visited AMC theatres in the first quarter

In the first quarter of 2021, 70 million people visited AMC theatres globally which shows the pent-up demand for outdoor entertainment after the crippling lockdowns of 2020. While many analysts have termed the increasing penetration of streaming services as a death knell for cinema chains, movie-going is an experience in itself that cannot be replicated by streaming for many people.

Streaming versus movie going

This is not to suggest that streaming is not a long term headwind for cinema chains especially with movie production houses releasing new titles simultaneously on their streaming platform. However, both streaming and movie-going would continue to attract wallet share from consumers. Also, at least in the near term, the demand for movie-going would be higher as people try to break the shackles of the lockdowns.

AMC continues to post losses

Meanwhile, AMC Entertainment continues to post losses. The cinema chain company reported a net loss of $567 million in the first quarter of 2021. While revenues have dwindled amid lower footfalls, cinema companies have to spend higher money towards maintaining COVID-19 hygiene. Also, the operating leverage is higher for cinema companies and they find it hard to post profits with low occupancies.

AMC has strengthened its balance sheet

AMC Entertainment has taken a series of steps since the pandemic began to strengthen its balance sheet. Overall, the company has raised around $3 billion through a mix of debt and equity issuance. It has also got concessions from landlords and lenders while securing $150 million from governments in Europe. The company has also generated $80 million through asset sales.

However, the business has been guzzling a lot of cash and in the first quarter, the company’s cash burn was $328 million which is a run rate of over $100 million per month. The company had $813 million as cash on its balance sheet at the end of the first quarter.

AMC had to abandon the share sale plan

AMC was also seeking shareholder approval to sell an additional 500 million shares. However, it had to abandon the plan. Notably, AMC was pumped by Reddit group WallStreetBets in an epic short squeeze. Almost all the companies pumped by the group have issued shares in a frenzy to capitalise on the rise in their share prices.

GameStop

GameStop, another WallStreetBets favourite, is also issuing more shares. While the share sale would help companies like AMC survive the current cash burn, they also come with long term cost in terms of dilution. AMC Entertainment’s outstanding shares have bloated after the capital raise which would mean lower per-share earnings when the company starts posting profits again.

It was a matter of survival for AMC Entertainment

It was a matter of survival for AMC Entertainment

Meanwhile, while a lot of companies including Tesla have raised far more cash than the business needs, for AMC Entertainment it was a matter of survival. Aron was candid about the troubles the company faced over the last year and said the company was “within months or weeks of running out of cash five different times,” He added on the earnings call that “Between April of 2020 and January of 2021, a lot of smart people on this call, and many of you, were certain that AMC would collapse.”

New releases are leading to higher footfalls

Meanwhile, Aron sounded optimistic about the company’s outlook and said that it is gaining market share as many of the smaller cinema chains have closed due to the pandemic. “We have every confidence in looking ahead that AMC will win. We certainly are well on our way,” said Aron. He also pointed to the strong collections of “Mortal Kombat” and “Demon Slayer” both of which were released in April and had the biggest weekend collection since March 2020.

Wall Street on AMC shares

“We believe the company has sufficient liquidity to allow it to survive with low utilization through at least Q3, now that most of its highest-earning theaters have reopened,” said Wedbush analysts before AMC Entertainment’s earnings. They added, “We think demand for theatrical content is high, and plenty of high-quality content is awaiting audiences.”

Last month, Riley had also upgraded AMC Entertainment shares from a neutral to buy and assigned a target price of $13.

Notably, AMC Entertainment had previously said that it expects to be cash flow neutral in the fourth quarter of 2021. If the company’s forecast turns out to be aggressive, it might have to again resort to a share sale to bridge the cash burn.

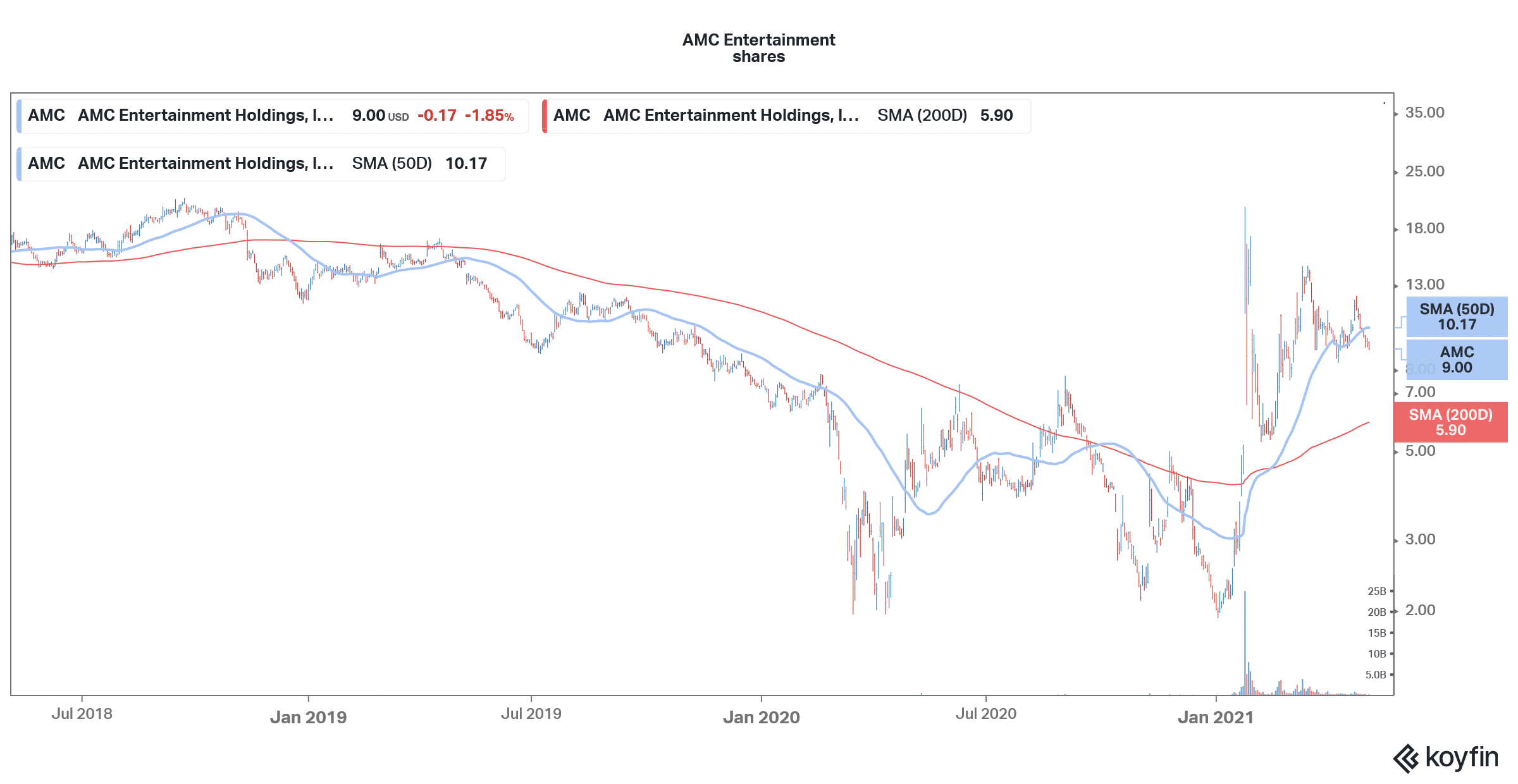

AMC Entertainment shares were trading 3.2% higher at $9.30 in US premarket price action today. The shares have a 52-week trading range of $1.91-$20.36 and are up 325% in 2021 as the pivot towards reopening shares and pumping from WallStreetBets has led to a buying spree in the shares.

It was a matter of survival for AMC Entertainment

It was a matter of survival for AMC Entertainment

Question & Answers (0)